When Mises Met MMA

It’s not often that you hear the brilliant Austrian school economist Ludwig von Mises referenced in the public sphere. And it is particularly unusual to hear him referenced in the aftermath of two men engaged in brutal mixed martial arts (MMA) combat. But that’s exactly what happened on April 14, when Brazilian fighter Renato Moicano, fresh off his impressive defeat over Jalin Turner at UFC 300, gave Mises a “shout-out.”

Here’s the family friendly version of what Moicano yelled out to the crowd in the post-fight interview with MMA commentator and podcaster supreme Joe Rogan:

“I love America, I love the Constitution… I love the First Amendment… I want to carry… guns. I love private property. Let me tell you something. If you care about your… country, read Ludwig von Mises and the six lessons of the Austrian economic school.”

If you want to listen to the unedited version in all its passionately profane glory, click here, but be warned that it is NSFW (not safe for work).

Now, I did not watch UFC 300 last weekend, as I was attending my favorite sporting event of the year, the Long Beach Grand Prix.

Your editor enjoying the fast action at the Long Beach Grand Prix

I did, however, get a slew of text messages that night about Moicano’s Mises shout-out from multiple friends, who asked me basically the same version of the following: “Did you see that, Jim? Moicano sounds like you!”

That night, I had to look up the clip, as it went viral for its unique and passionate message. Indeed, the clip even made it to intellectual circles, with the likes of Dr. Jordan Peterson commenting on what Moicano said.

“This is unspeakably great,” commented Peterson, who went on to write via Twitter: “What a world. The satirists are Christian; the left shills for Big Pharma and the deadly boxers have become profound economic philosophers.”

And in a testament to the power that social media connections bring, Moicano then replied on his Twitter feed to what Peterson wrote, saying: “I cannot believe Jordan Peterson the man himself retweeted this!!! Thank you so much doctor Peterson.”

The Mises shout-out also was celebrated by the Mises Institute, a thinktank devoted to promoting “Austrian economics, freedom and peace.”

Here’s what the Mises Institute had to say about Moicano’s message:

Moicano’s endorsement of Mises is a credit to the growing Austrian economics movement in Brazil, which has not only enjoyed success within universities and the political system but also culturally. Despite the imposition of socialist president Luiz Inácio Lula da Silva, and the extreme crackdown on free speech being imposed on the nation through the court system, as highlighted by Elon Musk and journalists on X, the Menos Marx, Mais Mises movement that captivated Brazilian politics in 2016 continues to bear fruits.

Increasingly, MMA has become an arena for free thinkers to push back against progressive ideology across the globe. The UFC was among the first major brands to push against covid tyranny, and a number of its fighters have utilized their podiums for political messages that go against corporate-approved narratives. None, however, are as subversive as promoting the wisdom unique to Mises and the Austrian school.

Now, if you’ve been a reader of The Deep Woods for even a short time, you know that I love to bring the realm of ideas into seemingly disparate fields of human endeavor, and that’s exactly what Moicano did with his Mises shout-out on Saturday night.

But what is all the fuss about? What are these “six lessons” being praised by a professional athlete from Brazil?

As the Mises Institute writes: “The ‘Six Lessons’ Moicano references is the book Economic Policy by Mises, which was one of his most successful popular books. Republished in Brazil as ‘Six Lessons,’ Economic Policy covers important topics such as capitalism, socialism, inflation and more.”

Fortunately, the Mises Institute has made it easy for us to read Economic Policy for free, and I recommend you do so, as it will widen your thinking about the importance of these ideas to a well-functioning society.

Hey, if a mixed martial arts champion can devote time to reading, understanding and promoting Mises, surely you can, too.

***************************************************************

ETF Talk: Tapping into the Power of Language with This Communications ETF

While Charles Dickens’s famous statement, “It was the best of times, it was the worst of times,” does not quite describe where we currently stand, we are rapidly approaching one of the best times of the year for communication — we are nearing the time for an annual event by my good friend and Fast Money Alert co-writer Dr. Mark Skousen. Debate, discussion and good conversation reign at FreedomFest (and if you haven’t bought your ticket yet, why haven’t you?). As for one of the worst of times — consider the upcoming presidential election, which features candidates that polls indicate generally are not popular with voters.

As any reader of The Deep Woods knows, I am a fervent supporter of effective communication. The power that such a skill can bring to bear in almost every aspect of our daily lives is immense. Indeed, I strongly believe that effective communication skills are a potent antidote to the political polarization that is currently endemic in America.

However, one can make a case that Dickens’s famous opening line from “A Tale of Two Cities” does describe the status of the telecommunication sector. According to Zacks’ analyst Supriyo Bose, the telecommunications sector as a whole is suffering from several problems, including the ongoing conflicts in the Middle East and Russia’s ongoing invasion of Ukraine which are causing supply-chain disruptions and high customer inventory levels.

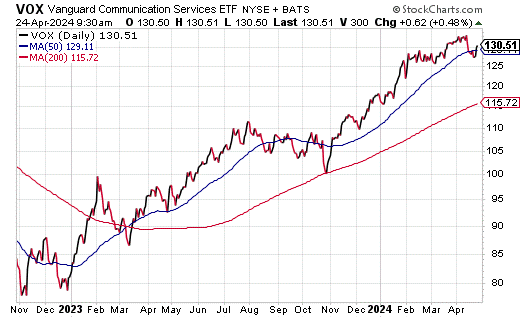

However, that does not mean that we should flee telecommunications and never look back. After all, our need, as humans, to communicate is still as prevalent as ever, and the sector continues to grow. Indeed, Supriyo Bose concurs with this trajectory, pointing to the continuing rise in 5G and increased fiber densification as signs of a vibrant sector. This is a key piece of evidence as to why exchange-traded fund (ETF) Vanguard Communication Services Index Fund ETF (NYSEARCA: VOX) had a very strong first quarter.

VOX is an ETF that tracks the performance of a benchmark index that measures the investment return of communication services stocks. However, its basket is not limited to just telephone, data-transmission, cellular and wireless communication services. It will also happily include companies that are centered around digital communication as well.

Some of the firms in VOX’s portfolio include Meta Platforms (NASDAQ: META), Alphabet Inc. (NASDAQ: GOOGL)/(GOOG), Verizon (NYSE: VZ), Netflix, Inc. (NASDAQ: NFLX), Comcast (NASDAQ: CMCSA), Walt Disney Co. (NYSE: DIS), AT&T (NYSE: T) and T-Mobile (NASDAQ: TMUS).

As of April 23, VOX has been down 1.04% over the past month and down 6.42% for the past three months. It is currently up 10.60% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $3.9 billion in assets under management and has an expense ratio of 0.10%.

Overall, the VOX ETF may be a good choice for investors looking for exposure to the telecommunications sector, but it’s important to carefully consider the risks and potential returns before making any investment decisions.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to email me. You may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Return of the Real

A lot of people these days like to use the term “real” to describe something or someone they admire. We say reverently that he or she is the “real deal,” or this team is “for real,” or this macho specimen is a “real man” or that this restaurant serves up “real Chinese cuisine,” etc. Hey, I use the term “real” too, as we all know what it means, even if it can be used in a many different contexts.

In 1996, “real” rap music icon Ice-T released his sixth studio album titled, “Ice-T VI: Return of the Real.” Now, I bring up Ice-T here not just because of his “realness,” but also because he happens to be the celebrity keynote speaker at this year’s largest gathering of free minds, FreedomFest.

I will be there, along with my fellow Eagle Financial Publications scribes George Gilder and Mark Skousen. This event is going to be amazing, as it features one of my favorite thinkers, Steven Pinker, as one of the keynote speakers. We also have one of the world’s most intriguing political figures, President Javier Milei of Argentina, who will also deliver a keynote address.

If you want to attend FreedomFest this year (and why wouldn’t you?) I am going to make it easy for you. This year’s conference takes place in Las Vegas, July 10-13, 2024, at the Caesars Forum Convention Center. And because you’re a reader of The Deep Woods, I am able to offer you a very special discount of $50 off the registration price.To take advantage of this special discount, simply go here, or call Hayley at 855.850.3733, ext. 202. Use the discount code EAGLE50 to get $50 off the registration price. (This discount ends on April 30, so act now.)

Getting back to the “real,” check out these lyrics from Ice-T’s hit “I Must Stand”:

And bein’ black ain’t easy, prejudice is real

But health and liberty is all we need for us to build

We gotta come together, unseparated

Check yourself like I did, black man, because we’re all related…

That’s as real as it gets, and it’s why I am excited to see Ice-T deliver his keynote.

Now, there’s another return of the real taking place right now, and here we come to the field of focus of my newsletter advisory services. That return of the real is the beginning of a return to reasonable equity market values.

As those of you who read my newsletters likely know, the macro environment in this market has deteriorated on numerous fronts over the past month. We know that because over the past month, we have seen a decline in stock prices that is A) Appropriate and B) Likely not over unless news turns more positive.

In fact, three of the five biggest market influences we track witnessed deterioration last month. The biggest here was the expectation for a June interest rate cut by the Federal Reserve. Hope of a June cut was extinguished by the hot March consumer price index (CPI) report, and now the market must deal with the possibility of just two (or even fewer) rate cuts in 2024 (remember the market started the year expecting as many as seven cuts).

Related here is a stall in the decline of inflation, which has proven “stickier” than the bulls had hoped. We know that because of the aforementioned hot CPI data. Finally, geopolitics has reared its ugly head again as an influence on the market due to the escalating conflict between Israel and Iran. That rising tension is pushing oil and other commodity prices higher and weighing on sentiment.

Importantly, this deterioration has not resulted in a change in what I call the “fair value” for this market given the current set up. Right now, the fair value, call it “real value,” is the S&P 500 index trading at a 19-20X multiple. And at the current expected 2024 S&P 500 earnings-per-share estimate of $243, that means an S&P 500 trading range between 4,617 and 4,860, with the midpoint being 4,739.

As of this writing, the S&P 500 traded at 5,023. So, here the “real value” of the S&P 500 (the midpoint value of 4,739) now is 5.65% below the current price. That’s still a bit higher than real value, but when you consider that at its high of 5,254 on March 28, the S&P 500 real value was nearly 10% below that price, the market is getting increasingly more “real.”

Now, does this mean we are likely to get a pullback of 5-10% in the S&P 500 from here? Not necessarily.

Things could materially improve for the market if the Fed signals a June rate cut is back on the table, if inflation data declines faster than expected and if artificial intelligence (AI)-related earnings remain strong and geopolitical risks decline. Of course, the opposite could take place. The Fed could push back on the idea of any rate cuts in 2024, economic growth could suddenly roll over, inflation metrics could rebound and AI-related earnings could disappoint.

This latter scenario would essentially undermine the assumptions behind much of the market’s robust rally in Q4 2023 and year to date. And given how stretched markets still are, the net result would be substantive declines in stocks. And while the outcome here remains an open question, it’s a question we all, as investors, must be keenly aware of if we want to successfully navigate this “real” market.

*****************************************************************

Until They Throw Me in a Box

“I see all these old people who don’t have anything to do but eat, drink and sleep. I will never say ‘retired’ because that’s such a finality that I don’t want to be part of my life. I’ll work until they throw me in a box.”

–Mario Andretti

The racing great always pushed it to the limit during his driving career, and he keeps pushing things to the limit. In the quote here, Andretti basically echoes my thoughts on the subject of “retirement.” I have no plans to retire, ever, because what I have the privilege of doing each day (writing about this beautiful existence) is something that I intend to do until they “throw me in a box.”

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods