This Moment, and This Moment, and This Moment

Life can be a cruel mistress. You can love her, take care of her and be truly good to her, but the next thing you know, she delivers you a heart-crushing blow.

If you are an adult (and I know nearly all my readers are, despite the cadre of high school students in Southern California I know who are avid enthusiasts of The Deep Woods), then you already know that life is replete with pain, sadness and struggle. These formidable foes are an inextricable part of existence, and they’re part of nature.

There’s a great line in the novel “Fight Club” by Chuck Palahniuk that says: “On a long enough timeline, the survival rate for everyone drops to zero.”

Well, on a long enough timeline, no matter who we are or how well we’ve managed to organize our lives, all of us will experience profound sadness, crushing loss, deep disappointment and likely intense physical pain that becomes both all-encompassing and debilitating. Again, this is just part of nature.

Not to get morose, but every one of us, if we haven’t already, will likely have to deal with the pain, hurt and loss associated with the death of a parent, a favorite aunt or uncle, a brother, a sister, a close friend or even what is said to be the most difficult loss to bear, the loss of a child.

What’s even more intense is that, as humans, we know that we are mortal. We know we are going to die, and we know that everyone we know living today also is going to die. And once again, this reality is just part of nature.

Yet, as Sir Francis Bacon famously proclaimed, “Nature, to be commanded, must be obeyed.”

But how does one go about commanding nature in an effort to ease the pain that living brings?

For me, knowing the nature of existence allows me to focus on what I am doing right now — in this very moment. Because all we are sure of is that we have this moment, and this moment, and this moment.

This realization that life is now prompts me to ask myself why anyone would ever want to squander the now.

Why would you ever allow yourself to consciously live in a state of negativity, one replete with unhappiness, anger, distress, discontent and malaise over trivial things you have no control over? And let’s face it, nearly everything in our lives we have little to no control over.

Now, that’s not to say we should feel something other than deep sadness over pain, loss and other adverse circumstances. It is proper to feel these emotions, and you do not want to shut them down or cut them off, as that also would be a form of squandering the now. Yet, think about all the times we do squander the now by not paying close enough attention to our own minds.

We get mad when someone cuts us off on the freeway. We get upset if the barista gets our coffee order wrong. We become angry because one of the stocks we own slides after the company announces downbeat earnings guidance. But, if you realize that it is your reaction to these things which is the cause of your sadness, and not the actual events themselves, you realize that with a little effort, you can command nature by altering your mental state.

The first step in doing this is to recognize that thoughts are the root cause of all of our emotional states.

Indeed, the ideas you have in the now are what is affecting you right now. So, if you can consciously identify those thoughts, process them and either let them go, change them or integrate them for future use, you will be much better off when the inevitable wave of life’s sadness slams onto your shore.

By knowing your own mind, and by cultivating a self-awareness capable of identifying thoughts as the root cause of all discomfort, pain and pleasure, arousal and peak experience, you can avoid squandering the now.

Instead, you can embrace the now for what it is, and you can become better at dealing with the good, the bad and the ugly — because life is replete with all of these elements, and that reality isn’t going to change.

So, do not let your head wander its way into despair.

Take control of your thoughts, which one can do via practices such as mindfulness meditation and other active efforts to recognize the content of one’s own mind.

By recognizing the “you” in there, and the content of your inner life, you will put yourself on the path to making sense of the sad, happy, debilitating and glorious days — and everything in between.

Finally, consider that while the world can at times be a very scary dragon — it’s a dragon we can tame, as long as we understand what’s in our own frame — and as long as we obey nature.

ETF Talk: ‘MOOving’ to a ‘Cash Cow ETF’

You may not know that the common expression “cash cow” was coined by the great management guru Peter F. Drucker in the 1960s to refer to a product or business that continues to retain its sizable market share, even as the market itself is stagnant or declining.

Such a business or product can continually churn out profits with little maintenance, investment or oversight, in much the same way that a cow is able to generate milk virtually endlessly if simply provided with grass for grazing. Meanwhile, the funds that are generated are then able to be used by the parent company for investment or research and development purposes.

Nowadays, it seems that many investors are looking for their own cash cows in anticipation of the release of the December Consumer Price Index (CPI) data tomorrow and the prospect of interest rate cuts sometime this year. While the start of 2024 was mixed, with the Nasdaq falling by more than 1%, more than a few investors have argued that small-caps are the “cash cow” the market has been waiting for.

As I wrote in my Eagle Eye Opener (and if you aren’t a subscriber yet, why aren’t you?) that while small-caps performed poorly in 2023 when juxtaposed against the broader market, small-caps lagged the S&P 500 by more than 10%, after Chairman Jerome Powell and the Fed began singing a more dovish tune. In addition, small-cap stocks shifted to trading at reduced valuations, such as 20% below their historical measures.

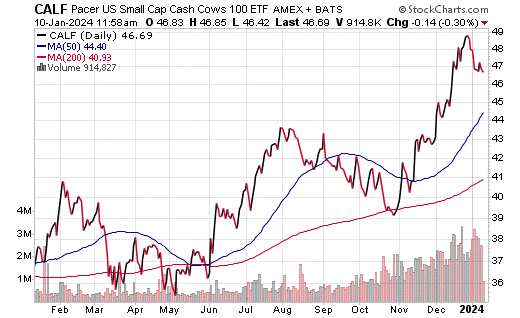

One of the exchange-traded funds (ETFs) that aims to provide investors with access to the world of small-cap stocks is the Pacer US Small Cap Cash Cows 100 ETF (BATS: CALF).

Although the base of its portfolio is the S&P Small Cap 600 Index, the fund’s managers quickly weed out financial companies (other than real estate investment trusts) and companies that will likely have negative free cash flow or earnings in the following two years. The companies that make the cut are sorted by trailing 12-month free cash flow yield, then the top 100 companies are weighted by their trailing cash flow yield.

Some of the stocks currently in the portfolio include Alpha Metallurgical Resources, Inc. (NYSE: AMR), Boise Cascade Co. (NYSE: BCC), M/I Homes, Inc. (NYSE: MHO), Tri Pointe Homes, Inc. (NYSE: TPH), M.D.C. Holdings, Inc. (NYSE: MDC), Mueller Industries, Inc. (NYSE: MLI), Meritage Homes Corporation (NYSE: MTH) and Cal-Maine Foods, Inc. (NASDAQ: CALM).

As of Jan. 9, CALF has been up 4.39% over the past month and up 14.57% for the past three months. The fund has an annual expense ratio of 0.59%.

Chart courtesy of www.stockcharts.com

In short, while CALF does provide an investor with a way to invest in small-cap stocks, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors should always conduct their due diligence and decide whether the fund is suitable for their investing goals.

Finally, remember that I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

In case you missed it…

Avoid the Folly of Market Assumptions

You know what they say about assumptions? That’s right, they can make a “you-know-what” out of “u” and “me.”

Unfortunately, when it comes to markets, the folly of assumptions can do just that to many a confident and otherwise sophisticated investor. For example, just think about where we were last year at this time. The S&P 500 had just logged its worst annual performance since the financial crisis, the Federal Reserve was in the midst of the most aggressive rate hike campaign in decades, inflation was above 6% and concerns about an imminent recession were pervasive across Wall Street.

That bearish cocktail conjured market assumptions of more doom and gloom for 2023, one where the bears would devastate the bulls for a second consecutive year. Of course, we all know what happened. The S&P 500 finished the year with a gain north of 24%, while the Nasdaq Composite soared nearly 44%.

Today, the market outlook couldn’t be much more positive than it was a year ago.

The Fed is done with rate hikes and rate cuts are on the way, likely in early 2024. Economic growth has proven more resilient than most could have expected, and fears of a recession are all but dead. Inflation dropped substantially in 2023 and is not far from the Fed’s target, and corporate earnings growth is expected to resume this year.

So, yes, we are definitely in a more positive environment for investors compared to the start of 2023. However, just like overly pessimistic assumptions for 2023 proved incorrect, as we look ahead to 2024, we must guard against overly optimistic assumptions, because at current levels, both stocks and bonds have priced in a lot of positives in the new year.

Consider first that the S&P 500 is starting 2024 trading at a very lofty 19.5X valuation. Now, I’m not saying that valuation is unjustified, but I will say that valuation makes several positive assumptions about critical market influences in the coming year. How reality matches up with those assumptions will determine whether stocks extend the rally (and the S&P 500 hits new highs and makes a run at 5,000) or gives back much of the Q4 Santa Claus rally.

In a recent issue of my daily market briefing, Eagle Eye Opener, we defined the five most important assumptions investors are making right now, because it’s how reality plays out versus these assumptions that will determine if stocks and other assets rise or fall in Q1 and 2024. Let’s take a look at each now.

Assumption 1: Fed cuts rate six times for 150 basis points of easing and a year-end Fed Funds rate below 4.0%. The main factor behind the S&P 500’s big Q4 rally was the assumption that the Fed was done with rate hikes and would be cutting rates early and aggressively in 2024. How do we know this is a market assumption? Fed fund futures. According to Fed fund futures, there’s a 70%-ish probability the Fed fund rates finishes 2024 between 3.50-4.00%.

Assumption 2: No Economic Slowdown. Markets haven’t just priced in a soft landing, they’ve priced in effectively no economic slowdown as investors expect growth to remain resilient and inflation to decline, the oft-mentioned “Immaculate Disinflation,” a concept that’s possible, but to my knowledge has never actually happened. How do we know this is a market assumption? The market multiple. The S&P 500 is trading at 19.5X the $245 expected S&P 500 earnings expectation. A 19.5X multiple is one that assumes zero economic slowdown (if markets were expecting a mild slowdown, a 17-18X multiple would be more appropriate).

Assumption 3: Solid earnings growth. Markets are expecting above average earnings growth for the S&P 500 to help power further gains in stocks. How do we know this is a market assumption? The consensus expectations for 2024 S&P 500 earnings per share are mostly between $245-250. That’s nearly 10% higher than the currently expected $225-per-share earnings for last year (2023), which points to very strong annual corporate earnings growth.

Assumption 4: No additional geopolitical turmoil. Despite the ongoing Russia/Ukraine war, Israel/Hamas conflict and escalating tensions between the U.S.- and Iranian-backed militias throughout the Middle East, the market’s assuming no material increase in geopolitical turmoil. How do we know this is a market assumption? Oil prices. If markets were nervous about geopolitics, Brent Crude prices would be solidly higher than the current $77/bbl. Oil prices in the high $80s to low $90s reflect elevated geopolitical concern while prices above $100/bbl reflect real worry.

Assumption 5: No domestic political chaos. This is an election year in the United States. Republican front-runner Donald Trump is facing a long list of various civil and criminal charges along with challenges to whether his name will be on the ballot in certain states. Meanwhile, there has been no long-term compromise on funding the government, so shutdown scares remain a real possibility. And that’s before we get into the heart of election season later this year. How do we know this is a market assumption? Treasury yields. A 3.80%-ish yield on the 10-year Treasury does not reflect much domestic political angst. If markets become nervous about the U.S. political situation and/or fiscal situation in the United States, the 10-year yield would be sharply higher than it is now (well above 4.00%, like we saw in the late summer/early fall).

Bottom line, these market assumptions aren’t necessarily wrong. Events could unfold the way the market currently expects. But these assumptions are aggressively optimistic, and it is how events unfold versus these expectations that will determine how stocks and bonds trade to start the year.

If you’d like analysis such as this in your inbox every trading day, and if you want to avoid the folly of market assumptions, then I invite you to check out the Eagle Eye Opener, right now. For the cost of a morning latte, you’ll be completely up to speed on all of the essentials you need to thoroughly understand this dynamic market, and to avoid falling victim to overly pessimistic and overly optimistic assumptions.

*****************************************************************

Face It

“Facing it, always facing it, that’s the way to get through. Face it.”

–Joseph Conrad

One of my proudest academic successes was a paper I wrote for a graduate seminar on comparative literature while still an undergraduate at UCLA. The paper was on Joseph Conrad’s “Heart of Darkness” and the theme of entropy (philosophically, physically and geopolitically) woven throughout the author’s masterwork. This paper captured the attention of the English Department faculty, and it was widely lauded and held up by some of the best minds in the field as a stellar example of cogent, thoughtful and unique literary analysis.

The success of this paper, and the enjoyment I extracted from “the doing” of the work had a life-changing effect on me. It was then that I knew I was capable of offering up a worthy and different perspective to the wider discourse of important ideas. For that I am grateful, as it was one of the first plots on my life’s map that took me to where we are right now, together in exploring the world and all its intellectual wonders.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods