This Greek Philosopher Taught Me to Trade Options

Alright, I know what you’re thinking. How the heck did a Greek philosopher teach me to how to trade options?

Well, if you’ve been a reader of The Deep Woods for even just a short time, you likely know that I am a huge advocate of cultivating and integrating all kinds of knowledge about the world — and not just knowledge that’s directly related to stocks, bonds, exchange-traded funds (ETFs) and options.

The way I see things, it’s important to cultivate and integrate knowledge from wherever you find it, including from sources such as pop culture, literature, science, religion, music, history, art, biology, psychology — and especially philosophy.

Doing so makes you a better, well-rounded human and I think it also makes you a better investor. The reason why is because the more you know about why you’re doing things, the better you get at actually doing them.

Still, what do I mean when I say a Greek philosopher taught me how to trade options? Well, to understand this, we must go back about 2,500 years ago to pre-Socratic Greece and learn about the man named Thales of Miletus.

Thales was a brilliant philosopher and one of the first real Western thinkers and scientists (although “scientist” wasn’t a term that was used at the time). He is best known for his thesis that “all things are water,” which we know now to be erroneous, but was a groundbreaking thought, given the scientific infancy of 6th century B.C.E. Greece.

Moreover, Thales was among the first thinkers to make hypotheses that were testable and falsifiable, both bedrock principles of scientific inquiry today, but absent among his fellow thinkers at the time.

According to the Internet Encyclopedia of Philosophy, none other than the great Aristotle identified Thales as the first person to investigate basic principles, the first to question the origins of substances and matter and, therefore, the founder of the school of natural philosophy.

Among his accomplishments was the successful prediction of an eclipse of the sun that occurred on May 28, 585 B.C.E. Although it’s not known exactly how Thales was able to predict this event, the most likely explanation is that he studied the solar and lunar cycles.

Yet still, what did I learn about trading options from Thales?

To answer that, we must realize that Thales was a philosopher and a man not particularly concerned with the accumulation of monetary wealth. And because of his lack of finances, he often was criticized by the elites of Athenian society. To prove the elites wrong, and to demonstrate the power of reason and natural philosophy, Thales did something that should put him in the investing history books.

Based on his study, assessment and knowledge of the Greek climate, Thales reasoned that there would be a particularly good harvest for olives one year. But rather than sit on this information, Thales had taken the next step and put deposits down on all the olive presses in Miletus over the preceding winter.

Thales basically cornered the market on olive presses for a small investment. Stated in modern trading terms, Thales bought call options on olive presses and paid a small amount for the right to control those presses (i.e., he paid a small premium for the option).

When his prediction of a bountiful olive harvest did indeed come to pass, Thales’ bet paid off handsomely. The boom harvest created heavy demand for the olive presses, and because Thales held a virtual monopoly on these presses, he was able to rent them out at a huge profit.

In my opinion, this was perhaps one of the most important events — not only in market history, but in the whole of human history.

The reason why is because Thales demonstrated that “science” and the accumulation of wealth really are connected. And, as the old saying goes, knowledge is power. He also demonstrated that if you know what your competition doesn’t, you will have a tremendous advantage over them.

It is for this life lesson, as well as the accompanying investing lesson of Thales and the olive presses, that we should be thankful for the man from Miletus.

I know I am thankful for him, as his foresight and virtual creation of the concept of options trading has allowed me to help investors make some serious profits. And that’s precisely what we have done in my Bullseye Stock Trader advisory service, as we’ve consistently banked multiple double- and triple-digit-percentage profits using a combination of buying the right common stocks along with out-of-the-money call options, at precisely the right time.

To find out more about my Bullseye Stock Trader service, simply click here.

Finally, the next time someone asks who taught you about investing, instead of saying something conventional like Warren Buffett, Ray Dalio or John Templeton, tell them about Thales of Miletus.

***************************************************************

ETF Talk: Diversify Your Consumer Discretionary Holdings with this ETF

Investors are becoming increasingly familiar with the idea that market-cap weighting can result in massive investments in just a few companies that dominate a particular index.

The NASDAQ is a perfect example. Investing in the NASDAQ as an index results in an investment of close to 30% in just three companies: Apple (NASDAQ:AAPL), Microsoft (MSFT) and Amazon (NASDAQ:AMZN).

Although not every index has this extreme imbalance, typically when we look to invest in an index, it’s with the hope of gaining broad and diverse exposure to a number of companies. It is one of the advantages of exchange-traded funds (ETFs).

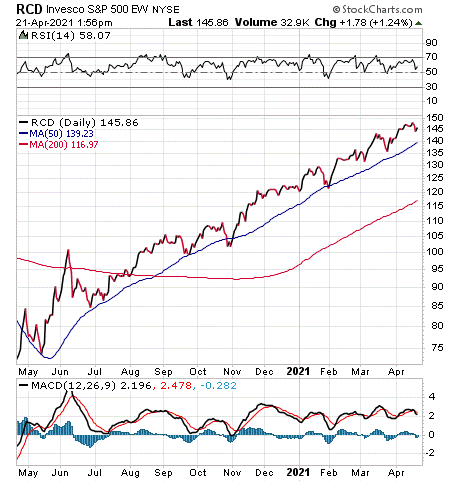

One strategy to recapture this advantage is the use of equal weighting, a practice in which a fund invests equal sums in all components of an index. This is how we get investment vehicles like Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD). This fund is a cross between the equal weight concept and a sector ETF. However, unlike some equal weight funds, it will not have much allocation to very small companies, since such companies do not exist in the S&P 500 index.

Like much of the market, this fund has had a great last 12 months. It is up nearly 94% during that period. It also has increased close to 20% in value this calendar year. The fund’s 0.40% expense ratio is in the typical range. Plus, RCD currently manages just under $950 million. The dividend yield is about 1%.

Chart courtesy of StockCharts.com

There are more than 60 companies held in this fund. Notably, the equal-weighting strategy prevents returns from being dominated by Amazon. RCD holds equal weight in an assortment of U.S.-based consumer discretionary names like Home Depot (NYSE:HD), Target (NYSE:TGT), D.R. Horton (NYSE:DHI) and Dollar General (NYSE:DG).

The increased allocation outside of mega-cap stocks due to this fund’s strategy means that the average market cap of its holdings is less than a fifth of the segment benchmark. This can be a good or a bad thing, depending on your feelings about the continued profit potential of massive companies like Amazon. If equal weighting sounds like a potentially profitable angle on the consumer discretionary sector, consider whether Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD) is right for your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

How to Do Less and Achieve More

Want to achieve more in life? Of course, you do. The fact that you read this publication basically tells me that. Yet, for most of us, the idea of achieving more comes with the corollary notion that we are going to have to do a lot more, put in more hours, work harder and generally take on more and more tasks and responsibilities.

Yet, what if doing less could allow you to achieve more?

Now, when I say, “doing less,” I am not talking about slacking off and just letting fate’s wind sail you across life’s lake. What I am referring to here is taking on fewer overall tasks and really concentrating on getting the critical things in life right.

Another way to describe this principle in action is to hone your focus on the most important tasks at hand, and thereby become a “master of selectivity.” You see, it is by concentrating your efforts on the most important priorities that are needed to achieve your goals, and letting go of extraneous and often distracting tasks, that you can enhance your performance in business and in life.

This idea of mastering selectivity and prioritizing tasks was the subject of a Wall Street Journal article titled, “How to Succeed in Business? Do Less,” by Morten Hansen, a former management consultant and now Professor of Management at the University of California, Berkeley.

In the article, Hansen explained how his strategy for success at his “dream job” at Boston Consulting Group was to work exorbitant hours, a practice which he said often resulted in 90-hour workweeks. Yet, despite all his time and hard work, there was one colleague he had that put in far fewer hours, yet always had better solutions to problems than he did. Moreover, this co-worker put in a normal 8 a.m. to 6 p.m. day, never stayed late and never worked nights or weekends.

So, was this outperforming coworker just that much smarter and talented than Hansen (as well as the rest of his colleagues)?

What Hansen discovered later in his academic research is that it’s not a case of “talent” or “natural ability” or the willingness to “work hard” that results in successful outcomes. Rather, researchers have found that what is even more important to success is the ability to master selectivity.

“Whenever they [top performers] could, they carefully selected which priorities, tasks, meetings, customers, ideas or steps to undertake and which to let go,” wrote Hansen. “They then applied intense, targeted effort on those few priorities in order to excel.”

Hansen’s research also found that just a select few critical work practices accounted for as much as two-thirds of the variation in performance among the subjects in a 2011 research study. “Talent, effort and luck undoubtedly mattered as well, but not nearly as much,” wrote Hansen.

So, how did the best performers in his study do this?

According to Hansen, “Rather than simply piling on more hours, tasks or assignments, they cut back.” Hansen then likened this ability to cut back and focus on what really makes the most difference to the philosophical principle known as Occam’s razor. Named after the philosopher and theologian William of Ockham, this principle stipulates that the best explanation in matters of philosophy, science and other areas is usually the simplest.

“At work, this principle means that we should seek the simplest solutions — that is, the fewest steps in a process, fewest meetings, fewest metrics, fewest goals and so on, while retaining what is truly necessary to do a great job,” wrote Hansen. “I usually put it this way: As few as you can, as many as you must.”

I like to apply this principle to my own life via something called the “minimum effective dose.” What this means is you want to concentrate on doing the things that have the most impact on your results and that have the fewest extraneous elements and/or time commitments.

For example, in the realm of fitness, I engage in what’s known as high-intensity training, or HIT, to get the best strength and conditioning results in the briefest period of time, and in the safest, most efficient manner.

Your editor engaged in the ultra-difficult, ultra-productive and supremely time-efficient high-intensity training protocol.

When investing and selecting top-performing companies for my Successful Investing, Intelligence Report and Bullseye Stock Trader advisory services, I concentrate on finding stocks with the strongest earnings and strongest relative share-price performance. They also must be in the strongest industry groups. By focusing on these key components and filtering out much of the “noise” of extraneous data, I am better able to make good investment choices.

Finally, the principle of focusing more on less, i.e., focusing your effort on the most critical elements of a task or objective, rather than becoming sidetracked by the superfluous, is something we can all apply to nearly every part of our lives.

So, if you want to achieve more success in any walk of life, focus on the critical elements and then get them right. Once you do that, you’ll often find the rest tends to fall into place.

*****************************************************************

A Spacious Worldview

Like a righteous inspiration

Overlooked in haste

Like a teardrop in the ocean

A diamond in the waste

Some world views are spacious

And some are merely spaced

–RUSH, “Grand Designs”

If you want to take in the world’s ideas and be open to the prospects of an enlightened life, then make sure you strive to embrace a spacious worldview. What this entails is being open to the facts about the world, and open to persuasion by evidence and rational arguments. What it doesn’t mean is being closed-minded and dogmatic about the world based on a narrow, myopic or “merely spaced” worldview. By allowing yourself to be persuaded by facts, arguments and reason, you will be a better thinker — and therefore a better human.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods