Try to Be More Kind

We live, then we die.

That’s a reality we all must grapple with each minute. And the fact that life is finite has implications for everything we do. And no matter what your beliefs are about the existence of an afterlife, there is no doubt that life on earth as we experience it is going to come to an end for us all.

This admittedly morbid, yet eminently liberating, realization is at the spine of nearly all of our decisions, even though many times we fail to realize it. Think about the actions you take each day.

You wake after a night of sleep, because your body requires sleep. You consume food because your body requires energy. Then for most of us, we engage in some form of productive activity that nets us financial compensation so that we can attain the capital required to fund our existence.

If we’re lucky, we have family and friends who we love that we can share our lives with, and that allow us both to provide and to receive mutual support.

The requirements of a finite life also have a profound effect on your decisions about what to do with your money, how to spend that money, how to invest it and how to plan for a time when you may not be able to, or may no longer want to, work. Then there’s your family, and the work involved in making the right decisions to provide for them when you’re no longer here to do so.

Now, much of my newsletter advisory services are aimed at the nuts and bolts of how to put your money to work in the financial markets so that you can maximize this critical aspect of your life. Yet as you likely know, in The Deep Woods I like to peel back the layers of the onion skin so that we can access the principles at the root of the issue.

And when you think about it, what is at the essence of our quest to make sure we are financially secure enough to take care of ourselves and the ones we love?

To me, the answer is simple: It’s a desire to be kind.

Indeed, the desire to be kind, i.e. the quality of being caring, attentive, considerate and otherwise thoughtful of others, is something that we all should strive to be motivated by. I know for me, the action I take out of kindness not only feels good, but it’s always in my rational self-interest to do so.

Acting kind doesn’t mean self-sacrifice. Rather, it means acting and interacting with others so that both parties receive maximum benefit from the interaction.

Extended out to the political realm, the desire for kindness is why I am a passionate advocate for laissez-faire capitalism. You see, capitalism is the only social system where men are free to interact with each other based on the principle of exchanged values.

For example, this morning I went to my local Starbucks and paid $4.95 for a latte. I wanted the latte more than I wanted the $4.95, and Starbucks wanted the $4.95 more than they wanted the latte. I didn’t exercise physical force to extort the latte from my barista, and she didn’t wrestle me into the store from the street to confiscate my money.

Instead, we engaged in a mutually kind exchange of values that also was mutually beneficial. This kindness is the essence of capitalism, and it’s the opposite of the radical left’s idea that capitalism exploits the proletariat.

In my view, a prescription for increasing societal happiness is to increase kindness. Not only in terms of our daily human interactions, but also in the wider sense of people interacting with each other via the kindest of all principles: free exchange.

Finally, I’ll leave you with a powerful quote from philosopher and neuroscientist Sam Harris regarding kindness. As Sam writes: “Consider it: every person you have ever met, every person will suffer the loss of his friends and family. All are going to lose everything they love in this world. Why would one want to be anything but kind to them in the meantime?”

If you want to make yourself and the world a better place, try to be more kind.

**************************************************************

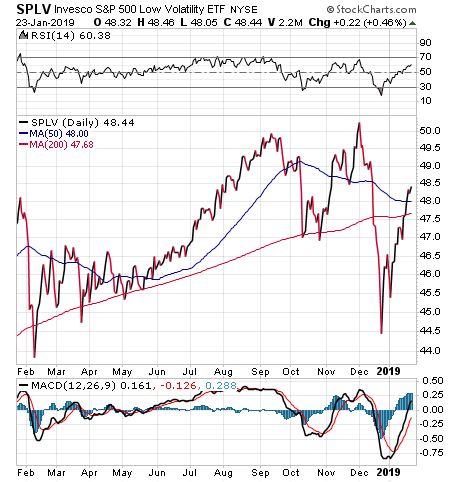

ETF Talk: Scouting out a Path of Limited Volatility

Investors seeking lower volatility securities may be interested in learning about the PowerShares S&P 500 Low Volatility Portfolio (SPLV).

If you read and watch market news as much as I do, you have heard prognosticators warn about slowing economic growth and high market volatility. With many observers speculating that we are heading into another global recession in the next couple of years, equities have not performed well lately.

But SPLV offers a possible defensive purchase for wary investors who like the exchange-traded fund’s (ETF) focus on replicating the performance of the 100 lowest volatility stocks in the S&P 500 Index, before expenses and fees. So, while large swings in the market can cause a lot of anxiety, the positions in the SPLV tend to move less than the overall market. The fund’s holdings are typically blue-chip companies that are much less volatile than other stocks in the S&P 500 Index.

The highest-weighted stocks in SPLV are those that have the lowest volatility. For example, the utilities and consumer staple sectors make up the majority of the SPLV, 32.80% and 22.94%, respectively. These sectors tend to outperform more volatile sectors such as technology or energy amid heightened uncertainty.

However, these securities aren’t likely to grow very much, since they’re already pretty large. They do, thankfully, usually pay out a solid dividend.

The fund’s 10 top holdings feature Coca-Cola Co., 1.30%; Duke Energy Corp., 1.22%; Exelon Corp., 1.20%; Republic Services Inc., 1.19%; WEC Energy Group Inc., 1.19%; CMS Energy Corp., 1.18%; Dominion Energy Inc., 1.18%; NextEra Energy Inc., 1.17%; American Electric Power Co. Inc., 1.16%; and Consolidated Edison Inc., 1.16%. These stocks tend to outperform in bear markets and underperform in bull markets.

They are companies in industries such as utilities and consumer staples that offer defensive places to invest your funds. Even when consumers spend cautiously, they still prioritize keeping their lights on, bathing and eating.

SPLV is an ETF that could have performed well during the most recent recession in 2007 had it been in existence then, but it launched in May 2011. It also could be a good addition to your portfolio now, if you believe that the defensive stocks held in SPLV are poised to outperform the market in the months and years ahead.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

Doug Fabian Unveils the Science of Economic Freedom

What’s the real importance of a pivotal person in one’s life?

That’s the lead question in Season 2 of the Way of the Renaissance Man podcast, featuring a name many of The Deep Woods readers already know and love, the great Doug Fabian.

As you likely know, Doug is both a close friend and a long-time business associate. In fact, Doug and I worked together for more than 15 years, first on the flagship investment advisory newsletter Successful Investing, and then with his money management firm.

Doug is currently a vice president at Mercer Advisors, which has been widely recognized as one of the top Registered Investment Advisers in the country. He’s also the host of a podcast I highly recommend called “The Science of Economic Freedom.”

I really enjoyed reminiscing with Doug about our mutual past. But more importantly, I am excited to share with you our conversation, which includes topics such as the importance of active listening; cultivating a commitment to lifelong learning; what books we’re currently reading; and details about his new podcast and why it can help everyone achieve economic freedom.

In this episode, we also discuss:

- What qualities Doug and I value most in our working relationship.

- Why people need to be mindful of their words.

- The one thing Doug and I agree is the most important part of Dr. Jordan Peterson’s “12 Rules for Life.”

- How Doug uses swimming to help him think and stay focused.

- Jim’s first impression of Doug’s bookshelf.

- What the Science of Economic Freedom podcast is all about.

- And much more…

If you’re a long-time reader of this publication, you are probably well aware of Doug and how engaging he is. Well, in this episode of the Way of the Renaissance Man podcast, you’ll experience Doug at his best, i.e. engaged in the art of conversation.

And remember, if you like the Way of the Renaissance Man podcast, I encourage you to subscribe to the show on iTunes.

Doing so is free, and it will ensure you never miss the latest episodes.

*********************************************************************

Stoic Kindness

“Wherever there is a human being, there is an opportunity for a kindness.”

—Seneca

The Stoic philosophers lived some 25 centuries ago, but much of their profound wisdom about life, the importance of virtue and the need to be emotionally resilient to life’s inevitable misfortune is something we all should practice today. And by “practice,” I mean just that. It’s not enough to know you should be kind, you also must be more kind.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods