The Actual Meaning of a ‘Midlife Crisis’

I just celebrated another trip around the sun, and based on my year of birth, I am still clinging to the age range where people like to ask you if you’re experiencing a “midlife crisis.” Fortunately, nobody that actually knows me has asked me this because they know better.

You see, usually people’s intention with this comment is pejorative, one aimed at a subtle and passive-aggressive criticism of another for the very real feelings of self-assessment and desire for peak experiences in what’s left of one’s life.

The standard bromide here is that if a man (and it’s almost always a man who’s scolded with this pejorative) wants to experience some actual fun in life, either through buying a motorcycle or a McLaren or entering into an exciting, new loving relationship with someone who sees his value, that he has somehow regressed into a state of lost and willful adolescence.

Well, to anyone out there who criticizes or critiques or otherwise derides another with the comment, “he’s just going through a midlife crisis,” my response is — why are you criticizing another for wanting to experience life to the fullest?

Why is your conception of what a middle-aged man “should” do of any relevance to the way that middle-aged man chooses to live his life?

What I have found to be the case is that those who sling arrows at others for how they choose to live their lives are often those who need that arrow aimed directly at themselves. “Misery loves company” is the adage that comes to mind here, because all too often, the “he’s just going through a midlife crisis” critique comes from a place of latent and/or explicit jealousy over someone choosing to experience life on their own terms.

The philosophic underpinnings that give rise to this sentiment are easy to identify. The ethics so prevalent and so ingrained in the culture for thousands of years are those of self-sacrifice, suffering, duty and the so-called “moral good” of living your life in the service of others. Your life is transient, and doesn’t really matter, so say these ethics. What really matters is your service to others, to the group, to society and to the collective.

Yet, ask yourself this: Why doesn’t your life matter just as much as anyone else’s life?

Isn’t your life the only one you can live? Moreover, don’t you have the right to be happy? Or is your happiness somehow a source of moral turpitude?

According to my ethics, the ethics of rational egoism and rational self-interest, you have the right to your own life, and your own achievement and your own pursuit of your own happiness. You don’t have the right to sacrifice others to your cause, nor do you have the duty to sacrifice your happiness to others.

The chief exponent of this philosophic view is novelist/philosopher Ayn Rand. In her magnum opus, “Atlas Shrugged,” the protagonist, John Galt, puts this theory of ethics in brilliantly succinct and powerful form during the climatic speech scene:

“A morality that dares to tell you to find happiness in the renunciation of your happiness — to value the failure of your values — is an insolent negation of morality. A doctrine that gives you, as an ideal, the role of a sacrificial animal seeking slaughter on the altars of others, is giving you death as your standard. By the grace of reality and the nature of life, man — every man — is an end in himself, he exists for his own sake, and the achievement of his own happiness is his highest moral purpose.”

Indeed, one of Rand’s most-brilliant contributions to intellectual history is this defense of one’s pursuit of one’s own moral happiness and rational self-interest. And because this view challenges thousands of years of conventional morality so deeply ingrained in us all, it’s both difficult and, at first, somewhat uncomfortable to consider.

Yet, when we do stop and really contemplate the idea of rational egoism, we realize that however difficult our struggles may seem, the pursuit of our own happiness is our highest moral purpose, whatever we deem that happiness to be — even if that happiness come to us in the form of a midlife motorcycle.

***************************************************************

ETF Talk: The Debtor Creates Opportunity for the Investor

The markets are looking for the economy to come in for a soft landing. And sure, that means equities will likely continue to do well. But it’s also important to reserve parts of one’s portfolio for investments other than stocks, especially when that economic plane lands softly.

Diversifying one’s portfolio in this way ensures that if the market takes a downturn, you’ll always have something other than equities that could rise. The SPDR Blackstone Senior Loan ETF (SRLN) is one such exchange-traded fund (ETF) to consider, since it invests in something that will always be around: debt!

Founded in 2013 by State Street Global Advisors, SRLN provides actively managed exposure to non-investment-grade, floating-rate senior secured debt from both U.S. and non-U.S. corporations that resets in three months or less. The fund employs an actively managed approach to the senior loan ETF space. That strategy has allowed SRLN to offer an investment largely uncorrelated to the stock market since its launch.

SRLN does not track an underlying index. Instead, the fund aims to outperform competing ETFs through two means. First, SRLN seeks to anticipate which credits will be added and dropped from the indexes to buy and sell accordingly. Second, it does not limit itself to only the debt of U.S. firms.

Currently, SRLN has $4.47 billion in assets under management and has an expense ratio of 0.70%. Its current top holdings include the Medline Borrower Lp Term Loan B 23-Oct-2028, the Peraton Corp Term Loan B 01-Feb-2028, the Mcafee Corp Term Loan B-1 01-Mar-2029 and the U.S. Dollar.

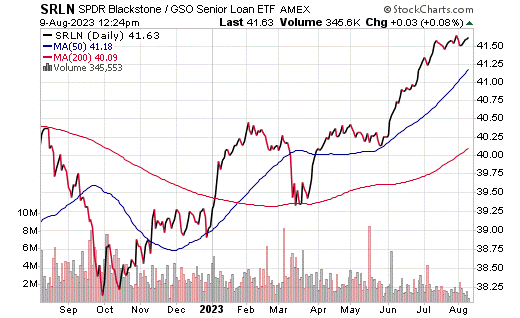

Chart courtesy of www.stockcharts.com

SRLN’s value has been steadily growing over the past year, as the fund is now trading above its 50- and 200-day moving averages. The fund has seen modest gains, having risen 0.75% in the past month, 3.19% in the past three months and 6.52% year to date, as of the market’s close on Aug. 7.

While an investment in debt might be good, burdening yourself with a personally bad investment is not. Remember to always consider your personal financial situation and goals before making any investment. Investors are always encouraged to do their due diligence before adding any stock or ETF to their portfolios.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

The Real Problem with Inflation

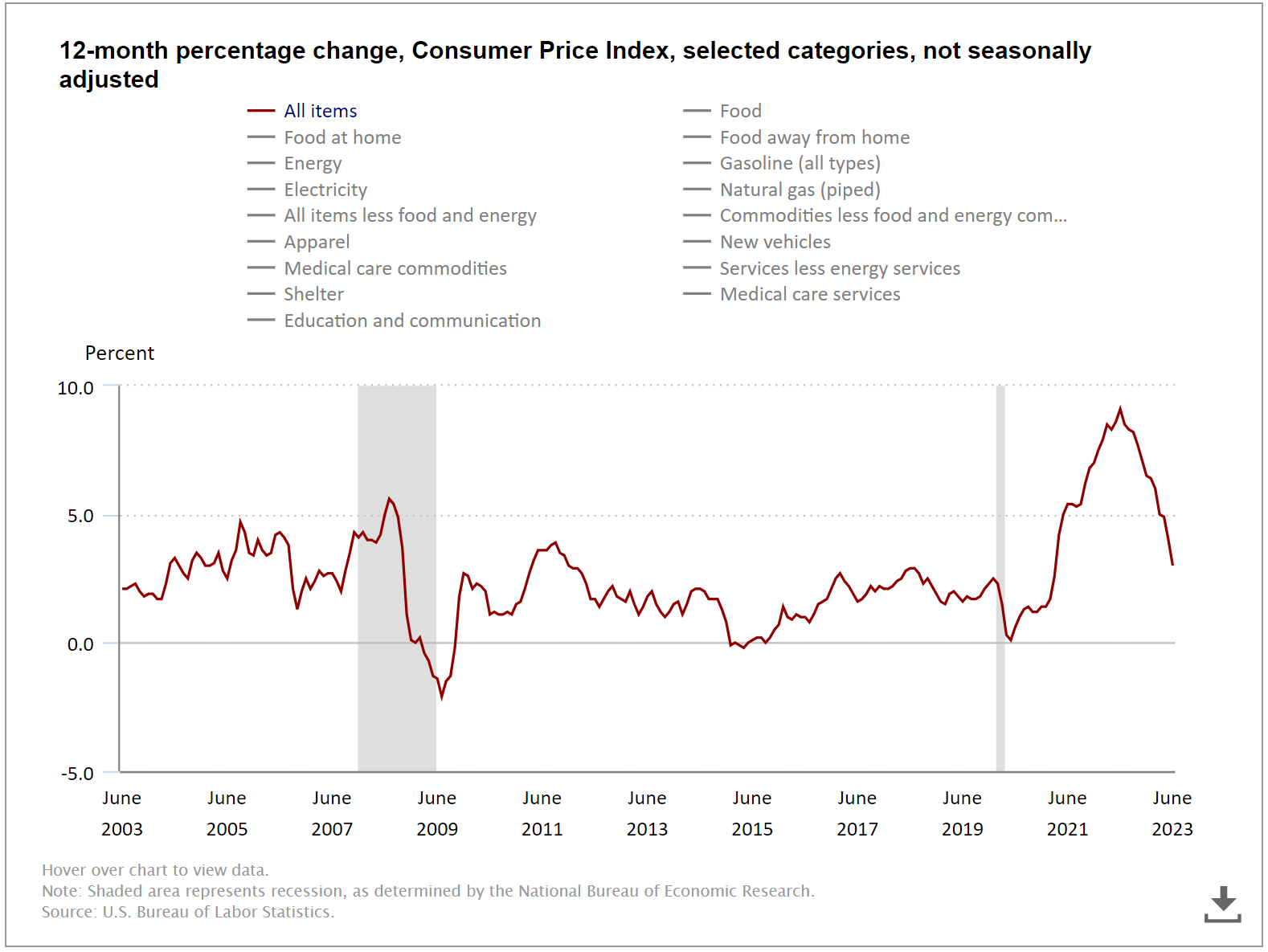

Have you seen a lot of inflation-related headlines in the financial and mainstream media recently touting how inflation is falling?

I know I have, and the headlines all read a little something like this:

- “Inflation is Falling!”

- “Inflation Declines More Than 50% from July 2022 Highs”

- “Inflation Hits Lowest Level since March 2021”

Now, I must admit that all the above headlines are actually accurate. Moreover, it’s also absolutely true that inflation is declining, and broadly speaking, that’s a good thing.

But what exactly does a decline in inflation (or “disinflation,” as I and others refer to it) mean? Here’s the easiest way to understand it, and in doing so, we can understand the real problem with inflation.

One note here before we go on is that the following analysis comes to you from my daily market briefing, “Eagle Eye Opener,” which, if you don’t subscribe to it, what are you waiting for?

The “Eagle Eye Opener” is a collaboration between myself and my “secret market insider,” a man who supplies institutional level analysis for clients paying thousands of dollars per year for his insights. But in the “Eagle Eye Opener,” you get a condensed version of what really matters in the market, that day, for a fraction of that cost.

Ok, now on to the real problem with inflation, which to explain, requires nothing more than a bag of Skittles.

I live in Southern California horse territory, and though it’s largely rural, there are still plenty of stores close by. One that I frequent is the Rite Aid near my ranch. Now, before the pandemic, if I bought a pack of Skittles, it cost me about $0.75. Today, it costs me about $1.50. And based on the current inflation rate, next year, that bag of Skittles will cost about $1.55.

So, while it’s good that those Skittles will only be about 2-3% above last year’s prices, the cost is still more than 100% above the price of the same pack of Skittles in 2020!

Bottom line, the decline in inflation (disinflation) that’s being celebrated in Washington, the mainstream media and the aforementioned financial media headlines is good, but it does nothing to reverse the massive price increases of the past several years. They, sadly, are here to stay, and the best the Federal Reserve can do is keep any further price increases small.

So, it’s important not to confuse disinflation with the idea that the price increases of the past several years will reverse, because they will not. I think the best hope for inflation is that it levels off, so my Skittles stay around $1.50. But $1.50 is still a lot for a pack of Skittles!

The longer people have to pay that price, the more it (and other things) will chip away at excess savings and excess spending, potentially resulting in a spending slowdown in the not-too-distant future. Perhaps people have so much money exiting the pandemic that the price gains can be absorbed over the long term, and that’s clearly what the bulls think today. But anecdotal observations are telling me that may not be the case.

Bottom line, disinflation is a positive; however, it’s important not to confuse the decline in inflation with the idea that prices are about to drop and give us all some relief. They are not — and the best we can hope for is that they simply stop going up very much.

*****************************************************************

The Things We Lost

They say time is the cruelest trick of all

You’re riding high, next thing you know your back’s against the wall

You can’t take it with you when you go

And we’ve all gotta die someday

When it all turns to black, we’ll be left looking back

At all the things we lost along the way

— American Aquarium, “The Things We Lost Along the Way”

As we grow ever more seasoned, the notion of “the things we lost along the way” builds up like the plaque in our arteries. Knowing the inevitable fate that befalls us, isn’t it incumbent upon us to live for the now? Doing so will allow us to create more beautiful memories that, eventually, we’ll all lose along the way.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

P.S. My Eagle colleagues will be hosting a free teleconference on Aug. 16 at 2 p.m. EST entitled “How to Turn $2k Into $10k in 90 Days.”The event is free, but you must register here to attend. Don’t miss out!

P.P.S. Come join me and my Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, enjoying a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Hear seminars on the days we are cruising from one destination to another, as well as dine with members of the Eagle team. Places we’ll visit include Mexico, Belize, Panama, Ecuador and more! Click here now for the details.

In the name of the best within us,

Jim Woods