When Mr. Crump Don’t Like It

I just spent nearly a week in Memphis, Tennessee, marinating in the spices of liberty, friends and great ideas at FreedomFest. Of course, the conference was amazing, as it always is. Highlights for me included delivering talks on markets, the economy and my investment advisory newsletters, and meeting up with friends, subscribers and fellow free marketeers.

My favorite personal highlight was that I got to sing and play a few of my original songs, and a Bob Dylan song, with the great FreedomFest band Triple AXL, live on Beale Street! So, I got to put another checkmark on my bucket list (and hey, at the rate I’m going, I’m gonna need to add to my bucket list, as I have been fortunate enough to have already put checkmarks on most of it!).

Another interesting part of FreedomFest for me was learning Memphis’ history. You see, while Memphis is a small city geographically, it’s big on musical history, civil rights history and the political history of the American South.

Your editor, playing and performing original tunes on Beale Street.

On Sunday, I went to a few of these historic places, including Sun Studios, where Elvis Presley, Johnny Cash, Jerry Lee Lewis and Carl Perkins all got their start. I also visited Stax Records, where greats such as Otis Redding, Isaac Hayes, Booker T. & the MG’s and many others recorded their most memorable hits.

Yet, one of the most interesting elements of my historical journey to Memphis was actually a walking tour of Beale Street. Here, I found out about the fascinating history of Memphis, and how the river city was built on the vices most port towns are built on — music, food, booze and “barrelhouse women.”

The story I liked most was that of “Mr. Crump,” also known as Edward Hull “Boss” Crump, the dominant force in the city’s politics for most of the first half of the 20th century. Crump served as mayor of Memphis from 1910 to 1915 and again briefly in 1940. However, it is said that he basically ran the political machine in Memphis, as he effectively appointed every mayor who was elected from 1915 to 1954.

During his mayoral campaign of 1909, Crump ran on a platform of getting rid of the vice trade in Memphis by ridding the city of the noisy music, free-flowing alcohol and the cathouses that populated Beale Street. Now, here is the lesson to be learned from Mr. Crump.

You see, a famous song was written as a protest to the Crump campaign’s message. That song, written by blues legend W. C. Handy, was officially titled, “The Memphis Blues,” but the subtitle is “Mr. Crump.” Here’s a version by the Beale Street Sheiks that I think captures the spirit of the song, and here are the lyrics from the first verse:

Mister Crump don’t like it, he ain’t gonna have it here

Mister Crump don’t like it, he ain’t gonna have it here

Mister Crump don’t like it, he ain’t gonna have it here

No barrelhouse women, lord, drinking no beer

Mister Crump don’t like it, he ain’t gonna have it here…

Now, you might think that Crump would want to prevent this song from being played in public, given its rather sarcastic tone. Yet, Crump actually made the song part of his mayoral campaign, a virtual theme song, if you will, by amplifying the message and ignoring the irony of a critical song about him.

This incident shows you that when it comes to publicity and spinning the circumstance in your favor, it usually pays to embrace the critics and to bring them into your fold. And while most of us will never run for public office, we all face our own critical songs at some point in life.

So, the next time you face this, do what Mr. Crump did — and make it your own!

***************************************************************

ETF Talk: If You Build This ETF, They Will Come

One of the sectors of the market that has caught the eye of many investors is the housing market. After a fall in housing prices across the board in 2022, home prices are rising again, largely due to a shortage of available homes, higher mortgage rates and the persistence of higher inflation. As an example, Forbes recently reported that, in my home state of California, the median sales price of homes across the state decreased across the board from 2022 to 2023. Since then, price trajectories have become more mixed, seeing rises in Los Angeles but falls in the Bay Area.

While some market analysts have predicted a renewed interest in real estate investment trusts (REITs) as a result of the present state of the housing market. Others disagree and point out that REITs are heavily weighted towards commercial real estate, which is currently in trouble. As evidence of this, you merely need to look at the myriad reports of downtown office buildings sitting empty and unused.

So, I want to discuss a specific exchange-traded fund (ETF) that is closely linked to the home building and construction market but is not a REIT.

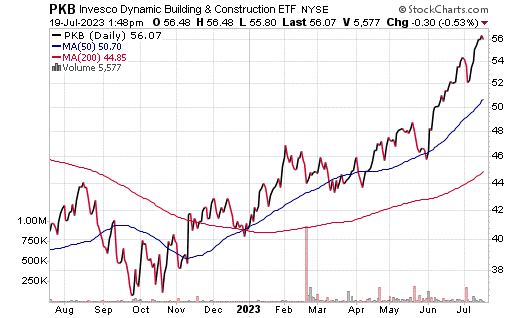

The Invesco Dynamic Building & Construction ETF (NYSEARCA: PKB) aims to track the performance of an index composed of companies in the building and construction industry. To do so, the fund’s managers use a list of criteria to evaluate prospective companies, including price momentum, earnings momentum, value and management action. The result produces a basket of 30 companies, most of which provided construction and engineering services for residential or commercial properties across the United States. However, the fund’s managers are also willing to consider companies that produce materials used in home improvement and construction.

The selected 30 stocks are placed by weight into groups, organized by market capitalization and then weighted equally within each group. This methodology, coupled with the fact that top-ranked large stocks are weighted at 40% of the index and top-ranked small stocks are given a weight of 60%, produces a noticeable slant towards small-cap stocks.

Top holdings in the portfolio include PulteGroup Inc. (NYSE: PHM), Lennar Corporation Class A (NYSE: LEN), D.R. Horton Inc. (NYSE: DHI), Trane Technologies plc (NYSE: TT), Martin Marietta Materials, Inc. (NYSE: MLM), Vulcan Materials Company (NYSE: VMC), NVR, Inc. (NYSE: NVR) and Tractor Supply Company (NASDAQ: TSCO).

Year to date, this fund has seen a total return of 38.5%. This ETF has total net assets of $250 million and an expense ratio of 0.62%.

The real estate sector, like all market sectors, is subject to fluctuations depending on factors such as economic conditions, interest rates and government actions can all affect the trajectory of the housing market. So, investors should be aware of the risks associated with investing in such a fund and always do their due diligence before adding any stock or fund to their portfolio.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

Elvis on Ambition

“Ambition is a dream with a V8 engine.”

— Elvis Presley

The “King of Rock and Roll” had a penchant for living his dreams, and for collecting a whole lot of powerful V8 engines along the way. While the life of Elvis Presley was riddled with tragedy, it also was infused with glory, greatness and happiness. And what was the key to Elvis’ success? In one word, “ambition.” If you want a result in life, ambition is a critical component, as it will serve as spiritual fuel that allows you to keep going even through the hardest times.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

P.S. My colleague, George Gilder, will be hosting a teleconference on July 26 at 2 p.m. EST — and you’re invited! The title of the conference is “How to Profit from the Next S&P500 Companies” and it is free. However, you have to register here to be able to attend. Don’t miss out!

P.P.S. Come join me and my Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

In the name of the best within us,

Jim Woods