The Best Stories of 2019, Part I

- The Best Stories of 2019, Part I

- ETF Talk: Boost Your Investment Portfolio with This Exchange-Traded Fund

- The Most-Hated Man in a Room Full of Politicians

- Washington and Cheese

The Best Stories of 2019, Part I

It’s almost the end of the year. Do you know what that means? It means it’s time for one of those year-end, “best of” issues you get from just about every publication.

Of course, I like to think that The Deep Woods gives you a lot more than those publications. And judging by the feedback I’ve received from readers this year, that is indeed the case.

For those of you who took the time to let me know what they thought, both positive and negative, I want to thank you. The goal of this publication is to peel back the onion skin on issues and ideas that matter to us all. If you found my analysis thoughtful, whether you agree or disagree with my arguments and/or conclusions, then I have done my job to help promote enhanced clarity on the issues. That’s all a writer can really hope to achieve. If I’ve done that, then it’s a case of mission accomplished.

Now, this week, I am in a city where clarity of thought on complex issues takes a backseat to hyperbole, tribalism and the lust for power. That, of course, could mean I am only in one place — Washington, D.C.

Fortunately, I am here for meetings with my publishing colleagues, dinners with good friends and a walk over to the Vietnam Memorial to pay my respects. What I am not here for is to be anywhere near the Congressional chambers or the White House, where impeachment proceedings reign supreme.

I’ll have more on that divisive issue in future issues of The Deep Woods. If you’ve been wanting my take on this event, then stay tuned. A philosophic look at this American tragedy will be forthcoming.

Today, it’s all about Part I of The Best Stories of 2019. Toward that end, I am going to link you to the following five lead stories which I thought were the most powerful or were stories that generated the most feedback.

So, here are top stories, 10 through six, according to my subjective assessment. (Hey, I’ll try to be objective, but I do have my favorites.)

10) Be Thankful, This Was Not a Mistake. This was my Thanksgiving reminder that we all should be grateful for all of the good fortune the universe has bestowed upon us. Doing so will make us better people, and by extension, help the world be that much better.

9) 5 Ways to Enhance Communication Skills. In this collaborative effort between myself and Heather Wagenhals, host of the highly recommended broadcast “Unlock Your Wealth Today”, we offer up ways to increase your ability to have meaningful interactions with other members of the human race — and what’s more important than that?

8) Issuing an Elizabeth Warren Stock Market Warning. As a free-market advocate, and as someone who abhors big government’s intrusion into our lives, it should come as no surprise that I am not a fan of Sen. Elizabeth Warren’s economic agenda. Here’s an outline of her ideas that I think are the most destructive to your wealth.

7) The Truth About Tariffs. This issue got a fair amount of pushback from those who like the idea of the United States’ decision to impose tariffs on other countries. I, however, do not like that idea. In this article, I tell you exactly why I don’t like tariffs, and why they only hurt Americans.

6) Something is Rotten in the State of Chi Town. Remember the actor Jussie Smollett and the drama surrounding the hate crime he was allegedly a victim of? This case had enough plot twists and turns that Shakespeare himself would be impressed. Unfortunately, the Smollett case turned out to be a sad tale of someone who failed to recognize just how benevolent fate has been to him.

Now, I know the above lists seems hard to top, but I will attempt to do just that next week when I bring you Part II of The Best Stories of 2019.

Consider it a little intellectual present to unwrap under your tree on Christmas morning.

**************************************************************

ETF Talk: Boost Your Investment Portfolio with This Exchange-Traded Fund

Investors looking to boost their investment portfolio might consider adding an equity with a high-yield dividend.

A popular choice in this category is the Vanguard High Dividend Yield Index Fund ETF Shares (VYM), an exchange-traded fund (ETF) with a high-yield dividend that is paid out quarterly. When investors start to see signs of an economic slowdown, a defensive approach becomes essential for their portfolio.

The past decade rewarded dividend ETF investors as central banks have been ultra-dovish. While the Fed cut rates three times in 2019, it has hinted at keeping interest rates unchanged in 2020 unless there is a dramatic change in the economic outlook that it currently views as being very good.

This $37.85 billion fund tracks the FTSE High Dividend Yield Index and offers a 12-month yield of 3.06%. That’s well above the S&P 500’s average 1.84% payout and is one of the cheapest high-yield dividend ETF options available, boasting an expense ratio of 0.06%. In my view, a good yield can cover up for capital losses to a large extent, if there are any.

As of Dec. 18, the Vanguard High Dividend Yield Index Fund ETF Shares (VYM) top 10 holdings include common stocks, many of which are household names, characterized by high-yield dividends.

Comprising 26.6% of the fund’s total assets, the top 10 holdings are: JPMorgan Chase and Co. (NYSE:JPM), 3.95%; Johnson & Johnson (NYSE:JNJ), 3.45%; Protector & Gamble Co. (NYSE:PG), 2.85%; Exxon Mobil Corp. (NYSE:XOM), 2.72%; AT&T Inc. (NYSE:T), 2.58%; Intel Corp. (NASDAQ:INTC), 2.43%; Verizon Communications Inc. (NYSE:VZ), 2.35%; Merck & Co. Inc. (NYSE:MRK), 2.12%; Chevron Corp. (NYSE:CVX), 2.11%; and Wells Fargo & Co. (NYSE:WFC), 2.04%.

VYM primarily is in financial services, 18.99%, as represented in the fund’s top 10 holdings, but also has a moderate presence in consumer defense, 14.25%. health care, 14.74% and technology, 10.57%.

The fund will take a smart approach toward security selections. It ranks them by their forecasted dividends of the next 12 months. The top half of those are included in the index, but they are weighted by market cap, not dividend. This method produces a diverse and relatively cheap dividend-oriented portfolio.

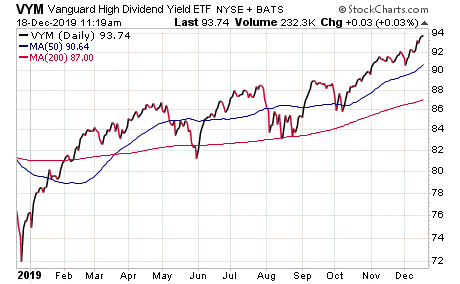

As you can see in the chart below, Vanguard High Dividend Yield Index Fund ETF Shares (VYM) is up 22.94% year to date.

Chart courtesy of StockCharts.com

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

The Least-Popular Man in a Room Full of Politicians

Get a bunch of politicians together and they’ll disagree on almost everything. Yet, the one thing they’ll all agree on is the desire to keep their jobs.

But there’s one man who has dedicated himself to making the profession of politics a part-time avocation.

His name is Nick Tomboulides, the Executive Director of U.S. Term Limits, a Washington-based group that advocates for term limits at all levels of government.

In the latest episode of the Way of the Renaissance Man podcast, you’ll hear Nick’s compelling arguments for why term limits are a must, and how the implementation of term limits is the first step to giving power back to the American people.

You’ll also discover why change in government isn’t about electing a new captain, it’s about trying to fix a damaged ship first.

Plus, find out why term limits are key to preserving natural rights, and why they represent a check and balance on government power.

Nick is a very articulate, very interesting man who is committed to his laudable cause, as you’ll soon hear in this episode.

*********************************************************************

Washington and Cheese

“Washington, D.C. is to lying what Wisconsin is to cheese.”

–Dennis Miller

I’m currently in our nation’s capital, and though I really like this city for all of its virtues, there’s that annoying waft of untruth that rises like a toxic vapor from the swamp it’s built upon. In talking to some politicos here from both sides, you quickly realize that truth is an abstraction that need neither be recognized nor heeded. Coming here makes me glad I chose a more objective, truth-based career in helping people protect and grow their wealth.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods