Welcome to the Hotel California

So I called up the Captain

“Please bring me my wine”

He said, “We haven’t had that spirit here since 1969”

— Eagles, “Hotel California”

Some nights in a life are just better than others. And then there are some nights that are epic.

This past Saturday, I experienced one of those epic nights when I attended a Halloween party at a friend and colleague’s home in Bel Air, California. Now, in addition to this being the most magnificent home I’ve ever set foot in, the hospitality was equally magnificent. Food, drink, holiday decorations — all supremely delicious and exquisitely detailed for the All Hallows’ Eve revelry.

Yet what really made this night epic was the performance from iconic musician, member of the Rock & Roll Hall of Fame and lead guitarist for the Eagles, Don Felder.

Felder is perhaps most famous for writing the main riff and the melodically poetic and unforgettable guitar solo to the song, “Hotel California.” Indeed, as I write this, you almost certainly now have that solo in your head. That’s how iconic Felder’s work is and how influential he’s been in the history of rock and roll.

Your editor in his “capitalist hippie” costume, alongside the famed Don Felder.

Watching Felder up close and personal (literally a few feet away) was nothing short of spectacular, and it’s one of those life moments that I will be talking about and remembering with an ultimate sense of joy and wonderment for the rest of my days.

I bring this evening to your attention this week in The Deep Woods, because it’s of critical importance to any life well lived to be able to have many peak experiences.

Now, peak experiences are different for everyone. The birth of a child, fulfilling a long-sought-after career achievement or a profound religious experience all fit into the category of peak experiences. And while you may not consider a private performance by a member of the Eagles a peak experience (although I can’t imagine why not), the important thing is that one strives to have these experiences on a somewhat regular basis.

You see, to me, life is about celebration.

Celebration that you are here and that you are a thinking entity capable of knowing how lucky you are as a sentient member of the universe. Just that realization alone is enough to be grateful, but then knowing you also can have the sublime feelings that come with peak experiences should make your sense of gratitude for existence overflow with a sense of awe and adventure.

Of course, life also is difficult. There’s pain, suffering and ultimately, you will no longer be attending the party. Worse yet, you will have to leave the party while the party is still going on.

Yet just because we know life is finite doesn’t mean we shouldn’t celebrate. Indeed, it’s precisely because life is finite that we must cultivate the peak experiences and moments that make our days on earth worth the struggle.

As “Hotel California” reminds us, “you can check out anytime you like, but you can never leave.”

I take that lyric to mean that, although we can choose to “check out” and live a life unexamined, we are still here and we exist right now, and we can “never leave” the responsibility of thinking and acting.

And because we have that life, and that choice, why not choose to live it inspired, with a sense of purpose and with a goal of basking in peak experience?

I know which way I want my life to go, and if you’re reading this, I suspect you do, too.

So, let’s all check in to the Hotel California, because it’s a lovely place, such a lovely place.

***************************************************************

ETF Talk: This ESG Fund Has a Wide Moat

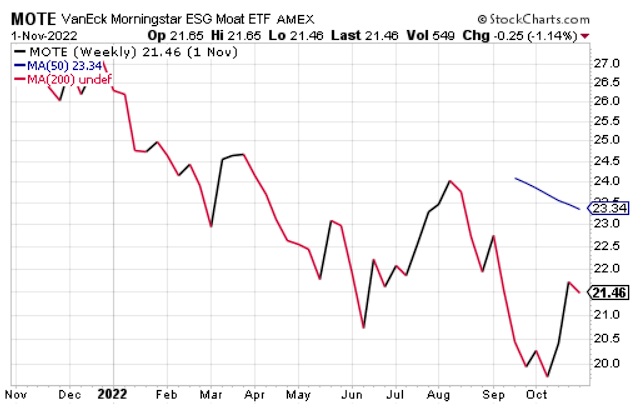

The VanEck Morningstar ESG Moat ETF (BATS:MOTE) tracks an equal-weighted index of U.S. stocks perceived to have high fair value, sustainable competitive advantage, positive momentum and excellent environmental, social and governance (ESG) ratings.

MOTE is a passively managed fund which tracks an index that provides exposure to U.S. stocks of any market-capitalization size that are deemed “wide moat” companies (attractively priced stocks that have sustainable competitive advantages) with low ESG risk. The fund selects wide-moat companies using quantitative and qualitative factors while screening out those with severe or high ESG Risk Scores, as well as those viewed as controversial.

Eligible securities are then ranked by momentum to only include the top 80%. Each sector is capped at 10%. The index is equally weighted, divided into two equal sub-portfolios, which follow a staggered rebalance strategy. Half of the portfolio is rebalanced in June and the other in December.

The fund normally invests at least 80% of its total assets in securities that compose the fund’s benchmark index. The U.S. Sustainability Moat Focus Index provides exposure to attractively valued companies with long-term competitive advantages, while excluding those companies with high ESG risks. The fund is non-diversified.

Source: StockCharts.com

As with any opportunity, potential investors should conduct their own due diligence in deciding whether this fund fits their own individual investing needs and portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

Wednesdays Mean Wisdom

Wednesdays mean wisdom, and that’s especially true at my podcast and lifestyle website, Way of the Renaissance Man.

This week’s wisdom comes to us courtesy of American statesman, diplomat, Founding Father and the fourth President of the United States, James Madison.

The insightful Madison warns us that if tyranny and oppression ever come to America, it will be in the guise of fighting a foreign enemy.

For the complete dose of Madison’s brilliance, check out the newly published Wednesday Wisdom featured right now at Way of the Renaissance Man.

*****************************************************************

In case you missed it…

Gentlemen, Start Your Investing Engines!

“There are only three sports: bullfighting, motor racing, and mountaineering; all the rest are merely games.”

— Ernest Hemingway

Hemingway’s inclusion of motor racing as one of only three real sports is often quoted with a sense of pride among those of us who pour our love, time and, yes, considerable financial resources toward this endeavor.

Speaking of the latter, there’s another saying that’s common in the auto racing world, and it goes like this:

Do you know how to make a small fortune in auto racing? You start with a big fortune.

This apropos adage is certainly one that amateur, semi-pro and even professional auto racing team owners discover very quickly, and that’s because when it comes to a costly venture, few things add up as fast as motor racing.

Now, the reason this subject is at the forefront in my mind today is because over the weekend, Formula 1 held the United States Grand Prix at the Circuit of the Americas in Austin, Texas. I wasn’t able to attend the race, but I had several friends who did and they told me about the excitement and pageantry of this tremendous event.

Of particular note was the remarkable drive by the former F1 champion, and my favorite driver on the circuit, Fernando Alonso. After being crashed into by another driver on a restart, Alonso went into the pits for a nose and tire change, and then went right back out and worked his way through the field for what many of us think was the drive of the season.

Here is how former F1 driver Jolyon Palmer described the remarkable Alonso: “Fernando is a driver of the steeliest determination. I remember his recovery in Baku a few years ago when he brought a hobbled McLaren back to the pits at the end of lap one, only to go back out and eventually come home in the points. This race, I think, was an even more spectacular recovery.”

So, now you know why Alonso is my favorite driver, as “steeliest determination” is one of the character traits I admire most in my fellow humans.

Interestingly, my friend who attended the F1 race once made an observation about the whole racing enterprise that sparked an idea for this column. Here’s what he told me:

“Jim, the racing business sort of seems like what you do. The team owners pour money into their people and products in pursuit of victory. And when it comes to investing, we put money into companies in pursuit of winning by growing our money.”

I thought about this for a while, and then I came to the conclusion that my friend was partially right. You see, in some ways auto racing is similar to investing, but in other ways, it’s very far from it. Let me explain.

Like auto racing, investors want to win. And like auto racing, investors have to take risks to come out with a victory.

And if you want to win in your portfolio, sometimes you have to push things along by buying high-momentum stocks and out-of-the-money call options on those stocks in pursuit of really fast gains, like the way we do in my Bullseye Stock Trader advisory service.

Yet unlike auto racing, when we put our money into a company, our winning comes in the form of more money.

You see, in auto racing, and particularly in the amateur and semi-pro ranks, but also largely in the professional ranks, the money you put into the venture doesn’t come back to you multiplied the way a good investment does. Sure, you might win a trophy, and it might be really fun, exhilarating and satisfying, but it’s going to cost you a whole lot of capital.

But when we invest, the trophy is the increased capital, and the bigger the gains, the bigger the trophy. So, unlike a pursuit that costs you money, investing is a pursuit that, when done properly, is going to make you a whole lot of money.

Another way to frame this for contrast is that unlike auto racing, investing doesn’t take a big fortune to make a small fortune. Instead, when you invest, you can take that small fortune and turn it into a really big fortune.

And when it comes to investing, there’s no time like the present to go out on the track and test your driving skills.

So, gentlemen, start your engines!

*****************************************************************

Take It Easy

We may lose and we may win

But we will never be here again

Open up I’m climbin’ in

To take it easy

— Eagles, “Take It Easy”

One of the most iconic songs by the Eagles is one that was co-written by the great Jackson Browne (a personal favorite). In the chorus here, the band reminds us that whatever life brings in the moment, whether good or bad, that moment will never be duplicated. So, just open up to it, climb in — and take it easy.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.