The Fed’s December Dust Bowl

The Fed’s December Dust Bowl

We can go from boom to bust

From dreams to a bowl of dust…

–RUSH, “Between the Wheels”

In the Great Depression era of the 1930s, the term “dust bowl” was used to describe the drought-stricken Southern Plains region of the United States that suffered severe dust storms during a dry period in the 1930s. Yet the term is more commonly associated with the blighted plains of the United States and global economies during that period.

As for markets, well, we know that this was a difficult and bearish period as well, particularly in the aftermath of the 1929 crash. That’s why it has become a disturbing comparison in the financial media of late that has noted that stocks are having their worst December since 1931.

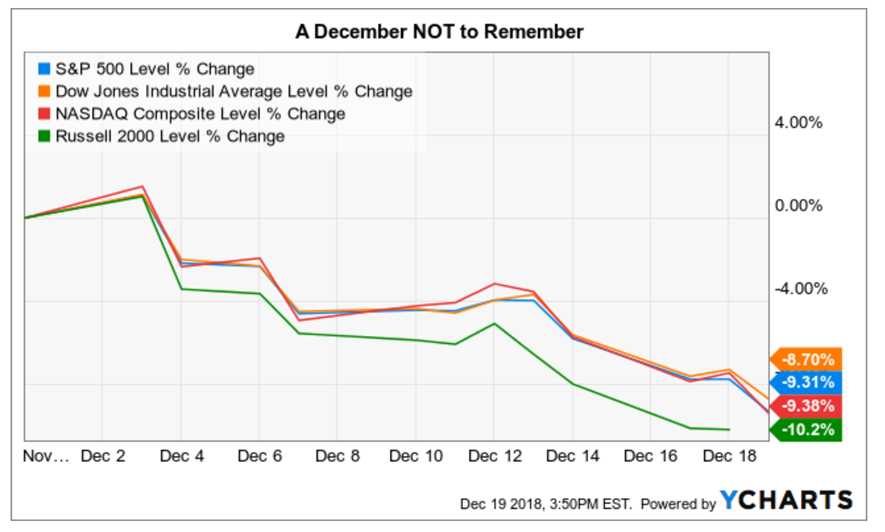

The chart here of the Dow, S&P 500, NASDAQ Composite and Russell 2000 shows just how tough things have been since the Nov. 30 close. The losses month to date in the major indices are still smaller than the Depression-era losses. Back then, the S&P 500 plunged 14.5%, while the Dow plummeted 17%. Still, the pain was very real in the 1930s, and it’s very real today.

And speaking of today, the Federal Reserve announced a quarter-point hike in interest rates, a move that was widely expected by most analysts, including yours truly. Yet what most analysts were expecting was a “dovish hike,” one with a clear signal that the Fed would ratchet down its language on future rate hikes in 2019 and beyond.

Well, the Fed did issue a somewhat dovish hike, but it wasn’t dovish enough for the markets. One of the key wording changes in the Federal Open Market Committee statement that was interpreted as not dovish enough came in the second paragraph, and it was the addition of the word “some” to the phrase “further gradual increases.”

That’s basically the Fed saying that it wants to remain flexible in its approach to rates, but that it’s not willing to go out and fully drop the notion of further gradual increases. As such, stocks went from being up some 300 points on the Dow, before the Federal Open Market Committee (FOMC) announcement and Fed Chair Powell’s press conference, to close down 352 points, or 1.49% on the day.

The disappointing combination of another rate hike and not-dovish-enough signaling means the December dust bowl is probably going to get a lot dustier from here.

Consider yourself forewarned.

**************************************************************

ETF Talk: This Fund Focuses on Stocks with Increasing Dividends

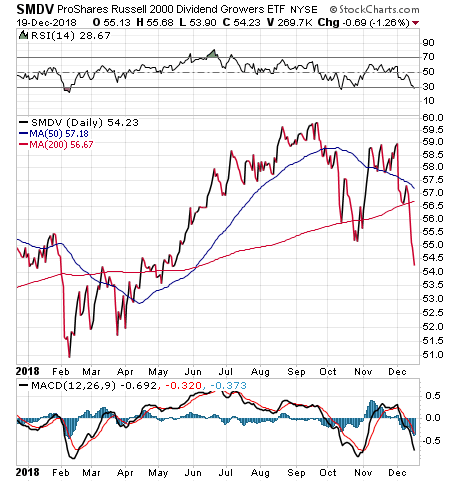

The ProShares Russell 2000 Dividend Growers ETF (SMDV) tracks an index of U.S. small-cap stocks with a 10-year record of increasing dividends.

The stocks are equally weighted in the fund, which seeks companies that are growing their dividends. The fund can contain as few as 40 stocks, but it strives to spread its exposure across all market sectors.

SMDV rose 2.7% in 2017 and is up 8.46% year-to-date in 2018. In addition, SMDV aims for strong total returns via a concentrated basket of small-cap stocks, each with a long history of increasing dividends.

The investment thesis is that small stocks with a proven record of increasing dividends deliver stable growth. The fund culls only about 50 names from a broad 2,000-stock universe, which indicates how few make the cut. SMDV competes most directly with WisdomTree’s DGRS, but strictly only invests in stocks with growing dividends, while DGRS holds dividend-paying stocks with quality and growth traits.

SMDV is the only ETF that tracks the Russell 2000 Dividend Growth Index. The fund also offers historical outperformance of dividend growers, the longest available records of dividend growth and is a part of the largest collection of dividend-growing exchange-traded funds (ETFs).

The top SMDV sectors include utilities, industrials, financial services, consumer defensive and basic materials. Among the funds top 10 holdings, 19.73% are in Atrion Corporation (ATRI), Tootsie Roll Industries, Inc. (TR), Middlesex Water Company (MSEX), Lancaster Colony Corp. (LANC), California Water Service Group (CWT), Black Hills Corp. (BKH), Ensign Group, Inc. (NGSG), Lindsay Corporation (LNN), ALLETE, Inc. (ALE) and NorthWestern Corp. (NWE).

SMDV currently has $443.5 million in net assets, a 1.82% yield and an average 0.14% spread, which is the difference between the bid and asking prices of a security. The fund also has an expense ratio of 0.40%, so it is relatively cheap to hold in comparison to other exchange-traded funds.

In short, the fund targets a narrow slice of the small-cap market — currently with a huge bias toward utilities — rather than broad coverage of the entire small-cap space. If you are interested in Russell 2000 equities that consistently pay rising dividends, consider SMDV. However, its liquidity is weak. As a result, investors should, as always, exercise their own due diligence to decide whether or not SMDV is a worthwhile investment.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

**************************************************************

Decisions, Motorcycle Adventures and the Way of the Bushido

Some men exude robust confidence. Others radiate intelligence and intellectual prowess. Still others project a quiet physical strength that tells the world, “I got this.”

But all of these qualities are rare to find in one man, and Keith Fitz-Gerald is just such a man.

On this episode of the Way the Renaissance Man podcast, I sit down with investment expert, husband, father, samurai and, most importantly, my good friend, to discuss a wide variety of fascinating topics.

From our debate at the FreedomFest conference about the future of Tesla and Elon Musk, to the qualities that make an ideal Renaissance Man, to the Japanese concept of “kaizen” and why it’s important to live by, I think you’ll find my discussion with Keith quite compelling.

You’ll also find out the lessons Keith gleaned from his great-grandfather, a WWI fighter pilot, and how his grandmother inspired his passion for life and influenced his career choice.

Plus, find out about Keith’s amazing immersion in martial arts, including his knowledge of Samurai and Japanese culture and how he integrates those concepts into everything he does. And, we also talk about motorcycle adventures, decision making, the way of bushido and much more.

Finally, I tell you a story about how Keith introduced me to the most incredible sound you never want to hear.

Remember, if you like the Way of the Renaissance Man podcast, I encourage you to subscribe to the show on iTunes.

Doing so is free, and it will ensure you never miss the latest episodes.

******************************************************************

Yes, There are ‘Always Up’ Stocks, (Even Now)

Last week, I told you that despite the struggles in markets since October, there are still many stocks that have done well, and that are ripe for nimble investors looking for alpha.

And despite the big sell-off over the past week, that premise remains true.

In fact, on Thursday, I will be publishing the first issue of my new stock and options trading service, Bullseye Stock Trader.

Subscribe now, and you’ll be able to get in on the first set of stocks that I suspect will continue to outperform.

Why do I say that? Well, because these are the stocks that are executing on fundamentals, technicals and that also offer a unique product or service that sets them apart from the herd.

If you want to find an island of bulls in a sea of bears, you have to be able to hit the bullseye — and that’s what the Bullseye Stock Trader is all about.

*********************************************************************

A Practitioner of the Arts

“The art of investing is being able to adjust to change.”

–Gerald Loeb

A lot of investors, advisors and pundits “adjusting to change” these days, and we’ve been forced to do so by a confluence of market headwinds. Yet as the founding partner of E.F. Hutton & Co. said, the ability to make those adjustments is truly the art of investing. So, I say, bring on the change. The skilled practitioner will make the necessary adjustments to prevail.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods