Revisiting a Healing Molecule

- Revisiting a Healing Molecule

- ETF Talk: Revealing a Real Estate Yield Play

- ‘He Shot My Arm Off’

- One More Thought on Healing

***********************************************************

Revisiting a Healing Molecule

Almost one year ago to the day, the lead story in this publication was titled, “Molecules From the Healing Gods.” That story was, and still is, very close to my heart for two main reasons. First, there’s a matter of personal history, which you will see in a moment. Second, there’s the matter of informing “The Deep Woods” readers about investable opportunities not likely to find their way into your regular financial news diet.

So, given this nearly one-year anniversary, today I am going to republish the original story. And after you read it today, I’ll give you a bullish update on the situation.

So, now please enjoy this reprise edition of “Molecules From the Healing Gods”:

January 16, 1991. That was the day that the first fighter aircraft were launched from Saudi Arabia, as well as off of U.S. and British aircraft carriers in the Persian Gulf, to commence the shock-and-awe bombing runs of Operation Desert Storm. The U.S.-led offensive against Saddam Hussein’s Iraq continued all night, and for many days later, as coalition forces pounded targets in and around Baghdad, as the world watched the events transpire in television footage transmitted live via satellite.

But why am I bringing up this nugget of military history? Well, it’s because on January 16, 1991, I was about one week away from graduating from the U.S. Army Airborne School at Ft. Benning, Georgia. Now, as you might imagine, I was admittedly terrified at the prospects of being sent over to Iraq to jump into a hot war zone after only being in the Army for a little more than six months. Yet that is where I thought I was headed.

Of course, my fellow Airborne infantry and special operations cohorts were all quite boastful and outwardly courageous at the prospect of getting into the fight for our country. After all, we had volunteered for one of the most dangerous jobs in the U.S. military, and we were being trained well in the serious business of killing. Yet underneath our tough exterior, we were all downright scared (or at least I know I was, and I knew my mates in the unit were too, because they admitted as much over many nervous rounds of beers).

One evening that week, a group of soldiers including yours truly were talking to one of the Airborne School instructors, also known as a “Black Hat.” This man had been in the Army many years and was a veteran of many combat missions. We were all excited and being boisterous about the possibility of jumping into Iraq, saying things like we are going to, “Kick Saddam’s ass and kill all of his elite Republican Guard.”

Well, after several minutes of this chatter, the Black Hat had heard enough, and with a calm yet commanding voice, he looked at us with an intense gaze and said something chilling that I shall never forget: “Guys, please don’t wish for combat. It will ruin your life.”

Fortunately, I was not sent into Iraq, and I did not have to suffer any of the trauma and life-ruining post-traumatic stress of war. Yet I was one of the lucky ones. Many of my friends and fellow soldiers were sent into harm’s way during that campaign, and a few didn’t make it back. And many that did make it back outwardly unscathed, later had to grapple with the remnants of deep psychological wounds that, in many ways, did, in profound ways, ruin their lives.

This was particularly true of the post-9/11 wars in Afghanistan and again in Iraq, only those wars lasted far longer and took a much, much greater toll on so many men and women of the armed forces.

According a 2013 study by the Veteran’s Administration, from 1999 to 2010, about 22 veterans died by suicide every day. That’s about one ruined and extinguished life every 65 minutes. And thousands more veterans, men and women just like me, only not as lucky, have struggled mightily with post-traumatic stress syndrome, or PTSD.

Of course, PTSD is an extreme form of stress. And while war-related PTSD is serious, the number of those afflicted pales in comparison to the estimated 40 million American adults who suffer from anxiety, and the 17 million or so who have experienced at least one major episode of depression. According to the Anxiety & Depression Association of America, in 2017 approximately 6.7% of American adults 18 or older, or about 17.3 million, grappled with this debilitating depression condition.

Now, statistics are one thing, but when it comes to anxiety, depression, alcoholism and addiction, and even PTSD, the numbers are somewhat shallow.

In fact, I am willing to bet that if you are reading this, you likely know a family member, close friend, professional colleague or someone you are otherwise acquainted with who has suffered from these or other mental disorders. And if you are unlucky enough, perhaps you are the one grappling with your own inner demons.

If you know someone like this, or if that someone is you, then you know that help is hard to find. Sure, there are many good counselors, and many well-meaning doctors out there. Yet the tools they have to treat these ailments are severely lacking in both efficacy and permanence. In fact, the results are so dismal that all the medical profession can really do at this juncture is give patients daily medication designed to mask the physical symptoms.

But what if there were a safe form of treatment that could really “reboot” the human brain and allow it to be more receptive to discarding the anxiety, depression and trauma that so many of us suffer from?

Well, there is such a treatment, and the substances used in these treatments have been known to humans for thousands of years. These substances are called psychedelics, and with the help of modern science, they are poised to become one of the most promising treatments on the mental health front in years.

Psychedelics are a class of hallucinogenic drugs whose primary effect is to trigger non-ordinary states of consciousness (known sometimes as “trips”) via serotonin 2A receptor agonism. This causes specific psychological, visual and auditory changes, and often a substantially altered state of consciousness.

Classical psychedelics, the psychedelics with the largest scientific and cultural influence, are mescaline, LSD, DMT and psilocybin.

It is the latter of these, psilocybin, that we are most interested in here, because synthetic psilocybin molecules, or what I call “Molecules From The Healing Gods,” are manufactured in the laboratory and designed for clinical therapeutic use are one of the most interesting, and most investable, trends in biotechnology.

And the company at the tip of this curative spear is Cybin Inc. (NYSE: CYBN).

Cybin is a publicly traded life sciences company focused on psychedelic drug development, delivery mechanisms, improved novel compounds and protocols that target psychiatric and neurological diseases. The shares were just uplisted to the New York Stock Exchange from the “pink sheets,” a big promotion to legitimacy from the investing community.

The company’s mission is to promote and progress psychedelic therapeutics by utilizing proprietary drug discovery platforms, innovative drug delivery systems, novel formulation approaches and treatment regimens for psychiatric disorders.

According to Cybin CEO Doug Drysdale: “We are focused on addressing the mental health crisis and transforming the treatment landscape. To do that, we are combining technology and our scientific expertise to pair novel psychedelic molecules with controllable drug delivery systems, aimed at improving outcomes for patients.”

In June (2021), I spoke with Doug and with Cybin Co-Founder, Executive Chairman and President, Eric So, via video conference about the company (isn’t that the way most meetings are held in COVID -19 America these days?). Although neither knew this at the time, I already knew all about the financials and what the company did. In this call, I was really just trying to size up their personalities to see if I could get a read on their focus and commitment to this venture.

Well, both gents passed my “authenticity test” with high marks, and if you are a reader of my publications, you know that I am a man who values authenticity and sincerity in corporate management quite a bit — perhaps more so than many of my colleagues. Of course, authenticity is one thing, but results, along with the promise of real opportunity for investors, is what I am most concerned about.

Here, Cybin, and the psilocybin-assisted therapy it is involved with, shows very promising results. In addition to being used by non-traditional medical practitioners for thousands of years, there have been many recent studies showing the efficacy of modern, clinical psilocybin-assisted therapy.

I go into far more detail about the recent positive clinical trial results, as well as much greater detail on Cybin the company, and the potential investment opportunity in this stock for those who are interested in getting in on an emerging biotech company on the bleeding edge of treating the gargantuan problems of mental health and addiction issues.

If you are interested in this subject, and I think we all should be, then I invite you to download my free special report, “Cybin: Molecules From The Healing Gods.”

I am very proud of how this free special report turned out, and I am also privileged to present to you a company that I suspect can help millions around the world overcome some of the most difficult medical issues in society today. So, check out the free special report today. I suspect that after you read it, you’ll be as interested in this subject as I am.

*********

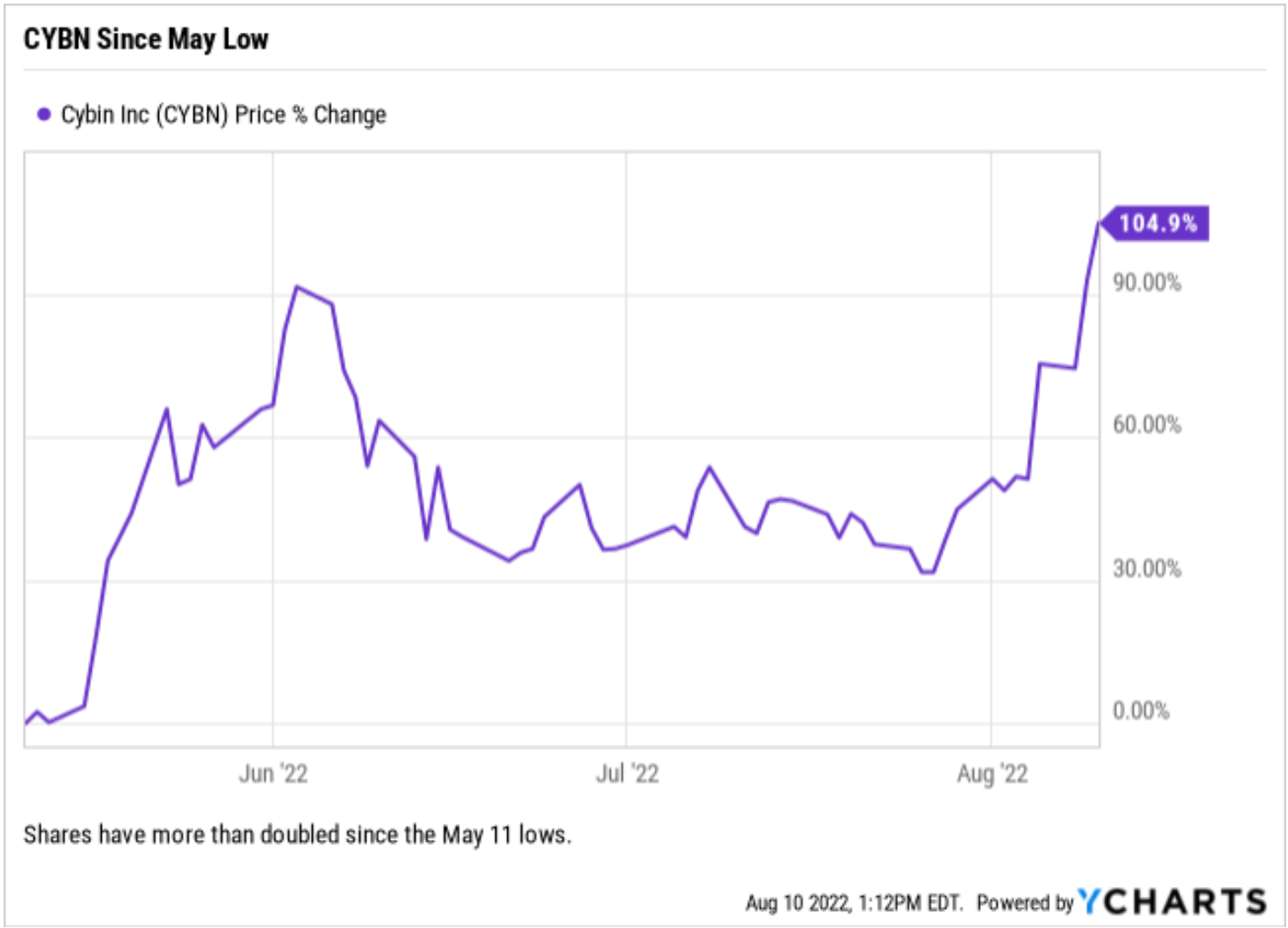

As promised, the bullish update here is that since falling to its May 11, 2022, low of $0.41 per share, the stock has more than doubled. As of this morning, CYBN shares traded at $0.83, more than double the value in just three months.

The chart here shows the recent rise in CYBN shares, and the clear momentum in the stock over the past several weeks.

On Monday, Aug. 8, Cybin reported earnings for the quarter ended June 30. I won’t dig into the details of that earnings report here, but I invite you to check it out, as there are some very bullish positives for the company going forward.

I know that; Wall Street knows that — and now, you know it, too.

***************************************************************

ETF Talk: Revealing a Real Estate Yield Play

Bloomberg has called it “America’s worst bond-market collapse in at least half a century.”

It was not too long ago that the Treasury yield curve inversion reached levels not seen since 2007, largely due to many investors continuing to believe that the Fed’s decision to quickly raise interest rates would throw the economy into recession.

While that scenario has not yet come to pass, underscored by last week’s unexpectedly good jobs report and today’s inflation data, the question of what bond yields will do and whether inflation will peak or continue rising (necessitating more rate hikes) remain unanswered.

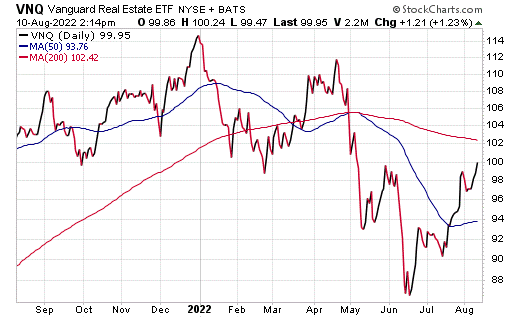

Of course, there are ETFs that will do well if bond yields begin to come back down due to a slowing economy. One such exchange-traded fund (ETF) is the Vanguard Real Estate Index Fund ETF (NYSEARCA: VNQ).

This ETF tracks the performance of the MSCI US Investable Market Real Estate 25/50 Index, which measures the performance of real estate investment trusts (REITs) and other investments related to real estate centered around American real estate. The focal difference between the portfolio and the index is that the fund’s managers seem to favor commercial REITs instead of specialized REITs. As is true with regard to many REIT ETFs, distributions from the fund are taxed as ordinary income.

The top holdings in the portfolio are Vanguard Real Estate II Index Fund Institutional Shares (MUTF: VRTPX), American Tower Corporation (NYSE: AMT), Prologis Inc. (NYSE: PLD), Crown Castle Inc. (NYSE: CCI), Equinix, Inc. (NASDAQ: EQIX), Public Storage (NYSE: PSA), Reality Income Corporation (NYSE: O) and Welltower Inc. (NYSE: WELL).

As of Aug. 9, VNQ has risen 7.23% in the past month and 4.04% for the past three months. It is currently down 13.88% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $40.13 billion in assets under management and has an expense ratio of 0.12%.

In short, while VNQ does provide investors with access to REITs, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

‘He Shot My Arm Off’

“Don’t mess with Norco.”

That was a headline of a story on my local Southern California news website KTLA, as it described one reaction to video of liquor store owner Craig Cope shooting an armed robber with a shotgun.

Now, this incident, as well as the very clear, high-definition video with sound that documented it, has gone viral and national. And if you haven’t seen it, then you should right now.

Oh, and if you are wondering why I chose this story as last week’s lead in “The Deep Woods,” well, it’s because this incident took place in my hometown of Norco, California, with this store located approximately 1.5 miles from my home.

It’s also because this is an example of why it’s so important to defend gun rights of law-abiding citizens. And yes, I am a passionate defender of the Second Amendment.

The reason this incident has become so popular is because the video shows the 80-year-old Cope taking action with a firearm to protect himself and his property. And in this case, the assailant and his accomplices were sent away running like scared rabbits.

The video shows a man armed with an assault-style rifle walk into the Norco Market at 816 Sixth Street around 2:45 a.m. this past Sunday. The man pointed the weapon at Cope and ordered him to put his “hands in the air.”

Seconds later, Cope stepped behind a glass display and fired a shotgun at the suspect, hitting him. The would-be robber immediately ran out of the store screaming and shouting, “He shot my arm off!”

A camera pointed at the store parking lot showed the suspect jump into a dark-colored SUV with at least several accomplices before driving away. The four suspects were later found at a hospital, with one of the men “suffering from a gunshot wound consistent with a shotgun blast,” according to the Riverside County Sheriff’s Department.

Ah, yes, justice served up from Cope’s shotgun blast — I must admit, I love it.

What I also love is the response from local law enforcement about this incident. Here’s the response as reported in the KTLA story from the Riverside Country Sheriff’s Department: “In this case, a lawfully armed member of our community prevented a violent crime and ensured their own safety, while being confronted with multiple armed suspects.”

Contrast that rational response to last month’s incident in New York City where a convenience store worker, Jose Alba, was charged with murder after he fatally stabbed a man who had gone behind the counter and attacked him in an attempted robbery.

The contrast here makes me glad that I no longer live in New York City, and that I now live in Norco, where police and the justice system recognize a person’s right to his own physical autonomy and his right to defend himself using a firearm.

Understandably, the horrific mass shootings that occur in the United States rightly capture the headlines. But there are far more incidents of citizens using firearms to protect themselves from would-be assailants than there are cases of mass murder using firearms.

A clear voice on this issue is Dr. John Lott, an economist and president of the Crime Prevention Research Center. In a recent Fox News interview, Lott said, “Having a gun is by far the safest course of action when people are facing a criminal by themselves.”

Lott also went on to describe that, in a typical year, the media reports about 2,000 defensive gun use stories. However, he says, “that is a dramatic undercount, because the vast majority of successful self-defense cases don’t make the news.” Lott says there are about 2 million defensive gun uses per year, according to the average of 18 national surveys.

The think tank The Heritage Foundation maintains a database that tracks how often guns are used in self-defense cases. The numbers here indicate that the Centers for Disease Control and Prevention looked at various studies and found “that Americans use their firearms defensively between 500,000 and 3 million times each year.”

The facts are the facts. “A is A.” And the fact is that the best way to prevent someone from violating your rights by force is to employ a greater amount of force against them in your own defense.

That’s exactly what the brave Norco store owner Craig Cope did, and that’s why I and others have the utmost respect and admiration for him. It is also why he’s come to embody the description, “Don’t mess with Norco,” which, if you know me, you also know makes me smile.

Now, unfortunately there is one negative to this story. After calling 911 and reporting the crime, Cope was taken to the hospital as he suffered a heart attack. Happily, Cope is not only out of the hospital, but after doctors inserted three stents, he’s already back to work at the store. This is one tough mudder!

In closing, I will leave you with my favorite quote from this incident, which was given by Cope’s wife to CBS News. This sentiment pretty much sums up why I am proud to have chosen Norco as my residence:

“Stay out of Norco, because everybody in Norco has a gun.”

Mic drop!

*****************************************************************

One More Thought on Healing

“Healing is a matter of time, but it is sometimes also a matter of opportunity.”

–Hippocrates

I’ll leave you today with one additional thought on the subject of healing from the original voice in Western medicine, the ancient Greek scientist Hippocrates. As he points out here, time is an important component of the healing process — but so too is opportunity. And if you have an opportunity to help heal yourself, or your fellow man, why wouldn’t you take it?

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods