What to Do in an Active-Shooter Situation

- What to Do in An Active-Shooter Situation

- ETF Talk: Equal Weighting and Systematic Rebalancing Define This Fund

- What the Tax Cut Plan Means for Markets

- Orwell on Violence

****************************************************************

What to Do in an Active-Shooter Situation

Most of the time, this publication is devoted to how to protect and grow your wealth. Yet given we are just a few days removed from the worst mass shooting in American history, I thought another type of protection message might be in order.

The fact is that acts of violent crime, terrorism and mass shootings are a reality that can happen to any of us at virtually any time, any place.

Yes, the odds of you being in some kind of violent situation, and particularly an active shooter situation, are infinitesimal. However, that doesn’t mean it can’t happen to anyone at any time.

Reality is what it is, regardless of how we might want it to be. That means we must be aware of how to deal with reality when it turns violent… especially given the potentially catastrophic consequences.

So, what must you do to maximize your chances of survival?

Well, there are many specific recommendations given by law enforcement officials on what to do, and many of them are certainly good. For example, officials will tell you to have an escape plan mapped out whenever you go to a public place. They’ll also tell you to be aware of your surroundings, and to report anything strange or seemingly out of the ordinary.

According to the Advanced Law Enforcement Rapid Response Training Center, or ALERRT, in an active-shooter situation you should employ three rules… “avoid, deny and defend.”

The first rule is to avoid the attacker by creating that aforementioned escape plan, which also means moving away from the threat as quickly as possible. Next, you need to deny the shooter access to your location. That means taking measures such as putting up barriers to block doors, turning off the lights in a venue or taking hardened cover.

As for the third rule, defend, that’s where the real action and preparation need to take place.

According to Dr. Peter Blair, the executive director of ALERRT and a criminal justice professor at Texas State University, when it comes to defending against an attacker,

“Do not fight fairly. This is about survival.”

It is this last rule that I think nearly every person must be aware of, and must take on as a personal responsibility for themselves, their loved ones… and for the rest of society.

And while being psychologically and physically equipped to defend against an attack will vary along the spectrum of individuals, there are some things most of us can do to make sure we maximize our chances of surviving a violent encounter.

First, make sure you are as physically fit as you can be. Train to gain strength and maintain and increase muscle mass in the proper fashion by using high-intensity, progressive resistance exercise.

Eat a healthy diet, and ingest your social poisons (tobacco and alcohol) in a responsible and moderate manner.

Learn some self-defense skills. Here I am speaking about skills such as hand-to-hand combat, and particularly my preferred form of martial art, Brazilian jiu-jitsu.

The next step is to learn some defensive firearms skills from a reputable training organization staffed by professionals from either law enforcement or the military, and who emphasize safety first in their instruction philosophy.

My recommended training group is located in Los Angeles, Calif., and it is International Tactical Training Seminars, or ITTS.

The staff at ITTS is comprised of former and current Los Angeles Police Department S.W.A.T. instructors and team members. As a former member of the U.S. Army’s elite combat schools, I can personally attest to the skill and professionalism of the team at ITTS, as well as their first-rate training facility.

The photo here is me training at the ITTS facility, honing my own defensive firearms skills.

Hopefully, I will never have to use the knowledge and skills I’ve learned from ITTS in a live scenario. Yet I feel I have the obligation to do what’s necessary to maximize my chances of prevailing during a violent conflict, and to help my loved ones and my fellow citizens survive if the unthinkable happens.

Of course, all the preparation in the world can’t ensure you won’t become a victim of violence before you’re able to take any volitional action. That’s certainly the case with the horrific murders in Las Vegas.

Yet being prepared as well as you can be will help increase your odds of surviving an active-shooter situation, and other types of violent situations.

And, to bring it back around to investing, being prepared to take action in defense of your own money during a bear market or financial crisis is similar to being prepared to deal with a violent situation.

You may not avoid the negative consequences completely, but by being aware, prepared and ready to act, you will increase your odds of prevailing.

Upcoming Appearances

Dallas MoneyShow, Oct. 4-6: If you’re in the “Big D” in early October, then come by the Hyatt Regency Dallas and see me, as well as many other great industry speakers, at the Dallas MoneyShow. I will be giving a presentation on Friday, Oct. 6, 8:00 – 8:45 a.m., titled, “5 ETFs to Fight the Fake News.” For your complimentary tickets, go to Woods.DallasMoneyShow.com.

*************************************************************

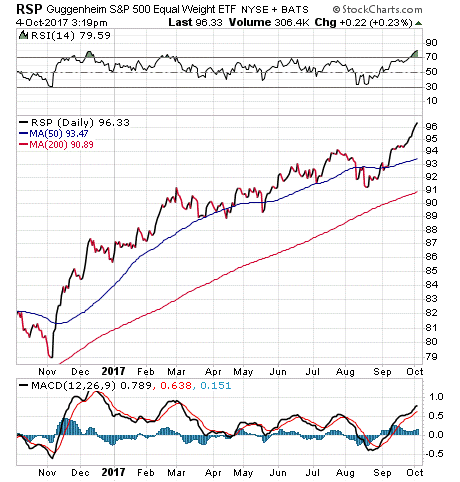

ETF Talk: Equal Weighting and Systematic Rebalancing Define This Fund

This week’s exchange-traded fund, Guggenheim S&P 500 Equal Weight ETF (RSP), uses an equal-weighting strategy to build its portfolio.

In fact, as probably the best-known equal-weighted ETF on the market, RSP simply takes all the stocks in the S&P 500 and weights them equally, disregarding the market caps of the stocks. As a result, RSP is biased toward the smaller caps in the S&P 500 index compared to other similar funds, resulting in a higher beta, or volatility.

However, this strategy also lowers concentration and thus reduces the risk of failure from any one single stock. RSP specifically employs a disciplined rebalancing system.

The ETF assesses and balances its portfolio on a quarterly basis, at which time it employs a contrarian strategy of selling the winners and buying the losers. This strategy is aimed at reallocating the fund’s assets from outperforming to underperforming stocks and market segments, which may provide an opportunity to improve long-term performance.

Since the fund’s strategy is about rebalancing to improve returns in the long run, it holds a stronger appeal for buy-and-hold investors than active traders.

Since it reduced its fee by half in June 2017, RSP’s expense ratio stands at 0.20%, which is relatively low when compared to many other funds with alternate ways of weighting their portfolios.

The fund has $13.66 billion in total assets. Its year-to-date return is 12.04%, compared to a 13.07% year-to-date return for the S&P 500. RSP has a one-year return of 16.32%.

The fund’s top five holdings are Micron Technology Inc. (MU), 0.24%; Range Resources Corp. (RRC), 0.24%; Newfield Exploration Co. (NFX), 0.23%; Concho Resources Inc. (CXO), 0.23%; and Anadarko Petroleum Corp. (APC), 0.23%.

For those seeking a fund that matches closely the performance of the S&P 500, I encourage you to look at Guggenheim S&P 500 Equal Weight ETF (RSP).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

****************************************************************

What the Tax Cut Plan Means for Markets

Question: What’s been the biggest driver of stocks since the election of Donald Trump as the 45th president?

Answer: The hope of tax cuts.

Last week, that hope got a little bit closer to reality, as Republican Congressional leaders unveiled their plan to reform the tax code.

Long-time readers of this publication and my Successful Investing newsletter know that I’ve constantly written about the “hope trade,” in markets, i.e., the hope that the president’s pro-growth campaign agenda would translate into real-world economic and market stimulus.

And while much of that hope has been dashed on many fronts (e.g. health care reform) the one remaining hope, as well as the most important, is tax reform.

Here are some of the key specifics of the GOP plan:

- A slash in the corporate tax rate to 20% from 35%

- A cut in the “pass -through” business tax rate to 25%

- A reduction of individual tax brackets to three, with a top rate of 35%

- A doubling of the standard personal tax deduction

- Elimination of the state and local tax deduction

- Elimination of the estate tax and the alternative minimum tax

- Expansion of refundable tax credits for childcare/dependent care

- Allows businesses to accelerate expensing of investments

- Creates a one-time repatriation of foreign earnings

My impression of this proposal is… it’s a decent start.

Of course, that comes from my admittedly radical mindset on the tax issue, one that thinks that morally speaking, all forms of taxation represent government theft.

Yes, I know I am in the minority here when it comes to my purest view, but being in the minority on an issue never stopped me from holding that view. And, just because a view is in the minority doesn’t mean it’s incorrect.

Galileo held a minority view of the cosmos, and he was convicted of heresy by the Catholic Church for his belief that the Earth revolves around the Sun. A view, of course, later validated by reality.

As for markets, the tax proposal offered up by the GOP today could be either a bullish game changer, or a bearish game changer, depending on whether its key proposals actually become law (or fail to become law).

From a bullish standpoint, a tax cut (particularly a sizeable corporate tax cut) could easily push the S&P 500 up another 4% (about 100 points, or over 2600), because that will increase expected 2018 S&P 500 Earnings Per Share to (conservatively) $145/share.

From a bearish standpoint, while tax cuts aren’t fully priced into stocks, there is the expectation something does get done, especially regarding foreign profit repatriation.

If tax cuts, like health care, fail, then we’re now sitting with a market at 18 times next year’s earnings with no identifiable future growth catalyst, and with a Federal Reserve that’s committed to raising interest rates and normalization of its balance sheet (not good for the bulls).

My go-to research source, as well as the provider of research for the Intelligence Report newsletter, Tom Essaye of the Sevens Report, summed up the tax cut situation for me nicely. Here is what Tom says the market expects out of the final tax reform legislation, and how it likely will react to the different tax reform scenarios:

- What’s Expected: Corporate rate cut to around 28%. Likely market reaction: Mildly positive.

- Bullish If: Corporate rate cut below 25%. Likely market reaction: The “reflation trade” sectors (e.g. financials, banks, energy, small caps) outperform.

- Bearish If: Corporate rate doesn’t change. Likely market reaction: Modest decline in equities, but not a bearish game changer.

- Foreign Profit Repatriation Holiday: Expected to pass. Likely market reaction: Positive for super-cap tech stocks and for multinational consumer companies.

The one wildcard to watch here that both Tom and I were surprised, and indeed encouraged, to see was the “pass-through” rate cut proposal.

This is very important to small businesses (including my own). The reason why is that approximately 95% of American businesses are structured as pass through tax entities, i.e. they are structured as LLCs, S Corps, etc. In this situation, the business owner is taxed at the individual tax rate, far higher than large corporations are taxed.

A cut in the pass-through tax rate lowers taxes for small business, and that could be a potentially significant (and unexpected) positive for the economy (assuming Congress can get its act together and actually pass at least some version of this proposed tax reform).

The bottom line here is that I don’t want you to let either the positive or the negative headlines regarding the tax reform proposals fool you. The fact is that the tax cut battle has only just begun, but how it works out will have potentially significant consequences for the economy… and for the markets.

As the battle unfolds, I will be there for you to make sense of it all, and to provide a little Galileo-esque perspective.

***************************************************************

Orwell on Violence

“People sleep peaceably in their beds at night only because rough men stand ready to do violence on their behalf.”

— George Orwell

The ugly truth about humans is that we are violent. To contain the darker angels of our nature, we must employ and codify the use of rational values, including respect for life as an end in itself. We also must employ the use of force in defense of those values, because there will always be those who seek to violate those rights — whether it’s in pursuit of material gain, political ends, religious ends or even seemingly inexplicable ends. The fact is we all must be vigilant protectors of our sovereignty, and we must not abdicate that responsibility.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.