The One Must-Own ETF for 2021

- The One Must-Own ETF for 2021

- ETF Talk: Unleash the Power of a Small Plant

- My Favorite Holiday Gift Ideas

- On Taking the First Whip

***********************************************************

The One Must-Own ETF for 2021

About this time of year, you see a whole lot of articles in the financial press touting or predicting what the best investments will be in the year to come. Sometimes, those picks turn out to be brilliantly on point. Very often, however, many a new-year prognostication falls short of expectations.

This should come as no surprise, as those of us who are tasked with breaking out the crystal ball and predicting what human behavior will be like months down the road face a perilous pursuit. Take this year, for example. I mean, nobody predicted that a global pandemic would cause the human, social and economic devastation that it did in 2020. Or that the S&P 500 would plunge some 25% from late February through late March, only to surge back to all-time highs in the fourth quarter of the same year.

Now, while there are many reasons to be fearful of future peril when it comes to the lasting damage caused by COVID-19, the recent developments of the first doses of a vaccine actually being injected into the arms of the first recipients is a tremendously encouraging omen for 2021.

My “prediction” here, if you want to call it that, is that, by mid-2021, we will be close to a sense of “normal” in the world. What that normal will be like, and how it will look compared to the pre-pandemic days, is very difficult to assess. Yet, I do think that humans are a remarkably resilient species, and that means we will recreate, rebuild and return (as close as possible) to the lives that we created before this pandemic knocked us on tilt.

Indeed, we have already seen that in the aforementioned rise to new highs in the major domestic averages. Will that rise continue? Will the leaders from this year be the leaders of last year? What specific exchange-traded funds (ETFs) should we own to take advantage of the likely prevailing tailwinds that can drive stocks in that segment higher?

All of these questions remain to be answered in what promises to be, hopefully, a more “normal” year. So, with the caveat here that nobody has a coveted crystal ball, today, I will give you one “must-own” ETF that I think will deliver for investors over the next 12 months. It is the Invesco S&P 500 Equal Weight (RSP).

In late 2020, we finally started to witness a “Growth to Value” rotation. This is a trend Wall Street has been waiting for, but over the past several years, it has remained elusive. Yet, with the vaccine now literally waiting to be injected, this could be the moment that investors have been waiting for to finally rotate capital out of large-cap tech/growth stocks and reposition that money into more traditional value sectors.

With RSP, you get exposure to the same stocks in the S&P 500 that are in the more common SPDR S&P 500 ETF Trust (SPY). However, with RSP, you get each company equally weighted in the index. Meanwhile, SPY is market-cap weighted.

My macro analyst firm of choice, Sevens Report Research, crunched the numbers here and discovered the real difference between RSP and SPY. Because SPY is market-cap weighted, you get about 35% of assets in technology, followed by about 15% in consumer discretionary. And of that consumer discretionary sector, almost half is dedicated to Amazon (AMZN) because of that stock’s heavy market-cap weighting. This means that SPY is effectively about 40% large-cap tech/growth stocks.

Now, that overweight has worked extremely well for many years. However, if we do see a rotation into value sectors, then RSP is likely to outpace SPY because of its greater exposure to value sectors such as industrials, financials, consumer staples and health care. Together, these sectors make up about 53% of RSP, as opposed to just 41% of SPY.

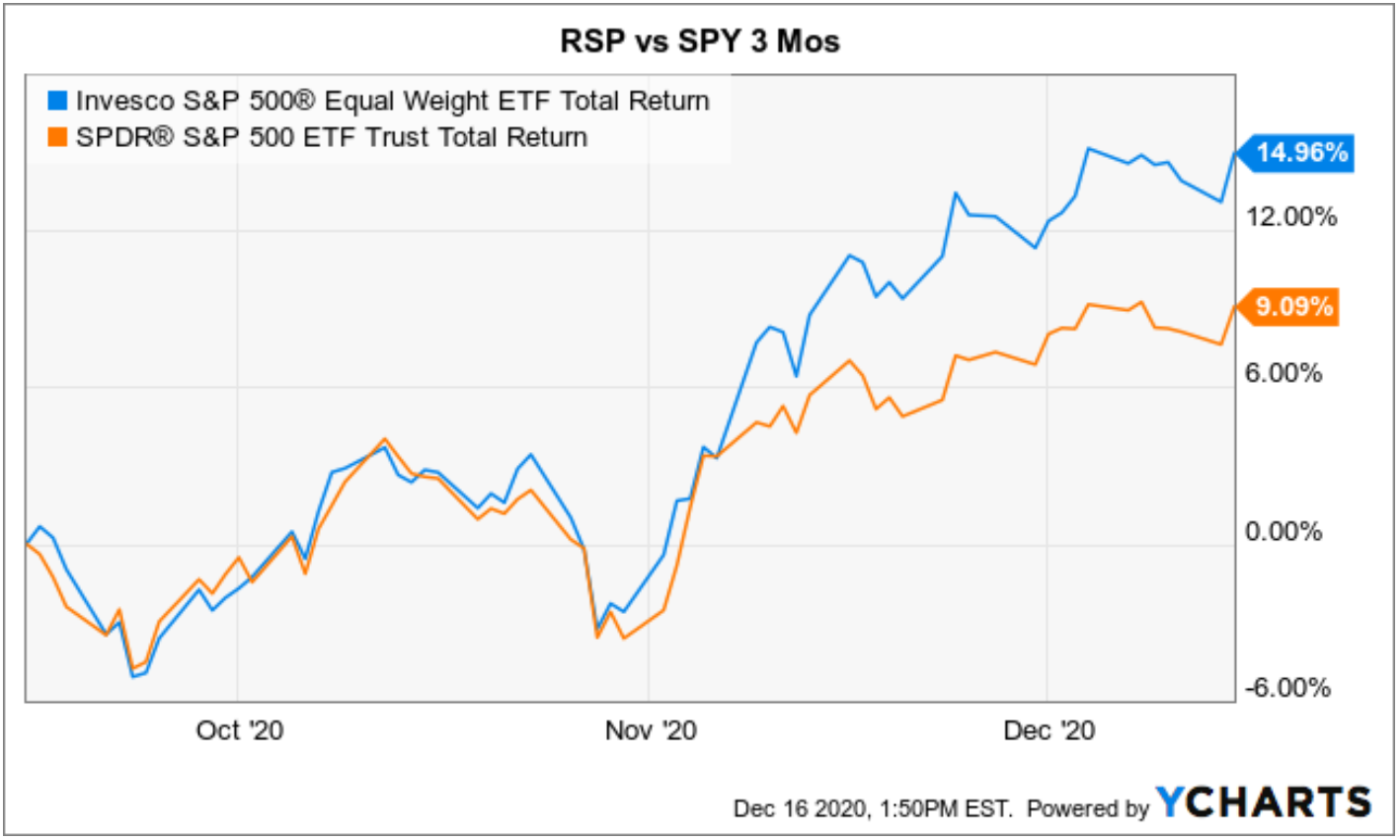

To be certain, owning RSP vs. SPY over the past several years was not wise from a relative performance standpoint. Over the past three years, RSP has had a total return of 33.7%, while SPY has delivered some 46.1%.

Yet, over the past three months, that performance has reversed, with RSP far outpacing its market-cap weighted brother with a gain of nearly 15% vs. a gain of just 9% for SPY. So, by adding RSP to your holdings, you can immediately gain greater exposure to the value segment without making any drastic bets on any one value sector fund (e.g. financials or industrials) or any specific value-oriented company.

Earlier this year, subscribers to my Intelligence Report newsletter advisory service received a recommendation to add RSP to their tactical portfolio, as this is one of those medium- to long-term trends that I suspect we will have in the portfolio well into 2021 (and likely beyond).

If you want to find out what other funds, and which individual stocks, I am currently recommending in Intelligence Report, then I invite you to check out the service today.

And, if you are looking for that “must-own” fund for the coming year, then definitely consider RSP.

***************************************************************

ETF Talk: Unleash the Power of a Small Plant

I am a passionate devotee of freedom in all its forms.

That’s why I am encouraged to see the recent shift in American public opinion favoring the legalization of cannabis/marijuana. To date, marijuana is legal for adults in 11 states and the District of Columbia, while medical marijuana is legal in 34.

With President-elect Joe Biden announcing that he favors the decriminalization of cannabis on the federal level, the path has opened for pot stocks to rise again. Those stocks generally had been in a slump since 2019 due to overproduction and a lack of profitable cannabis companies.

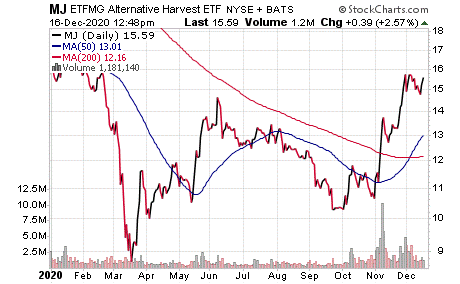

Thus, it is time to turn our attention to an exchange-traded fund (ETF) that has appeared in one of my trading services. The ETFMG Alternative Harvest ETF (NYSEARCA:MJ) tracks a market-cap-weighted index of global firms engaged in the legal cultivation, production, marketing or distribution of cannabis, cannabinoids or tobacco products.

Some of this fund’s top holdings include Aphria Inc. (NASDAQ: APHA), GW Pharmaceuticals PLC Sponsored ADR (NASDAQ: GWPH), Canopy Growth Corporation (NASDAQ: CGC), Aurora Cannabis Inc. (NYSE:ACB), Cronos Group Inc. (NASDAQ:CRON), GrowGeneration Corp. (NASDAQ:GRWG), Tilray, Inc. (NASDAQ:TLRY) and HEXO Corp. (NYSE: HEXO).

This fund’s performance has been relatively strong, even when including the damage done by the COVID-19 pandemic. As of Dec. 15, MJ has jumped 17.08% in the past month and 34.71% for the past three months. However, it currently is down 6.40% year to date to show how much it had fallen before its recent rebound.

Chart courtesy of www.stockcharts.com

The fund has amassed $986.33 million in assets under management and has an expense ratio of 0.75%.

While MJ does provide an investor with a chance to tap into the world of cannabis, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

Finally, whether by reading this e-letter, subscribing to my trading services or meeting me in person, you likely know that I am a staunch advocate of freedom and I respect the personal views of others about whether to use or invest in cannabis. I further think that any legal substance that consenting adults choose to use is entirely their prerogative.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

************************************************************************

In case you missed it…

My Favorite Holiday Gift Ideas

It is that time of year.

Indeed, the holidays will soon be here, and that means now is the time to start thinking about the gifts you will be giving to those you value. And if you’re like me, you love giving gifts, but not just any gifts.

To me, gift giving is an art. A wise friend told me long ago he had two maxims when giving gifts. The first applies more to a man courting a woman, and it goes like this: “The key to a woman’s heart is an unexpected gift, at an unexpected time.”

From experience, I can confirm that this maxim works exceedingly well. As for maxim two, it is as follows: “It doesn’t have to be expensive, but it does have to be special.”

This is the rule that applies not just to lovers, but to all of us during the holidays.

Indeed, it’s the special gifts that matter most, as they not only are the most memorable, but they’re also the most meaningful. And by meaningful, I mean they convey what the person receiving the gift means to the gift giver.

Today, I am going to tell you about some of my favorite gift ideas — ideas that are both inexpensive and special. And while some of these gift ideas might not be right for everyone on your shopping list, I suspect these ideas will be a good fit for many readers in The Deep Woods demographic — a demographic that is highly successful, highly educated, rational, life-loving and always interested in displaying the very best within.

To me, the most special gift is the gift of knowledge.

The easiest, most cost-effective and arguably the best way to give knowledge is through books. Whether it’s a great work of literature, an insightful self-help manual, or a great “how to” book on a subject close to the recipient’s heart, a really good book has got to be my all-time favorite special gift to give (and one that also happens to be inexpensive).

For those who love literature, fiction, action, adventure, mystery and philosophy, then give the gift that asks, “Who Is John Galt?”

Here, I am recommending the greatest novel ever written (in my not-so-humble opinion), “Atlas Shrugged” by Ayn Rand.

If you’ve read the novel already, you know how brilliant it is. But if you haven’t read it in some time, give yourself a gift and read it again. And, if you have any young minds on your holiday shopping list, then giving them “Atlas Shrugged” will make them remember you forever — and it may indeed alter the course of their lives the way it altered mine.

For those who prefer self-help style works, I recommend one of the original works on how to be human, “Meditations,” by Marcus Aurelius.

This work is more than 2,000 years old, but the wisdom in it applies to what you are doing right now — and what a human being should do every day to maximize his/her time on Earth. The insights, wisdom and practical guidance delivered on every page of this work are amazing, and the subjects vary from how best to deal with life’s inevitable adversity to how best to interact with others. I also highly recommend the Gregory Hays translation, as I think it is the smoothest and most poetic out there.

As for the “how to” category, well, I’ve always felt that a collection of wisdom from the best brains in that industry has been most special to me. And on this front, there is no better “how to” anthology than the one by my friend, fellow Fast Money Alert co-editor and brilliant economist, Dr. Mark Skousen.

The work I am specifically referring to here is “The Maxims of Wall Street.” This is a collection of some of the greatest wisdom ever to flow from the biggest and brightest names on Wall Street. Great investors such as Jesse Livermore, Baron Rothschild, J.P. Morgan, Benjamin Graham, Warren Buffett, Peter Lynch and John Templeton are just a sneak peek at some of the names you’ll discover in this fantastic collection.

Then there is profundity from the likes of Ben Franklin, John D. Rockefeller, Joe Kennedy, Bernard Baruch, John Maynard Keynes, Steve Forbes and numerous other luminaries too copious to mention.

Your editor with his very own signed copy of “The Maxims.”

As Mark puts it, “For years, I’ve been compiling these financial adages, ancient proverbs and immortal poems found in new and rare financial books and quoted regularly by investors, money managers, brokers and old timers.”

Now, this year marks the 10th anniversary of “The Maxims,” and fortunately for us all, Mark has made available this special 10th-anniversary edition just in time for you to give that inexpensive and special holiday gift.

Whether that gift is to yourself or to someone very special, you should definitely do yourself a favor and give this book to those you value (including yourself).

The new edition is indeed special, as it is some 282 pages, with an additional 200 quotes since the first edition came out in 2011 (I can’t wait to get mine!)

So, if you want to give the gift of knowledge this year, the best kind of gift, and if you love money, investing and wisdom (and I know you do because you read this publication), then “The Maxims of Wall Street” is the perfect holiday present.

******************************************************************

On Taking the First Whip

Mae-do meon-jeo maj-neun ge nas-da.

–Korean proverb

The literal translation of the above is: “It’s better to get beaten by the whip first.” The lesson here is that when you are confronting something unpleasant that you know you’re ultimately going to have to endure, it’s better to step up and just get it over with. A similar English proverb would be to just “rip the bandage off.” And while we here in the West are familiar with that bandage idiom, I think the Korean version is far more intense — and far more poetic.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods