Gaming the Market’s Golden Lining

Gaming the Market’s Golden Lining

Stocks have been in a bad way since our last issue, and the bears have wrestled away control from the bulls. How long this reversal of bullish fortune will last is anyone’s guess, but until we get some material progress on the United States-China trade war, we can expect continued volatility to make itself right at home on Wall Street.

While stocks have taken a serious hit over the past five trading sessions ever since the trade war really began heating up, there is one asset class that has been on a bullish rampage. That asset class is gold, as the yellow metal’s safe-haven status has proven itself in times of market tumult.

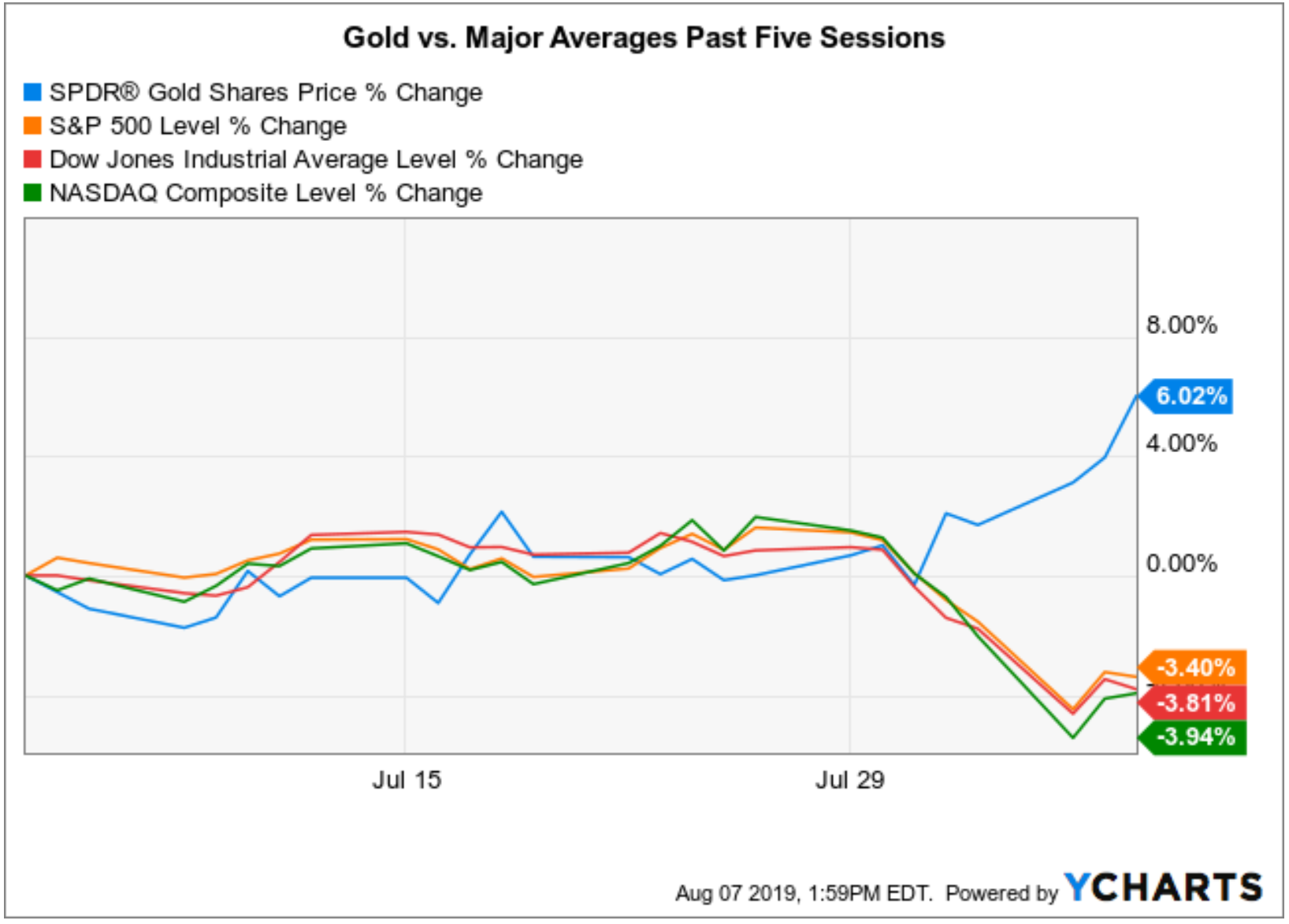

To see just how powerful that flight to safety in gold has been, take a look at the chart below of the SPDR Gold Shares ETF (GLD) vs. the major domestic averages since last Thursday.

As you can see, gold is up more than 6% while the major averages are down nearly 4%. Yet the question I’ve been fielding from readers here is whether this run higher in gold is just a temporary market reaction, or if it’s a trend that’s sustainable. Of course, the corollary here is whether we should be buying gold right now.

Well, in my Successful Investing advisory service, we have been bullish on gold and gold mining stocks since the beginning of the year. Our trend of following the Gold Plan gave us the green light to allocate assets to gold and gold mining stocks. We’ve done that with tremendous results.

For example, our position in the SPDR Gold Shares ETF (GLD) is up 12.35% since our Dec. 31 buy, while our holding in the VanEck Vectors Gold Miners ETF (GDX) is up 34.4%. We have even bigger gains in our more aggressive holdings, with a remarkable 68.6% win in the ProShares Ultra Gold Miners (GDXX) and a 74.6% spike in gold mining stock Kirkland Lake Gold Ltd. (KL).

Yet the question remains on gold, i.e., is there still time to get into the yellow metal?

To help me answer this question, I turned to my friend, colleague and all-around Renaissance Man, Rich Checkan of Asset Strategies International. Rich and company are the smartest guys in the business when it comes to precious metals, and they are the only firm I recommend if you want to own physical gold and precious metals. In fact, if you go anywhere else, well, then you probably are doing yourself a disservice.

Here’s my brief Q&A with Rich. I think you’ll find it as enlightening as I did.

Jim Woods (JW): So, Rich, the million-dollar question my friend — is it too late to buy gold?

Rich Checkan (RC): Absolutely not, and I am not just saying that because gold and precious metals are my business. I am saying that because gold now has emphatically broken out of its long period of consolidation through $1,350 per ounce and further through $1,400 per ounce. Gold did pullback below $1,400, but then it recovered above that key level almost immediately. Since then, there has really been no looking back for gold.

JW: I know that gold and precious metals are seen as a flight-to-safety trade. I also know gold is good in low-yield environments such as our current milieu. Yet, there is a bigger driver to gold’s latest shine. Can you explain that?

RC: That driver is primal and it is fear. Fear in markets is synonymous with the gold and larger precious metals markets. Those in fear seek protection, and there is no better, more proven protection for wealth known to man than gold. This store of purchasing power has been the choice for wealth insurance for several millennia. Plain and simple, it is gold’s moment yet again.

JW: So, given the fear bid, how brilliant can gold shine before we see a slight dulling?

RC: I expect higher prices for gold, but we shouldn’t expect that to come in the form of a straight line. For investors, straight lines are not your friends. As gold continues its ascent, I prefer it do so in “staggered steps.” That’s because when assets appreciate in unfettered straight lines, expect that any correction will be swift and painful. As with any asset class, it is much healthier for an asset to appreciate, pull back a little, appreciate further, pull back a little, etc. With each rise, you see a new higher high, and with each pullback, you see a new higher low.

JW: Okay, so how high, in your expert opinion, can gold go from here?

RC: The ultimate answer will only be known via hindsight, but don’t expect much significant resistance between here and $1,800 per ounce for gold. That means we have a lot more upside ahead.

JW: If investors want to buy physical gold here, how do you suggest they do so?

RC: I recommend investors consider dollar-cost-averaging into the market on the inevitable dips along the way. You will hear this from me often in this bull market, and that is that the dips are not to be feared, they are to be embraced.

Excellent advice here from a man who knows of what he speaks. And though Rich and company are filled with more analysis on the current gold and precious metals climate, that analysis will be better if it comes directly from them in a longer format.

For those interested in that analysis (I’m included in this group), I recommend you check out Rich’s “On the Move” webinar series. I have been a guest on this program, and I can tell you Rich and co-host Chris Blasi of Neptune Global are the bona fide real deal when it comes to this topic.

The next webinar also happens to be timely, as it will be held tomorrow, Thursday, Aug. 8, at 7 p.m. EDT. To sign up for this free webinar, simply click here. I know I will be there, so come join Rich, Chris and me for more on gaming this market’s golden lining.

**************************************************************

ETF Talk: Real Estate ETF Focuses on REITs

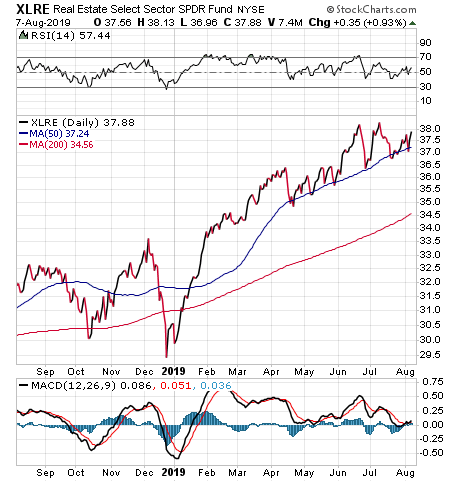

The Real Estate Select Sector SPDR Fund (NYSEARCA: XLRE) is an exchange-traded fund that can give a prospective investor access to the segment of the global economy that is involved with real estate.

Specifically, XLV tracks the Real Estate Select Sector Index, which, in turn, attempts to provide an effective representation of the real estate sector of the S&P 500 Index. This exchange-traded fund was launched in October 2015 when the Global Industry Classification Standard (GICS) financial sector was divided into the financial sector and the real estate sector.

Initially, XLRE’s liquidity was quite poor as it was unable to match the level of liquidity that its sister ETFs had managed to obtain. However, this situation changed in September 2016, when XLRE’s sister ETF, the Financial Select Sector SPDR Fund (XLF), which I have featured previously in The Deep Woods, had to part with its real estate investment trusts (REITs) to meet the new classification standard. As a result, XLF transferred $3 billion in assets under management to XLRE. By doing so, XLRE’s liquidity improved a great deal.

Currently, the fund’s assets are divided among specialized REITs: 43.60%; Commercial REITs, 39.50%; Residential REITs, 14.70%; and Real Estate Services, 2.20%.

This fund’s top holdings include American Tower Corporation (NYSE: AMT), Crown Castle International Corp. (NYSE: CCI), Prologis Inc. (NYSE:PLD), Simon Property Group Inc. (NYSE: SPG), Equinix Inc. (NASDAQ: EQIX), Public Storage (NYSE: PSA), Welltower Inc. (NYSE: WELL), Equity Residential (NSYE: EQR) and AvalonBay Communities Inc. (NYSE: AVB).

The fund currently has more than $3.57 billion in assets under management and an average spread of 0.03%. It also has an expense ratio of 0.13%, meaning that it is less expensive to hold than many other ETFs.

This fund’s performance has been solid in both the short and long terms. As of Aug. 5, XLRE is up 1.10% over the past month, 4.68% over the past three months and 22.60% year to date.

Chart courtesy of StockCharts.com

While XLRE does provide an investor with a chance to profit from the real estate segment, the sector may not be appropriate for all portfolios. Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*******************************************************************

Chatting with Rock Star Philosopher Dr. Stephen Hicks

In the world of philosophy, those who achieve “rock star” status are few and far between. Well, in the premiere episode of Season 2 of the Way of the Renaissance Man podcast, I speak to a man who has become a public intellectual par excellence.

That man is Dr. Stephen Hicks, Professor of Philosophy at Rockford University and the Executive Director of the Center for Ethics and Entrepreneurship. He’s also a Senior Scholar at The Atlas Society.

Over the past year, Dr. Hicks has become well known in more than just academic circles. He has appeared on many podcasts and television shows. His work on the subject of postmodernism and its application to today’s cultural climate is just one of the many subjects that has vaulted him into the limelight.

During our discussion, you’ll discover the importance of understanding postmodernism, as well as other pathological cultural movements. You’ll also learn why we agree that the only solutions to bad ideas are good ideas.

The stakes are high, and the fight for a culture that respects individuals, freedom and rationality is a deadly serious enterprise.

Yet listening to this conversation, you might get the sense that Dr. Hicks and I are just two life-loving warriors on a mission to promote reason

I hope you enjoy the premiere episode of Season 2 of the Way of the Renaissance Man podcast as much as I did.

*******************************************************************

Toni Wisdom

“If there is a book that you want to read, but it hasn’t been written yet, you must be the one to write it.”

— Toni Morrison

This week, the world mourned the passing of Nobel Prize-winning novelist Toni Morrison. Now, I must admit that I have only read one of Ms. Morrison’s novels, the 1987 classic “Beloved.” I thought the novel was quite beautiful, and well-deserving of its many accolades.

In her quote here, Ms. Morrison reminds us that life as we want it to be is often just a matter of us choosing to make the world our own. So, if things in your world aren’t what you want them to be, get off your duff and write your own book. The world is yours to change, if you have the courage to change it.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods