This Is What It Means

This Is What It Means

Hopes and fears

And chasing dreams

This is what it means

Smiles and cries

And making memories

This is what it means…

–Jim Woods, “What It Means”

There’s an old saying in the literary world that a man’s life is incomplete until he has tasted love, poverty and war.

Beginning with the latter, my closest brush came in January 1991. I was just graduating from the U.S. Army Airborne School at Ft. Benning, Georgia, when the bombs began raining down on Saddam Hussein’s Iraq. As it turned out, that conflict was so short-lived that I missed out on the active war leg of the complete life.

As for poverty, well, although I come from a modest middle-class American family, I would hardly say that qualifies as poverty by global standards. And aside from some lean, post-college days working at the financial newspaper Investor’s Business Daily, I also would have to say that poverty mostly has eluded me.

When it comes to love, I think this is where I’ve more than made up for any deficit in the other two complete life components.

Love of family, friends, career, music, literature, philosophy, nature, fitness, sport, combat and, perhaps most of all, love of learning. These are the animating forces at the core of my being.

That love runs particularly deep when talking about the love I have for helping investors better understand — and better profit from — the financial markets. In fact, you might say that this love is a form of war on poverty itself… the poverty of knowledge that keeps investors paralyzed into subpar performance.

Ironically, my love for this pursuit also encompasses my own desire to be a complete man.

In Ayn Rand’s magnum opus “Atlas Shrugged” (in my opinion the very best novel ever written), one of the heroes of the novel is asked, “…what’s the most depraved type of human being?”

The answer: “The man without a purpose.”

This notion stuck with me as a guiding principle when I first read the novel as a 20-year-old trying to sort out the world. And ever since digesting this pithy profundity, I have set my life with “purpose” as a primary directive.

In The Deep Woods, my purpose is to shine a more luminous intellectual light on the issues that matter most to me, and that hopefully resonate with you. Sometimes those issues are economic, sometimes they’re social, sometimes they’re philosophic and sometimes they’re political.

Yet, every time, the issues are of personal importance to me, and achieving a better understanding of them is my purpose. And if you are reading this, I hope sharing my purpose with you has helped you better understand your purpose.

Together, we can learn, grow, flourish and allow the very best within us to express itself — and we’ll do it all while having fun! Because when it comes down to it, hopes, fears, dreams, smiles and cries and making memories is really what it all means.

So, thank you for your time, attention and trust. I shall always value, cherish and respect them, and I will endeavor to always make this column worthy of you.

***************************************************************

ETF Talk: Seeking Security in Long-Term Bonds

In my Successful Investing and Intelligence Report newsletters, I have written about how the contours of the future macroeconomic environment are likely to turn out in the wake of the economic problems caused by global central banks making decisions to increase interest rates to combat inflation.

But just to recap, I strongly feel that the future macroeconomic environment will be defined by three factors: slowing economic growth, largely due to high interest rates, falling inflation, as the effects of rising interest rates finally begin to make themselves known and finally central bank interest rate cuts to encourage economic growth in the wake of a contraction. In that environment, longer-dated fixed income bonds should outperform their rivals.

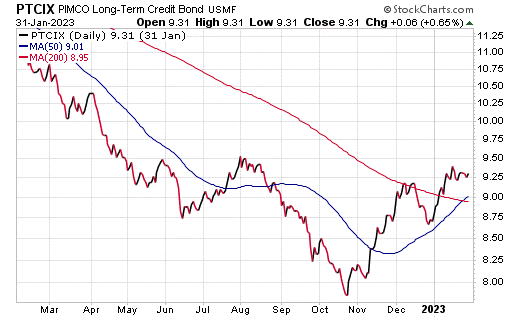

One such investment is the Long-Term Credit Bond Fund (MUTF: PTCIX). This is a fixed income mutual fund that seeks total return above its benchmark, consistent with preservation of capital and prudent investment management.

The goal is pursued through global macroeconomic analysis that focuses on maximum total return in terms of both income and capital appreciation by using long-duration, investment-grade corporate and sovereign bonds, as well as mortgages and foreign bonds. At the same time, since duration reflects, in part, a bond’s price sensitivity to interest rate changes, this strategy requires a greater tolerance to such changes.

Specifically, the fund’s portfolio is normally 80% of its assets in a combination of varying maturities, including forwards or derivatives such as options, futures contracts or swap agreements. Up to 20% of its total assets can be invested in junk bonds that are rated B or higher by Moody’s, S&P or Fitch. Unrated bonds appear in the portfolio if the fund’s managers deem them to have an equivalent rating.

As of Jan. 31, PTCIX rose 7.27% in the past month, 14.85% in the last three months and 7.27% year to date. As with any investment, it’s important to carefully consider one’s individual financial situation and goals before making a decision.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Don’t Fear the AI Reaper

When one of the biggest and most important companies ever announces a fiscal push toward the use of artificial intelligence (AI), you know things are starting to get serious.

On Monday, tech-behemoth Microsoft (MSFT) revealed that it is putting its money where its AI mouth is, as the Redmond, Washington, giant said it was making a $10 billion investment in ChatGPT software developer OpenAI.

The move will allow Microsoft to offer GPT-3, the service that the generative AI chatbot ChatGPT is based on, in its various platforms across its cloud-based services. Basically, if you have Microsoft applications, you will likely soon be able to use ChatGPT.

Now, in addition to being a move designed to get out in front of competitors such as Amazon (AMZN), Alphabet (GOOGL) and Salesforce (CRM), Microsoft’s embrace of AI here is telling, especially considering the company also just announced it was laying off some 10,000 actual human workers.

“It tells you a lot that within a week of announcing pretty substantial layoffs, Microsoft is also announcing a substantial investment in OpenAI.” That’s according to Gil Luria, technology strategist at D.A. Davidson, in an interview with Yahoo Finance.

But what is so important about ChatGPT, and why is Microsoft so intent on its use?

Basically, ChatGPT allows users to have human-like conversations and much more with other chatbots. Perhaps more importantly, the AI language models can answer questions, assist users with tasks such as composing emails, essays, writing computer code, etc. Essentially, ChatGPT can do a whole lot of what we thought could only be done by human writers, human programmers and even human artists.

Already, the program is capturing the brains of some of the biggest thinkers in the AI space, including Elon Musk, chief of Tesla (TSLA) and Twitter. “ChatGPT is scary good. We are not far from dangerously strong AI,” said Musk, who was actually one of the founders of OpenAI before departing the company.

Like all new technologies, there are those who fear the worst from AI, claiming that it will cause massive worker dislocation and result in even greater “wealth inequality” and other supposed societal damage. And while technology has always been a societal disrupter (mostly for the good), AI and tools such as ChatGPT have the very real possibility of venturing deep into the creative domains that were long thought to be only “humanly” possible, such as profound emotional content, creativity, personality, etc.

Then, there are the more optimistic views on AI, ones such as those held by a man who was perhaps the highest-profile example of a victim of the efficacy of AI, chess-great Gary Kasparov. In 1996, Kasparov famously vanquished what was then the strongest chess engine ever created, IBM’s Deep Blue. Then just one year later, Kasparov was beaten by a new, and better, version of the AI-based Deep Blue.

A recent article in one of my favorite publications, Reason, titled, “Artificial Intelligence Will Change Jobs — For the Better,” points out that despite being defeated by AI, Kasparov actually views the technology as one of the greatest opportunities for humanity to advance its well-being.

“The reason is that Kasparov has observed in the intervening years that the highest level of performance, on the chessboard and elsewhere, is reached when humans work with smart machines.”

As the Reason piece goes on to explain, “After Deep Blue’s programmers established that it could see deeper into the game than the human mind, Kasparov and a group of partners came up with a new concept: What if instead of human vs. machine, people played against one another but with the assistance of chess software?”

This new style of chess, known as “advanced chess,” showed that it wasn’t the player with the best chess software that won, nor was it the best human player. “The top performers were the players who were able to use the machines most effectively, those who were able to get the most out of the chess engines and their own creative abilities.”

This is where I think the confluence of AI and human intelligence can be maximized. The way I see it, AI is just a tool. And like any tool, it can be used to enhance positive outcomes that help the world, or it can bring about pernicious consequences that destroy.

The question then becomes will we be wise enough to know the difference.

For more on this important issue, and to find out if we should indeed fear the AI reaper, I invite you to listen to one of my favorite podcast episodes, “Will AI Destroy Humankind?” featuring my friend, computer scientist and AI expert, Robert Deadman (yes, that is his real name).

In this fascinating discussion, Robert and I discuss the current state of AI, and what the future holds for this increasingly ubiquitous technology.

Topics include such questions as at what point will AI begin making its own decisions? How far away is this circumstance? What is the role of quantum computing in this question? Will AI actually have “free will”? When will the move take place from “artificial intelligence” to “artificial sentience”?

Perhaps most importantly, can we solve the so-called “alignment” problem of AI, and how can we really understand this concept?

If you want to indulge in a much deeper dive on the issues surrounding AI, I invite you to check out my discussion with Robert Deadman, as I assure you it will captivate your attention.

*****************************************************************

O. Henry Wisdom

“If a person has lived through war, poverty and love, he has lived a full life.”

–O. Henry

It should come as no surprise that the great short story writer O. Henry is one of my literary favorites. And yes, he is the fountainhead of the above notion, and by extension, the progenitor of the ideas I hold regarding love, poverty and war. If you want to expend some of your limited time wisely, grant the great O. Henry your attention.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods