Don’t Fear the AI Reaper

- Don’t Fear the AI Reaper

- ETF Talk: Going the Distance with SPTL

- Is It Time to Buy China?

- Men vs. Machines

***********************************************************

When one of the biggest and most important companies ever announces a fiscal push toward the use of artificial intelligence (AI), you know things are starting to get serious.

On Monday, tech-behemoth Microsoft (MSFT) revealed that it is putting its money where its AI mouth is, as the Redmond giant said it was making a $10 billion investment in ChatGPT software developer OpenAI.

The move will allow Microsoft to offer GPT-3, the service that the generative AI chatbot ChatGPT is based on, in its various platforms across its cloud-based services. Basically, if you have Microsoft applications, you will likely soon be able to use ChatGPT.

Now, in addition to being a move designed to get out in front of competitors such as Amazon (AMZN), Alphabet (GOOGL) and Salesforce (CRM), Microsoft’s embrace of AI here is telling, especially considering the company also just announced it was laying off some 10,000 actual human workers.

“It tells you a lot that within a week of announcing pretty substantial layoffs, Microsoft is also announcing a substantial investment in OpenAI.” That’s according to Gil Luria, technology strategist at D.A. Davidson, in an interview with Yahoo Finance.

But what is so important about ChatGPT, and why is Microsoft so intent on its use?

Basically, ChatGPT allows users to have human-like conversations and much more with other chatbots. Perhaps more importantly, the AI language models can answer questions, assist users with tasks such as composing emails, essays, writing computer code, etc. Essentially, ChatGPT can do a whole lot of what we thought could only be done by human writers, human programmers and even human artists.

Already, the program is capturing the brains of some of the biggest thinkers in the AI space, including Tesla (TSLA) and Twitter chief Elon Musk. “ChatGPT is scary good. We are not far from dangerously strong AI,” said Musk, who was actually one of the founders of OpenAI before departing the company.

Like all new technologies, there are those who fear the worst from AI, claiming that it will cause massive worker dislocation and result in even greater “wealth inequality” and other supposed societal damage. And while technology has always been a societal disrupter (mostly for the good), AI and tools such as ChatGPT have the very real possibility of venturing deep into the creative domains that were long thought to be only “humanly” possible, such as profound emotional content, creativity, personality, etc.

Then there are the more optimistic views on AI, ones such as those held by a man who was perhaps the highest-profile example of a victim of the efficacy of AI, chess-great Gary Kasparov. In 1996, Kasparov famously vanquished what was then the strongest chess engine ever created, IBM’s Deep Blue. Then just one year later, Kasparov was beaten by a new, and better, version of the AI-based Deep Blue.

A recent article in one of my favorite publications, Reason, titled, “Artificial Intelligence Will Change Jobs — For the Better,” points out that despite being defeated by AI, Kasparov actually views the technology as one of the greatest opportunities for humanity to advance its well-being.

“The reason is that Kasparov has observed in the intervening years that the highest level of performance, on the chessboard and elsewhere, is reached when humans work with smart machines.”

As the Reason piece goes on to explain, “After Deep Blue’s programmers established that it could see deeper into the game than the human mind, Kasparov and a group of partners came up with a new concept: What if instead of human vs. machine, people played against one another but with the assistance of chess software?”

This new style of chess, known as “advanced chess,” showed that it wasn’t the player with the best chess software that won, nor was it the best human player. “The top performers were the players who were able to use the machines most effectively, those who were able to get the most out of the chess engines and their own creative abilities.”

This is where I think the confluence of AI and human intelligence can be maximized. The way I see it, AI is just a tool. And like any tool, it can be used to enhance positive outcomes that help the world, or it can bring about pernicious consequences that destroy.

The question then becomes will we be wise enough to know the difference.

For more on this important issue, and to find out if we should indeed fear the AI reaper, I invite you to listen to one of my favorite podcast episodes, “Will AI Destroy Humankind?” featuring my friend, computer scientist and AI expert, Robert Deadman (yes, that is his real name).

In this fascinating discussion, Robert and I discuss the current state of AI, and what the future holds for this increasingly ubiquitous technology.

Topics include such questions as at what point will AI begin making its own decisions? How far away is this circumstance? What is the role of quantum computing in this question? Will AI actually have “free will”? When will the move take place from “artificial intelligence” to “artificial sentience”?

Perhaps most importantly, can we solve the so-called “alignment” problem of AI, and how can we really understand this concept?

If you want to indulge in a much deeper dive on the issues surrounding AI, I invite you to check out my discussion with Robert Deadman, as I assure you it will captivate your attention.

***************************************************************

ETF Talk: Going the Distance with SPTL

In today’s economy, investors are looking for exchange-traded funds (ETFs) that can go the distance and ride out what may be an impending recession.

Looking forward, the macroeconomic environment likely will be shaped by three key elements: slowing growth, falling inflation and central bank rate cuts. If this is indeed the case, longer-dated, fixed-income exchange-traded funds (ETFs) should outperform.

One way for investors to take advantage of that outlook is through several best-of-breed investment vehicles for embracing duration in bond portfolios. The first of those investments is SPDR Portfolio Long Term Treasury ETF (SPTL).

SPTL is a low-cost ETF that seeks precise and comprehensive exposure to the entire long-term U.S. Treasury spectrum of bonds with remaining maturities of 10 years or more — excluding inflation-protected bonds. The fund uses a sampling method to track its index, the Bloomberg Long U.S. Treasury Index.

Simply, the fund invests in a sample of securities that collectively have an investment profile like the benchmark. While SPTL is one of the lower-cost core SPDR Portfolio ETFs, its long-effective duration, weighted-average maturity and yield-to-maturity naturally may expose investors to elevated interest-rate risk. But it’s no more risk than is expected in the market.

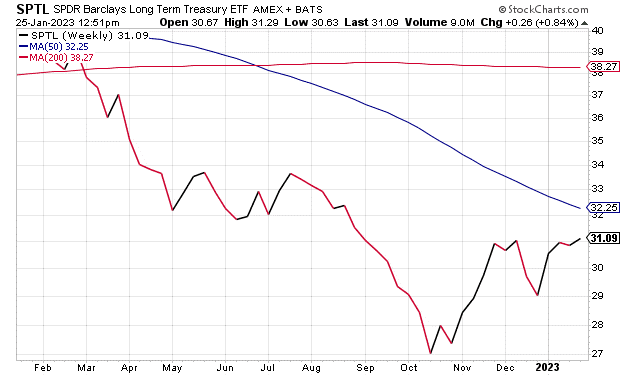

SPTL has $5.74 billion in net assets and a low expense ratio of 0.06%. As is visible in the chart below, the fund showed a sharp decline last October but recouped a fair amount of ground by December.

Courtesy of Stockcharts.com.

Overall, SPTL is a cost-efficient ETF offering investors comprehensive exposure to the U.S. Treasury spectrum of bonds with remaining maturities of 10 years or more. While SPTL may be more sensitive to interest-rate fluctuations than vehicles with a shorter duration, it is nothing extraordinary.

So, for investors looking for a best-of-breed investment vehicle to go the distance, the SPDR Portfolio Long Term Treasury ETF may be worth considering.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Is It Time to Buy China?

As investors, we are always looking for the next big opportunity to profit. And often, ideas that worked in the past but have gone out of favor are a great hunting ground for that next big opportunity. In recent weeks, we’ve seen one segment of the market start to show a nice mover higher after a big downturn in the last two years. That segment of the market is Chinese stocks.

So, now the question becomes, “Is it time to buy China?”

To help answer that question, today’s The Deep Woods features an excerpt from my daily publication, Eagle Eye Opener, which if you aren’t yet a subscriber, why not? This analysis comes to us from my “secret market insider,” a man who provides macro intelligence to some of Wall Street’s biggest firms, and who also has teamed up with me to give my readers a daily market brief with all the key information you need to understand the market that day — and every trading day.

And now, let’s find out if it’s time to buy China, courtesy of my secret source.

***

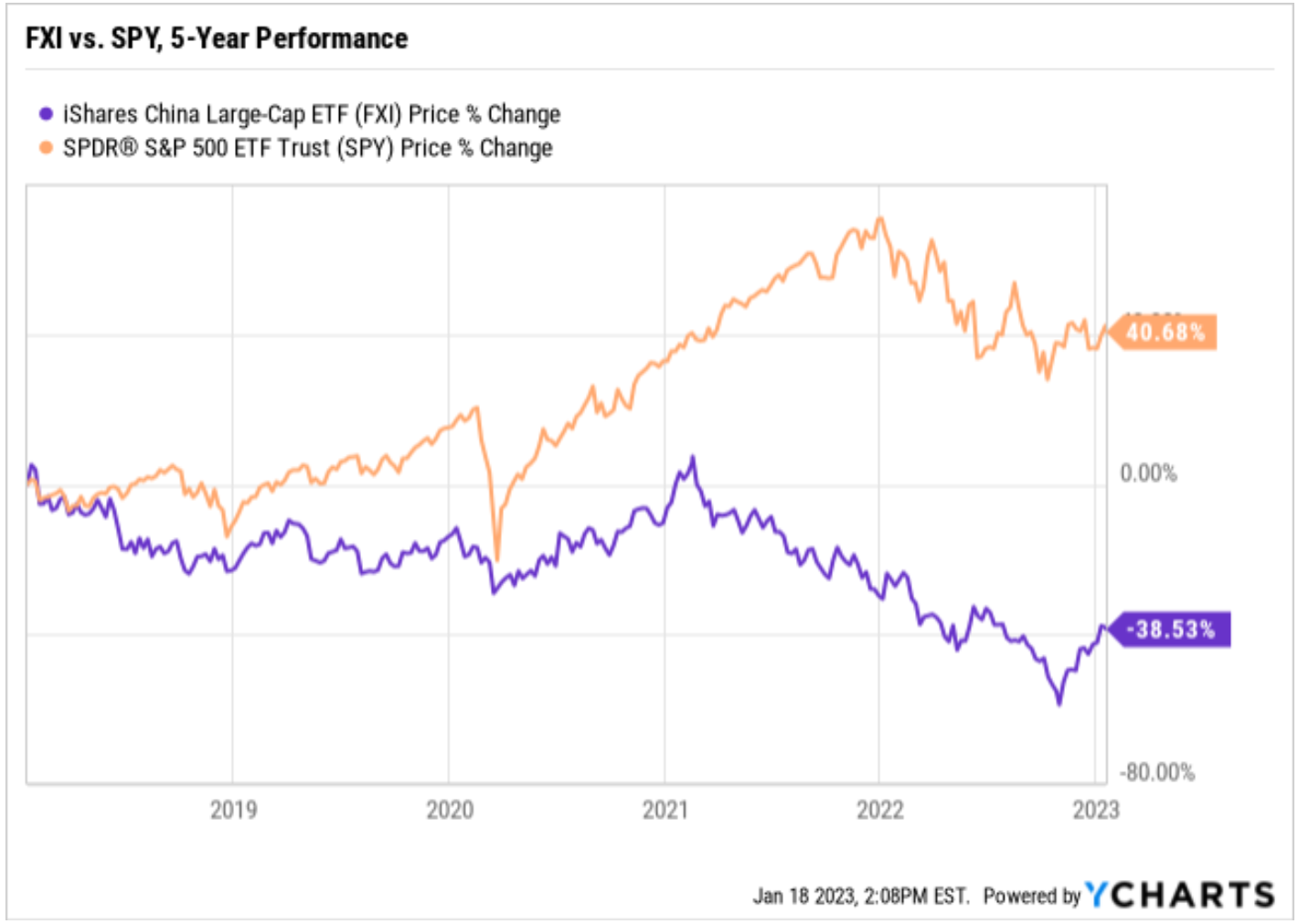

Over the past several years there have been few sectors/regions that have performed as poorly as Chinese stocks, as a series of policy decisions seen as hostile to private business in China combined with the Zero-Covid policy to hammer Chinese shares. The impact of these policies is clearly visible in the five-year performance gap between Chinese shares, represented via iShares China Large-Cap ETF (FXI), and the S&P 500, represented by the SPDR S&P 500 ETF (SPY), which is nearly 80% (-38.53% for FXI vs. 40.68% for SPY).

But over the past several weeks, China has taken a series of steps that address, and possibly reverse, these negative economic and business-related policies. And for the first time in years (perhaps since the start of the Trump administration) one can make the case that the outlook for Chinese growth is turning positive.

First, China has abandoned Zero-Covid and the economy is returning to pre-pandemic normal. Zero-Covid was a major economic headwind on the Chinese economy for the past several years, but the policy was effectively abandoned on Jan. 8, when China downgraded the severity of the disease and relaxed travel and quarantine rules. Now, in part because of a surge in Covid cases, the Chinese economy is not back to “normal.” Yet for the first time since March 2020, the case can be made it’s on the way.

Second, China appears to be relaxing its crusade against domestic tech companies. The poster child for Chinese authorities’ crackdown on Chinese tech companies was Didi Global, the Chinese ride sharing app. Some 18 months ago, Chinese authorities prevented downloads of Didi’s 25 various apps and forbade the company from taking on new registered users as punishment for Didi seeking a NYSE stock listing. That crackdown then led to Chinese authorities targeting other companies, but in many ways Didi was the one that started it all.

On Sunday, Chinese authorities announced that the Didi Global exile is over, as once again Chinese consumers can download the company’s apps and they are allowed to begin to register new users again, effectively allowing the company to start growing again. Time will tell if this signals a broader easing of the crackdown on Chinese tech firms, but it’s clearly a good start.

Third, the Chinese property market has been a weight around the neck of the Chinese economy for months, even since the collapse of Evergrande in late 2021. Since then, Chinese authorities have been conducting targeted/stealth bailouts or “takeunders” of various struggling Chinese property firms.

China recently announced the creation of a $25-billion fund to recapitalize the property market. The fund will come from the PBOC and the China Industrial and Commercial Bank of China (China’s largest bank) and funnel into the economy via selected property managers. But make no mistake, this is a bailout of the property market and the capital should help to repair that market and contribute to better economic growth.

Fourth, and perhaps most importantly, China appears to be willing to try and re-engage the West. Last week at the Davos World Economic Forum, Chinese Treasury Secretary Liu He stated that China was once again open for business and sought policies that would “strengthen international cooperation” and “world peace” and promote a return to globalization. It was later announced that He and Treasury Secretary Yellen would have a meeting today at Davos.

While broad, these moves reflect the most business and economically friendly policy changes in China in many years, and if they are followed through on, then Chinese growth should accelerate and that should translate to substantial gains in Chinese stocks.

Bottom line, while it’s only for the right risk-tolerant investor, for the first time in a long time the risk/reward for Chinese stocks is attractive, as long as these policy changes continue to progress. Chinese authorities appear committed to economic growth, if it’s like they were in the 2000s and early 2010s, then the return potential for Chinese stocks is significant.

From an exposure standpoint, FXI remains the “easiest” way to get exposure to Chinese stocks, while KWEB remains our preference for high-growth Chinese Internet names (although we stress that is a very volatile ETF and is not for the faint of heart).

***

As you can see, the analysis in my Eagle Eye Opener is far from the average take on markets you get anywhere else. Moreover, it’s this kind of market analysis that we provide you every day, straight to your inbox, by 8 a.m. ET — but only if you’re a subscriber to the Eagle Eye Opener.

*****************************************************************

Men vs. Machines

“The real problem is not whether machines think but whether men do.”

–B. F. Skinner

Machines may indeed become sentient one day, and they may well develop something indistinguishable from “consciousness.” Yet as Skinner points out, that’s not really the big problem. The bigger problem is whether humans choose to think, which means whether we hold reason and rationality as our primary tools of survival. If we fail to do this, then we will fail as a species no matter how smart we create our machines.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods