Under A Benevolent Mushroom Cloud

Growing up as a child during the Cold War, I had a persistent, if not immediate, sense of fear omnipresent in my mind. That interred fear was caused by what was then a very real possibility of a global thermonuclear war between the United States and the Soviet Union.

Indeed, the horrifying idea of a world engulfed in a skyline of atomic “mushroom clouds” capable of wiping out humanity was the unthinkable fear I suspect was buried in the back of every schoolkid’s developing brain from the 1950s all the way up until the fall of the Berlin Wall, when the “Doomsday Clock” was finally dialed back.

The ominous fear generated by the thought of a nuclear mushroom cloud capable of incinerating the planet and ushering in a post-apocalyptic landscape with few, if any, survivors was the stuff of Cold War kids’ nightmares.

In fact, I can vividly conjure up the thought of a mushroom cloud, and to this day it gives me a deep sense of impending doom. Well, at least it did until I discovered what I suspect could be the next big development in human health and physical and mental performance.

You see, I think we could be ready to experience a very different kind of “mushroom cloud,” one that’s capable of generating a benevolent radiation throughout humanity.

A radiation that not only will benefit mankind’s collective health, but one that also could radiate huge profits for savvy investors who get in during the early stages of this health, fitness and medicinal explosion.

This new, benevolent mushroom cloud comes to us courtesy of a company whose express purpose is to “create the future of human optimization through natural and medical fungi derived solutions.”

That company is Optimi Health (OTC: OPTHF; CSE: OPTI), and in my free, just-released special report, I introduce you to this leader in the “functional mushroom” market, and I show you why this company is one you should be thinking about as an investor, right now.

Interestingly, I got a hint about Optimi Health almost a year ago today. That’s when I attended an unusual gala fundraiser in Malibu, California. This gala celebration was the first “real-life” event I attended in pandemic 2020; it was held outdoors, and the attendees all were tested for COVID-19 before entering the premises.

This fundraiser also was unusual in that it celebrated freedom, reason and capitalism, with no apologies for the virtue of any of these values.

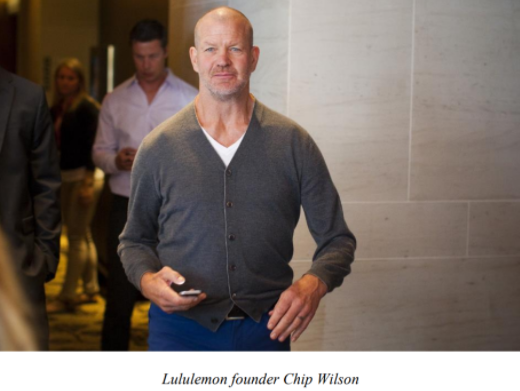

One of the capitalists celebrated that night was Lululemon Athletica (NASDAQ:LULU) creator Chip Wilson. The Canadian businessman and philanthropist, and the man who is basically responsible for creating the athleisure trend, also happened to be quite approachable.

I introduced myself to Wilson that night, and we exchanged pleasantries. I also told him I was a big admirer of his work and his fantastic achievement with Lululemon. I joked with him about how much money I’ve spent over the years buying his products. He laughed with me on that front, and then he said that he was working on some new projects that I could spend my money on.

Now, Wilson didn’t mention any specifics about what he was working on that night, but I was intrigued. After all, when you have a track record of creating a mega success such as Lululemon, investors pay close attention.

Fast forward about 11 months and I discover the new project Wilson was working on — and that project is Optimi Health, as Wilson is an advisor to the company as well as an investor.

So, what is Optimi Health’s mission?

Well, it’s quite philosophical, and if you are familiar with my work, it shouldn’t come as a big surprise that the company’s message resonates with my own sense of life.

Here’s the money quote from Optimi Health’s Initial Public Offering presentation:

“Optimi Health believes that personal identity is a fluid and evolving aspect of all our lives and encompasses our physical, spiritual and mental well-being.”

Now, that is a broad and ambitious idea. I mean, what kind of company talks about a fluid sense of “personal identity” that includes “physical and spiritual well-being” in its mission statement?

Well, it’s the kind of company that wants to bring medical and nutraceutical mushrooms into mainstream use.

If you want to know more about Optimi Health’s mission, its products and the investment opportunity in the nascent stages of a well-positioned company in the booming mushroom industry, then simply go to my free special report, “Profiting Under the Radiation of A Benevolent Mushroom Cloud,” right now.

***************************************************************

ETF Talk: The Sky’s the Limit with This Aerospace and Defense ETF

This article is the sixth in a series exploring equal-weight ETFs.

For investors looking to diversify their portfolio, the sky is the limit with the SPDR S&P Aerospace & Defense ETF (NYSE:XAR).

This exchange-traded fund (ETF) has a unique composition compared to similar funds. The fund is primarily comprised of aerospace and defense stocks, as defined by the Global Industry Classification Standard, but it also invests in other stocks as well.

XAR has a holdings ratio of 40/40/20, meaning that the fund invests those ratios in large-cap, mid-cap and small-cap stocks, respectively. That mix allows for ample diversity and market access. The majority of the fund’s holdings, roughly 80%, are allocated to the aerospace and defense sector, but the remaining 20% of its portfolio is spread across the industrial and capital goods sectors.

The U.S.-based ETF uses a random sampling technique to track the performance of the S&P Aerospace & Defense Select Industry Index. This method allows the fund to track data performance free of bias and ensures that its holdings reflect the characteristics of the larger index.

XAR has an expense ratio of 0.35% and a hefty dividend yield of 0.72%. The fund currently has $1.24 billion in assets under management. The fund, which was formed in 2011, saw a steep drop in early November 2020, but then shot back up into December. Since February of this year, the fund has seen a fair amount of price activity but has managed to remain in an uptrend. As seen in the company’s latest stock chart, there have been several small dips this year, but none too large.

Given the sector, the fund has undoubtedly been affected by the less-than-even-keeled political climate of late. However, its price is once again climbing higher and it opened today at $121.20, which is at the high end of its 52-week range.

Chart courtesy of stockcharts.com

The fund’s top five holdings include Northrop Grumman Corporation (NOC), 4.65%; Spirit AeroSystems Holdings, Inc. Class A (SPR), 4.60%; HEICO Corporation (HEI), 4.58%; Raytheon Technologies Corporation (RTX), 4.49%; and Lockheed Martin Corporation (LMT), 4.39%.

For investors looking to soar into the aerospace & defense sector, the SPDR S&P Aerospace & Defense ETF (NYSE:XAR) may be a good opportunity. Not only does it allocate a portion of its holdings into different sectors, but it also invests in large-, mid- and small-cap stocks. Further, this fund is less expensive than others in its arena.

However, as this fund focuses mainly on one specific area, and a large percentage of its holdings are in large-cap stocks, it may not be the best fund for investors looking to expand their long-term portfolios. But it could seem inviting to those who are more interested in tactical trading and looking to overweight this segment of the market. Interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***********************************************************

Milton Friedman, Happy Warrior

When I was a kid, I watched a documentary that influenced my young brain immensely, and it was called “Free To Choose.”

The original 1980, 10-part television series was by the great Nobel-Prize-winning economist Milton Friedman.

In academic circles, Friedman was chiefly associated with the renaissance of the role of money in inflation and the consequent renewed understanding of the instrument of monetary policy. For his studies in these subjects, he was awarded the Nobel Prize in 1976.

Yet it was the “Free To Choose” documentary, as well as his many subsequent public appearances via lectures and on TV, that helped bring into the mainstream the meaning of freedom, and why it is so vital to economic prosperity and social prosperity.

The “happy warrior” approach that Friedman took, as well as his passion for ideas, are kept alive by the Free To Choose Network, a global media nonprofit organization dedicated to promoting Friedman’s work, as well as other outstanding scholars such as Thomas Sowell.

Directing that effort is Free to Choose Network President and CEO Robert Chatfield.

At the recent FreedomFest Conference, Chatfield sat down with me for an episode of the Way of the Renaissance podcast to reminisce about Freidman, his wife and intellectual partner Rose, Friedman’s insatiable intellectual curiosity, the history of the “Free To Choose” documentary and how it came to fruition and even how Milton Friedman, at age 90, learned how to do stomach crunches!

I loved this interview with Robert Chatfield, and if you’ve ever wanted to learn more about the great Milton Friedman and the critical role he played in my life, and the life of society at large, then this episode of the Way of the Renaissance Man podcast is just for you.

*****************************************************************

My Favorite Friedman Quote

“Underlying most arguments against the free market is a lack of belief in freedom itself.”

— Milton Friedman

This is my favorite nugget of wisdom from Friedman because it expresses what the underlying attitude is within so many politicians and would-be power mongers. You see, in most cases I am convinced this type doesn’t believe in freedom. In fact, freedom is dangerous to them because freedom is the opposite of control — and control and power are the lust of the second hander. Remember that when you vote for ANY politician.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.