The Two Big Changes in 2024

One of my favorite aspects of what I do is that every year in markets is different.

Indeed, unlike so many other businesses, the circumstances of every market year change, and often quite dramatically. Hey, it’s one of the reasons this is such an interesting business.

In a recent issue of my morning briefing, Eagle Eye Opener, we covered two of the most important changes from the current year that I anticipate occurring in 2024. This week, I want to share those thoughts with you, The Deep Woods reader, because these changes mean that events that were tailwinds for stocks in 2023 will become neutral to potentially negative in 2024.

How will that be? And what are those two changes? I’m glad you asked.

The first big change is that falling bond yields will no longer be positive for stocks. Now, consider that there were two overarching reasons for the rally in 2023: The first was artificial intelligence (AI) enthusiasm powering the “Magnificent Seven” stocks higher and pulling the S&P 500 higher with it. The second was expectation of a dovish Fed pivot that essentially saved the 2023 rally in late October.

Falling interest rates were a clear positive in 2023 because they eased valuation headwinds and signaled that Fed hikes were ending, which reduced recession chances. But as we start 2024, the dovish Fed pivot is now fully priced into stocks with the S&P 500 just under 4,800, and the market now has priced in six Fed rate cuts and a year-end 2024 Fed funds rate below 4%.

So, the dovish pivot and expected easing of monetary policy is already priced into stocks and Treasuries. If we see the 10-year Treasury Note yield continue to fall to the low-3% or sub-3% range, that’s not going to be a major tailwind for stocks, because that won’t be forecasting a dovish Fed, it’ll be forecasting slowing economic growth. And those falling yields will then become a harbinger of a potential economic slowdown, and not the welcomed signal of a Fed that’s finally turning dovish.

The second big change is that earnings results won’t have low expectations to excuse poor performance. Earnings from companies in the S&P 500 weren’t particularly great in 2023, but they were much better than some of the awful expectations that were prevalent when the year started.

To put some numbers on it, many analysts penciled in 2023 S&P 500 earnings between $220 and $225. But there was a definite minority that had estimates much lower, anywhere from $185 to $215, as these analysts expected the recession that never appeared.

As we start 2024, it’s the total opposite. Consensus S&P 500 earnings growth is nearly 10% year over year, well above the long-term averages of around 5%-ish annual growth. And keep in mind, at 4,800, the S&P 500 is trading over 19.5X that $245 earnings estimate, which means there’s little room for disappointment from a valuation perspective.

The point here is that just “okay” earnings won’t be good enough to drive stocks higher, and we got a preview of that in the third-quarter numbers (which weren’t great) and especially in December, as earnings results were generally poor. Now, that doesn’t mean the upcoming fourth-quarter earnings season (which begins in mid-January) won’t be positive, but for it to be positive it’ll have to be because of actual good results, not just better-than-feared results that were good enough in 2023.

The bottom line here is that markets will need something “new” to power stocks higher in 2024, because the dovish pivot (which powered stocks higher since October) is fully accounted for, while low expectations for earnings and economic growth no longer exist.

That doesn’t mean we won’t get new, positive influences on stocks, but it will have to come from something new in 2024, because the low hanging fruit of a dovish pivot and not-as-bad-as-feared earnings have already been picked to fuel the Santa rally.

If you’d like analysis such as this in your inbox every trading day, then I invite you to check out my Eagle Eye Opener, right now. For the cost of a morning latte, you’ll be completely up to speed on all of the essentials you need to thoroughly understand this dynamic market.

***************************************************************

ETF Talk: AI is ‘Big Generator’

Second nature comes alive

Even if you close your eyes

We exist through this strange device

— Yes, “Big Generator”

Artificial intelligence (AI) has captivated our imaginations and industries on a global scale. We are, like the Yes lyrics above, starting to see our existence through what may seem like strange (AI) devices.

But you may need to blink more than once before you miss the AI trend. It has been booming in 2023, and seems poised to continue its growth into 2024 and beyond.

Reaching into sectors from technology and communication to healthcare and retail (and sooner than later, perhaps, into the most mundane aspects of our daily lives), AI is a central new technology that has companies and investors buzzing with excitement.

Your editor listening to “Big Generator” by Yes, while also rocking the band’s t-shirt.

Major leaps in generative AI have come from heavyweights such as Microsoft Corporation (MSFT), Alphabet Inc. (GOOG), Amazon.com, Inc. (AMZN) and Meta Platforms, Inc. (META). In addition, Intel Corporation (INTC) and Advanced Micro Devices, Inc. (AMD) seek to challenge leading AI chipmaker Nvidia (NVDA) for the top spot in AI chip production. The stage now is set for potentially significant growth across multiple sectors.

And investing in those hard hitters is certainly tempting. But for those who are looking for diverse exposure to the broader value chain as the development of AI technologies ramps up, let me introduce iShares Robotics and Artificial Intelligence Multisector ETF (IRBO).

IRBO is a passively managed, equal-weighted exchange-traded fund by iShares that tracks the performance of the NYSE FactSet Global Robotics and Artificial Intelligence Index, which measures the performance of equity securities across multiple sectors, including information technology, communication, industrials, consumer discretionary and health care.

The fund is composed of developed and emerging market companies that could benefit from the long-term growth and innovation in robotics technologies and artificial intelligence.

As such, IRBO invests significantly in mid- and small-cap companies, alongside more established large-cap companies. It also invests 46.1% of its holdings in non-U.S. stocks for a broader geographical exposure. Top countries include the United States, 53.90%; China, 12.24%; Japan, 9.48%; Taiwan, 7.64%; France, 2.83% and South Korea, 2.60%.

Its equal-weighted stock strategy means that all holdings are allocated the same weight across the portfolio, giving investors even access to companies producing AI and robotics hardware, software and components and to smaller companies with the potential for growth.

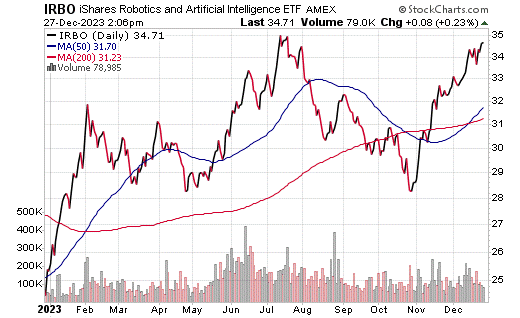

This strategy also allows the fund to remain less volatile than similar funds. And it has made a solid recovery from its 2022 downward trend. As the chart below shows, it is currently sitting above its current 200-day moving average and has been in an upward trend since the start of the year.

Source:StockCharts.com

The fund’s top 10 holdings include Snap Inc. Class A (SNAP) (formerly Snapchat, Inc.), 1.1%; Autostore Holdings Ltd. (AUTO), 1.06%; Maytronics Ltd. (MTRN), 1.06%; Silicon Laboratories Inc. (SLAB), 1.05%; Atmos Energy (ATO), 1.05%; Lumen Technologies Inc. (LUMN), 1.04%; DigitalOcean Holdings, Inc. (DOCN), 1.04%; Lattice Semiconductor Corp. (LSCC), 1.03%; Genius Sports Ltd. (GENI), 1.01% and Advanced Micro Devices Inc. (AMD), 1.01%.

IRBO has $536.09 million in assets and a price-to-earnings (P/E) ratio of 21.94. The fund is up 5.93% over the last month, 13.45% over the last three months and 35.24% for the year to date. It has an expense ratio of 0.47%.

As we look forward to a new year and new advancements in AI, perhaps we’ll find out if, like androids, AI dream of electric sheep.

Finally, remember that I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

One More is Never Enough

One more night could kill me, baby

One is one too many, one more is never enough

–Grace Potter, Kenny Chesney, “You and Tequila”

Peak experiences. By their very nature, they’re infrequent and gone too soon. Yet, it seems like whenever we’re fortunate enough to experience them, it’s just never enough — and we want one more.

This quest for just one more is at the heart of achievement and living a happy and fulfilling life. It’s also why capitalism is such a virtue, because capitalism is the only social system that can allow us to achieve that just one more.

My reflections on this topic come courtesy of a peak experience I recently completed, which is the writing of last week’s issue while on board the SS Splendor, the opulent cruise vessel operated by Regent Seven Seas Cruises.

I was there with my colleagues Roger Michalski, Bryan Perry and Dr. Mark Skousen for the Eagle MoneyShow cruise from Miami to Lima. While writing this, I was about to spend my final day in Lima before returning via airplane to Southern California.

The best part of the trip was interacting with my cohorts, meeting interesting people from all over the world and, most of all, engaging in the ultimate peak experience — learning new things.

You see, in a world where we often feel so small, I can’t stop thinking big.

I want to fill my head with big ideas about who we are and what we are, and I want those ideas to be as fully vetted by reality as they can be. And the only way to do that is to conduct your own intellectual “boots-on-the-ground” research that takes you to places you haven’t been, and to touch, see and hear things you never have — or indeed, never knew existed.

Of course, to make this task possible, you must have the capital. I mean, these Regent cabins don’t come cheap!

Fortunately, there’s plenty of outstanding knowledge that can help you stack up your investment capital, and I’m proud to say that my colleagues and I at Eagle Financial Publications specialize in delivering just that.

So, if you are in search of more investing capital that allows you to think bigger and bigger in a world that can make you feel small, then the offerings from Eagle Financial Publications are a great way to expand your mind.

Finally, I want to thank you, The Deep Woods loyalists, for reading this column and for making me feel so fantastic about what I do and how I get to interact with the world. It’s because of you that I am able to think big in a world where it’s so easy to feel small.

And with that, I’m off to drink up more knowledge — and to keep thinking big!

*****************************************************************

Franklin Forever

“The things which hurt, instruct.”

–Ben Franklin

Putting wisdom in the pithiest of proclamations is something that the great Ben Franklin can do like no other. In this quote, he reminds us that the best source of knowledge is that which burns us emotionally.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods