Will AI Destroy Humankind?

Will artificial intelligence, or AI, destroy humankind?

That’s the very serious and eminently fascinating discussion I had with my friend, computer scientist, investor and fellow Renaissance Man, Robert Deadman (and yes, that is his real last name).

Robert is one of those rare individuals who possesses a breadth of knowledge that he can eloquently translate into casual conversation, even about such advanced and interesting topics as the rise of AI and the potential benefits and dangers of this technology.

In the new episode of the Way of the Renaissance Man podcast, Robert and I discuss the current state of AI and what the future holds for what is increasingly becoming a ubiquitous technology that most of us don’t even know is operating on us at all times.

Topics in this conversation include such questions as…

At what point will AI begin making its own decisions?

How far away is this circumstance?

What is the role of quantum computing in this question?

Will AI actually have “free will”?

When will “artificial intelligence” become “artificial sentience”?

Can we solve the so-called “Alignment” problem of AI, and how can we really understand this concept?

If you are familiar with the subject of AI, then you will undoubtedly find this conversation interesting, as I think Robert approaches the subject in a unique way. And if you aren’t familiar with the issues surrounding AI, including the benefits and dangers of this technology, then you really must acquaint yourself with the topic — and this podcast is a great way to do just that.

I absolutely loved this conversation with the fascinating Robert Deadman, and at the risk of alienating my other guests, I must say that this was my favorite podcast yet — and I hope you think so as well.

***************************************************************

ETF Talk: Finding Sanctuary in a Dividend ETF

As a result of the wave of selling caused by war in Ukraine and the continued effects of supply chain disruptions amid the COVID-19 pandemic, some investors are turning to dividend-paying stocks as sources of solace in an increasingly turbulent and unstable world.

Studies by Ned Davis Research, among others, have lent empirical support to this strategy, as scholars have found that both domestic and international companies whose dividends increased year-over-year for the past 20 years outperformed companies whose dividends either remained flat or decreased. The task of finding good dividend-paying stocks is easier said than done.

After all, discovering the companies that have such a history is problematic. It involves predicting which ones are best suited to endure the unpredictable shocks that the world generates without cutting or eliminating the dividend payouts.

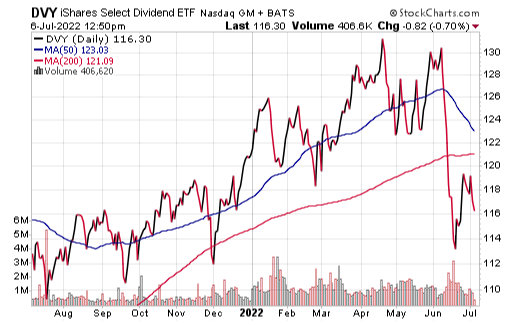

However, there are more than a few dividend-paying-related exchange-traded funds (ETFs) that aim to demystify this process. One of these is the iShares Select Dividend ETF (NASDAQ: DVY).

This ETF tracks a dividend-weighted index of American companies, including real estate investment trusts (REITs), that is slanted toward small-cap companies that pay dividends, but the stocks in the portfolio are selected after a rigorous selection process. The fund’s managers draw on five-year dividend growth patterns, payout ratio and payment history as criteria for selection in the portfolio.

The top holdings in the portfolio are International Business Machines Corp. (NYSE: IBM), Altria Group Inc. (NYSE: MO), Valero Energy Corp. (NYSE: VLO), Philip Morris International (NYSE: PM), Gilead Sciences, Inc. (NYSE: GILD), ONEOK, Inc. (NYSE: OKE), Exxon Mobil Corp. (NYSE: XOM) and Verizon Communications (NYSE: VZ).

As of July 6, DVY has been down 8.82% over the past month and 7.57% for the past three months. It is has slid 3.13% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $21.35 billion in assets under management and has an expense ratio of 0.39%.

While DVY provides investors with access to dividend-paying stocks, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

All We Have Is Now

Today, right now, in this very moment, you have an incredible opportunity to do something so sublime, and yet so ordinary, that you may not even realize its power or its importance.

You see, right now, you have the ability to “just begin again.”

That is the advice from philosopher and neuroscientist Sam Harris, whose book “Waking Up,” along with his brilliant app of the same name, is one of my most highly recommended resources for enhancing your personal well-being.

Both the book and the app provide essays and instruction on how to implement mindfulness meditation in your life. Broadly defined, mindfulness meditation is simply a mental training practice that teaches you to slow down racing thoughts, let go of negativity, and calm both your mind and body.

There’s nothing “woo-woo” about the practice, and you don’t have to buy into any pseudoscience or mystical silliness to make it a part of your life. That’s because mindfulness is basically just cultivating and enhancing your innate ability to be fully focused on “the now.”

Being aware of “the now” and all that this entails truly is one of your superpowers as a human. The reason why is because being mindful of the now means you can acknowledge and accept your thoughts, feelings and sensations in the moment.

And in case you haven’t yet fully realized it, “the moment” is all that any of us ever have.

My view from atop Catalina Island is a stunning location for mindfulness meditation.

Perhaps a few thoughts on this subject directly from Sam Harris will help further illustrate this point:

Take stock of how you’re feeling in this moment. And think about how you’ve spent the last few minutes, or last hour. What has your mind been like? Has it just been chaos in there? Take a moment to start the day again, and just rest your mind.

Everything that’s already happened is well and truly gone, and the future hasn’t arrived. So simply embrace this moment. It’s crucial to recognize that no one can do this for you. But no one can prevent you from doing it either. Where you stand, this bright corner of the universe, there is no one to enjoy it but you.

The beauty here of being mindful is that in any given moment, no matter what is going on within you, you have the ability to pause, reflect and just begin again.

Or as Harris puts it: “However good or bad things seem, nothing lasts. Everything you’ve done, or not done, is now just a memory. And everything you’re telling yourself about the future is a half-truth at best. This present moment is your opportunity, your only opportunity, to connect with your life — and that will always be the case.”

If you want to reboot your thinking and upload a new, enhanced operating system to your mind, then try some mindfulness meditation — because all you have is now, so why not be fully present for it?

*****************************************************************

Eating Software

“Software is eating the world, but AI is going to eat software.”

— Jensen Huang

Sticking with our theme of this issue, I uncovered this quote from Jensen Huang, co-founder and CEO of semiconductor maker NVIDIA Corp. You see, it’s not just the scientists that know AI is a game changer, it’s also those who want to be sure to profit from AI’s eventual gobbling up of all things. So, let the buyer — and the investor — beware.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.