Rejecting Waco Market Mavens

I recently watched the television miniseries “Waco,” which was a dramatized exploration of the 51-day standoff that took place in 1993 between the FBI, ATF and the “Branch Davidians,” a religious cult lead by the messianic and self-proclaimed “Lamb of God,” David Koresh. I highly recommend this show, as it was an intensely interesting examination of what happens when very bad delusory ideas collide with incompetent and overreaching government use of force.

The way I see this sad episode in American history is that both sides of this conflict were at serious fault, and the result was bad for the Branch Davidians, the government and, ultimately, every American. Indeed, in the follow-up series, “Waco: The Aftermath,” (which I also recommend) we learn how the events at the Branch Davidian compound were the genesis of the horror that was the Oklahoma City bombing by Timothy McVeigh.

Watching the “Waco” series and the fervent and emphatic end of times prophecies that David Koresh preached reminded me of many of the wild, hyperbolic and fear-focused marketing prognostications in my own industry, the financial newsletter/advice business. You see, when you want someone to buy what you are selling, one very good way to do this is to aggressively scare them into action.

You know the promotions I’m talking about. “The End of America” by one of my rival publishers is perhaps the best known example of this, but there are many others. I call these promos, and those who advocate for them, doom-and-gloom merchants, but I think a better term for them is “Waco market mavens.”

These Waco market mavens want to convince you that the world is about to end, and that you are going to lose all of your money — and that the only thing that can save you from financial Armageddon is to cough up a couple of hundred dollars a year for their publication.

Ok, before we go on, I understand the appeal of such dire predictions. I mean, doesn’t everyone fear an end-of-the-world scenario where civilization collapses, money is no longer of any use and people resort to pillaging others and eating one another’s flesh to survive? This is the ultimate fear, and it is why so many books, films and TV series are created to dramatize this kind of dystopian world. The best of this genre from a literary standpoint is Cormac McCarthy’s “The Road.”

Yet, while a dramatization of these fears might be good subject matter for fiction, it is absolutely NOT a way to invest in the equity markets.

Fear of loss might be a way to get you to buy someone’s advice, but if that advice is for you not to invest in the greatest wealth-building mechanism ever devised, then you are simply a sucker that’s fallen prey to bad ideas. Another way to put it might be you’ve been seduced by the likes of a financial David Koresh.

Think about it this: What end times prognostication, or what doom-and-gloom financial prediction, has ever come to pass?

The answer is… none.

We currently live in the most prosperous, safest and healthiest time the world has ever seen. And if you don’t believe me, check out the work of Harvard psychologist Steven Pinker in his seminal book, “Enlightenment Now.” As for things in the financial markets, stocks now are quicky approaching all-time highs on the S&P 500 Index.

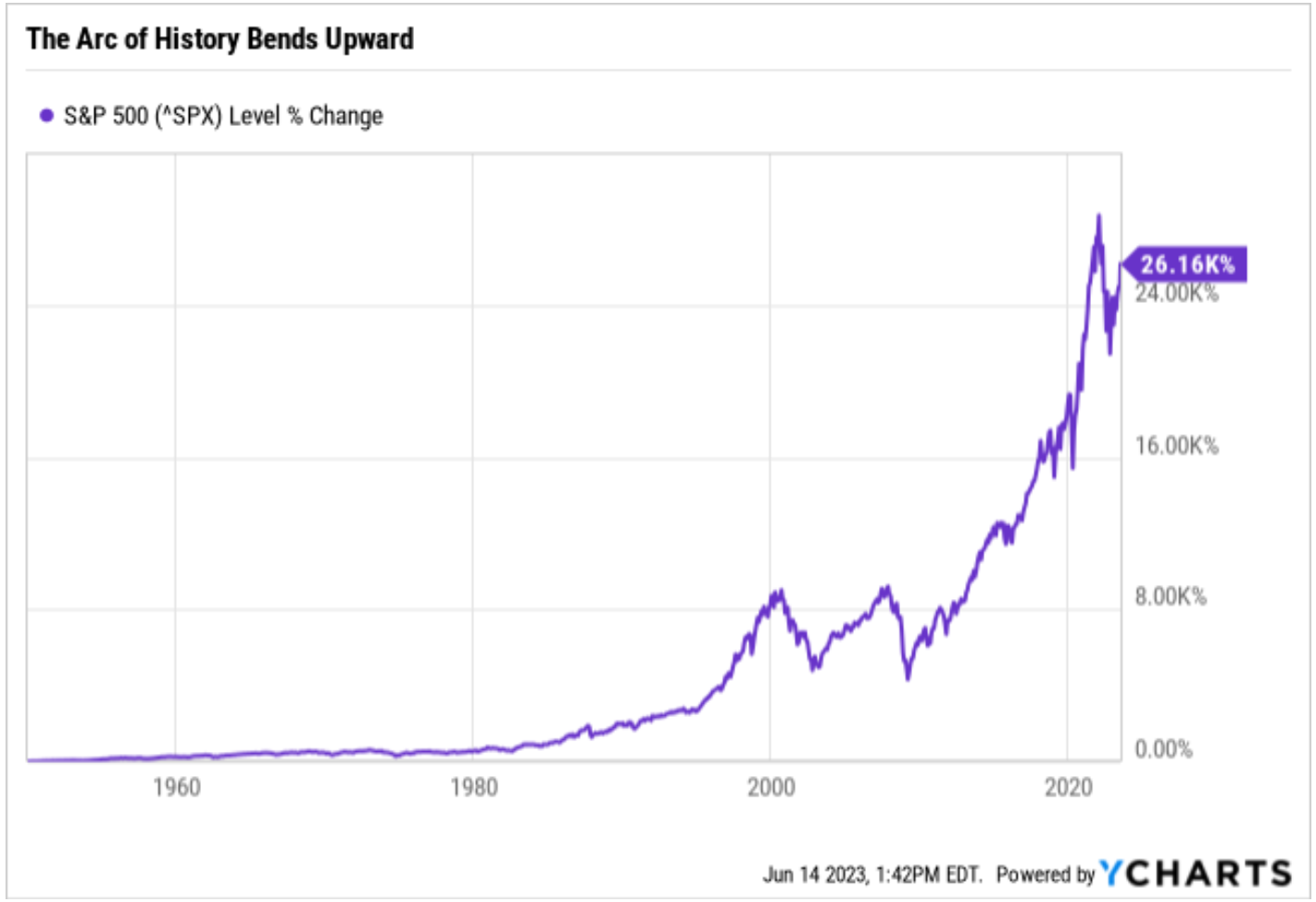

Perhaps a visual here will make my point even more forcefully. Take a look at the S&P 500 since 1950. As you can see, the arc of history bends upward, and no matter how closely you look, I defy you to locate Armageddon on this chart.

Now, is this to say that markets always go higher? Of course not. Bear markets are real, and, in my nearly 30 years in this business, there have been some very destructive periods of market selling. This reality must be respected, but it also must be accepted as part of the cost of doing business.

Yes, markets, to be commanded, must be obeyed. In fact, “Markets, To Be Commanded, Must Be Obeyed,” is the actual title of one of my presentations at the upcoming FreedomFest conference next month in Memphis, Tennessee. So I don’t want you to think that I’m bullish all the time. That would be as equally bad an error as the one made by the doom-and-gloom Waco market mavens, albeit in the opposite direction.

Yet, what I want you to take away from my thoughts here is that listening to the merchants of fear is a prescription for paralysis — not just in terms of your money, but in terms of your life and your happiness.

If you want to live a wealthy life, not just fiscally but also psychologically, emotionally and intellectually, I behoove you to reject the Waco market mavens and embrace the reality of a benevolent universe. Much more happiness, truth, beauty, wisdom and wealth will come to you that way.

***************************************************************

ETF Talk: Invest in Disruptive Innovation with This Technology Fund

The ARK Innovation ETF (NYSEARCA: ARKK) is an actively managed exchange-traded fund (ETF) that seeks long-term capital growth from companies globally involved with, or that benefit from, disruptive innovation.

Its investments in foreign equity securities will be in both developed and emerging markets. The non-diversified fund may invest in foreign securities listed on foreign exchanges as well as American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs).

One reason I like ARKK is that it is full of cutting-edge firms, selected to represent the adviser’s highest-conviction investment ideas in this space. ARKK, launched on October 31, 2014, defines “disruptive innovation” as a technologically enabled new product or service that has the potential to change the way the world works.

The fund’s portfolio focuses on companies involved in genomics, automation, transportation, energy, artificial intelligence and materials, shared technology, infrastructure and services and technologies that make financial services more efficient. ARKK’s proprietary macroeconomic and fundamental research, aimed at assessing company potential, drives security selection and weighting.

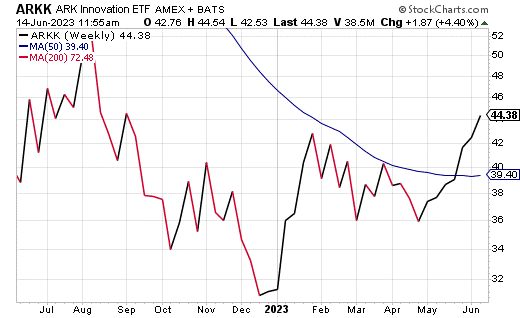

Source: StockCharts.com

ARKK, with net assets totaling $7.7 billion, currently trades around $44 a share with an expense ratio of 0.75%, meaning it is relatively expensive to hold in relation to other ETFs. The fund typically has anywhere between 35 and 55 holdings, and is part of the investment empire of its famed founder and technology aficionado, Cathie Wood. ARKK’s year-to-date return is an impressive 29.61%.

However, as with any opportunity, I urge all potential investors to exercise their own due diligence in deciding whether or not this fund fits their own individual portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

The Virtue of Tenacity

“Victory belongs to the most tenacious.”

This is the statement stenciled onto the inside of the stands at Court Philippe-Chatrier, the center court at the Stade Roland Garros. In English, the “Stade Roland Garros” translates from French into “Roland Garros Stadium,” and it is the name of the complex of tennis courts located in Paris that host the French Open.

This year’s tournament wrapped up on Sunday, and if you are a tennis fan like me, then you know that last Friday, we were treated to a men’s semifinal match up between the two best players in the world, the legendary Novak Djokovic, and tennis’ newest brilliant star, Carlos Alcaraz.

Last year about this time, the tennis world was treated to an epic match between Djokovic and Rafael Nadal. That outcome was a Nadal victory in four sets, with the final set being an intense tiebreaker that saw some of the match’s most brilliant shots. That match also showed the resolute nature of both men, battling with what appears to be every fiber of their respective beings in the pursuit of a single goal, i.e., to make a great shot, to win a point, to win a game, to win a set, to win a match and to win a tournament.

Both incredible competitors will go down in the annals of the sport as two of the most tenacious players ever to pick up a racket. And that is appropriate, because tenacity is a trait that embodies the actual person the Stade Roland Garros was named after.

Now, you might think (as I naturally did) that given this is a tennis stadium, the Stade Roland Garros would be named after a tennis great. I mean, in America, we hold the U.S. Open at the National Tennis Center in Flushing Meadows, New York, and the featured center court matches there are played in Arthur Ashe Stadium. That stadium was named after one of the greatest American tennis stars, Arthur Ashe, a man who won the inaugural U.S. Open event in 1968.

Yet, Roland Garros wasn’t a professional tennis player.

The intense eyes of Roland Garros betray his tenacity. Photo is in the public domain.

Roland Garros was a French businessman, an aviator, a World War I fighter pilot, an inventor, a skilled pianist, a pioneer, a hero and a trailblazer — definitely a Renaissance Man. Born in Saint-Denis de la Réunion on October 6, 1888, Garros was educated at the HEC business school. At the age of 21, he started his own company, a car dealership near the Arc de Triomphe in Paris. Now, mind you, this was in 1909, and there weren’t many car dealerships at that time.

Interestingly, in August 1909, his life changed, as he attended his first air show in the Champagne region of France. Garros is said to have fallen in love with these new winged machines, and soon thereafter, he bought a plane and taught himself how to fly.

Two years later, on September 6, 1911, Garros broke his first altitude record, reaching 3,910 meters (about 13,000 feet). He was soon a regular on the nascent air show circuit and in competitive air races, and he became known for his daring aviation skills. He even became a bit of a star in the aviation world, as hundreds of thousands of people in both Europe and South America would come to watch him in action.

Just two years after that altitude record, Garros took his airplane across the Mediterranean Sea, something that had never been done at the time. On September 23, 1913, he flew from Saint-Raphaël on the French Riviera to Bizerte (Tunisia), a journey that took nearly eight hours.

At the onset of World War I, Garros employed his aviation skills in defense of his native France. At that time, aviation in war was new, and airplanes were equipped with little or no weaponry. That changed, however, once Garros decided to invent a machine gun that could be mounted on a fighter plane — one that could be synchronized to fire through the propeller.

In April 1915, Sub-Lieutenant Roland Garros had already used his aviation skills and new invention to win several aerial battles against German aircraft. But on one mission, his plane was hit by German anti-aircraft fire over Belgium. Garros was forced to land, and he was subsequently taken prisoner before he had a chance to destroy his plane. His brilliant invention unfortunately fell into German hands, and that nation’s engineers used his ideas and adapted them to their own aircraft.

But the story gets even better. After three years in captivity, Roland Garros escaped his captors, and he did so disguised as a German officer. Unfortunately, his health had suffered mightily during captivity, but that didn’t stop the tenacious Garros from rejoining the fight.

As a result of his capture, he became badly short-sighted and had trouble seeing well enough to fly a plane. But Garros didn’t let this ailment deter him. So, he made himself eyeglasses in secret, not telling any of his fellow French aviators, so that he could see well enough to keep flying and keep battling the Germans. Sadly, on October 5, 1918, Roland Garros was killed in the skies over the Ardennes, doing what he wanted to do, and becoming legendary in the process.

In 1928, about a decade after his death, France had turned her attention to sport via the building of a large tennis stadium in Paris. One of the heads of this tennis stadium project was a man named Emile Lesueur, a former business school classmate of Roland Garros at the HEC. It was Lesueur who made sure that the Stade Français would be named the Stade Roland Garros in honor of his friend and fallen hero.

So, what can we take out of this story that I suspect you never knew about until now?

By reading about the valorous lives of those who shaped the world around us with their intelligence, courage and, most importantly, their tenacity in the face of unspeakable adversity, we can draw inspiration in our own lives when it comes time to meet our own challenges, set our own records, battle our own enemies, escape our own captors and rejoin the fight to defend our values.

Because as Garros said, “Victory belongs to the most tenacious.”

*****************************************************************

Dylan’s Little Red Bike

Little red wagon, little red bike

I ain’t no monkey but I know what I like

I like the way you love me strong and slow

I’m taking you with me honey baby, when I go…

— Bob Dylan, “Buckets of Rain”

I never had a little red wagon, but I did have multiple little bikes (red, silver, black, etc.) when I was a youth. Indeed, some of my fondest childhood memories are of going out and exploring the world on my little bike. Alas, those memories are multiple decades away, and the little bikes have been replaced with little supercars. Yet, the thrill and excitement of discovering the world remains with me, and I think that’s an important key to happiness as we mature. So, whenever you’re feeling nostalgic, remember the thrill of your own little red bike. It will take you to places you yearn to be.

Finally, if you want to hear a brilliant version of this classic Dylan song, check out this rendition by singer/songwriter/guitarist Toni Lindgren. And if you are so inclined, pop me an email and thank me for the smiles.

In the name of the best within us,

Jim Woods