The Virtue of Tenacity

“Victory belongs to the most tenacious.”

This is the statement stenciled onto the inside of the stands at Court Philippe-Chatrier, the center court at the Stade Roland Garros. In English, the “Stade Roland Garros” translates from French into “Roland Garros Stadium,” and it is the name of the complex of tennis courts located in Paris that host the French Open.

This year’s tournament is taking place right now, and if you are tennis fan like me, then you know that on Friday, we will be treated to a men’s semifinal match up between the two best players in the world, the legendary Novak Djokovic, and tennis’ newest brilliant star, Carlos Alcaraz.

Last year about this time, the tennis world was treated to an epic match between Djokovic and Rafael Nadal. That outcome was a Nadal victory in four sets, with the final set being an intense tiebreaker that saw some of the match’s most brilliant shots. That match also showed the resolute nature of both men, battling with what appears to be every fiber of their respective beings in the pursuit of a single goal, i.e., to make a great shot, to win a point, to win a game, to win a set, to win a match and to win a tournament.

Both incredible competitors will go down in the annals of the sport as two of the most tenacious players ever to pick up a racket. And that is appropriate, because tenacity is a trait that embodies the actual person the Stade Roland Garros was named after.

Now, you might think (as I naturally did) that given this is a tennis stadium, the Stade Roland Garros would be named after a tennis great. I mean, in America, we hold the U.S. Open at the National Tennis Center in Flushing Meadows, New York, and the featured center court matches there are played in Arthur Ashe Stadium. That stadium was named after one of the greatest American tennis stars, Arthur Ashe, a man who won the inaugural U.S. Open event in 1968.

Yet, Roland Garros wasn’t a professional tennis player.

The intense eyes of Roland Garros betray his tenacity. Photo is in the public domain.

Roland Garros was a French businessman, an aviator, a World War I fighter pilot, an inventor, a skilled pianist, a pioneer, a hero and a trailblazer — definitely a Renaissance Man. Born in Saint-Denis de la Réunion on October 6, 1888, Garros was educated at the HEC business school. At the age of 21, he started his own company, a car dealership near the Arc de Triomphe in Paris. Now, mind you, this was in 1909, and there weren’t many car dealerships at that time.

Interestingly, in August 1909, his life changed, as he attended his first air show in the Champagne region of France. Garros is said to have fallen in love with these new winged machines, and soon thereafter, he bought a plane and taught himself how to fly.

Two years later, on September 6, 1911, Garros broke his first altitude record, reaching 3,910 meters (about 13,000 feet). He was soon a regular on the nascent air show circuit and in competitive air races, and he became known for his daring aviation skills. He even became a bit of a star in the aviation world, as hundreds of thousands of people in both Europe and South America would come to watch him in action.

Just two years after that altitude record, Garros took his airplane across the Mediterranean Sea, something that had never been done at the time. On September 23, 1913, he flew from Saint-Raphaël on the French Riviera to Bizerte (Tunisia), a journey that took nearly eight hours.

At the onset of World War I, Garros employed his aviation skills in defense of his native France. At that time, aviation in war was new, and airplanes were equipped with little or no weaponry. That changed, however, once Garros decided to invent a machine gun that could be mounted on a fighter plane — one that could be synchronized to fire through the propeller.

In April 1915, Sub-Lieutenant Roland Garros had already used his aviation skills and new invention to win several aerial battles against German aircraft. But on one mission, his plane was hit by German anti-aircraft fire over Belgium. Garros was forced to land, and he was subsequently taken prisoner before he had a chance to destroy his plane. His brilliant invention unfortunately fell into German hands, and that nation’s engineers used his ideas and adapted them to their own aircraft.

But the story gets even better. After three years in captivity, Roland Garros escaped his captors, and he did so disguised as a German officer. Unfortunately, his health had suffered mightily during captivity, but that didn’t stop the tenacious Garros from rejoining the fight.

As a result of his capture, he became badly short-sighted and had trouble seeing well enough to fly a plane. But Garros didn’t let this ailment deter him. So, he made himself eyeglasses in secret, not telling any of his fellow French aviators, so that he could see well enough to keep flying and keep battling the Germans. Sadly, on October 5, 1918, Roland Garros was killed in the skies over the Ardennes, doing what he wanted to do, and becoming legendary in the process.

In 1928, about a decade after his death, France had turned her attention to sport via the building of a large tennis stadium in Paris. One of the heads of this tennis stadium project was a man named Emile Lesueur, a former business school classmate of Roland Garros at the HEC. It was Lesueur who made sure that the Stade Français would be named the Stade Roland Garros in honor of his friend and fallen hero.

So, what can we take out of this story that I suspect you never knew about until now?

By reading about the valorous lives of those who shaped the world around us with their intelligence, courage and, most importantly, their tenacity in the face of unspeakable adversity, we can draw inspiration in our own lives when it comes time to meet our own challenges, set our own records, battle our own enemies, escape our own captors and rejoin the fight to defend our values.

Because as Garros said, “Victory belongs to the most tenacious.”

***************************************************************

ETF Talk: Getting More ‘Momentum’

Sometimes, especially during times of economic uncertainty, bank failures and high interest rates, it is best to play it safe and stay within the comfortable domain of well-known and safe sectors of the market.

Returns from these stocks may not be extremely high, but they are safe, regular and somewhat predictable. At other times, the momentum in the market, or a certain sector of the market, is such that you cannot ignore it.

One such sector involves the growth and expansion of artificial intelligence (AI), especially in the wake of AI-trailblazer NVDIA’s (NASDAQ: NVDA) recent blowout earnings report. Now, I have talked about artificial intelligence and its effects on your job, your life and your money in both The Deep Woods and my Way of the Renaissance Man podcast, but here, I want to discuss a specific exchange-traded fund (ETF) that is closely correlated with the recent AI boom.

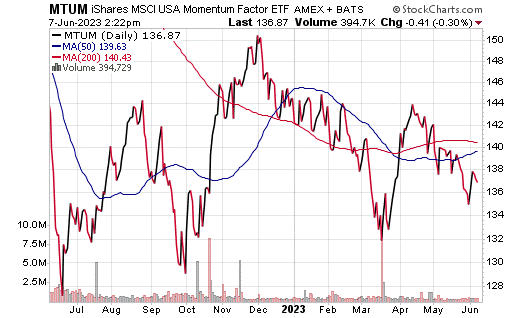

The iShares MSCI USA Momentum Factor ETF (BATS: MTUM) is a popular exchange-traded fund (ETF) that is comprised of a basket of stocks that have recently, but steadily, increased in price. In order to do this, the fund’s managers look at each stock’s returns for both six- and 12-month periods, and then scale them based on the volatility of returns during the past three years. This produces a small portfolio in comparison with its competition (the fund only has between 100 and 350 different stocks) and contains the possibility of both high risks and high rewards.

At the same time, while momentum investing (especially with regards to AI-related companies) may seem like a path to alpha, it is important to note that past performance is not always indicative of future success. All stocks, after all, are prone to sharp reversals at any time — as we have seen in the technology sector. In addition, this fund’s portfolio is heavily centered around large-cap stocks, leaving out large segments of the market that may provide similar (or better) returns.

Top holdings in the portfolio include NVDIA (NASDAQ: NVDA), Meta Platforms Inc., Class A (NASDAQ: META), Microsoft Corp. (NASDAQ: MSFT), Exxon Mobil (NYSE: XOM), Broadcom Inc. (NASDAQ: AVGO), Eli Lilly and Company (NYSE: LLY) and Merck & Co. (NYSE: MRK).

As of June 6, 2023, this fund has been down 1.93% over the past month, down 2.49% over the past three months and down 4.99% year to date. This ETF has total net assets of $9 billion and an expense ratio of 0.15%.

Chart courtesy of StockCharts.com.

While MTUM is a way to ride the momentum of the market, investors should be aware of the risks associated with investing in such a fund and always do their due diligence before adding any stock or fund to one’s portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Thank You, Mr. O’Neil

The Roman statesman and philosopher Cicero wrote, “The life of the dead is placed in the memory of the living.” This quote came into my consciousness for the first time in decades right after I learned of the death of my mentor, the great William J. “Bill” O’Neil. Businessman extraordinaire, investing genius and creator of the publication Investor’s Business Daily, Bill O’Neil died on May 28, 2023 at age 90 at his home in Santa Monica, California.

Why is “Mr. O’Neil” my mentor? Well, because my first real job when I got out of the U.S. Army in the early 1990s was at Investor’s Business Daily. Interestingly, at the time I didn’t really know much about stocks or investing, although philosophically I was a champion of free markets and capitalism, ideas I learned from brilliant thinkers such as Ludwig Mises, Milton Friedman, Adam Smith and Ayn Rand. Yet by happenstance, fate or just dumb luck, I was fortunate enough to begin my business career working for one of the smartest and most innovative men in the investing business, a man whose work has made countless individuals wealthy — including your editor.

Now, why do I call him “Mr. O’Neil” and not Bill O’Neil? Well, because his presence commanded respect, a respect that I will always hold for the man based on what he taught me, what he did with his life and what he did for me and so many others. I think the best way to describe Mr. O’Neil is that he was a no-B.S. straightshooter with a purpose. That purpose was to make money in the stock market, and to show others how to do the same.

Indeed, his seminal book on investing was basically named after his mission. “How to Make Money in Stocks,” first published in 1988 and revised and updated multiple times since, remains to this day the very best book on investing I’ve ever read. And if you haven’t read it, then get yourself a copy today. Subscribers to my trading services will no doubt recognize Mr. O’Neil’s DNA throughout my investing philosophy, strategy and tactics. I mean, when the man himself teaches you his strategies, how can it not?

One of my proudest moments in business is when I was selected to create and write online courses teaching the investing ideas in “How to Make Money in Stocks.” I still remember the famous “education modules” as we called them, which premiered in the earliest online platforms such as America Online and CompuServe. In those days, the internet was just getting started as a place for publishers to add value to existing content. I recall arguing with some skeptical Investor’s Business Daily colleagues, including Mr. O’Neil, that the internet and online publishing would soon replace print as the dominant way to convey information. Needless to say, my prognosis proved prescient.

One thing that I always loved about Mr. O’Neil is that despite understandable skepticism regarding the future migration of his company to a predominantly online platform, he was always ready to embrace a good idea. This willingness to adapt to changing circumstances and to adopt new tools is a quality found in every really successful person I’ve ever met. I think the reason why is because recognizing the need to adapt to change is the mark of a person guided by reason, not dogma. And because man’s only tool of survival is his rational mind, the recognition of needed adaptations is always a precursor to continued success.

Mr. O’Neil proved his ability to adapt using reason in the 1960s, when he was an early adopter of computers used to analyze stock market data much more efficiently. By the mid-1970s, he was using a computer program to help pick stocks. “What we’re trying to do is take emotion completely out of the market,” Mr. O’Neil once told The New York Times.

While a reduction of emotion via identifying key metrics that make stocks go higher (e.g. earnings growth, relative price strength, industry strength, overall market conditions, chart patterns, etc.) was his goal, Mr. O’Neil never lacked emotion in his approach to success. My recollection of him was always a man driven to achieve. A man who embodied the “can do” ethos in his very being. I mean, just the way he walked, talked and looked into your eyes when he spoke with you gave one the very real sense of a man not messing around with reality. A man who was always intent on getting things done. Indeed, a man who loved the doing.

As Ayn Rand famously wrote in “The Fountainhead,” “Before you can do things for people, you must be the kind of man who can get things done. But to get things done, you must love the doing, not the secondary consequences. The work, not the people. Your own action, not any possible object of your charity.”

That is the ideal that I associate with Mr. O’Neil, and it’s one of the reasons why I consider myself most fortunate to call him my mentor.

Now, over the past couple of weeks, I’ve read a few good obituaries about Mr. O’Neil that dig into more details about his upbringing and his early idea formation. I recommend you read these obituaries as a way to get more acquainted with the facts of what made him who he was. Yet, obituaries always seem to fall short of the emotional imprint that a life leaves on those profoundly influenced by it.

Yet, if Cicero is right, the life of the dead is placed in the memory of the living, then Mr. O’Neil will remain alive and well within those he helped live a better life — and for those who revere men who love the doing.

*****************************************************************

Simon Says Tears and Smiles

Many is the time I’ve been mistaken

And many times confused

Yes, and I’ve often felt forsaken

And certainly misused

Oh, but I’m alright, I’m alright

Just weary to my bones

Still, you don’t expect to be bright and bon vivant

So far away from home, so far away from home

–Paul Simon, “American Tune”

Perhaps the greatest singer/songwriter of the past five decades, Paul Simon is a huge musical force that’s moved listeners around the world with tears and smiles. In this solo acoustic performance form the Dick Cavett Show in 1974, Simon delivers a gorgeous rendition of the iconic and deeply thoughtful anthem “American Tune.” If you are so inclined, I recommend checking out this performance, as well just about any Paul Simon performance. You will, I suspect, come away with a sense of appreciation for artistry of the highest type. And you may also come away with tears and a smiles.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods