Turn and Face the Strange

- Turn and Face the Strange

- ETF Talk: Banking on Beating the Benchmark with This ETF

- Reeducating America, Conceptually

- It’s Time to Go Clubbing

- On Falling Together

Turn and Face the Strange

Ch-ch-ch-ch-changes

Turn and face the strange

Ch-ch-changes

There’s gonna have to be a different man

–David Bowie, “Changes”

If you thought that the beginning of 2022 would be volatile, then you were right on the money, literally. You see, in this business, being “right on the money” is what I attempt to do each day, week, month and year.

Now, for much of the past two years, and certainly since the March 2020 pandemic lows, the equity markets have trended higher on a bullish combination of 1) A very accommodative central bank, 2) Fiscal stimulus via big federal spending/giveaways, 3) COVID-19/vaccine optimism and 4) Strong corporate earnings.

I’ve written about these four bull market factors in my newsletter advisory services with the biblical reference, “The Four Horsemen,” as their presence escorted the bulls on their trek through Wall Street and the American and global economies for much of the past 22 months.

Yet as David Bowie famously wrote in his classic song, “Changes,” sometimes we must turn and face the strange, and if necessary, become a different man.

So far in this nascent year, one that is not yet even one month old, we’ve already witnessed aggressive gyrations that have created massive changes in the major domestic averages.

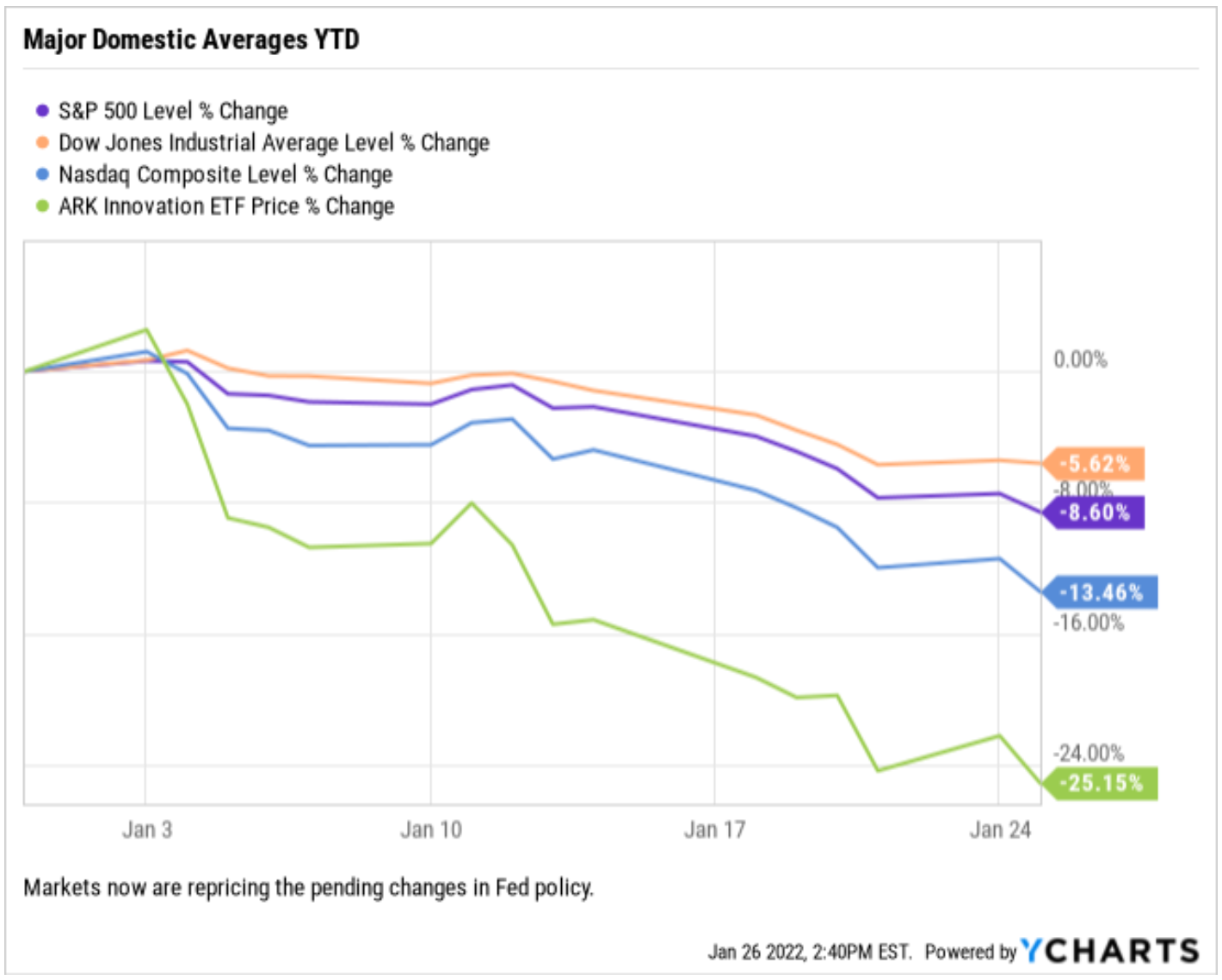

Through the close on Tuesday, Jan.25, the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite all were firmly in negative territory year to date. The Dow was the best performer over this period, but it was still down 5.62%. The S&P 500 has already witnessed an 8.60% pullback, while we saw big selling in the tech-heavy Nasdaq Composite with a loss of 13.46%.

The big losses in the higher-valuation, tech-heavy Nasdaq are all you need to know to understand the changes we face here, changes that are no longer supported by two of the four horsemen (a very accommodative central bank and fiscal stimulus via big federal spending/giveaways).

In fact, not only have two of the four horsemen basically been relegated to the barn, but there also has emerged a dark presence in the market atmosphere that’s clouding the outlook going forward, and that is multi-decade-high inflation.

Yet, why is it that high-valuation, high-growth tech stocks are getting hit the hardest? Aren’t these the stocks that everyone wanted to own last year? The answer is largely yes, these are the stocks everyone wanted to own, and that’s part of the reason we are seeing the segment sell off here, as these were the stocks that were over-owned for years.

Another reason why there’s been an exodus from growth stocks/sectors to value stocks/sectors this year is because those high-growth stocks also are high price-to-earnings (P/E) stocks. Now, as interest rates rise, a headwind will begin to be created on economic growth. And as growth potentially slows, it hits the highest P/E stocks hardest, because these companies are priced for perfection, and perfection doesn’t include slowing growth.

The high P/E leaves these stocks and sectors a long way from a level that would attract anyone looking for value. For example, a 100 P/E tech stock could get cut in half (50 P/E) and that’s still a multiple double that of the S&P 500. Conversely, a 30 P/E stock could drop to 25 P/E (so less than 20%) and now it’s trading much closer to the overall market multiple and is more attractive to more buyers. Point being, when rates are rising and growth could potentially be slowing, buyers won’t defend the high P/E stocks until there have been big drops.

We’ve seen those big drops occur already this year, as many of these high-growth tech names, best represented by the holdings in the very popular ARK Innovation ETF (ARKK), have tumbled. In fact, ARKK is down over 25% year to date. Yet still, the big holdings in ARKK are nowhere near “value” levels that would entice investors to step back in and defend these stocks at a certain level.

The reason that’s a problem is we have no idea just how over owned the high-growth, high-P/E space is by hedge funds, nor do we know how much leverage there is in these holdings. If the answer to both is “a lot,” then the drop in this sector could cause a bigger market correction.

For astute market watchers trying to determine the next leg higher for equities, the key is watching these high-P/E, high-growth tech names. Stated more practically, if ARKK can stabilize that will be a sign that stocks in this space have declined enough to entice buyers.

Going forward, I will be closely monitoring funds such as ARKK, along with all of the Fed’s actions and market signaling, to determine when it’s safe to turn back and face the strange of the high P/E equity segment. Until then, as investors, we’re gonna have to be a different man and embrace the “quality” stocks out there with more attractive P/Es and better valuations—and hey, there’s nothing wrong with that kind of change!

***************************************************************

ETF Talk: Banking on Beating the Benchmark with This ETF

Some funds attempt to provide market-like sector exposure in relation to their benchmark index, while other funds attempt to beat the benchmark.

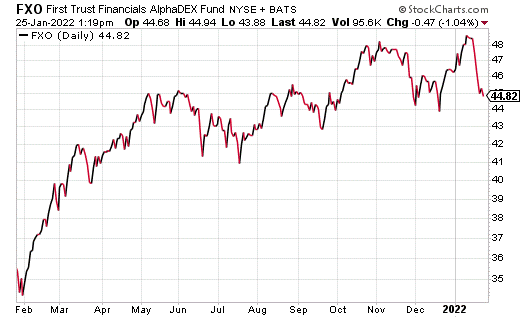

One such fund trying to beat a benchmark is the First Trust Financials AlphaDEX Fund (FXO). In an effort to beat the U.S. Financials market sector, FXO seeks to replicate a unique index known as the AlphaDEX Index, which is part of the StrataQuant Series owned by ICE Data Indices, LLC.

The Index employs a unique quantitative strategy that is designed not only to generate excess returns relative to traditional cap-weighted benchmarks but also to identify stocks positioned to outperform.

Launched in 2007, the passively managed fund’s ultimate goal is to pick winning stocks by determining the degree to which companies outperform or underperform on a risk-adjusted basis relative to the Index which is applied to the Russell 1000 financial sector.

As FXO uses a multi-factored index selection methodology, it maintains a lower concentration of top holdings than cap-weighted funds. Simply put, the fund’s performance is not as dependent on a collection of large-cap stocks, which may allow interested investors broader access to financials.

As a testament to its innovative index selection methodology, FXO’s top 10 holdings only account for about 16.21% of its total assets under management. Moreover, as it uses an equal-weighted tiering method, the fund’s holdings are more skewed toward mid-cap stocks.

The fund has $1.52 billion in assets under management, $1.62 billion in net assets, a distribution yield of 1.92% and an expense ratio of 0.62%. Further, FXO has a modest price-to-earnings (P/E) ratio of 8.44 and a solid price-to-book (P/B) ratio of 1.30.

As indicated by the chart below, FXO started the new year with a bang and was trading at around $48.99, which is at the highest end of its 52-week range. At the time of this writing, the fund is trading at $44.99. Though that is lower than earlier in the first month of 2022, the chart shows that it has the ability to regain its upward momentum.

FXO’s top five holdings include: MGIC Investment Corporation (MTG), 1.78%; Berkshire Hathaway Inc. Class B (BRK.B), 1.75%; Allstate Corporation (ALL), 1.74%; OneMain Holdings, Inc. (OMF), 1.74% and Cincinnati Financial Corporation (CINF), 1.72%.

By seeking to replicate the AlphaDEX Index, the fund is comprised of stocks with a good chance of outperformance, in relation to the Russell 1000. Further, the fund’s top five holdings all boast low P/E ratios, as do the majority of the stocks within the fund.

Ultimately, while First Trust Financials AlphaDEX Fund (FXO) may be a bit pricier than its counterparts, it may be a smart move for investors interested in a fund that will provide broad exposure to the financial sector through its one-of-a-kind index methodology. However, this ETF may not be appropriate for all portfolios, and investors are encouraged to conduct their own due diligence to determine whether this fund aligns with their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

Reeducating America, Conceptually

You often hear that education is the key to success. And while I agree with that statement in principle, it’s important to understand that it is the kind of education one gets that really matters.

In the new episode of the Way of the Renaissance Man podcast, I speak with Ed Thompson, a man whose mission is to help reeducate America, conceptually.

Ed is the founder of the Conceptual Education Project, a group spearheading an effort to reform the education system by guiding it away from the current “progressive” philosophy first created by John Dewey, and into a more “conceptual” philosophy.

Jim Woods and Ed Thompson talk “conceptual” education.

The basis of the organization’s program is to help train intellectuals who can articulate and advocate a rational approach to primary and secondary education, with a view to radically influencing how teachers’ colleges teach.

If you are concerned with the current state of the anti-conceptual approach to education that pervades America’s K-12 system, and you want to find out how you can help make things more philosophical, and more conceptual, then this episode is a great place to start.

******************************************************************

In case you missed it…

It’s Time to Go Clubbing

I’m not usually the type of man who wants to be in a “club.” In fact, I generally eschew membership in social organizations, political parties and other artificial constructs that humans create to feel kinship with one another.

However, there is one club of sorts, or more specifically, a list of individuals, that I would love to count myself a member of. That club, if you will, is the group of individuals profiled in what has been described as a “bombshell” story by investigative journalism organization ProPublica last summer.

Here’s the headline of the article that captured the attention of the mainstream media, as well as progressive and populist websites around the globe: “The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax.”

The story, which is an interesting read for a variety of reasons, is basically an analysis of the taxes paid by the richest Americans. The analysis is based on the private tax returns that ProPublica says it received from an “anonymous source.” The organization also claims that disclosing this very private information about American citizens is in the greater “public interest,” and this, they’ve concluded, outweighs privacy considerations.

So, who is in this “club” of the richest Americans, and what’s all the fuss about?

Here are some of the top names mentioned in the ProPublica article: Jeff Bezos, Elon Musk, Warren Buffett, Carl Icahn, George Soros, Michael Bloomberg, Bill Gates, Rupert Murdoch and Mark Zuckerberg. According to the report, the tax data “shows not just their income and taxes, but also their investments, stock trades, gambling winnings and even the results of audits.”

The article goes on to claim that “taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most. The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.”

Okay, let me unpack that statement, because it’s riddled with a few bad insights.

First, as my friends at Reason.com point out, “For the 2018 tax year, the last year for which we have data, the top one percent paid over 40 percent of federal income taxes, despite earning just under 21 percent of total adjusted gross income (AGI). The bottom 50 percent of taxpayers earned 11.6 percent of total AGI, but paid less than 3 percent of income taxes.”

So, while the elite club of richest Americans profiled in the article show that they often paid very little or no income taxes in some years, the wider point is that the oft-vilified “top one percent” pay far more into the federal tax system than any other group. So, in a way, the ProPublica article unwittingly got it right in the sense that this is definitely not “fair,” i.e., not fair to the top one percent of Americans who pay far more into the system than other groups.

The other point here from ProPublica is that the records show that the wealthiest can pay “income taxes” that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.

The problem here is that the growth of one’s fortune via such things as share price appreciation of assets, including shares in a company, or real estate or a business, is not “income” until those assets are sold. And then it’s not the same as ordinary income, but rather more like a capital gain.

Here again, I’ll let Reason.com do the explaining:

“ProPublica, however, tries to make the case that the wealthy are getting away with murder through the tax code, so they do a calculation that has never been done before, comparing growth in wealth over the course of a year to taxable income. They use this to calculate an individual’s ‘true tax rate,’ which is sort of like handing out wins in a baseball game in the middle of the early innings and calling it the ‘true outcome’ of the contest.

“It’s hard to overstate how nonsensical this comparison is (which is perhaps why it’s never been done before). Our tax system rightly does not tax growth in one’s wealth until it is realized as income. After all, the alternative is a monstrously complex and unfair system of wealth taxation that developed countries have avoided.”

Ah, but you see, here is where the progressive and the populist dream “wealth tax” comes in, one where the most successful among us are taxed on our investment prowess and our ability to accumulate appreciating assets. That tax would not just be on our incomes, but on what we own. We know this because Senators Elizabeth Warren and Bernie Sanders have already piggybacked on the ProPublica article to buttress their argument in favor of a wealth tax.

But let’s put this into perspective that most of us can relate to. A wealth tax would, in effect, consist of tax authorities coming to you and taking an annual inventory of your stock portfolio, 401(k), home value, automobile values, collectibles, art, furniture, etc., and then determining a figure of how much you are worth. Then, they would send you a tax bill on that amount each year. It doesn’t matter that you haven’t sold these items. The tax is just based on their overall value.

In essence, the ProPublica “exposé” is, in my view, just another attempt to try and vilify the rich for doing what we all should be doing — using the money we’ve accumulated via our productive achievement and investing that money in appreciating assets that can flourish into enormous wealth.

So, one day I hope to be in that exclusive club, the club where my tax returns reveal that I paid little or no taxes in a given year on income because all of my wealth was tied up in the best stocks, real estate and business investments that I made with the expert knowledge of the markets that I’ve accumulated over the years.

To me, the ProPublica article was a financial form of a Tony Robbins seminar, one that has motivated me to be a subject of the next ProPublica on how the super-rich legally avoid paying Uncle Sam.

If you want to “go clubbing” alongside me as a future member of this exclusive wealth club, then I invite you to check out my newsletter advisory services today. Together, we can get on our way to being the subject of the next ProPublica wealth piece.

*****************************************************************

On Falling Together

“Sometimes good things fall apart so better things can fall together.”

–Marilyn Monroe

The iconic sex symbol also happened to be a very good actress, as well as an intelligent, thoughtful individual who worked very hard at her craft. In this quote, Monroe reminds us that even good things come to an end, but that just means that there is a possibility of better things to come. Looking at the issue with this kind of positive spin is what can be described as a benevolent sense of life, and it’s one that I embrace. Yes, life is tough. However, your values are achievable if you are willing to do what’s required to nurture those values and make them the reality of your existence.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods