The Real Problem With Inflation

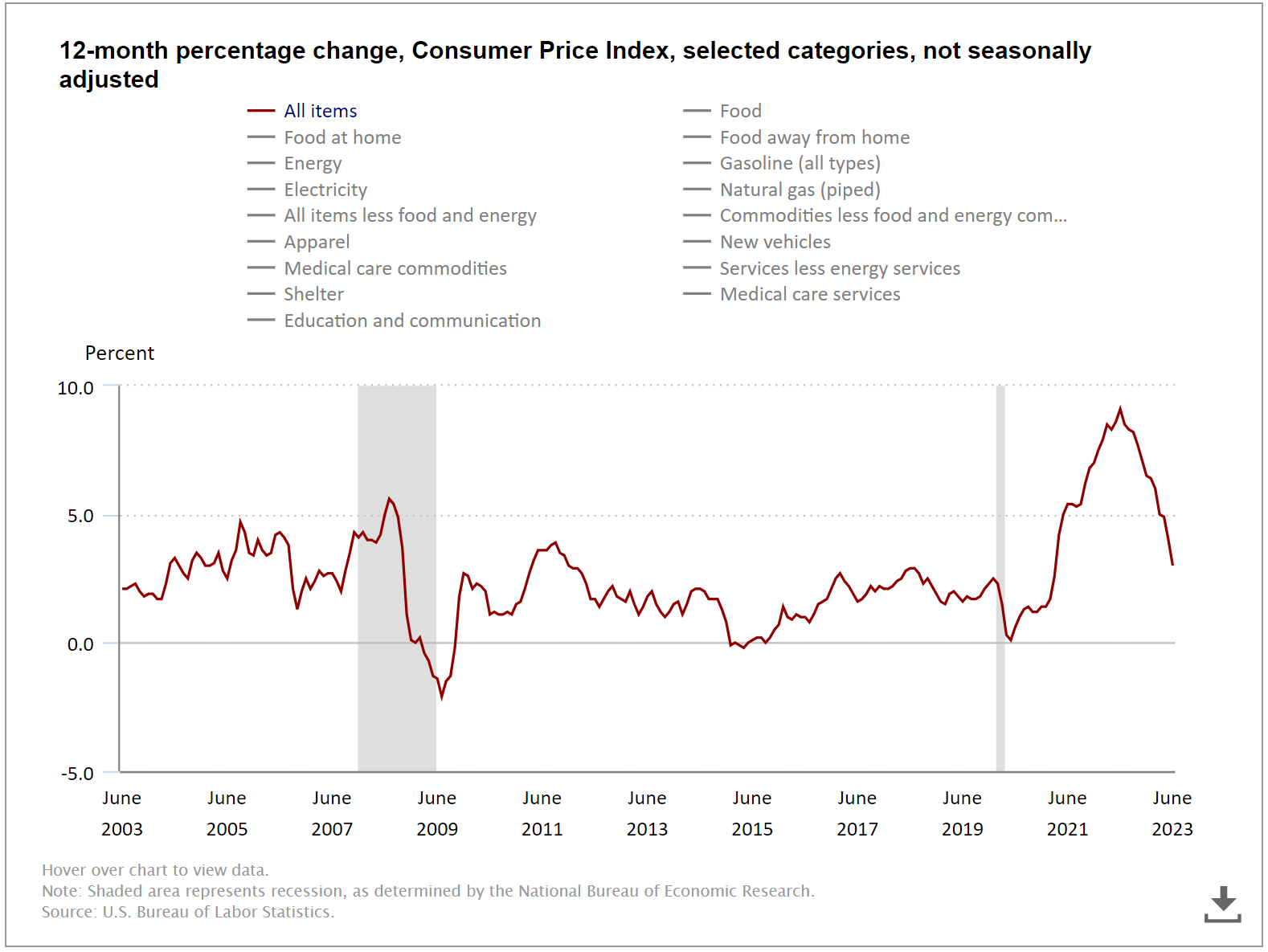

Have you seen a lot of inflation-related headlines in the financial and mainstream media recently touting how inflation is falling?

I know I have, and the headlines all read a little something like this:

- “Inflation is Falling!”

- “Inflation Declines More Than 50% from July 2022 Highs”

- “Inflation Hits Lowest Level since March 2021”

Now, I must admit that all the above headlines are actually accurate. Moreover, it’s also absolutely true that inflation is declining, and broadly speaking, that’s a good thing.

But what exactly does a decline in inflation (or “disinflation,” as I and others refer to it) mean? Here’s the easiest way to understand it, and in doing so, we can understand the real problem with inflation.

One note here before we go on is that the following analysis comes to you from my daily market briefing, “Eagle Eye Opener,” which, if you don’t subscribe to it, what are you waiting for?

The Eagle Eye Opener is a collaboration between myself and my “secret market insider,” a man who supplies institutional level analysis for clients paying thousands of dollars per year for his insights. But in the Eagle Eye Opener, you get a condensed version of what really matters in the market, that day, for a fraction of that cost.

Ok, now on to the real problem with inflation, which to explain, requires nothing more than a bag of Skittles.

I live in Southern California horse territory, and though it’s largely rural, there are still plenty of stores close by. One that I frequent is the Rite Aid near my ranch. Now, before the pandemic, if I bought a pack of Skittles, it cost me about $0.75. Today, it costs me about $1.50. And based on the current inflation rate, next year, that bag of Skittles will cost about $1.55.

So, while it’s good that those Skittles will only be about 2-3% above last year’s prices, the cost is still more than 100% above the price of the same pack of Skittles in 2020!

Bottom line, the decline in inflation (disinflation) that’s being celebrated in Washington, the mainstream media and the aforementioned financial media headlines is good, but it does nothing to reverse the massive price increases of the past several years. They, sadly, are here to stay, and the best the Federal Reserve can do is keep any further price increases small.

So, it’s important not to confuse disinflation with the idea that the price increases of the past several years will reverse, because they will not. I think the best hope for inflation is that it levels off, so my Skittles stay around $1.50. But $1.50 is still a lot for a pack of Skittles!

The longer people have to pay that price, the more it (and other things) chip away at excess savings and excess spending, potentially resulting in a spending slowdown in the not-too-distant future. Perhaps people have so much money exiting the pandemic that the price gains can be absorbed over the long term, and that’s clearly what the bulls think today. But anecdotal observations are telling me that may not be the case.

Bottom line, disinflation is a positive; however, it’s important not to confuse the decline in inflation with the idea that prices are about to drop and give us all some relief. They are not — and the best we can hope for is that they simply stop going up very much.

***************************************************************

ETF Talk: Invest in Global Equities and High Yield With This Fund

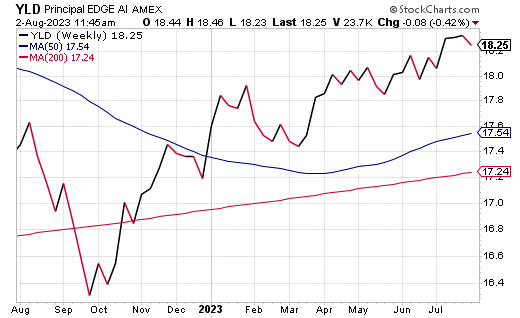

The Principal Active High Yield ETF (YLD) is an exchange-traded fund (ETF) that provides income through exposure to global equities, investment-grade and high-yield debt, mortgage-backed securities (MBS)/asset-backed securities (ABS), preferred stock, master limited partnerships (MLPs) and real estate investment trusts (REITs).

I like that the ETF with $107 million in assets is actively managed and seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its net assets, plus any borrowings for investment purposes, in below-investment grade (also known as “junk” or “high yield”) fixed-income securities. Such securities include bonds and bank loans.

Specifically, YLD invests in U.S. Treasury bills, bonds and other obligations issued or guaranteed by the U.S. government or its agencies or instrumentalities. The ETF also can offer exposure to investment-grade bank loans (also known as senior floating rate interests), and preferred securities.

Source: www.stockcharts.com

YLD’s share price, as of this writing, trades around $18, giving it an impressive 6.46% dividend yield. Its expense ratio is 0.39%, meaning it is relatively inexpensive to hold in relation to other exchange-traded funds.

This fund is a truly active ETF because its portfolio manager has broad leeway to invest across asset classes and geographic boundaries in search of income, unlike active ETPs with index-based strategies. The portfolio manager vaguely provided selection criteria for eligible securities such as economic factors, credit spreads, investor sentiment and momentum.

The fixed-income component may include corporate and sovereign debt, investment-grade and high-yield debt, convertibles, preferred stock, mortgage securities and floating-rate instruments. The manager faces no exposure limits of any kind, other than those mandated by RIC compliance.

With any new opportunity, potential investors should conduct their own due diligence in deciding whether or not this fund fits their own individual investing needs and portfolio goals.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

The Power of Meaningful Conversation

Last week, I had the privilege of guest lecturing for a class of MBA students at California Baptist University. My original plan was to deliver a lecture on how I select stocks in my Bullseye Stock Trader advisory service, and to talk about the financial newsletter industry at large.

Yet, there was a slight obstacle to my giving this talk, because there were some technical issues with the A/V equipment in the room that prevented me from sharing my PowerPoint presentation replete with charts, technical analysis, etc. So, instead of trying give the lecture I had planned, I called an audible that I think turned out to be much more enjoyable.

What I chose to do instead is to simply have a conversation.

Now, by conversation I don’t just mean me pontificating about what I do. By conversation, I mean that I asked each and every student in the room what they wanted to do with their lives.

The answers were quite interesting. Some of the students had very specific goals and an exact path mapped out to get there. Others didn’t quite know what they wanted to do, but they knew that getting their MBA would help them become more knowledgeable and more marketable.

During these conversations, I learned quite a lot about the students’ ambitions, how they thought and why they were choosing their respective paths. I found this out because I asked questions first, and then, most importantly, I listened to their answers.

I say listened, because so often, we engage in discussions with colleagues, friends, family and casual acquaintances without truly listening to what is coming our way.

Instead, many times we are so intent on getting ready to present what we want to say that we are tone deaf to the dynamics of the interaction. Hey, this happens to all of us, but it doesn’t have to.

If you make the conscious effort to really listen to another person, and not merely wait for them to stop talking so that you can make your point, you will become the kind of person that people really like to converse with.

This is of critical importance in life, because the only means of understanding, persuading, changing and growing is via honest, open and meaningful conversation.

Ask yourself this, when was the last time you engaged in a truly meaningful conversation? If coming up with an answer is difficult, perhaps you’re long overdue for just such a meaningful interaction.

Here are three actions steps/how-to tips for engaging in a truly meaningful conversation:

– Actively listen to your interlocutor. Pay attention to what is being said, and how it’s being said. Then, don’t interrupt, don’t make negative facial gestures and don’t look away. Pay attention and learn.

– Be an honest interlocutor. If you want to have a meaningful conversation, come from a place of honesty, integrity, facts and values. Don’t evade reality, don’t make stuff up and don’t deny your feelings. Be frank; and be real.

– Find points of commonality and build from there. Every meaningful conversation consists of hashing out points of disagreement, and more importantly, finding points of commonality. It is my belief that whatever differences people have, they have many more points of commonality they can build on. After all, we are in this thing called life together, and regardless of different perspectives, we share far more agreement than disagreement. So, build on that commonality and run with it.

For more tips on effective communication and how to have increasingly meaningful conversations, I recommend, “5 Ways a Renaissance Man Can Improve Communication,” by my friend, colleague and communications expert Heather Wagenhals.

*****************************************************************

Avett Wisdom

I don’t want a loudmouth for a president

I don’t cheer for the red or blue team

All I want is a neighbor I can learn something from

Be good to them and they be good to me…

— Seth Avett, “Song For A Neighbor”

Seth Avett of the Americana band The Avett Brothers is one of the best song writers of his genre, and in “Song For A Neighbor” he demonstrates just that. A catchy melody and biting lyrics like the ones above pack a powerful warning punch against the prevailing negative trends of tribalism and cult-like political worship. They also promote something I hope we can all get behind, and that is the importance of bonding with those closest to you.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

P.S. Come join me and my Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

In the name of the best within us,

Jim Woods