The Skinny on Weight-Loss Stocks

America loves weight-loss drugs.

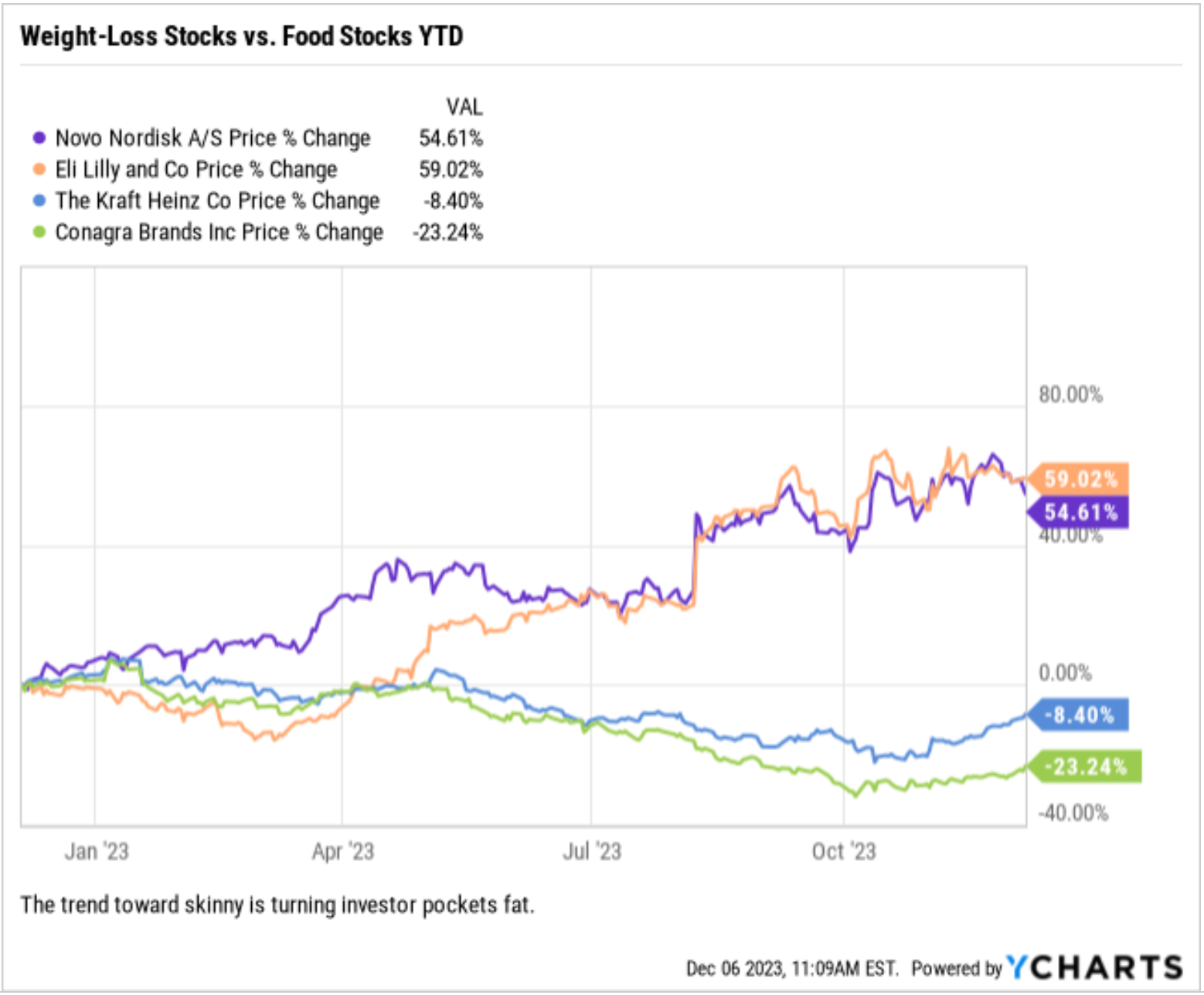

Here, I’m talking about the newest class of weight-loss drugs, the “GLP-1 drugs.” Indeed, the long-term impact of GLP-1 drugs has been a significant story in markets throughout 2023, but lately its had a bigger macro impact as expectations for this drug have resulted in substantial gains for specific large-cap pharmaceutical stocks and recent significant weakness in previously “safe” food stocks that’s contributed to the underperformance of the consumer staples sector in 2023.

The reason these GLP-1 drugs have had such a varied and broad impact on different parts of the market can be summed up by this statement: There are expectations that these GLP-1 drugs could result in substantially less food consumption across the country in the coming years. They literally could reduce the demand for food!

In a recent issue of our daily morning briefing Eagle Eye Opener, my “secret market insider” and I presented an analysis of the potential impact of these weight-loss drugs on different parts of the market, as they are becoming an increasingly popular topic amongst investors. Here, we explained 1) What GLP-1 drugs are (and what they do), 2) Why they’ve impacted markets and 3) How to gain exposure to them (and, for contrarians, what food and staples ETFs have underperformed because of GLP-1 drug concerns).

Let’s take a look at that analysis now, as it could turn skinny investor pockets fat!

What are GLP-1 drugs? The brand names of two of the most popular GLP-1 drugs are Ozempic and Wegovy (both produced by Novo Nordisk (NVO)). GLP-1 drugs were initially designed as a diabetes drug, as GLP-1 drugs stimulate the body to produce more insulin after someone has eaten. The extra insulin helps to reduce sugar levels and has proven very effective in controlling Type-2 diabetes. But along the way, users of the drugs noticed a side effect: They weren’t as hungry and lost weight. Studies have found that using GLP-1 drugs can lead to 10-15 pounds of weight loss. Given that, these now are being marketed as weight loss drugs and their popularity has exploded.

Why has this impacted markets? In short, because a lot of people are starting to use them. In the second quarter, sales of Ozempic rose more than 50% from a year ago (from $2.1 billion in 2022 to $3.2 billion), while Wegovy sales rose 30% from 2022 (to $1.1 billion). That’s having a direct impact on two of the biggest pharma stocks that have “first mover advantage” in this space.

Novo Nordisk, who has two GLP-1 drugs (Ozempic and Wegovy), has risen 54.5% year to date (YTD). Eli Lilly (LLY), who manufactures Mounjaro, is up nearly 59% YTD (full disclosure, I am long both NVO and LLY in my newsletter advisory services). Conversely, pharma names that are not in this space have seen less-stellar returns. Merck (MRK) is down 5% YTD, while Pfizer (PFE) has collapsed 42%, in part due to collapsing Covid vaccine demand.

While certain pharma names have benefitted, a lot of processed food companies have seen their stocks fall sharply on concerns that, over the long term, widespread adoption of these GLP-1 drugs could structurally reduce demand for processed foods. Companies such as Kraft (KHC), Conagra (CAG) and Mondelez (MDLZ) have lagged the S&P 500, and in the cases of Kraft and Conagra, posted substantially negative returns (down 8.5% and 23% YTD, respectively). The reasoning here is clear: Estimates for GLP-1 drug usage forecast 25-50 million users by 2030.

If GLP-1 drugs reduce appetites by 10-20%, then the impact of aggregate food consumption will be in the low-single-digit-percent range (according to Bank of America). For the food companies, that’s evaporation of real and substantial demand. Being, it’s anecdotal and still early, but the risk here to food companies is real.

Finally, because food companies are a large part of consumer staples ETFs, their poor performance has negatively impacted the returns of the Consumer Staples Select Sector SPDR (XLP) and other consumer staples funds. XLP has declined 7.9% YTD, and while part of that has been the lack of a growth slowdown and higher yields that makes high dividend stocks less attractive, another part of this underperformance has been concerns about food demand. Food products account for 17% of XLP, while the impact of potentially reduced caloric demand can impact the grocers and the food-inclusive retailers.

The point being, food processors and large retailers with food exposure aren’t as big a weight on the market as tech, but they’re not unsubstantial, either. Meanwhile, those types of industries are heavily weighted in consumer staples ETFs and some dividend-focused ETFs. Bottom line, the evolution of these GLP-1 drugs and how they impact food demand is something all investors need to watch going forward.

So, what is the best way to get exposure to GLP-1 stocks, and what food stocks could be a contrarian opportunity?

For targeted GLP-1 exposure, obviously buying Novo Nordisk (NVO) and Eli Lilly (LLY) gets the job done as these two names are leaders in the space.

From an ETF standpoint, there are many pharmaceutical ETFs in the market today. The largest pharma ETF, the iShares U.S. Pharmaceuticals ETF (IHE), doesn’t have exposure to Novo Nordisk, which is a problem if the goal is GLP-1 exposure. Instead, the VanEck Pharmaceutical ETF (PPH) (here again, we are long PPH in my newsletter advisory services) is a better choice as Eli Lilly (LLY) is the largest holding (8.3%) while Novo Nordisk (NVO) is second at 6.5%.

Additionally (and presumably), most major pharma companies will invest in these GLP-1 drugs (PFE has a once-daily weight loss GLP-1 drug in development, as do most other major pharma companies) so we can expect other pharma names to release their versions in the coming year. Bottom line, PPH provides broad pharma exposure but also provides relatively large allocations to the two market leaders in the GLP-1 space.

Switching to the losers of the GLP-1 drug story (and for the contrarians out there), the case can easily be made that a lot of these longer-term forecasts about food demand destruction are overblown, and as such, there’s opportunity in the food names.

The Invesco Food and Beverage ETF (PBJ) has lagged the broader markets this year (down 5.7%), in part because of GLP-1 demand concerns. Some of the largest holdings in PBJ are the negative-exposed GLP-1 names, including Kraft Heinz (KHC) and Mondelez (MDLZ). PBJ trades at just 13.9X forward earnings and sports a yield of 2.41%. The point being, the underperformance has created value for those value-oriented types.

The anticipation of the impact of GLP-1 drugs has influenced specific stocks and sectors both positively and negatively, and that’s not likely to change. Given this potential and the topic in the popular lexicon, we think that understanding what GLP-1 drugs are and how they are impacting markets is important, especially for those interested in either side of this trade.

Did you like what you just read? Do you want this kind of analysis every morning before the market opens? If so, then you need to subscribe to the Eagle Eye Opener, today.

For just a skinny price, you can read about all kinds of ways to make your pockets fat!

***************************************************************

ETF Talk: ‘DIVining’ a Path Through the Fog in Search of Wealth

In my most recent Successful Investing newsletter (and if you aren’t a subscriber, why aren’t you?), I weighed the proverbial scales as to whether the bulls or the bears would come out on top. To keep a (very) long story short, there are four tenets of the bullish faith that must be fulfilled for the market to climb. These are:

- No economic slowdown

- Inflation continues to decline

- No hawkish surprises from the Fed

- No reduction in earnings

Some investors believe these tenets to be within reach, as corporations have proven themselves resilient and much better-than-expected in cutting costs without causing an economic slowdown and inflation has continued to decline. Despite Fed Chairman Jerome Powell recently stating that he and his fellow U.S. central bank leaders are still willing to increase interest rates again, that seems less likely, according to some market analysts, who have projected interest rate cuts to start in May.

In such a market environment, some investors have continued to use dividend-paying stocks as a shield against all this uncertainty. Studies by Ned Davis Research, among others, have lent empirical support to this strategy, as scholars have found that both domestic and international companies whose dividends increased year over year for the past 20 years outperformed companies whose dividends either remained flat or decreased.

However, the task of finding good dividend-paying stocks is easier said than done. After all, discovering the companies that have such a history is problematic. It involves predicting which ones are best suited to endure the unpredictable shocks that the world generates without cutting or eliminating the dividend payouts.

However, there are more than a few dividend-paying exchange-traded funds (ETFs) that aim to demystify this process. One of these is the Global X SuperDividend US ETF (NYSEARCA: DIV).

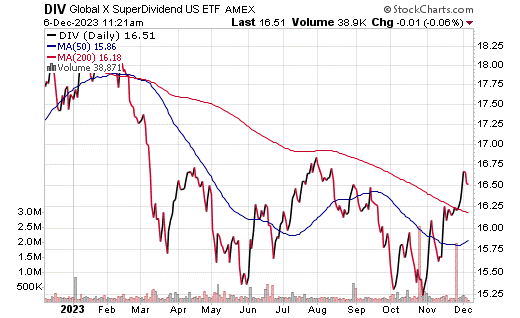

Dedicated to generating a maximal income strategy, DIV’s managers seek to own the 50 highest dividend-paying stocks trading in the U.S. market, including traditional dividend common stocks, real estate investment trusts (REITs) and master limited partnerships (MLPs). Only companies with sizable dividend payouts, lower relative volatility and a history of paying out consistent dividends over the previous two years make the cut. As a result, that methodology gives this dividend ETF a flavor heavily concentrated in financials, energy and utilities.

Some of the stocks currently in the portfolio include Iron Mountain (NYSE: IRM), International Business Machines Corporation (NYSE: IBM), USA Compression Partners LP (NYSE:USAC), Universal Corp. (NYSE: UVV), Cross America Partners LP (NYSE: CAPL), PACCAR Inc. (NASDAQ: PCAR), New York Community Bancorp Inc. (NYSE: NYCB) and MPLX LP (NYSE:MPLX).

As of Dec. 6, DIV has gained 2.69% over the past month and 1.46% for the past three months. It is currently down 6.06% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $601.09 million in assets under management and has an annual expense ratio of 0.45%.

In short, while DIV does provide an investor with a way to invest in dividend-paying stocks, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors should always conduct their due diligence and decide whether the fund is suitable for their investing goals.

I am always happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

An Evening with Heroes

Some nights in life are just way better than others. In fact, some nights, you just wish for what we call, “Time Stand Still.” Some nights, you want to “Freeze this moment a little bit longer, make each sensation a little bit stronger.”

Now, if you recognize these lyrical references, then you know the “we” I’m referring to here is my fellow superfans of the greatest rock band ever — RUSH. And as a superfan, last night was a “Time Stand Still” evening.

You see, last week, I went to an author reading and interview/conversation with RUSH frontman/bassist/keyboardist/vocalist Geddy Lee, as he spoke and read from his new memoir, playfully titled, “My Effin’ Life.”

Geddy was joined by a “special guest host,” actor/comedian/musician Jack Black. Black is also a RUSH superfan, and he made a rather famous appearance during the band’s R30 tour show in Irvine, California, on July 14, 2004 (superfans also tend to know the dates of the shows we’ve been to). I was there that night, and I witnessed the porcine actor run out on stage, strip down to his underwear and strike the RUSH “Starman” pose in the middle of their performance of the operatic “2112.”

Jack Black was decidedly more subdued last night, although still wittily playful and funny, as he directed the conversation with Geddy. That conversation started with an intensely beautiful reflection on how Geddy’s parents met, and how they both managed to survive a Nazi labor camp that made munitions in their native Poland. And then, how they managed to reunite after they were separated and sent to the death camp Auschwitz. It was an amazing story of reverence for one’s past that tugged at the heart of the human spirit.

The conversation then moved to recollections of the band, its 40-year history, its highs and lows along the winding path and the intimate, humorous and poignant musings of the music, people and places experienced along the way.

Yet for me, the best part of the night was the many recollections about Geddy’s band mates — master guitarist Alex Lifeson and the inimitable drummer/lyricist, the late Neil Peart.

The stories and reverence for his childhood friend Alex, and the incredible admiration and love with which Geddy spoke of his bandmate, were quite moving and inspirational. I hope that my colleagues have even a modicum of that kind of love and respect for me, as that would be a tremendous honor.

Your editor, pre-show, with his copy of “My Effin’ Life” by Geddy Lee.

For me, the absolute best moments were hearing Geddy’s tender reflections on Neil Peart. From the story of how mesmerized he and Alex were when they first heard Neil play drums at the band’s audition, to the moment when they realized he would be the perfect person to write the band’s lyrics. That latter story was one of my favorite moments of the evening, as it reminded me of something in my own life.

You see, Neil was a voracious reader, and Geddy and Alex always saw him with his nose in a book, usually a challenging literary classic. One day they said to Neil, and I paraphrase here from memory, “Hey, you like to read a lot, why don’t you try to write some lyrics?”

Neil did just that, and artistic genius was born.

I had this same sort of moment as a child. One night, I recall my parents asking me what I wanted to be when I grew up. I said, “I don’t know, I’m only 12 years old.” After I left the room, I heard my parents chuckling, then I heard my father tell my mother, “Well, he’s always reading those big books, maybe he’ll be a writer.”

I guess parents do sometimes get things right.

The recollections of Neil, his brilliance, his unique lyrical style and masterful musicianship and his unquenchable desire for knowledge and for always improving all came to life in Geddy’s heartfelt recollections of his fallen comrade, and that was the best part of spending time last night with Geddy, and by extension, my fellow heroes of RUSH.

Today, I want to leave you with my own recollections of Neil Peart, as I wrote about my thoughts on what his life meant to me upon hearing of his death nearly four years ago. I hope you find my tribute worthy of the man, worthy of my heroes and worthy of the very best within us.

A Shadow Crossed My Heart

(Originally published January 16, 2020)

Suddenly, you were gone

From all the lives you left your mark upon…

— RUSH, “Afterimage”

On Friday afternoon, I learned of the death of one of my real-life heroes. And after the initial wave of incredulity subsided, I felt a shadow cross my heart.

Perhaps not surprisingly, those precise words, “I felt a shadow cross my heart,” are lyrics from the song “Nobody’s Hero” by my favorite rock band, RUSH. Those lyrics also happened to be written by that real-life fallen hero, the band’s virtuoso drummer and lyricist Neil Peart.

Peart is a rock and roll legend. He’s inarguably one of the greatest drummers in music history, and at age 31, he was the youngest drummer ever to be inducted into the Modern Drummer Hall of Fame. Decades later, he and his RUSH bandmates, bassist-vocalist Geddy Lee and guitarist Alex Lifeson, would be inducted into the Rock and Roll Hall of Fame.

Yet, “The Professor,” as he was referred to by the legions of RUSH fans around the world, was more than just a genius behind the drum kit. And he was much more than just someone with a penchant for turning a lyrical phrase.

Peart was a man who helped shape my mind, and my existence, with the profundity of his prose and the intensity of his thought.

His intellectual genius can only really be appreciated within the full context of the band’s 19 studio albums, 11 live albums and 33 music videos, not to mention the thousands of shows the band played over the course of its incredible 40-year career. Yet today, I will attempt to reveal a glimpse of the man’s mind with a sampling of a few of my favorite lyrics from his epic body of work.

After you read them, along with my thoughts on the lessons they convey, you’ll get a better sense of what was so profoundly influential for me about Peart’s work. I also suspect you’ll get a much deeper look at the man that I am, and the man I continually aspire to be.

Hold your fire

Keep it burning bright

Hold the flame

’Til the dream ignites

A spirit with a vision

Is a dream with a mission

— “Mission”

The lesson here is that man requires a productive life purpose, and the key to achieving that purpose is carrying out your vision with passion and persistence.

From the point of ignition

To the final drive

The point of the journey

Is not to arrive

— “Prime Mover”

Life isn’t about the endpoint of attaining a goal. Life is much more about the doing, and the experience, of action in the moment.

The most endangered species: the honest man

Will still survive annihilation

Forming a world, state of integrity

Sensitive, open and strong

— “Natural Science”

The virtue of honesty is hard to adhere to, but one must always pledge fealty to truth. Doing so allows you to live in a state of integrated calm. Another way of saying this is that the moral is the practical.

You don’t get something for nothing

You can’t buy freedom for free

You won’t get wise with the sleep still in your eyes

No matter what your dream might be

— “Something For Nothing”

The only way to learn is by engaging with the world; however, doing so comes at a price. Let’s face it, it’s damn hard to really think things through. Yet as humans, we have no other choice but to think, and no amount of denial will make that fact go away.

Philosophers and Ploughmen

Each must know his part

To sow a new mentality

Closer to the Heart

— “Closer To The Heart”

We all have a responsibility to ourselves to be as happy as we can be, whatever our role is in this grand play we call life might be. Doing so not only helps us achieve happiness, it helps the world be a little bit better place for everyone.

He’s a writer and arranger

And a young boy bearing arms

He’s got a problem with his power

With weapons on patrol

He’s got to walk a fine line

And keep his self-control

— “New World Man”

There’s a constant struggle in each of us to maintain calmness of mind and spirit, and to keep our self-control in a world that’s so often seemingly out of control. Yet, the truth is that all we can have control over is ourselves, and we must struggle to achieve that. It is this battle that rages within every human, and it’s one that first must be recognized and acknowledged in order to be won.

Now, I could go on for volumes here with an analysis of significant RUSH lyrics and their deep meaning, but I think you’ve already got a clear sense of how much Peart and his work mean to me. And, I can’t properly convey the influence Peart had on my life without mentioning his love of literature and philosophy, which he weaved brilliantly via direct references into his lyrics.

Perhaps the most influential of these references for me was his dedication, “To the genius of Ayn Rand,” in the liner notes to the concept album “2112.” As a very young man listening to that 1976 album, I had no way of knowing the immense influence Rand would have on my own life. Yet, a seed was planted there by Neil to investigate Rand’s unique mind further, and I did just that with intellectual gusto.

Finally, I will conclude this tribute with a reflection on my own personal interaction with Neil, and it came, of all places, behind the wheel of a racecar.

It was October 2010, and I was at Willow Springs International Raceway in Southern California. The legendary track is home to many pro and amateur sports car and motorcycle races. It’s also a place where motorsports enthusiasts can bring their own cars and motorcycles to do some performance driving on a real track.

On that day, I was there testing my own cars. I was also there to help coach some of the “newbies” at the track to make sure they were safe and to help them gain more confidence behind the wheel at high speeds.

Much to my amazement, one of the attendees at Willow Springs that day was Neil Peart.

Now, as you might guess, for me, this was a surreal moment burned into my consciousness. I mean, it’s not often you meet a real-life hero of yours in the flesh. It’s also pretty rare to have that hero ask you about how fast, and in what gear, he should be taking the notoriously difficult Turn 9 at Willow Springs.

Neil Peart strolling through the pits at Willow Springs (Photo by Jim Woods)

Yet, that is what Neil did. He asked me for advice on how to be a better driver.

I happily gave him that advice, and I also allowed him to follow me around the track so I could point out to him the proper turn-in points, “apexes” as we call them, so that he could improve his lap times.

After helping Neil Peart improve as a driver, I felt compelled to tell him how he helped me become a better human through his music and lyrics.

Peart was flattered by my confession, but I could also tell he felt characteristically uncomfortable with my fanboy, tearful praise of his work. I mean, I even had a RUSH patch on my driving suit!

Upon seeing the patch, Peart said to me, “Well, I hope it brings you luck.”

What Peart didn’t realize was that he had already brought me the greatest luck a man could ever have — the luck of discovering the beauty, passion and intensity of his brilliant achievements.

*****************************************************************

Just Say ‘Yes’

Move me on to any black square

Use me anytime you want

Just remember that the goal

Is for us all to capture all we want

Don’t surround yourself with yourself

Move on back two squares

Send an instant karma to me

Initial it with loving care

— Yes, “I’ve Seen All Good People”

Through references to chess, and specifically the movement of the Queen’s Bishop, prog-rock masters Yes wisely remind us that when we surround ourselves with those who think the same way we do, we can get trapped in a confirmation bias that stunts our ability to win the game. So, always try to take a couple of steps back and be sure you are grounded and fully aware of your circumstances. It’s only then that we can move forward toward our goal of capturing all we want.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods