The Best Week in a Very Bad Year

The action in equity markets this week was good.

That’s a very pleasant surprise in an otherwise solemn 2016, and it is something that we really haven’t been able to say with conviction this year. The gains week to date (through midday Friday) were very strong, with the Dow surging 2.46% while the S&P 500 has vaulted 2.75%. The NADSAQ Composite has really enjoyed a spike higher, up 3.91% so far this week.

That’s a very strong rebound, and it comes on the backs of the fast money getting back into the markets after things became way too oversold.

Recall that it was just last week that stocks were on the verge of officially breaking down into bear market territory. In fact, some funds, such as the Vanguard Total Stock Market Index (VT), actually did fall into the official clutches of the bear, having dropped more than 20% from its most-recent high.

While some major indices, e.g., the small-cap Russell 2000 Index, remain in official bear market territory, other major indices did a good job of gaining a bit of distance from the pursuing grizzly.

So, does this week’s action mean a short-term low has been put in for stocks?

The answer to that question is “yes,” but that doesn’t mean we aren’t still in a wider market downtrend. We know that because key market exchange-traded funds (ETFs) still are well below their respective 200-day moving averages.

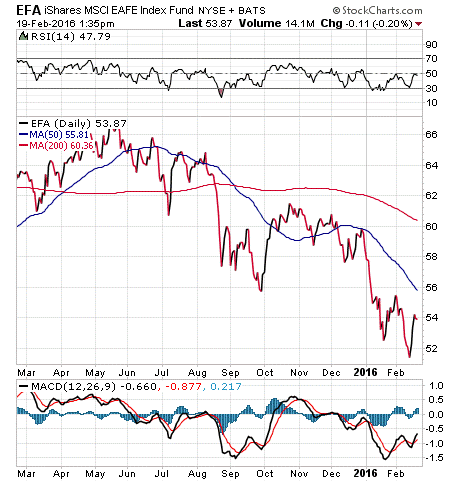

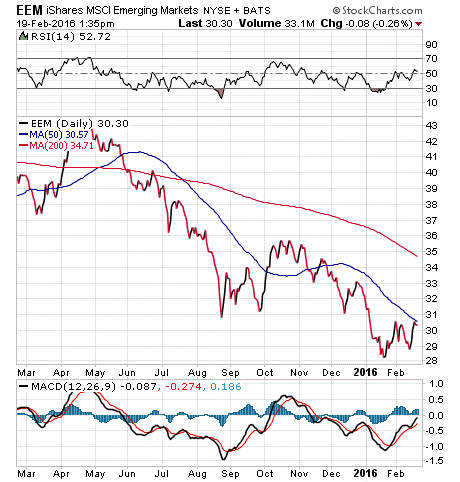

The three charts below, the SPDR S&P 500 ETF (SPY), iShares MSCI EAFE (EFA) and the iShares MSCI Emerging Markets (EEM), all remain firmly under this key technical metric.

Although each of these funds has had a good week, each still has a lot of work to do on the upside before we can proclaim the “all clear” sign for the presence of bears.

If you’d like to find out more about how the Fabian Plan is designed to identify the various signs blaring out of all sorts of market conditions, then I invite you to check out Successful ETF Investing today!

ETF Talk: Hedging Your Bets on Japan

This week’s growth-oriented exchange-traded fund (ETF) offers investors exposure to Japanese equities while hedging away the currency risk to let you sleep better at night. The WisdomTree Japan Hedged Equity Fund (DXJ) is pegged to an index that holds the biggest and best Japanese stocks.

The story for investing in Japan is an interesting one. The country has been locked in a deflationary spiral for almost three decades, and that has been the chief contributor to the decades-long decline in the benchmark Nikkei 225 index. Given that history and other downbeat factors, you would think that the Japanese equity investment landscape would be somewhat barren.

Yet nothing could be further from the truth. In fact, over the past three years, the Nikkei 225 has trounced the performance of stocks in developed markets such as Europe and here at home, spiking more than 43% vs. gains of some 8% in Europe’s STOXX 50 and nearly 25% in the S&P 500.

Japan continues to put the pedal to the metal on “Abenomics” — the economic reforms promoted by the country’s Prime Minister Shinzo Abe — which means more quantitative easing from the Bank of Japan, and likely more upside for Japanese stocks.

Most recently, the Japanese central bank has fearlessly waded into negative interest-rate territory in a move that has led to a recent rise in Japanese stock prices.

View the current price, volume, performance and top 10 holdings of DXJ at ETFU.com.

While global stock market conditions have weighed on DXJ, which is down 15% year to date, the fund is poised to rally on the back of domestic stimulus, and offers more promising near-term potential than many other developed economies. DXJ has around $11 billion in assets under management, an expense ratio of 0.48% and a distribution yield of 3.77%.

DXJ is invested in consumer discretionary and industrial companies, which make up nearly half of its holdings, as well as information technology, consumer staples, financials, health care and other sectors. DXJ’s top holdings include Japan Tobacco, 5.24%; Toyota, 4.87%; Canon, 3.80%; Mitsubishi UFJ Financial, 3.62%; and Takeda Pharmaceuticals, 3.16%.

If you think it might be advantageous to pay attention to the Japanese equity story, the WisdomTree Japan Hedged Equity Fund (DXJ) might be a good place to start.

Remember to look for the current price, volume, performance and top 10 holdings of DXJ at ETFU.com.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

The Best ETF Ideas for 2016

Over the past several weeks, we’ve covered what I think are the five best ETF ideas for 2016 for both growth investors, and income investors.

Here’s a quick review of all 10 ETFs on our list.

Growth ETFs

1) Health Care Select Sector SPDR Fund (XLV). Health care is an industry that continues benefitting from demographics, innovation, M&A deals and insurance mandates. XLV is the ETF that holds the biggest and best health care stocks around.

2) First Trust Dorsey Wright Focus 5 ETF (FV). This is a “fund of funds” that simultaneously holds other funds that have allocations to top-performing sectors. Biotech, Internet, consumer staples, consumer discretionary and health care all are part of this fund.

3) PureFunds ISE Cyber Security ETF (HACK). This is the cyber security stock ETF, one that we’ve written about extensively in this publication, and in the Successful ETF Investing newsletter. We also recently conducted a FREE webinar on HACK, which I encourage you to check out before you start making investment decisions in 2016.

4) iShares India 50 ETF (INDY). India is a country that has a pro-capitalist political climate, a huge amount of human capital and citizens hungry for economic growth and an enhanced living standard. INDY is a way to get exposure to the companies benefitting most from these trends.=

5) WisdomTree Japan Hedged Equity Fund (DXJ). Japan continues to put the pedal to the metal on “Abenomics,” which means more quantitative easing from the Bank of Japan, and likely more upside for Japanese stocks. And, with DXJ’s hedge component you get that performance without the negative influence of any currency disparities.

Income ETFs

1) SPDR DoubleLine Total Return Tactical ETF (TOTL). This bond fund is actively managed by the “New Bond King,” Jeffrey Gundlach of DoubleLine Capital, and it takes advantage of the best bonds in the market. The fund invests across global fixed-income sectors, and with an eye toward shorter-duration bonds.

2) iShares US Preferred Stock (PFF). This fund gives you exposure to the best preferred stocks in the market. These hybrid securities are sort of like stocks, and sort of like bonds, as they tend to move higher with the equity markets while also delivering strong yields.

3) PowerShares CEF Income Composite ETF (CEF). This ETF “fund of funds” gives you exposure to the closed-end fund market, a market that’s consistently delivered outstanding yields for income-oriented investors.

4) iShares US Real Estate ETF (IYR). Real Estate Investment Trusts, or REITs, are a fantastic tool for generating yield, and in this fund of funds you get broad-based exposure to the best REITs operating in the market today.

5) iShares Select Dividend ETF (DVY). This is the best ETF for exposure to the biggest and arguably the best dividend-paying stocks in the market today. DVY gives you a very solid yield along with the upside potential of the broader equity markets.

If you want more ideas, including which funds we’re buying right now, then I invite you to check out my Successful ETF Investing newsletter, today!

Scalia on Broccoli

“Everybody has to buy food sooner or later, so you define the market as food, therefore, everybody is in the market; therefore, you can make people buy broccoli.”

–Supreme Court Justice Antonin Scalia

The passing of Supreme Court Justice Antonin Scalia was a big loss to the country. Scalia was a mental giant, but he also was someone who could use humor to illustrate an important point. In his famous “broccoli” analogy, Scalia pointed out to lawyers representing the Obama administration and the Affordable Care Act that an interpretation of the law could be used basically to force Americans to buy vegetables. His analysis (shown above) is why he will be sorely missed on the high court.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

I encourage you to read my column from last week about why gold is the answer to recent market turbluence. I also invite you to comment about my column in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian