What is Your Purpose?

There’s an old saying in the literary world that a man’s life is incomplete until he has tasted love, poverty and war.

Beginning with the latter, my closest brush came in January 1991. I was just graduating from the U.S. Army Airborne School at Ft. Benning, Georgia, when the bombs began raining down on Saddam Hussein’s Iraq. As it turned out, that conflict was so short-lived that I missed out on the active war leg of the complete life.

As for poverty, well, although I come from a modest middle-class American family, I would hardly say that qualifies as poverty by global standards. And aside from some lean, post-college days working at the financial newspaper Investor’s Business Daily, I also would have to say that poverty mostly has eluded me.

When it comes to love, I think this is where I’ve more than made up for any deficit in the other two complete life components.

Love of family, friends, career, music, literature, philosophy, nature, fitness, sport, combat and, perhaps most of all, love of learning. These are the animating forces at the core of my being.

That love runs particularly deep when talking about the love I have for helping investors better understand — and better profit from — the financial markets. In fact, you might say that this love is a form of war on poverty itself… the poverty of knowledge that keeps investors paralyzed into subpar performance.

Ironically, my love for this pursuit also encompasses my own desire to be a complete man.

In Ayn Rand’s magnum opus “Atlas Shrugged” (in my opinion the very best novel ever written), one of the heroes of the novel is asked, “…what’s the most depraved type of human being?”

The answer: “The man without a purpose.”

This notion stuck with me as a guiding principle when I first read the novel as a 20-year-old trying to sort out the world. And ever since digesting this pithy profundity, I have set my life with “purpose” as my prime directive.

Your editor engaged in his “purpose” of communicating investing knowledge.

In The Deep Woods, my purpose is to shine a more luminous intellectual light on the issues that matter most to me, and that hopefully resonate with you. Sometimes those issues are economic, sometimes they’re social, sometimes they’re philosophic and sometimes they’re political.

Yet, every time, the issues are of personal importance to me, and achieving a better understanding of them is my purpose.

If you’re reading this, I hope sharing my purpose with you has helped you better understand your purpose.

Together, we can learn, grow, flourish and allow the very best within us to express itself — and we’ll do it all while having fun!

So, thank you for your time, attention and trust. I shall always value, cherish and respect them, and I will endeavor to always make this column worthy of you.

Now it’s your turn. Here’s what I want you to tell me: What is your purpose?

How do you see your life’s mission, and what animates your spirit and what is your prime directive?

I know this isn’t exactly a typical survey-style question, but hey, I’m not exactly a typical survey-style person — and I suspect you’re not either.

So, I’d love for you to tell me about your purpose, and doing so is as simple as sending me an email.

I look forward to your response.

ETF Talk: Speculating on That Old Herb

You don’t need me to tell you that the market is currently taking a beating.

While there have been some days where it seems that the bulls have defeated the bears and the market rose a bit as a result, overall, it seems that the bears are still driving the market bus. Indeed, only a quick glance at the headlines of any major newspaper or news site reveals the causes of the bears’ iron grip: “higher-for-longer” Fed policy, the persistence of inflation and war in Ukraine and the Middle East.

Such a negative market milieu has impelled many investors to turn to defensive sectors in order to protect their hard-earned money. Others have turned to speculative stocks, which, though a great risk, have the potential for big rewards. One such field is that of marijuana stocks.

Like I discussed in my ETF talk last week, the future of marijuana legalization remains up in the air. While several states have made moves towards decriminalization and even legalization, a move toward reclassifying the drug at the federal level has stalled. But the winds of change may be blowing in a positive direction with the passage of the Secure and Fair Enforcement Regulation (SAFER) Banking Act. Even so, until we get more clarity about the future of marijuana on the federal level, investing in the green herb will always be an inherently risky endeavor.

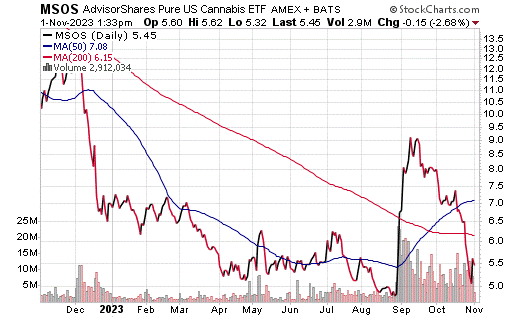

However, one exchange-traded fund (ETF) aims to reduce the risk, at least to some degree, through tracking a basket of U.S. stocks or swap contracts related to the domestic cannabis and hemp industry. The ETF in question is the AdvisorShares Pure US Cannabis ETF (NYSEARCA: MSOS).

MSOS’s managers aim to achieve this goal by selecting only legal and domestic cannabis equities from both small-cap and mid-cap companies and by requiring that all companies in MSOS’s portfolio must be registered with the Drug Enforcement Administration (DEA) specifically for the purpose of handling marijuana for lawful research and development.

Some of the stocks currently in the portfolio include Green Thumb Industries Inc. (OTCMKTS: GTBIF), Curaleaf Holdings Inc. (OTCMKTS: CURLF), Verano Holdings Corp. (OTCMKTS: VRNOF), Trulieve Cannabis Corp. (OTCMKTS: TCNNF), Terrascend Corp. (OTCMKTS: TSNDF), Cresco Labs Inc. (OTCMKTS: CRLBF) and Glass House Brands Inc. (OTCMKTS: GLASF).

As of Oct. 31, MSOS has been down 29.47% over the past month and down 0.36% for the past three months. It is currently down 19.89% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $457 million in assets under management and has an annual report expense ratio of 0.80%.

In short, while MSOS does provide an investor with a way to invest legally in marijuana stocks, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

I am always happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

In case you missed it…

Are You Ready for $250 Oil?

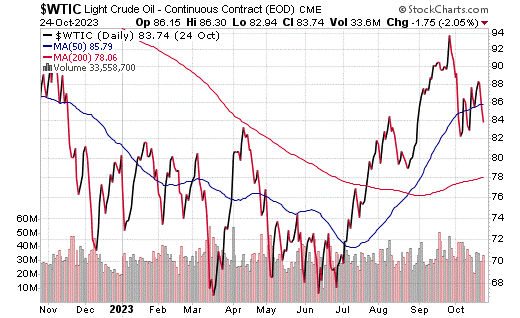

Last week, I received a text from a very smart colleague who has substantial investments and expertise in the oil and gas industry. And when this man alerts me to something he thinks I should know, I pay attention. In the text, there was a link to the following CNBC story with this ominous headline: “How oil could spike to $150, even $250 if Israel-Hamas war escalates, according to Bank of America”.

Now, one doesn’t even need to read any further to get a bit of a chill down the spine at the prospect of an oil spike of such magnitude.

Of course, if you are long oil stocks, E&P (exploration and production) stocks or crude oil ETFs/futures contracts, that chill down the spine was more likely felt as the tingling adrenaline surge of potentially big gains.

The thesis here with respect to these big oil price spike predictions is that, if the conflict between Israel and Hamas escalates into a wider conflict in the Middle East, that would likely cause big supply disruptions. According to analysts at Bank of America, any escalation involving Iran could trigger a jump in crude prices from $120 to $130 per barrel.

Chart courtesy of www.stockcharts.com

While that high a cost of oil per barrel would be ugly for the global economy, it would look like a teenage beauty queen in comparison to the extremely ugly scenario of oil prices spiking to some $250 per barrel.

The theory here is that if Iran gets more involved in the conflict (it already supports Hamas, militants in Syria and the Lebanese militant group Hezbollah — all three of which have fired rockets into Israel since early October), that would trigger a retaliatory strike on Iran by Israel and her allies, i.e., the United States.

Here’s the money quote from the CNBC article that’s downright frightening:

“Bank of America warned that any retaliation against Tehran could risk the passage of vessels through the Strait of Hormuz, a vital channel for the world’s crude. If the strait is closed, oil prices can spike above $250 per barrel, the bank said.”

Bank of America’s concerns continued, saying, “While keeping the Strait of Hormuz open is key to oil market stability because 17 million barrels cross it every day and prices could spike above $250/bbl if it shuts down for an extended period of time, there are plenty of other energy choke points.”

Now, I am not sure I even need to point out to you the gravity of this situation for the broader equity markets, but I will do so here for the sake of clarity and unambiguity.

A spike in oil prices of this magnitude would certainly send stocks into a protracted bear market, and the surge would easily wipe away all of the year-to-date gains in the major domestic industries.

The silver lining to this scenario would be the aforementioned move higher in oil stocks, E&P stocks and oil futures. The other silver lining would be a constriction of economic activity that would cause the Federal Reserve to reverse course on monetary policy despite the inflationary (or in this case, stagflationary) influence of Mt. Everest-altitude oil prices.

The way I see it, if you want to be ready to deal with whatever the craziness in the oil patch brings to the equity markets, and the economy at large, you are going to have to have a plan in place that keeps you in stocks when things are trending materially higher, and that gets you out of stocks when the material trend is lower.

Fortunately, our flagship newsletter advisory service Successful Investing is just such a plan — and it’s been helping investors expertly navigate wars, oil spikes, bear markets, political unrest and all sorts of unknowns for more than 40 years!

So, if you want to sleep well at night even in the face of $250 oil, then you need to get on the plan today with Successful Investing.

*****************************************************************

Way of the Bison

“A mindset of power, intelligence and curiosity: If you value your existence and aspire to live with significance daily, you may already be living the Way of the Bison credo.”

—Way of the Bison lifestyle website

Do you have a “spirit animal”? I do. My spirit animal is the bison, also known as the American buffalo. Why is the bison my spirit animal? Because the bison represents abundance, freedom and strength. Native Americans call the bison a wise teacher of living in balance with the “Great Mother.” As the bison roams, it undertakes a journey of discovery that requires endurance, strength, intelligence and the purposeful embrace of existence. And now you know why the bison is my spirit animal.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods