The Ultimate ‘Fixer Upper’ for Your Portfolio

“Landlords grow rich in their sleep.” — John Stuart Mill

The English philosopher and political economist John Stuart Mill is one of the most influential figures in intellectual history and the classical liberalism movement. Mill is best known for his theory of “Utilitarianism,” which in essence states that an action or type of action is right if it tends to promote happiness or pleasure and wrong if it tends to produce unhappiness or pain.

Now, the details of Utilitarianism are interesting to debate, especially for someone like me who spent his undergraduate years majoring in Philosophy at UCLA. Yet what might be an even more interesting concept is Mill’s pithy statement here, that “Landlords grow rich in their sleep.”

Indeed, if you’ve ever owned residential and/or commercial investment property you know that it can be a lucrative endeavor — if you get the variables right. Yet you also likely know that there are a lot of variables you must get right to be successful. Get a few things wrong in the process, and rather than growing rich in your sleep, you might just wake up in a cold, nightmare-induced sweat.

So, how do you get the variables right in real estate?

One great way to do that is to align yourself with a team of experts, and doing that right now is as simple as reading my new, free special report, aptly titled, “The Ultimate ‘Fixer Upper’ for Your Portfolio.”

In this report, I tell you all about a company whose mission, business model, structure (a Real Estate Investment Trust, or REIT), expert management and track record of success represent a way for investors to participate and potentially profit mightily from a specialized segment of the real estate market that involves buying distressed assets, fixing them up and then renting the properties out to credit-worthy tenants.

That’s why I call this the ultimate “fixer upper” for your portfolio, because an investment in this non-public REIT is like having a team of real estate experts doing all of the hard work for you. All you must do is put some money to work in this pre-IPO deal — and start watching your returns accumulate.

The name of the company is RAD Diversified REIT, and it is a Regulation A+ offering.

What that means is that you can invest directly in the shares of the company without even a brokerage account. Moreover, you don’t have to be a “qualified investor” to do so, the way you have to for traditional Initial Public Offerings (IPOs).

Of course, if you are reading this, you likely have a long history of putting money to work in the public markets via a brokerage account, and if you’ve been following the recommendations in my newsletter advisory services, then you have likely done extremely well.

Yet what you might not have had access to before are these pre-IPO, Regulation A+ private offerings that allow you to buy shares of the company with as little as $1,000.

Well, RAD Diversified REIT is one such company, and I think it represents an outstanding opportunity for investors looking to supercharge returns in the real estate market without ever swinging a hammer, taking on a commercial or residential mortgage, or having to maintain a physical asset.

So, what, exactly is RAD Diversified REIT?

In essence, the real estate experts at RAD “turn ugly into pretty.”

What that means is that they look for residential and multi-family properties in key real estate markets across the United States that they can buy at a discount. Often, these purchases are made in properties with tax liens, tax deeds and foreclosures.

Indeed, it is the company’s ability to use multiple channels to purchase properties well below market value and leverage the knowledge and experience of its management team to maximize returns for its investors.

So, think of it as a twist on the old Wall Street maxim, “Buy low, sell high.”

With RAD, it’s “buy low, rent high, collect the rents, pay a distribution, increase the share price for investors.”

Here’s the basic strategy RAD employs to get this job done, using a strategy that they call “The Compound Acceleration.”

According to RAD’s official language: “We rehab, we rent, we leverage, we repeat. We will spend more money to find good deals than anyone else, obtaining more properties than anyone else. We buy something to make it better and we spend more money to make our properties more valuable.”

That’s why I call this company the ultimate fixer-upper for your portfolio. The experts at RAD know how to find the properties, how to “fix them up” to increase their value and how to translate value into the share price of their REIT.

But how well has this strategy worked?

I mean, as a reader of mine you know I am all about the earnings prowess of companies and the returns they offer. So, how about the following audited results:

RAD Diversified REIT made a 36.7% annualized return in 2020, including unrealized gains (based on net asset value (NAV) per share on January 1, 2020, compared to NAV per share on January 1, 2021). As you likely know, that is a major league high performance, and it’s the kind of performance that you want when considering putting your money to work.

For much more detail on the investment opportunities in RAD Diversified REIT, and how you can get in on this Regulation A+ private offering that allows you to buy shares of the company with as little as $1,000, then read my new special report, “The Ultimate ‘Fixer Upper’ for Your Portfolio,” today.

This report is absolutely free, and you don’t even need to provide your email to access it. All you must do is read it, click a few links and you’ll be ready to conquer the real estate market!

***************************************************************

ETF Talk: A Mutual Fund Alternative that Won’t Break the Bank

Usually, what is considered one of the advantages of mutual funds compared to exchange-traded funds (ETFs) is active management.

Many investors prefer the idea that someone is making intelligent, intentional decisions behind the wheel of the money those investors are willing to invest. However, more recently, the concept of the actively managed ETF has risen as a possibility and, in so doing, dealt another blow to mutual funds.

One such actively managed ETF is Alpha Architect U.S. Quantitative Value ETF (QVAL).

This fund invests in U.S. equities based on a number of quantitative metrics, including valuation, competitive advantage and financial strength, basing each of these “screens” on public data. The fund also has a proprietary method of eliminating companies that may be utilizing questionable accounting practices.

The hoped-for result is a portfolio of high-quality companies with metrics indicating they are strong investments. As there are about 50 companies currently held by the fund, it diversifies less than some other ETFs, but the companies selected have clearly been chosen with care.

After some time as an index-tracking fund, this week QVAL switched its strategy back to active management. In the past year, this fund’s performance has been a 19.5% gain, just under the performance of the S&P. There have been times during the last year when its performance beat that of the S&P fairly significantly, but late 2021 was unkind to QVAL. The fund has an expense ratio of 0.49% and a yield of 1.34%.

Chart courtesy of StockCharts.com

Among this fund’s largest holdings are such stalwarts as Kohl’s Corporation (KSS), 2.54%; Magnolia Oil & Gas Corp. (MGY), 2.41%; Nexstar Media Group Inc. (NXST), 2.31%; ManpowerGroup Inc. (MAN), 2.27%; and Dick’s Sporting Goods Inc. (DKS), 2.24%. The top 10 positions fill out 22.8% of QVAL’s investments.

For investors who might be leery of the unthinking nature of index-tracking ETFs, actively managed options like Alpha Architect U.S. Quantitative Value ETF (QVAL) may be an appealing strategy.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

The ‘Red Pill’ of Real Estate featuring Dutch Mendenhall

What happens when you put two entrepreneurial Renaissance Men together in a recording studio?

You get a wide-ranging podcast that includes topics such as real estate investing, healthy eating habits, Chinese politics, technology, sensory deprivation tanks, capitalizing on history, gun rights, the psychology of foreclosures and a peek inside the unique RAD Diversified REIT.

Jim Woods and Dutch Mendenhall discuss real estate investing, capitalizing on history and sensory deprivation tanks.

In this episode, I discuss all of these topics and much more with the very interesting Dutch Mendenhall, president of RAD Diversified.

You can read all about RAD Diversified and the company that Dutch built, and the investment opportunities in their unique real estate investment trust (REIT), in my new special report, “The Ultimate ‘Fixer Upper’ for Your Portfolio.”

If you want to get to know more about the man behind the RAD Diversified REIT, then this podcast is for you.

*****************************************************************

In case you missed it…

Turn and Face the Strange

Ch-ch-ch-ch-changes

Turn and face the strange

Ch-ch-changes

There’s gonna have to be a different man

— David Bowie, “Changes”

If you thought that the beginning of 2022 would be volatile, then you were right on the money, literally. You see, in this business, being “right on the money” is what I attempt to do each day, week, month and year.

Now, for much of the past two years, and certainly since the March 2020 pandemic lows, the equity markets have trended higher on a bullish combination of 1) A very accommodative central bank, 2) Fiscal stimulus via big federal spending/giveaways, 3) COVID-19/vaccine optimism and 4) Strong corporate earnings.

I’ve written about these four bull market factors in my newsletter advisory services with the biblical reference, “The Four Horsemen,” as their presence escorted the bulls on their trek through Wall Street and the American and global economies for much of the past 22 months.

Yet as David Bowie famously wrote in his classic song, “Changes,” sometimes we must turn and face the strange, and if necessary, become a different man.

So far in this nascent year, one that is not yet even one month old, we’ve already witnessed aggressive gyrations that have created massive changes in the major domestic averages.

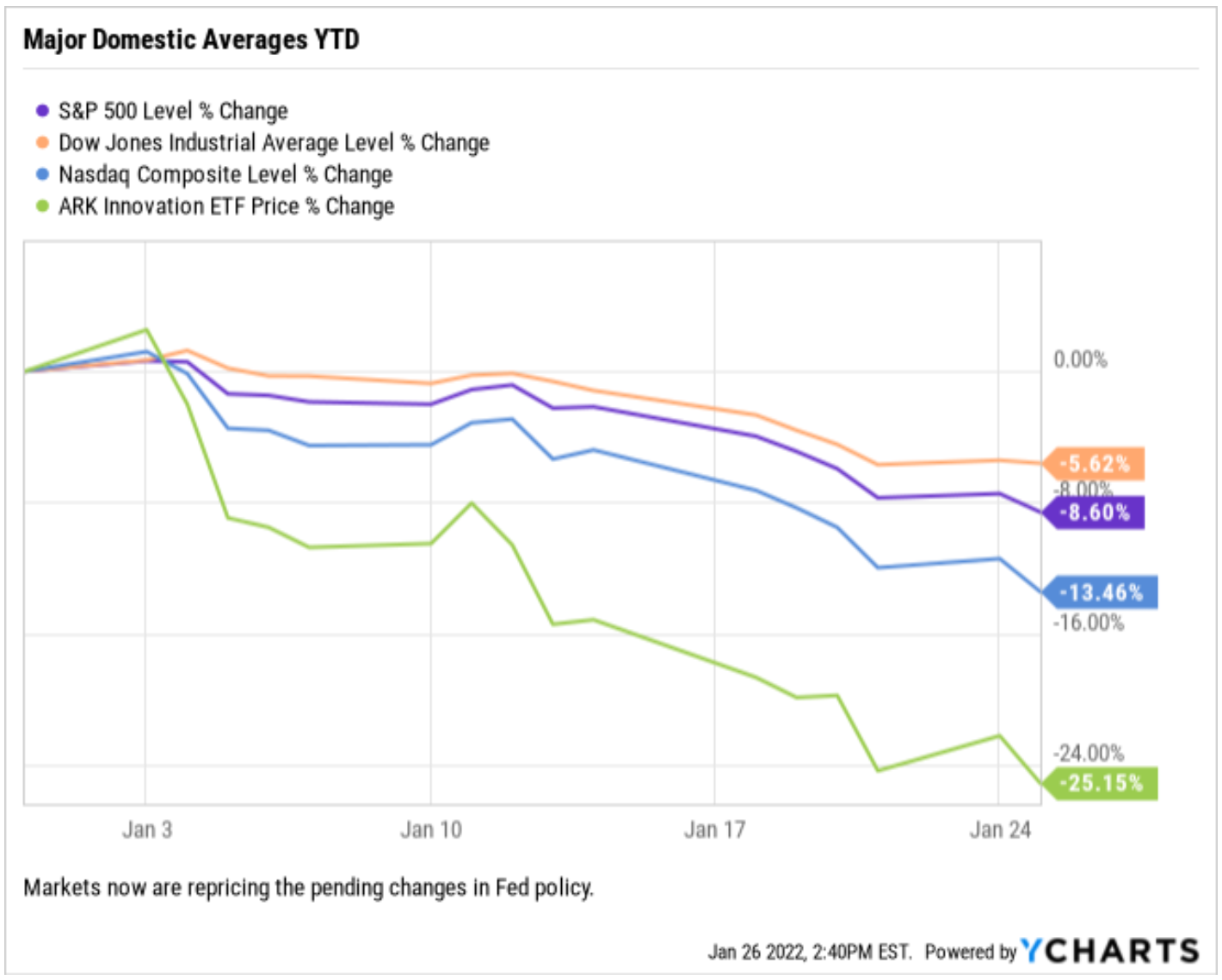

Through the close on Tuesday, Jan.25, the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite all were firmly in negative territory year to date. The Dow was the best performer over this period, but it was still down 5.62%. The S&P 500 has already witnessed an 8.60% pullback, while we saw big selling in the tech-heavy Nasdaq Composite with a loss of 13.46%.

The big losses in the higher-valuation, tech-heavy Nasdaq are all you need to know to understand the changes we face here, changes that are no longer supported by two of the four horsemen (a very accommodative central bank and fiscal stimulus via big federal spending/giveaways).

In fact, not only have two of the four horsemen basically been relegated to the barn, but there also has emerged a dark presence in the market atmosphere that’s clouding the outlook going forward, and that is multi-decade-high inflation.

Yet, why is it that high-valuation, high-growth tech stocks are getting hit the hardest? Aren’t these the stocks that everyone wanted to own last year? The answer is largely yes, these are the stocks everyone wanted to own, and that’s part of the reason we are seeing the segment sell off here, as these were the stocks that were over-owned for years.

Another reason why there’s been an exodus from growth stocks/sectors to value stocks/sectors this year is because those high-growth stocks also are high price-to-earnings (P/E) stocks. Now, as interest rates rise, a headwind will begin to be created on economic growth. And as growth potentially slows, it hits the highest P/E stocks hardest, because these companies are priced for perfection, and perfection doesn’t include slowing growth.

The high P/E leaves these stocks and sectors a long way from a level that would attract anyone looking for value. For example, a 100 P/E tech stock could get cut in half (50 P/E) and that’s still a multiple double that of the S&P 500. Conversely, a 30 P/E stock could drop to 25 P/E (so less than 20%) and now it’s trading much closer to the overall market multiple and is more attractive to more buyers. Point being, when rates are rising and growth could potentially be slowing, buyers won’t defend the high P/E stocks until there have been big drops.

We’ve seen those big drops occur already this year, as many of these high-growth tech names, best represented by the holdings in the very popular ARK Innovation ETF (ARKK), have tumbled. In fact, ARKK is down over 25% year to date. Yet still, the big holdings in ARKK are nowhere near “value” levels that would entice investors to step back in and defend these stocks at a certain level.

The reason that’s a problem is we have no idea just how over owned the high-growth, high-P/E space is by hedge funds, nor do we know how much leverage there is in these holdings. If the answer to both is “a lot,” then the drop in this sector could cause a bigger market correction.

For astute market watchers trying to determine the next leg higher for equities, the key is watching these high-P/E, high-growth tech names. Stated more practically, if ARKK can stabilize that will be a sign that stocks in this space have declined enough to entice buyers.

Going forward, I will be closely monitoring funds such as ARKK, along with all of the Fed’s actions and market signaling, to determine when it’s safe to turn back and face the strange of the high P/E equity segment. Until then, as investors, we’re gonna have to be a different man and embrace the “quality” stocks out there with more attractive P/Es and better valuations — and hey, there’s nothing wrong with that kind of change!

*****************************************************************

The Bard on Real Estate

“I would give a thousand furlongs of sea for an acre of barren ground.”

— Shakespeare, “The Tempest”

Even The Bard of Avon knew about the importance of real estate in human life. Indeed, owning physical real estate and/or owning it through investments such as homebuilder stocks, lumber stocks, building supply companies and especially REITs plays an important role in your overall investment picture. If you are light on real estate, think about ways you can right that ship and sail it from open sea to “an acre of barren ground.”