What’s the Deal with Bond Yields?

What’s the reason for the big decline in stocks of late?

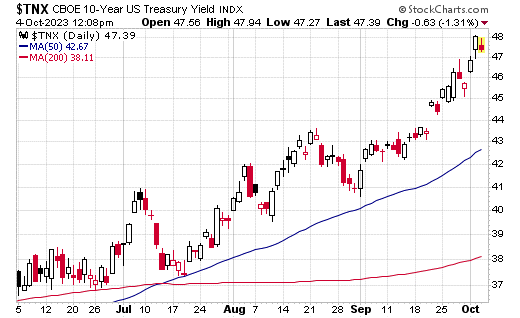

While a lot of pundits have offered explanations such as the rising dollar, recession fears, high oil prices and “higher-for-longer” monetary policy, the real reason is simple… rising Treasury bond yields.

And here, I am not just talking about a modest rise. Rather, bond yields are now at their highest levels in 16 years, and we could soon be approaching a benchmark 10-year Treasury note yield with a “5” handle — ouch!

Yet, a critical question here remains, and that is… Why are bond yields still rising?

The answer is neither simple nor obvious, which is why a thoughtful treatment of this issue is something required at this juncture. And to provide just such as treatment, I am going to show you what we wrote today in the daily market briefing, Eagle Eye Opener.

The Eagle Eye Opener is a collaboration between myself and my “secret market insider,” a man who provides actionable intelligence to the biggest Wall Street brokerage firms at a very high cost — intelligence of the sort you are about to read here, with my compliments.

So, again, why are yields rising? Here’s what we wrote this morning…

The rise in Treasury yields once again hit stocks as the 10-year yield rose through 4.70% for the first time since April 2007, and that continued move higher weighed on stocks. For reference, the 10-year yield was 4.18% just one month ago, and the rise in yields has gained steam lately and that is pressuring stocks.

But as always in markets, the key question to ask is: Why are yields rising?

There are three typical causes of higher yields: Rising inflation expectations, surging growth expectations and fears of a hawkish Fed. I want to investigate each of these to see if they are behind this acceleration higher in yields.

Potential Cause 1: Rising inflation expectations. Inflation expectations can drive long-term Treasury yields. When inflation expectations are rising sharply, that can push yields on longer-dated Treasuries higher as investors demand more long-term interest to offset potentially longer-term inflation. Inflation expectations rising sharply? No, they are not.

The five-year TIPS/Treasuries inflation breakevens have moved up over the past month, but barely so as they’ve risen from 2.17% on Sept. 1 to 2.22% as of Sept. 29. The recent high was 2.30% a few weeks ago, but these breakevens are well off the 3.57% peak in March 2022. Is inflation responsible for surging yields? No. Inflation expectations have not materially changed and are not fueling this rise in yields.

Potential Cause 2: Surging economic growth. Growth is the other factor that can influence longer-term Treasury yields, as higher growth can mean more inflation and investors demand higher longer-term yields to offset that risk. Point being, higher growth = higher yields. Are growth expectations accelerating? No, not meaningfully.

Looking at the Atlanta Fed’s GDP now, they are anticipating a sharp increase in gross domestic product (GDP) from 2.10% in Q2 to the current estimate of 4.9% for Q3. That’s a definite increase. But that growth expectation has been steadily declining from a high of just under 6% quarterly growth, so it’s not like growth expectations have spiked higher recently. Meanwhile, Wall Street analysts’ GDP estimates have risen to just under 3% recently, but that’s not the type of growth that would justify a 70-bps increase in the 10-year yield. Is growth responsible for surging yields? No. Growth expectations have risen from Q2, but that hasn’t happened recently and growth isn’t strong enough to justify this type of move higher in yields.

Source: StockCharts.com

Potential Cause 3: Hawkish Fed expectations. If the market truly believes the Fed will be “higher for longer,” that could push both short- and long-term yields higher. So, are Fed expectations getting materially more hawkish? No, not substantially so.

According to fed fund futures, there is currently a 53.6% probability the Fed does not hike rates between now and year-end. A month ago, the probability was 51.9% (so no change). Looking towards 2024, there has been a shift in market expectations. Currently, the market expects between 50-75 basis points of rate cuts from the Fed in 2024. A month ago, the market expected between 100-125 basis points of cuts in 2024. That’s a 50-basis-point change in expectations. Are Fed expectations responsible for rising yields? Partially. The market starting to believe the Fed will stay higher for longer has likely contributed to the yield rally, but it can’t account for the recent acceleration or size.

If the “usual suspects” aren’t doing it, what is? First, sentiment and speculation. CBOT U.S. Treasury short positions are just off the spike highs of the year, and we can tell by the reaction in bonds to “second tier” economic data and Fed/important financial people speak. Point being, JPMorgan CEO Jamie Dimon said it’s possible that Fed funds goes to 7% (a lot is possible) while some Fed officials have called for multiple additional Fed rate hikes (but the median dots still show just one between now and year-end, and that’s barely so). Point being, there’s clear downward momentum in Treasuries, and just like momentum can push stocks higher or lower than fundamentals justify, so too can it happen in bonds, and sentiment and momentum are major contributors to this past month’s drop in bonds.

Second, U.S. governmental dysfunction matters. For those of a certain age, this will ring a bell: It looks like the “bond vigilantes” have returned (at least in part). Bond vigilantes was a classic Wall Street term for bond investors who would sell Treasuries and send yields higher to voice disapproval over U.S. fiscal policy. They were popular and prevalent in the 1970s, ’80s and early ’90s, but were considered “extinct” by some on Wall Street after they failed to appear over the past 20 years. Well, they’re back!

Dysfunction in Congress is starting to matter, because markets want the government to address the long-term fiscal path of the country. To be clear, this isn’t a big enough reason to push Treasuries lower/yields higher by itself, but combine it with hawkish Fed fears and momentum, and we’ve got ourselves a solid drop in Treasuries, and that is why we are seeing bonds drop and yields spike.

What makes it stop? Disappointing economic data that reminds investors a growth slowdown is still possible. As we’ve covered, none of the long-term drivers of yields have changed much. Neither growth nor inflation are surging. That’s an important positive, and it strongly implies this spike in yields will be temporary because growth and inflation determine longer-term yields, regardless of what we’re seeing now.

That means for this spike in yields to stop, we need to see economic data that underwhelms and makes investors think a slowdown could occur. And given how oversold the 10-year Treasury is right now, any sort of disappointing economic data could easily cause a 20-basis-points decline in yields, if not more. Until then, momentum and general anxiety about the Fed and U.S. fiscal policy will push yields higher, and until they stop rising, we can expect continued volatile stock prices.

If you would like to get this kind of deep analysis on the economy, stocks, bonds and anything that makes the market move, each trading day 8 a.m. Eastern time, then I invite you to check out my Eagle Eye Opener, right now. I suspect it will be the best decision you make today!

***************************************************************

ETF Talk: ’Cause I’m Radioactive!

Well, I’m not uptight

Not unattractive

Turn me on tonight

’Cause I’m radioactive…

–The Firm, “Radioactive”

Given the recent shift toward cleaner and more reliable energy sources, interest in nuclear energy is rising. This has led developed nations to invest increasingly in new nuclear power facilities and extend the lifespan of existing reactors. Consequently, the Global X Uranium ETF (NYSEArca: URA) and other funds are performing well in this sector, driven by demand projections and potential sanctions affecting Russia’s energy supply, resulting in increased demand for nuclear power.

The exploration of the uranium market offers a unique insight into the present energy market. To begin with, uranium fuel — which enables nuclear power plants to generate electricity — is a key to the green energy transition. The wide availability of this raw material in countries such as Australia (28%), Kazakhstan (15%), Canada (9%) and others shows potential for nuclear power energy development, as indicated by the data from the World Uranium Association (2022). The advantages include low fuel costs — due to the minimal amount of uranium needed — and using one of the cleanest methods of electricity production, nuclear energy.

Another reason for URA’s excellent performance this year is that the fossil fuel reductions are set to keep uranium demand high. Nuclear power is a green energy source that offers low carbon emissions of just 12KW/h, compared to 820KW/h produced by coal. According to the Office of Nuclear Energy (2022), one Gigawatt of power generated from a nuclear reactor equals approximately 3.125 million photovoltaic (PV) solar panels to produce the equivalent amount of electricity.

Other factors include uranium’s role as a reliable and cost-effective energy source, as well as the construction of new reactors as a proxy for uranium’s future geographical demand increase. With 60 reactors under construction and 436 existing reactors worldwide, this expanded capacity is gaining the attention of investors. Strong support for nuclear energy is coming from China, India and South Korea. On top of that, small module reactors (SMRs) are also on the rise, with more than 70 now under construction.

I see investing in URA as offering multiple benefits to diversifying one’s portfolio, including targeted exposure, ETF efficiency and emerging energy opportunity benefits. Furthermore, URA gives investors access to a broad range of companies involved in uranium mining and the production of nuclear components. Uranium businesses include those engaged in extraction, refining, exploration or manufacturing of equipment for the industries.

The Global X Uranium ETF (URA) seeks investment results that correspond to the price and yield performance, before fees and expenses, of the Solactive Global Uranium & Nuclear Components Total Return Index.

Top holdings in the portfolio include Cameco Corp (CCO.TO, 24.09%), Sprott Physical Uranium Trust Units (U-UN.TO, 10.28%), NexGen Energy Ltd (NXE.TO, 6.28%), National Atomic Co Kazatomprom JSC ADR (KAP, 5.65%), Uranium Energy Corp (UEC, 4.52%), Paladin Energy Ltd (PDN.AX, 4.19%), Yellow Cake PLC Ordinary Shares (YCA.L, 3.28%), Denison Mines Corp (DML.TO, 3.22%), Energy Fuels Inc (EFR.TO, 3.10%) and Mitsubishi Heavy Industries Ltd (7011.T, 2.29%). The total number of holdings in URA is 46, with the majority in the energy sector (77.47%), with the remainder in industrials, basic materials and technology.

As of October 2023, this fund had jumped 7.24% in the past month, 20.14% for the past three months and 29.83% year to date. The fund has net assets of $2.05 billion under management and an expense ratio of 0.69%.

Source: StockCharts.com

URA allows global investors to expand their portfolios while benefiting from the growing energy sector. However, investors in this ETF should be aware of public sentiment, which could affect the fund, as well as currency fluctuations and other factors that might impact their investments. Beware that risk exists when investing in emerging energy markets, such as uranium, due to increased volatility and reduced trading volumes versus developed markets.

As I always advise, investors should do their due diligence before adding any stock, fund or ETF to their portfolio holdings.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Avoid the ‘Tearing of the Flesh’

I’ve had a few recent encounters with people who have demonstrated a form of behavior that I find vexing, caustic and very revealing. That behavior is sarcasm, and it’s an ugly trait that should be avoided in others, and in ourselves.

I say this, because contrary to popular belief, sarcasm isn’t just witty humor, or a sign of intelligence or mere kidding around at another’s expense. I am not referring here to good-natured jocularity. Rather, I am referring to the actual nature of sarcasm, which is a form of hostility toward others and to oneself that’s merely disguised as humor.

Perhaps we can understand this better by first understanding that the origin of the word “sarcasm” derives from Greek words that mean “tearing of the flesh.” So, when we describe someone as having a “biting” sense of humor, it refers to the “tearing of the flesh” that takes place when someone wants to hurt another person.

Let’s take a look at this in terms of a real-world example. Now, this example comes directly from a friend of mine, and I was granted his permission to use it for this article (no names need be mentioned). Here’s what took place between husband and wife.

The couple was about to go to Disneyland, and the wife asked if the husband knew the right roads to take. The man said he did, as he remembered the route from the last time he was there.

After a few wrong turns and some confusing road restrictions due to construction, the couple found themselves off track and somewhat lost. The husband then said, “I thought I knew the right way, but somewhere we made a wrong turn.” The wife, and here is the sarcasm part, then said in a mocking tone, “Wow, I always knew you had a great sense of direction.”

Now, at first glance, you may not think this is a big deal. But it is a big deal, and I will tell you why.

The husband had admitted that he was wrong about the route and made a mistake (a quite common one at that). Yet, rather than try to help the situation by using the GPS on her phone to find a new route or to tell him that it was going to be ok, the wife took the opportunity to tear at the flesh by insulting the man’s acumen at navigating life.

I wonder how many other not-so-subtle sarcastic remarks this woman has made to this man over the years, remarks that have eroded their love and friendship little by little, like a leaky pipe that allows water to slowly seep into the walls, building up mold until the levels become toxic. Indeed, the fact that my friend told me about this episode when I asked him how things were going tells you right there that this is not just some harmless form of kidding.

Yet, for those who wear their sarcasm as a badge of honor, or who hoist their sarcasm flag up the pole as some sort of virtue to the world, they can always just hide behind the bromide, “I was only kidding” when they’re challenged on their behavior.

Most of the time, however, the sarcastic person claiming they were only kidding is the one who is kidding themselves. The truth is that kidding with the intent to tear the flesh is hurtful, petty, cowardly and passive aggressive. I say “cowardly,” because if the sarcastic person had any guts, they would just come right out and tell the other person what they think is the problem.

To this I say, don’t abide sarcasm — not in others, and especially not in yourself.

Like nearly everyone, I have been guilty of this fault many times. Yet, every time I’ve reflected on my bouts of sarcasm, I’ve become a little less valorous in my own eyes.

If, after your own reflection, you find that your personality tends toward sarcasm, ask yourself why. What are you trying to convey to others or the world? If you are trying to show the world you have an intelligent sense of humor, then perhaps you can do so in another fashion, one that is humorous but isn’t carried out by tearing at another’s flesh.

Of course, if you just want the world to think you are a witty jerk, then that’s probably what the world thinks of you anyway. And hey, good luck with that.

Finally, remember that sarcasm is intended to be a little dig on another. And when it comes to relationships, repeated little digs will inevitably become big holes.

*****************************************************************

My Favorite Buffett Wisdom

“The stock market is a device to transfer money from the impatient to the patient.”

–Warren Buffett

The virtue of patience isn’t stressed enough when it comes to money. But think about it. Aren’t some of your biggest investing successes the ones that you’ve owned for a very long time? Sure, we can trade stocks and options to take advantage of tactical trends; however, when it comes to wealth building, there is no substitute for patience.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods