How to Park Your Car Like a Renaissance Man

- How to Park Your Car Like a Renaissance Man

- ETF Talk: Invest in a Growing Energy Trend

- Springsteen Would Make a Good Fund Manager

- The Righteous Path to ‘A is A’

***********************************************************

How To Park Your Car Like a Renaissance Man

Note: Today’s lead article is written by my friend, colleague and bona fide “Renaissance Human” Heather Wagenhals. Here, the author tells us how a relatively simple task such as parking a car can be used to help focus your actions on success in any life pursuit.

How a Renaissance Man does anything is how a Renaissance Man does everything. This includes how one parks his car. For a Renaissance Man, even this seemingly mundane task reflects his approach to life.

A Renaissance Man considers every action, especially those repetitive actions that become habits and eventual behaviors. He decides for himself if they add or subtract value. I have observed through my own behavior that how one parks a vehicle tends to reflect how he manages his life. Let me explain.

For some, parking styles evoke strong feelings. Family friend, racing legend and arguably the greatest NASCAR engine builder of all-time, the late Robert Yates, had very strong opinions on how one parks.

Robert viewed any employee of his who parked backward as someone, “too itching to get out of work.” So, any employee he observed parking backward at his shop he would summarily fire and help them out the door.

A Renaissance Man’s view is different. He parks “tail-in,” and for specific reasons.

First, backing into a parking space is safer, and the chief reason why is because when you leave that space, you’re already entering the flow of traffic going forward. If you consider this approach as a wider metaphor for life, that means you’re always “going forward” — and that is a key principle in cultivating a successful life.

Let’s explore the opposite view here to illustrate the importance of forward motion to one’s approach to life. If you are going into the flow of traffic backward, you will necessarily creep into it, and usually with some heightened level of trepidation. And when you back up out of a parking space and into traffic, you also have less time available to execute any maneuvers before that traffic arrives. Invariably, you have blind spots. You will constantly be looking from side to side, relying on secondhand information from mirrors or passengers telling you what they see and what obstacles are in your path.

This is the approach I consider “backing into your life.” And, with this approach, your chances of being blindsided are far greater than if you were looking forward. Moreover, your judgment is necessarily impaired by limited information.

In contrast, when entering the flow of traffic moving forward, a Renaissance Man has the full view of his surroundings right in front of him. And though the terrain further down the road may still be unknown, going forward allows you to clearly watch the territory unfold as you proceed down your chosen path.

What’s behind you doesn’t matter and almost becomes irrelevant, because you’ve already dealt with it when you originally backed into your parking spot.

In life, this approach means you’re tackling your “issues,” i.e., your past, and you’ve proactively chosen to make it a known quantity. And, even if dealing with this past is really hard, your decision to confront life’s dragons on your terms gives you the upper hand.

The author always parks her McLaren 570S Spider “tail in.”

By choosing to embrace the initial awkward or uncomfortable tasks to get a better view of the future, a Renaissance Man increases his ability to observe reality and to cleanly apply his full powers of critical thinking and reasoning to determine the best course of action.

Finally, by choosing the opposite and parking head-in, which also forces you to back into the flow of traffic, you put yourself at a disadvantage physiologically. Your primitive brain is going to feel vulnerable with your back exposed while entering into “danger.” Yet when you enter into danger from a tail-in position, you know that you’ve already “covered your back,” and that you are in a much better position to confront reality with eyes forward and with a greater degree of confidence — regardless of how scary the unknown may be.

When you park like a Renaissance Man, you are prepared to handle anything because you’re able to see reality with eyes wide open. And let’s face it, your decisions are only as good as the quality of information you have to make those decisions.

So, the next time you pull into a parking lot, remember that seemingly little decisions in life — i.e., how you park your car — really do have a wider context. Because how a Renaissance Man does anything is how a Renaissance Man does everything.

Heather Wagenhals is a best-selling author, FOX News Contributor, Founder and Host of the Web TV Series, “Unlock Your Wealth Today” and has been featured in numerous publications, radio and television. Heather notes with pride for the last 30 years, she has parked “tail-in.”

***************************************************************

ETF Talk: Invest in a Growing Energy Trend

When investors talk or think about energy stocks, they likely consider traditional commodity investments, such as oil, natural gas producers and refiners.

However, those companies don’t tend to excite investors or spur thoughts of exponential growth. One alternative energy that is currently seeing some time in the limelight is nuclear.

It is considered a relatively clean energy, and in the United States, both parties are warming to the idea as a long-term solution to the nation’s energy woes. In recent days, prices of uranium have also been driven up as a result of the war in Ukraine.

There are not many options on the exchange-traded fund (ETF) market to allow investors to target this specific theme, but one is Global X Uranium ETF (URA). The investment thesis for this fund is precisely what it sounds like. URA holds companies involved in uranium mining as well as the production of other components of the nuclear energy process. It is a strategy for those who believe nuclear energy is the way of the future.

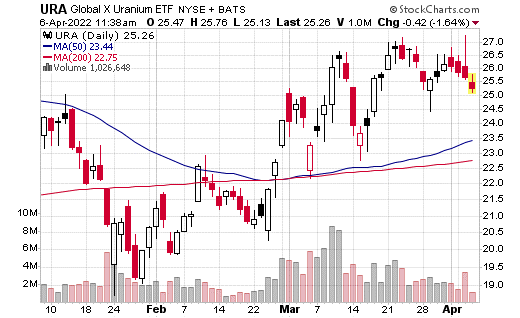

This fund has performed impressively of late. Its one-year return sits at 30.95%, including a more than 10% gain in the last month which came on the heels of a more than 10% spike in just a few trading days in late February after Russia invaded Ukraine. The stark price changes are plain to see in the chart below.

This fund holds just under $2 billion in assets. The expense ratio of 0.69% is not cheap, but that is par for the course with highly specific ETFs. URA pays only a small dividend of 0.41%.

Among the fund’s 49 holdings, the largest by far is Cameco Corp., at 25.01% of assets. Other significant investments include Sprott Physical Uranium Trust, 7.00%; Nexgen Energy Ltd., 5.68%; and Paladin Energy Ltd., 3.85%.

For investors seeking to invest in an alternative energy source that has recently come into favor, Global X Uranium ETF (URA) may be the right investment at the right time.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Springsteen Would Make a Good Fund Manager

You might find this hard to believe, but the iconic New Jersey rocker Bruce Springsteen never had a number one record. Well, sort of.

You see, Bruce’s childhood memoir masterpiece, “Blinded By The Light,” did reach number one on the charts, but not in its original form (find out the real story behind the song and its unconventional lyrics straight from Bruce).

The song actually first appeared on Springsteen’s 1973 debut album, “Greetings from Asbury Park, N.J.” Yet, it was the 1976 cover version of the song by British rock band Manfred Mann’s Earth Band that reached number one on the Billboard Hot 100 in the United States in February 1977.

So, why am I bringing up rock history here in The Deep Woods?

Well, aside from the fact that the subject is fun to discuss, the meaning of the song, and its history on the Billboard charts, can teach us some important lessons about the markets, investing and life.

First, when Bruce wrote his story about being “blinded by the light” of the new and the unknown, and wanting to, as he puts it, “do things I hadn’t done and see things I hadn’t seen,” he didn’t envision the song being covered by a band across the pond. He also didn’t think that song would become a number one hit.

Yet, that’s the thing about life, most of the time we don’t know where our choices will lead us. Even seemingly pedestrian choices can have giant ramifications for our lives, and we never really know which of those everyday decisions will end up morphing into life-changing circumstances. So, the lesson here is to always choose wisely no matter how seemingly insignificant your decision may be, as you never know the causal significance it could have.

He was just blinded by the light

Cut loose like a deuce another runner in the night

Blinded by the light

Mama always told me not to look into the sights of the sun

Whoa, but mama, that’s where the fun is…

— Bruce Springsteen, “Blinded By The Light”

Second, when Bruce wrote about his desire to do things he hadn’t done, see things he hadn’t seen, and allow himself to look into the sights of the sun (because that’s where the fun is), I doubt he realized that this would be a profound lesson for investors.

You see, in February and March of 2020, many investors were “blinded by the light,” and not in a positive way. In fact, many were blinded by the market turmoil occurring during the beginning of the pandemic, and many pulled their money out of the market and went to cash.

Now, this was a smart move for several months; however, the pernicious, COVID-19-inspired selling in markets blinded many an investor into staying on the sidelines well into the big rally and economic rebound that, despite the rocky first quarter of 2022, is still going today.

The lesson here for investors is to not allow yourself to be blinded by the often-intense light of fear in markets.

Indeed, one of the biggest problems I encounter when talking to investors is not that they are too aggressive with their money, but that they aren’t even in the market because they want to avoid experiencing another Q1 2020 sell-off. Some investors are even still on the sidelines as a result of fear of another 2008-2009 financial crisis.

In this case, you don’t want to be blinded by the light of fear. Instead, you want to move toward the light of future possibilities, and you want to put your money to work in the investment vehicles best suited to serve your particular circumstances and goals.

So, if you are still leery about getting in this market, I implore you to shed the fear of a tired bull. Allow yourself to look into the sights of the sun and the brightness of opportunity and embrace the potential upside — because as Bruce told us, “that’s where the fun is.”

You know, with his outlook on life, and his famous work ethic, I think Bruce would make a great fund manager.

*****************************************************************

The Righteous Path to ‘A is A’

“Suffering is wishing things were other than they are.”

–Gautama Buddha

“A is A,” and reality is what reality is. The denial of these basic premises seems like an obvious error, but it’s actually the source of much of our suffering. Perhaps the Buddha put it best in this pithy, wisdom-enriched saying, because what he is warning against is the denial of “A is A.” Stated differently, he is warning that unless you accept yourself and the world for what it is, you will always be unhappy.

Of course, that doesn’t mean we can’t work hard to change ourselves and the world, and that is part of our purpose and nature as individuals, and that’s part of “A is A.” Yet what we must realize is that wishing doesn’t make it so. Only rational action designed to invoke change can do that. So, if you want your reality to be different, take the actions necessary to bring about a new “A is A.”

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.