Time to ‘Superhydrate’ Your Portfolio

In bodybuilding and fitness circles, we sometimes practice a technique called “superhydration.” This is basically the consumption of one gallon of cold water every day. You see, because the human muscular system is approximately 72% water, the essential liquid is a natural part to aiding in fat loss, workout recovery and the muscle building process.

Yet like all things in life, not all water is created equal. That’s especially true when it comes to specialty, high-performance bottled water sold today. You see, most water is just municipally tapped, put in a cheap plastic bottle with a cheap label, and then sold to us at a big markup.

Then there’s Alkaline88.

As its name suggests, Alkaline88 water refers to the alkaline nature of the product, and its specific pH level. The pH level measures how acidic or alkaline a substance is. Fitness and health experts have determined that alkaline water can neutralize acidity in the body caused by stress, diet and other exogenous influences such as environmental hormesis.

And again, as its name implies, the pH level in Alkaline88 is “8.8.” Now to my palate, this is easily the best-tasting, smoothest and most thirst-satisfying beverage on the market today. This water also is excellent for superhydration, and for use in beverages such as coffee, tea and especially in protein shakes. I use it in my protein shakes, and it makes a huge difference in both taste and texture.

Yet perhaps the best part about drinking Alkaline88 is the fact that owning the company’s stock can also superhydrate your portfolio!

The Alkaline Water Company (WTER) is the maker of Alkaline88, and it is listed on the NASDAQ. Year to date, WTER shares have made quite the splash, starting 2021 at about $1.00, and closing on August 2 at $2.19. That’s a year-to-date gain of 116.8%!

A lot of that gain has come recently, as shares are up about 33% in the past month. So, why the big one-month surge?

Well, it has a lot do with the recent partnership the company entered with one of the biggest, and I do mean BIGGEST, and most successful celebrity athletes/businessmen today, legendary basketball star Shaquille O’Neal.

Now, because I am a fan of Alkaline88, and because I know the company’s management (we had dinner together last night in Dallas, Texas), they invited me to meet “Shaq” and interview him for my podcast, Way of the Renaissance Man. That episode will air soon. Of course, I will provide you with a link to it as soon as it’s ready.

But more importantly, I got to meet Shaq and pick his brain about how he got involved with Alkaline88. I also asked him about how he picks the companies he wants to work with, and how he likes to work. Hint: Shaq is a hands-on guy, and when he gets involved in a deal, he is involved in the details. In fact, it was Shaq who approached the Alkaline88 team to be involved in the company because he tried the water out one day and loved it.

Legendary Shaquille O’Neal makes your fitness-focused editor feel small in comparison.

I must say that although I am not a huge sports guy, I always was a Los Angeles Lakers fan. That’s because I grew up in Los Angeles. When you grow up in LA, the Lakers are basically a religion. So, it was pretty darn cool to sit across from one of the high priests of the Lakers, and have him answer my questions about business, his influences in life and his relationship with Alkaline88.

Now, I have written much more about Alkaline88, including information about why the product is superior to its competitors, and why I like the stock here — especially now that Shaq is the company spokesman. You can read all about it my new, free special report, “Alkaline88: Liquid for An Optimal Body, Optimal Portfolio.”

Your editor interviewing Shaquille O’Neal and Alkaline Water Chairman Aaron Keay.

Finally, one thing I love about what I do is that it allows me to meet, interact with and learn from some of the most interesting, most successful and most excellent people in the world. And the way I look at it, the more knowledge and wisdom I can ascertain from them, the more knowledge and wisdom I can bring to you each week in this publication and in all my newsletters and advisory services.

So, if you are intrigued by Alkaline88, and its most excellent Shaq connection, I invite you to read my special report, and to stay tuned for my full video interview with Shaq on an upcoming episode of the Way of the Renaissance Man podcast.

***************************************************************

ETF Talk: Chinese Technology Stocks Compose Internet ETF

In most aspects of life, the adage “the grass is always greener…” references sacrificing one thing for another. However, in the stock market realm, it’s not that cut and dried.

When it comes to the Internet and Information Technology sectors, the U.S. stock market has some stiff competition, and it hails from China. But there’s no need to wonder if that grass is indeed greener, as KraneShares CSI China Internet ETF (NYSEArca: KWEB) is a one-of-a-kind exchange-traded fund (ETF) that offers pure-play exposure to Chinese software and information technology stocks.

KWEB tracks a foreign equity index composed of overseas-listed Chinese internet companies. The ETF offers not only exposure to companies that provide services similar to U.S. internet companies, like Google (NASDAQ:GOOG), Facebook (NASDAQ:FB) and Twitter (NYSE:TWTR), but it also offers exposure to companies that are benefitting from an increase in domestic consumption by China’s growing middle class. The fund specializes in Chinese markets and its portfolio ranges from well-known large-cap stocks, like Alibaba (NYSE:BABA), to smaller- and mid-cap stocks.

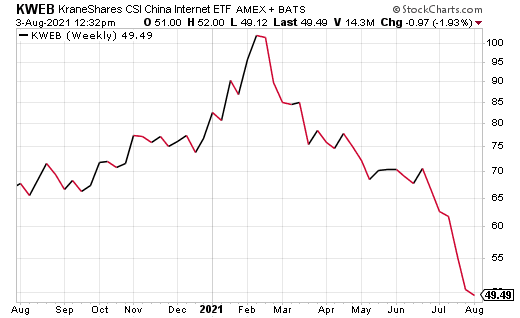

The fund, which was started in 2013, has an expense ratio of 0.73% and a dividend yield of 0.43%, with an annual payout of $0.22. KWEB has $4.75 billion in assets under management and $4.7 billion in net assets. As evidenced by the chart below, KWEB was stable for the latter months of 2020, spiked higher in early 2021 and is now experiencing a major dip. However, this dip is not without reason, as many Chinese stocks in the space recently have experienced serious selling, which was prompted by the government’s crackdown on for-profit education. The fund is currently trading at the lower end of its 52-week range, $45.75-104.94, but the high-end is proof that it possesses the potential to bounce back.

The fund’s top five holdings and their respective weightings, as of Aug. 3, were Alibaba Group Holdings Ltd ADR (BABA), 10.89%; Tencent Holdings Ltd (00700), 10.30%; JD.com Inc. ADR (JD), 7.46%; Meituan (03690), 7.17%; and Pinduoduo Inc ADR (PDD), 7.07%.

In sum, KWEB is a unique way to tap into China’s Internet and information technology sectors. It offers exposure not only to well-known large-cap and a variety of smaller- and mid-cap stocks, but equities benefitting from China’s growing middle class. For investors looking to expand their global equity palates and see if the grass is truly greener, KraneShares CSI China Internet ETF (NYSEArca:KWEB) may be of interest. However, investors are always advised to conduct their own research and decide whether a given fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

An Epic Week of Celebrating Freedom

One week ago today, I was basking in the bosom of freedom.

And while it’s “back to reality” this week, I feel compelled to make this issue all about what just went down at the epic celebration that is FreedomFest. First of all, the event was an amazing success. There were over 2,700 attendees, a record high, along with several hundred speakers/exhibitors.

Now, I have been to many FreedomFests over the years, but this one had an intangible element of excitement, energy and sense of appreciation that I had not experienced before. I attribute this to the pandemic, as we had to forego FreedomFest last year due to COVID-19. You see, as humans, when we are deprived of something we love, our yearning for it becomes even greater.

This year, I think everyone just felt good to be around each other after a two-year pandemic drought. And with hardly a mask in sight, we were all able to see our fellow liberty warriors smiling, shaking hands and interacting the way humans were meant to.

And speaking of smiling, I must tell you that I had so many poignant moments at this FreedomFest that my smiles actually morphed into tears of joy on several occasions. One of those big moments occurred at Mt. Rushmore, and specifically at the monument’s lighting ceremony.

At the end of the ceremony, the park ranger invited military veterans to come down for the “retiring of the colors,” which is just what they call it when the American flag is taken down, folded and put away until the following sunrise. On this excursion with me was my good friend, Rich Checkan of Asset Strategies International. In addition to being my go-to precious metals dealer, Rich also is a West Point graduate and served as an officer in the U.S. Army for many years.

Your editor (dressed in all black) flanked on his right and to the rear by West Point graduate and gold dealer Rich Checkan of Assets Strategies International, at the Mt. Rushmore flag ceremony along with fellow veterans.

As we came down to the stage, the audience of Mt. Rushmore attendees applauded us in gratitude for our service. And as Rich and I discussed afterward, this was the first time in many, many years that we were honored with this show of gratitude. Hey, I must admit that turning to salute the flag and to be honored by other grateful Americans felt really good. And even recalling this moment makes me well up again.

Yet perhaps the greatest moments for me this FreedomFest came in the form of subscribers to my newsletters honoring me by offering their heartfelt thanks for what I do.

Literally dozens of you came up to me multiple times during the event to thank me for helping you make money in the markets via my stock and options advice. More importantly, many of you thanked me for helping you buy houses, take grand vacations and send your kids to college using the information garnered from my expertise.

For a writer/stock picker whose job it is to help others find the best exchange-traded funds (ETFs), individual stocks and stock options to own, hearing of the real-world success subscribers have had is perhaps the most gratifying feeling one can have.

So, for those of you who came up to me and offered your thanks, eminently kind words, appreciation and gratitude for what my Eagle Financial Publications colleagues and I do each week, may I also now formally, in print, tell you that whatever appreciation you have for us, we have far more for you.

It is because of you, the subscriber to our publications, that we are allowed to do what we do. Without you, we couldn’t do what we love. And so, from the depths of my soul, and in the name of the very best within us, thank you for celebrating an epic week of freedom together.

May our hearts soar the skies of prosperity and liberty for all our days to come!

*****************************************************************

Harper Think

You can lead a horse to the water

But you cannot make him drink

You can put a man through school

But you cannot make him think

–Ben Harper, “People Lead”

The art of clear thinking is not an automatic skill. In fact, often our biases and prejudices and emotional screens filter our better judgment. Yet the more ruthlessly rational you can be about reality, the better you are able to think. And the better able you are to think, the better your life will be.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.