Be Thankful, This Was Not a Mistake

- Be Thankful, This Was Not A Mistake

- ETF Talk: Profiting Off Gaming Just Got Easier

- Exploring the Mind of a Polymath Featuring Mike Turner

- More Thanksgiving Wisdom

***********************************************************

Be Thankful, This Was Not A Mistake

My two favorite holidays are Independence Day and Thanksgiving Day.

The first gives me a chance to celebrate one of the greatest achievements in human history, i.e. the founding of a nation which was based on the principle that the individual citizen has supremacy over the collective state. That’s the essence of America, and that reverence for man’s sovereignty over the state is why this country has been great from the start.

My second favorite holiday happens to also be tomorrow and it’s Thanksgiving.

To me, Thanksgiving is a chance to reflect on just how thankful I am for the immense good fortune I’ve had in life. It’s also a chance for me to express my gratitude for all the blessings reality has bestowed upon me. Here are a few things I am thankful for, and more importantly, they’re things that I had absolutely zero hand in creating.

To begin with, I was born in America during the 20th century. That means I was born in the freest, most prosperous, most politically stable society. This country is replete with a tremendous sense of safety, boundless educational opportunities and nearly incalculable economic opportunities the likes of which no society has ever known.

To amplify that good fortune, I also was born to parents that loved and cared for me and who provided me with a safe and secure middle-class upbringing in Southern California. My parents also instilled a sense of value and self-worth in me and they nurtured my interest in academics, music, literature, athletics, martial arts, animals — just about anything I was interested in, they helped cultivate.

Then I was blessed with good health, a well-functioning brain, a personality that’s largely unafraid to try new experiences and an aptitude for music, sports and scholastic pursuits.

These are all blessings of fate that I had zero to do with.

Now, think about that for a moment. None of us, no matter how hard we’ve worked in life, are responsible for our genetics, our upbringing or the fate of where and when we were born. We didn’t choose our parents, and we didn’t choose our genetic endowments. Moreover, we didn’t pick the culture we were born and raised in. All of these things are beyond our control, so if we were dealt a strong hand from the beginning — then we had better damn well be thankful, grateful and humbled by that accident of reality.

Yet, that accident of reality can also be rewound, and not just within the framework of your life, but on a grand, or even universal, scale.

That sentiment is expressed beautifully in lyrics by folk/Americana singer/songwriter John Craigie in his song, “Dissecting the Bird.” When you read them, I recommend doing so slowly and deliberately, so that you can properly contemplate and appreciate their depth:

So when the candle flickers, when the days get dark

They call them first world problems but they still break your heart

The universe feels like it’s against you

Just take a minute to realize, all it took to make you

Your parents had to meet, as random as that was

And hang out long enough at least, to make some love

And make a baby, and give it your name

And all your ancestors had to do the same

Exponentially backwards, to the start of life

So much had to happen, just exactly right

Sparks had to catch, oceans had to freeze

Billions of cells had to survive, endless disease

Civilizations had to crumble, wars had to be fought

Bad presidents had to get elected, good presidents had to get shot

People had to leave, hearts had to get broken

People had to die, just so your eyes could open

The universe is not against you

It went through a lot just to give you a chance

It must have wanted you, pretty bad

You don’t gotta be perfect, you don’t gotta be a saint

Just don’t waste it — this was not a mistake.

No, this was not a mistake, and the more we realize and appreciate that fact every day, the better our outlook on life will be and the happier we’ll be. And the happier we are, the happier the people around us will be — and by extension, the happier the world will be.

So, this Thanksgiving, be especially grateful for all of the good fortune the universe has bestowed upon you.It will make you a better person, and by extension, the world will be that much better. Oh, and remember, the universe must have wanted you pretty bad — so don’t waste it and be thankful for it.

**************************************************************

ETF Talk: Profiting Off Gaming Just Got Easier

(Note: Fifth in a series of ETF Talks on the Millennial generation).

Esports not only allow video game enthusiasts a chance to compete against each other, they have become so popular they also now offer an investment opportunity.

Wall Street has taken notice and is providing a way to seek profits from the fast-growing trend by creating the ETFMG Video Game Tech ETF (NYSE: GAMR), one of a few millennial-based exchange-traded funds that have been launched to ride the wave. Esports events are filling arenas that are normally used for professional basketball, as ironic as that seems, and certain tournaments even are broadcast on major cable networks.

There are more than 90 million millennials — people who were born approximately between 1980 and 2000 — representing about 35% of the labor force today and an expected 75% of U.S. workers by 2030, according to Global X. So, the market is huge.

The age demographic of millennials recently replaced Baby Boomers as the largest in the United States. Investment firms have zeroed in on catering to millennials by studying their spending patterns, their gaming habits and other characteristics more than any other group. Additionally, millennials are making more money now than ever as the oldest ones have reached their late 30s. They’re also expected to receive $30 trillion in wealth from Baby Boomers.

GAMR’s top 10 holdings, which comprise 28.95% of its total assets, include major blue-chip names in the gaming industry such as Nintendo (OTC: NTDOY) and Electronics Arts (NASDAQ: EA), which is more commonly known as EA. If you don’t know these names, don’t worry. Trust me, they’re the most-recognizable stocks in the gaming industry.

Others holdings in the fund include: Square Enix Holdings (9864), 3.58%; Activision Blizzard Inc., (ATVI), 3.07%; CD Projekt SA (CDR), 3%; Micro-AStar International co. (2377.TW), 2.96%; Capcom Co. Ltd. (9697), 2.93%; NCsoft Corp. (036570.KS), 2.78%; Bilibili Inc. ADR (BILI), 2.76%; Take-Two Interactive Software Inc. (TTWO), 2.72%; Electronics Arts Inc., 2.59%; and Nintendo Co. Ltd. (7974), 2.56%.

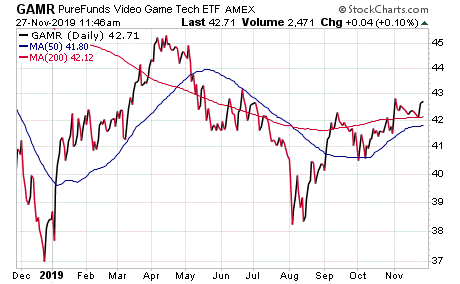

Chart courtesy of www.StockCharts.com

As you can see in the chart here, GAMR’s share price is up about 10% so far this year. After its investors received the company’s most recent dividend of $0.13 on Sept. 20, GAMR’s forward dividend yield equals about 1.55%.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

Exploring the Mind of a Polymath Featuring Mike Turner

Every once in a while, you meet someone who just thinks a little different, and someone who brings a unique set of skills to bear to solve an age-old problem.

That’s how I describe my friend Mike Turner, founder of Turner Capital Investments.

In the latest episode of the Way of the Renaissance Man podcast, you’ll learn about Mike’s background in structural engineering and computer science, and how he trained his problem-solving skills on the challenge of how to make money in the financial markets.

Then you’ll find out about Mike’s unique analytical approach to investing in the markets, which focuses on knowing when to be in stocks, when to be out of stocks — and even when to be short in stocks.

You’ll also find out about the folly of predictive market models, and you’ll discover the ridiculously simple rule about markets — which is that the current trend in the market will last exactly until it doesn’t.

Plus, find out why I think the way Mike approaches markets is the way a rational person should approach life, which is to constantly be assessing the facts, and to change your disposition when those facts dictate a change.

Mike Turner is a special individual, and you’ll discover that from the outset of this episode of the Way of the Renaissance Man podcast.

*********************************************************************

More Thanksgiving Wisdom

“Gratitude is the inward feeling of kindness received. Thankfulness is the natural impulse to express that feeling. Thanksgiving is the following of that impulse.”

— Henry Van Dyke

It often takes a poet to express what we all feel, and here I think Van Dyke does a great job of capturing the essence of the Thanksgiving holiday. I want to thank all of my friends, family, colleagues and, most importantly, you, the reader of my publications. Without you, I would have much less to be thankful for.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods