Panaceas Are a Fool’s Ointment

- Panaceas Are a Fool’s Ointment

- ETF Talk: Finding Shelter in an Inverse ETF

- A Retail Rout and Recession

- The Importance of Scars

***********************************************************

Panaceas Are a Fool’s Ointment

Whenever there is tragedy, there is an immediate reaction from all sides to first ascribe blame and then to propose a solution.

This is our nature as humans, as we are, in essence, problem-solving creatures who use our primary tool of survival, our reason, to prevail. And while humans have become the dominant species on Earth due to our capacity to mold the raw materials of reality into our visions, there are many things that we still do not have control over.

Now, I don’t think I need to remind you of this, but I think it begs reminding here that the world is a difficult place. And while we are brilliant in our ability to solve problems, often the rush to panacea in the face of bad things is a futile endeavor.

The latest tragedy to consider here is the horrific school murders in Uvalde, Texas, where at least 19 children and twp adults were killed by an 18-year-old gunman. Now, we don’t know the motive behind these killings, or what kind of weapons were used. What we do know is that we want answers, and we want solutions — because we are humans.

Moreover, and here is where things tend to go awry, we want our answers simple and our solutions easy.

In this particular case, we want to assign a variety of easy answers as to the motives of the killer, such as mental illness, racial animus, immigrant status, drug use, etc. As for solutions, well, the understandably heartfelt proclamations from politicians, pundits and empathic persons around the world that we need to “do something about guns” also represents an easy solution.

Yet, unfortunately, the complexity and intricacy of reality doesn’t often lend itself to easy blame and easy solutions. Perhaps most importantly, the futile rush to panacea ends in misguided efforts that do as much harm as they help.

In the case of gun control, the panacea for stopping these horrific mass shootings would be to ban a particular type of firearm, or better yet in this view, ban all firearms.

In the case of speech considered to be “hateful,” the panacea here is to ban anything that anyone considers “offensive” or “disturbing” or “harmful.”

In the case of abortion, the panacea is to simply overturn decades of legal precedent and hand things over to the states and then let states put their restrictions on the legal aspects of this issue.

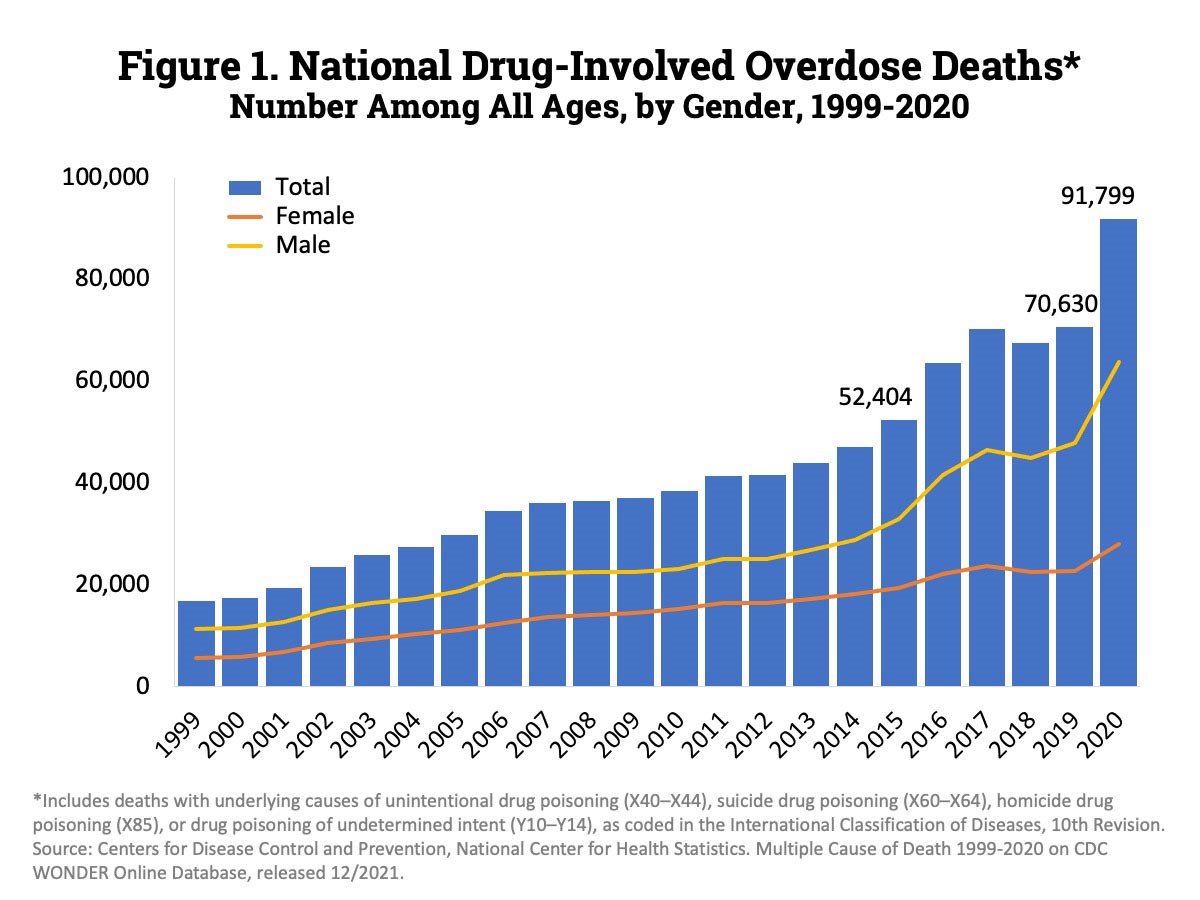

In the case of drug use, the panacea is to make certain drugs illegal and to put people in jail who use/abuse these illicit substances.

In the case of income inequality, the panacea is to levy pernicious taxes on millionaires and billionaires, who, the thesis goes, aren’t already paying their “fair share.”

Yet a simple step back into the realm of reality will tell you that no legislation or restrictions on firearms is going to end any particular individual’s propensity for malice or ill intent. And the idea that we are going to disarm America or repeal the Second Amendment is an equally fallacious panacea.

As for free speech, well, the only way to combat the ugly, evil and anti-human ideas such as racial superiority or anti-science or communism or even silly notions such as Flat Eartherism is to allow those ideas to be disinfected by the light of reason. Because the simple truth is that the only antidote to bad ideas is good ideas.

Regarding abortion, do we think that there won’t be abortions because certain state legislators deem them illegal? Can anyone really conclude that a woman who doesn’t want to carry a pregnancy to term is going to just do so because the state says she must?

As for drugs, well, we’ve had a “war on drugs” now for decades, and nearly every year, the number of drug overdose deaths has risen sharply. So, does anyone actually think more laws are the answer here?

Finally, is anyone really of the opinion that we are going to end income inequality simply by the raising taxes on the most financially successful among us? Even if this were a good idea, which it definitely is not, we all know that there are differences in human traits and circumstances that account for some people being better at certain things. It is like chopping down all the trees in the forest to make them all equal. Yet neither hatchet, axe nor saw is a panacea here, as trees will grow to the height their nature dictates.

Please don’t get me wrong here. I am truly sympathetic to the urge to “do something” in the wake of tragedy. But in life, panaceas are usually a fool’s ointment. And the better we understand this, the better we can dig deep and do the rational work needed to come up with sound solutions to complex problems.

In the end, I believe we can solve big problems, as we are problem-solving creatures. But as long as panaceas are thrown about like the intellectual bromides they are, real solutions will remain murky.

Important Announcement: At 2 p.m. EST on Tuesday, May 31, I will be holding a teleconference entitled “How to Make Fast Money in a Bear Market.” It is free for all my subscribers, but you must register here to be able to attend. Don’t miss out!

***************************************************************

ETF Talk: Finding Shelter in an Inverse ETF

As the old saying goes, “What goes up must come down.”

Indeed, up until the recent selling wave caused by Russia’s war against Ukraine and the continued effects of supply chain disruptions amid the COVID-19 pandemic, tech stocks, including semiconductors, were the darlings of the investment world. That is, it seemed as if the sky-high valuations of some tech stocks were sustainable in an atmosphere of seemingly perpetual growth.

That, of course, was not the case, and the too-good-to-be-true valuations were quickly brought down to earth by the forces of inflation and tight monetary policy. As a result, the tech-heavy Nasdaq entered a free-fall that has not yet found a bottom.

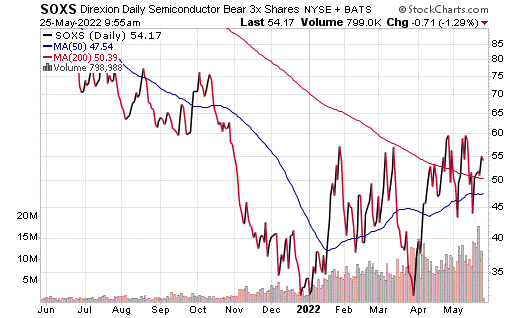

At the same time, that does not mean that we should abandon the sector as a lost cause. One such way to play the sector during its downhill slide is the exchange-traded fund (ETF) Direxion Daily Semiconductor Bear 3X Shares (NYSEARCA: SOXS).

As its title suggests, this is an inverse ETF, meaning that it is built to go up in value when its parent index goes down. Specifically, SOXS provides three times leveraged inverse exposure to a modified market-cap-weighted index of semiconductor companies that trade in American markets by using swap agreements, futures contracts and short positions.

While the index’s holdings are weighted by market capitalization, the fund’s managers cap the weights of the top five securities in the portfolio at 8% each. The weight of the remaining securities is capped at 4% each.

As of May 24, SOXS has been up 0.37% over the past month and up 24.73% for the past three months. It is currently up 60.47% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $258.15 million in assets under management and has an expense ratio of 1.01%.

In short, while SOXS does provide an investor with a way to invest in an inverse ETF, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

A Retail Rout and Recession

Retail stocks are getting slammed, and the culprit is something that has Wall Street rightly concerned.

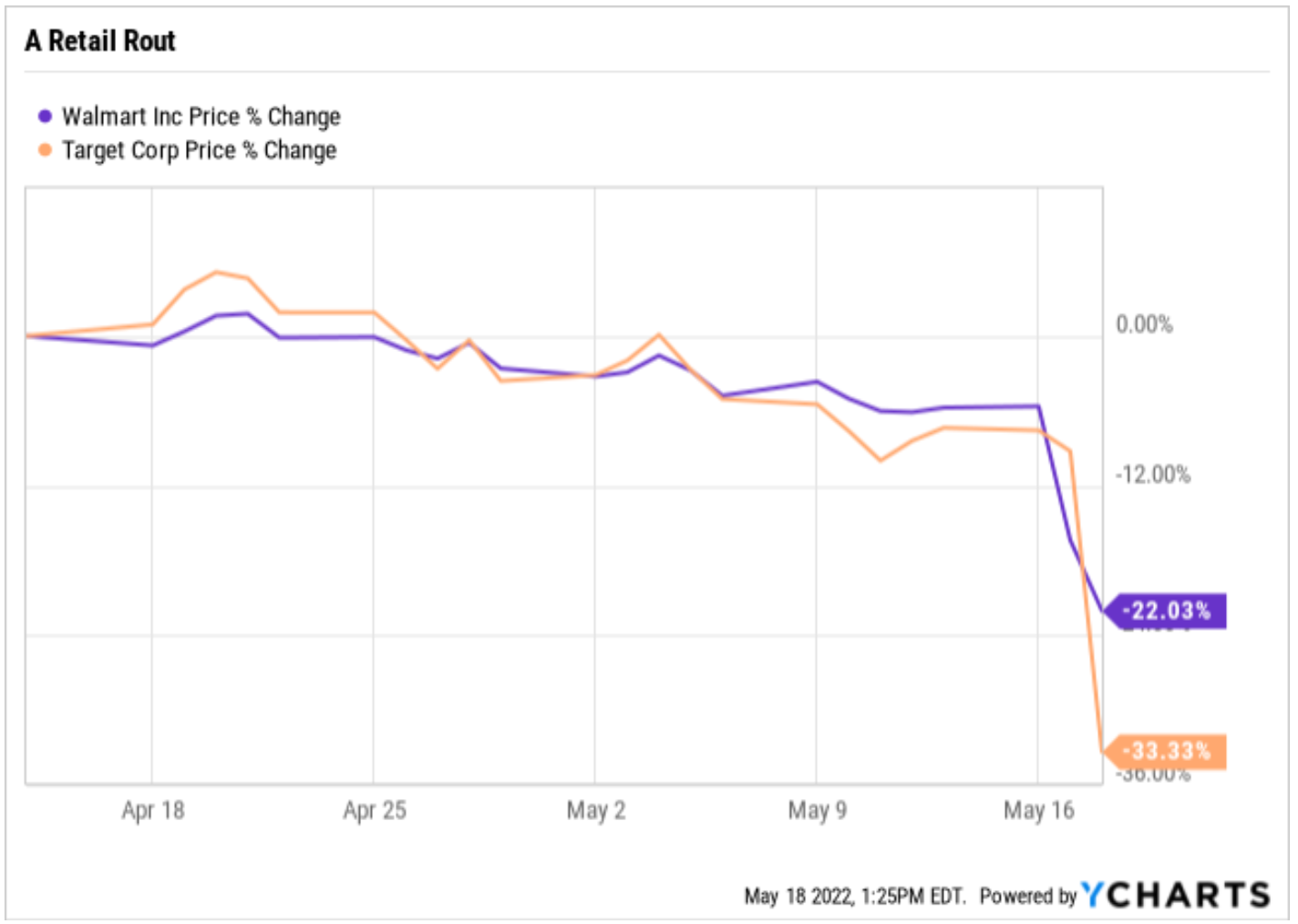

Last week, retail giant Target Corp. (NYSE: TGT) reported a very ugly first quarter earnings miss, as the company cited cost increases in areas such as freight and inventory for its very bad results. About halfway through that trading session, TGT shares were down more than 26%!

The previous day, the world’s biggest retailer, Walmart Inc. (NYSE: WMT) also reported pressured earnings, and like TGT, the company saw cost increases compress its margins. Like TGT, shares of WMT were down big (albeit not nearly as much).

“The conclusion from both reports is the same: Consumers are starting to tighten their belts and switching from discretionary items to staples such as food,” said Tom Essaye of Sevens Report Research. Tom is my personal go-to source for making sense of the macro and how it influences markets.

“More broadly, the weakness in WMT and TGT over the past two days reinforces a point I’ve been making for months: Despite equity market volatility, we have not even started to see the negatives from a slowing economy, and that’s one of the main reasons we’re hesitant to declare last week’s low the bottom,” added Essaye.

In last Wednesday’s issue of my daily marketing briefing, the Eagle Eye Opener, I explained to readers that Walmart missed earnings because of two main factors: First, consumers bought less high-margin merchandise and instead spent more money on lower-margin food. Additionally, WMT saw a shift from brand names to private label.

This is potentially important because those two shifts (from merchandise to food and brand names to private label) both anecdotally imply the middle and lower-end consumers are starting to get squeezed by inflation, and they are beginning to “cut back” on non-essential items.

To a point, this also was partially confirmed by the Home Depot (NYSE: HD) results, although they had a much better quarter. HD beat earnings and raised guidance and the stock rallied. But while sales amounts were strong, customer transactions fell 8.2% in the quarter. That drop in business was offset as the average ticket price per sale was up 11.4%.

The truth here is that the economy and investors are in very unfamiliar waters right now, and nobody knows just how quickly the economy will slow. Right now, the market is facing multiple 50-basis-point interest rate hikes in the months ahead, something we haven’t seen in more than two decades. And now that we are starting to see inflation really affect retail earnings, the thought of a real recession hitting the economy is causing both a retail stock rout and, at least today, a huge equity sell-off.

Now, I want to be clear that the downbeat retail earnings of late do not necessarily mean that we’re headed for a pernicious recession. They also don’t necessarily mean that stocks will plunge well below recent lows. After all, we have already seen a lot of selling in this market already, so the downside from here is arguably largely baked into the current valuations.

Yet, last Wednesday, the Dow Jones Industrial Averages was down more than 1,100 points. As such, the reality is the bears are still very much center stage, and they’re still delivering their morose monologue for this market.

***

If you want to get access to this kind of unique market analysis every trading day, directly to your inbox at 8 a.m. Eastern, then I invite you to check out my Eagle Eye Opener right now. There’s no time like the present to gain more market insight.

*****************************************************************

The Importance of Scars

“Out of suffering have emerged the strongest souls; the most massive characters are seared with scars.”

–Khalil Gibran

I have several people close to me who have collected a lot of scars of late, and I mean that both literally and figuratively. And while I am doing what I can to help placate their respective suffering, perhaps the best thing I, or anyone, can do for those going through acute pain of all sorts is to remind them that those with true character are often seared with scars.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods