Powell, the Pandemic and the Plunge

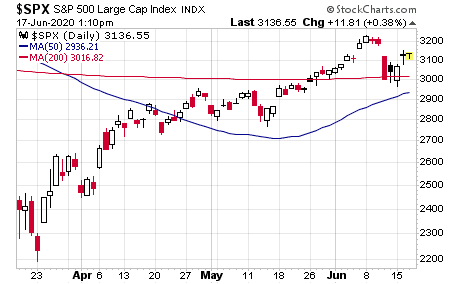

A funny thing happened in the markets last Thursday. Well, not funny “ha ha,” but rather, funny “unusual.” You see, after about four weeks of stocks surging some 12% or so, stocks abruptly turned tail and headed sharply south nearly a week ago.

The one-day loss on Thursday, June 11, in the major domestic averages of approximately 6% took out roughly half of the progress this market made in those four weeks. This is what can happen when a market runs up too far, too fast. It also is the reality of this COVID-19 market.

So, what prompted the market plunge that day? Well, there were two proximal causes: Federal Reserve Chairman Jerome Powell and the pandemic.

Specifically, despite its dovish proclamations on interest rates likely remaining at basically zero for the next two-and-a-half years, the outlook on future economic growth from the Federal Reserve at the July Federal Open Market Committee meeting was anything but encouraging.

On Wednesday, June 10, Federal Reserve Chairman Jerome Powell made no mention of a sustainable economic rebound, although he did acknowledge the improvement in the labor market. Yet it was the downbeat, even pessimistic, tone from the Fed chairman on future growth that upset markets.

As I’ve been telling readers of my Successful Investing and Intelligence Report advisory newsletters for months now, the economy needs to get back to something close to “normal” by the end of the summer/early fall if we are going to have the earnings and economic activity in 2021 that can support stocks at these valuation levels. The market is pricing in just that, or at least it did until Powell’s commentary last week.

Powell basically said that the economy was horrible, and there were no signs of a rebound on the horizon. Positively, however, Powell did say that the Fed is ready, willing and able to support the economy (and the markets) with whatever monetary policy easing it can deliver. Unfortunately, the bulls wanted a bit more positivity from Powell on economic growth, hence the first reason stocks plummeted.

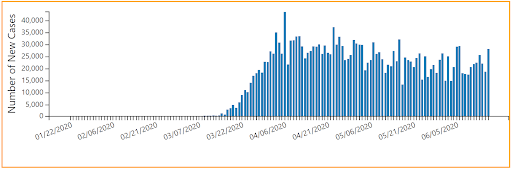

The second reason is something I’ve also been warning subscribers about, and that is the possibility of a “second wave” of coronavirus cases as we continue to relax the stay-at-home orders, social distancing measures and the wearing of masks. While we need to do this for economic reasons, I suspect it almost certain that this will lead to more cases of COVID-19.

On that downbeat morning last Thursday, the number of U.S. coronavirus cases topped 2 million, with the death toll rising past 111,000. According to data from Johns Hopkins University, there has been an uptick in cases in Florida, Texas and California. That spooked markets into concerns that a second wave of infections could lead to a return of restrictions on social and business activity. So, take a pessimistic Powell and fears over a second coronavirus wave in the same morning, and you get the worst day in markets since the COVID-19 crisis began.

Now the question becomes whether the June 11 sell-off is the start of a new downtrend or simply a healthy and much-overdue pullback in markets.

If I had to deliver an answer here, I would say that although the selling that day was intense, I don’t think it will end up being a bearish game changer. I say that because there really wasn’t any real news about an acute intensification of new coronavirus cases in the United States. As of now, the data do not support this fear.

Daily new coronavirus cases have been averaging around 20,000 for the past several weeks, and in the days leading up to this writing, the number of new cases nationwide was mostly trending lower. The chart here from the Centers for Disease Control and Prevention (CDC) of the number of new COVID-19 cases reported each day in the United States since the beginning of the outbreak tells us just that.

Of course, we are very likely to see this chart trend higher in the weeks ahead, and the reason why is the country is opening up again. Every state has eased restrictions to some extent, and most now are well past the initial post-lockdown stages. Oh, and then there were those nearly nationwide protests of late, which also are likely to increase transmission rates. Let’s face it; there wasn’t much “social distancing” going on in those throngs.

If we do see a significant second wave of the virus result in more economic disruption, that will bring about more selling in stocks. While that is certainly a possibility, at least for now, the data itself does not justify last week’s sharp plunge. And, that’s not just me saying it. It is also the market reflecting that sentiment, as the S&P 500 is up some 4.5% from Thursday’s close.

That’s a resilient market, and one that begs for the embrace of your investing capital.

**************************************************************

ETF Talk: Invest in Highly Rated Socially Responsible Companies

(Note: First in a series of environmental, social and governance (ESG) ETFs)

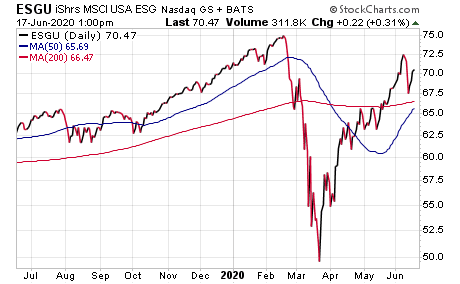

The iShares ESG MSCI U.S.A. ETF (ESGU) tracks an index composed of U.S. companies that have been selected and weighted for positive environmental, social and governance (ESG) characteristics.

ESGU invests in companies with strong ESG traits, while maintaining an overall market-like portfolio. Companies in the broad MSCI USA Index are rated on risk factors related to environmental (carbon emissions, water use and toxic waste), social (health and safety, labor management and sourcing) and governance issues (corruption, fraud and anti-competitive practices).

Portfolio optimization software is used to maximize the fund’s stake in highly rated companies, while also staying true to market-like exposure. In addition, the fund completely excludes tobacco companies, producers of certain weapons (landmines and bioweapons) and companies embroiled in “severe business controversies.”

The fund is competitively priced for its exposure. However, a distinct lack of interest from investors can make the fund difficult to trade at the retail level and significantly raises the risk of closure. Prior to June 1, 2018, the fund tracked the MSCI USA ESG Focus Index.

Although the risk involved with ESGU might deter some investors, you can see its general positive uptrend, aside from late 2019 and March 2020, in the chart below.

The fund’s top five holdings are in Apple (NASDAQ:APPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB) and Alphabet (NASDAQ:GOOGL). Each of those holdings accounts for less than 6% in the portfolio. Its top sectors are technology (32.51%), health care (14.97%), consumer cyclicals (12.69%), financials (12%) and industrials (8.58%).

Investors who want exposure to higher-rated environmental, social and governance companies, while accessing large- and mid-cap U.S. stocks, may want to consider this fund. ESGU seeks similar risk and return to the MSCI USA Index, while achieving a more sustainable outcome.

It can be used as a sustainable building block for the core of your portfolio at a low cost. However, I urge all potential investors to conduct their own due diligence in deciding whether or not this fund fits their own individual portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

********************************************************************

In case you missed it…

Freedom Is the Best Disinfectant

Contrary to the line from the Kris Kristofferson classic, “Me and Bobby McGee,” freedom isn’t just another word for nothing left to lose.

Instead, freedom is the primary value worth fighting for, because without freedom in all of its various forms, every other value is impossible. It is for this reason that I am such an advocate of freedom, and why I participate in and promote the largest annual gathering of free minds each year, FreedomFest, throughout my various publications.

This year, freedom has faced an acute and grave threat via the government lockdown and shelter-in-place orders. And while one can argue whether or not the virus mitigation orders that were imposed by government were warranted, nobody can argue that these orders haven’t had a pernicious effect on our economy.

Moreover, it’s quite evident that the pandemic has been a boom to one actor in our collective drama — big government.

“The pandemic of COVID-19 coronavirus threatens a world-wide wave of sickness, but it’s the healthiest thing to happen to government power in a very long time,” writes J.D. Tuccille, contributing editor for Reason.com. “As it leaves government with a rosy glow, however, our freedom will end up more haggard than ever.”

Some of that government intervention includes more than $6 trillion in various spending bills, and that number is likely to continue to get bigger and bigger before the COVID-19 crisis is over.

Then there’s the Federal Reserve, which just confirmed what the market bulls wanted to hear, i.e., that it would continue to keep the money spigot wide open by continuing to hold interest rates at zero, not just for the rest of 2020, but also through 2022.

Here’s the money quote from the Fed’s policy statement:

“The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term. In light of these developments, the Committee decided to maintain the target range for the federal funds rate at 0 to 1/4 percent. The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

Translation: The Fed’s got your back, baby.

Given the boom in big government, which is being facilitated by its handmaiden, the Federal Reserve, you can bet that one big unintended (or perhaps very much intended) consequence of it all will be a bigger government and a small individual citizen.

That’s unfortunate, too, because despite the widespread stay-at-home orders that were imposed by so many states, the worst of the economic damage is starting to subside.

We saw that in the May jobs report, which came in at an estimate-crushing 2.5 million new jobs created vs. expectations for job losses of 7.7 million. That’s a 10 million job swing! Yet even here, politicians from both sides of the aisle are claiming credit for the job gains by saying that it was the Paycheck Protection Program that allowed companies to rehire workers.

Here’s a personal maxim that I recommend you keep in mind: Always be skeptical of people who run out to claim responsibility for something that others actually do. A corollary to this maxim is to always be skeptical of those who claim to have all the answers to complex problems.

Another way to think about it is like this: In the name of public health, the government shut down the economy. Then, the government stepped in to “save the day” with massive stimulus that represents a growing and pernicious debt that is owed by each citizen. Now, the government is claiming victory and taking credit for a rescue from the clutches of depression.

So, I ask you, can you not see something afoul in this?

Finally, I will say that, in keeping true with my aforementioned maxims, I do not claim to have the answers to the complex problem of combating a global pandemic. I also understand human fallibility and that inevitably, government, scientists, medical professionals and citizens are going to get some things right and others wrong.

Yet, what we also need to keep firmly in the forefront of our minds is that freedom is the best disinfectant for any viral plague — be that a literal viral plague, as in the case of COVID-19, or a philosophical plague consisting of pell-mell bad Keynesian economic stimulus and the imposition of draconian lockdowns on the rights of citizens to engage freely in the commerce of their choice.

So, you see, freedom’s not just another word for nothing left to lose — it’s the only word that matters. It also is the best disinfectant to bad ideas.

*********************************************************************

Drawing the Wright Inferences

“Don’t leave inferences to be drawn when evidence can be presented.”

— Richard Wright

The great American novelist is chiefly known for his brilliant novel “Native Son” and his even more poignant memoir “Black Boy,” two works I highly recommend. Here, the author reminds us that evidence is more powerful than inferences, but only if we’re willing to stare existence in the face and confront the objective reality of the world. Now more than ever, facts and objective reality are what the world needs to embrace. At the same time, we also need to shed the temptation to draw tribal inferences.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.