Make Every Day Someone’s Birthday

Make Every Day Someone’s Birthday

Today, March 22, is my mother’s birthday. And as fate would have it, she is a spry and spunky 86-year-old with a penchant for literature, current events and cats.

Now, if you know me, you know the idiom “the apple doesn’t fall far from the tree” applies here, as I also have a fondness for literature, current events and cats (thanks, momma). If I am lucky, and if I make smart life decisions, perhaps fate will smile upon me as well, and grant me a spry and spunky 86 years and counting.

Interestingly, this celebratory occasion got me thinking about one aspect of life that, if I could, I would love to change. You see, why do we just celebrate someone’s existence on the anniversary of their birth? Why don’t we choose to live every day as if it was that person’s birthday?

Of course, I realize that if every day was cause for a birthday celebration then the unique occasion would inevitably blend into the norm, and that the meaning and special nature of the day would be lost.

Yet, what if we can use the feelings of goodwill and love and the celebratory mood of the birthday occasion as a sort of meme that can re-orient our disposition toward others every day?

Think about how you feel when you give someone a birthday gift, and when they smile back at you with gratitude, warmth and affection. That’s just about the best feeling one can have, and the best thing about that feeling is it’s open to all of us right this moment, if we choose it.

To prove this point, I challenge you to do a little experiment.

Pause for a moment, close your eyes and try to recall a time when you gave someone a birthday present, and they looked back at you with eyes that involuntarily divulged profound happiness.

Now look within yourself at how you feel right now, this moment.

I suspect you’ve already felt a wave of happiness wash over your spirit (see, I told you I could prove it to you).

The next step is to take that feeling you have and harness it toward the people that matter most to you, and not just in theory, but right this moment.

Here, I challenge you to do another little experiment.

Think of someone that matters to you (husband, wife, boyfriend, girlfriend, child, grandchild, co-worker, friend, neighbor, etc.). Now pretend that it’s their birthday, and that you are going to greet them with a “happy birthday” disposition.

I suspect negative thoughts such as anger, fear, jealousy, envy, etc. are not part of that happy birthday disposition. Rather, I suspect that positive thoughts such as gratitude, joy, delight and pleasure now animate your spirit.

Now, take that duly animated spirit and contact one of those people right now and wish them a great day. Heck, why not even wish them an early happy birthday? I mean, even if their birthday just passed, there will likely be another one in no more than 364 days.

So, today, I challenge you to channel that positive disposition that comes with celebratory well wishes and go out and make every day someone’s birthday.

And if today is that special someone’s birthday, as today is my mother’s birthday, then make sure you treat that person with the love and kindness they deserve. Because in addition to making them feel great, you will make yourself feel equally great — and that’s a present you can give yourself any moment you want.

***************************************************************

ETF Talk: Predict the Wave of the Future with This Quantum ETF

Investors are often interested in finding the “next big thing” before it becomes huge.

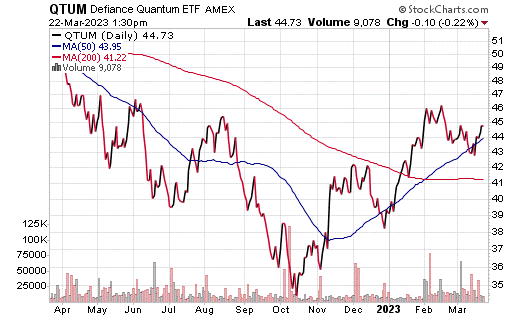

Successfully predicting the next trends in markets can potentially offer windfalls — consider, for example, the results of investing in Google in 2004. Although an ETF might not produce massive results in the way a single company stock can, it could still be immensely profitable if one can determine what is coming. One industry that could potentially blossom into something very important forms the thesis of the Defiance Quantum ETF (QTUM).

This exchange-traded fund invests in companies involved with quantum computing and machine learning. These technologies have been finding profitable uses in recent years, and their importance only seems to be increasing thus far. The fund can hold companies involved in quantum computing development, application, interfacing with traditional computers and the supply chain, for creating materials such as semiconductors that are involved with quantum computing.

The fund’s holdings are equal-weighted, providing even exposure without regard for market cap.

In the last year, QTUM is down 11.07%, which puts its performance close to that of the S&P 500, but, notably, above that of the tech-saturated Nasdaq. Net assets of just $109 million make it a relatively small fund, but it offers enough liquidity to make it a viable investment vehicle. The fund offers a small yield of 1.30% and a middling expense ratio of 0.40%.

Chart courtesy of www.StockCharts.com

QTUM’s portfolio is primarily U.S.-based, but also offers some international exposure. About 60% of assets are invested in U.S. companies, with the remainder allocated to a variety of stocks based in countries that most prominently include Japan, Taiwan, China, France and the Netherlands.

Some notable names among QTUM’s holdings are NVIDIA Corp. (NVDA), Cirrus Logic (CRUS), Baidu Inc. (BIDU), Advanced Micro Devices (AMD) and Microsoft Corp. (MSFT), but there are plenty of non-household names in the portfolio as well.

For investors looking to find the next wave before it really gets going, Defiance Quantum ETF (QTUM) offers an investment that provides such an opportunity.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

What’s the Deal with Banks?

When you wake up to news of banks failing, stocks tumbling and the Federal Deposit Insurance Corporation (FDIC) swooping in to “save” the 16th largest bank in the country, you have to ask yourself: What is the deal with banks?

Simply put, the deal here is that last Friday, venture-focused Silicon Valley Bank (SVB) failed, marking the largest bank failure in the U.S. since Washington Mutual during the financial crisis. Then, on Sunday, Signature Bank of New York (SBNY) also failed, and was taken over by the FDIC. Like the also-failed Silvergate Capital (SI) and SVB, Signature Bank had a lot of crypto exposure. In sum, three large banks failed in less than a week!

In response, the Federal Reserve and the Treasury Department aggressively stepped in and announced that all depositors at SVB and SBNY, including FDIC insured and non-insured, will be made whole and have access to their deposits.

Then, in a flashback to the financial crisis, the Fed also created a new lending facility, the Bank Term Funding Program (BTFP). This new institution will provide one-year loans to banks, accept Treasuries and agency mortgage-backed securities (Fannie/Freddie MBSs) as collateral and the lending facility will value the bonds at par (not current market values).

But did this situation just appear out of nowhere? Of course not, no effects happen without prior causes.

The underlying reason for the bank dislocations is in very large part due to the Fed’s monetary policies over the past couple of years. You see, after keeping the cheap-money fire hose on full blast for years, this past year, we reaped what we sowed and got inflation.

Now, the Fed is determined to reverse the easy-money policies of the past to try to tame inflation, and that’s resulted in a contracting money supply and the price of money (interest rates) going up very fast. We also now are suffering the pernicious effects of a negative yield curve, where short-term interest rates are higher than long-term rates. And while bond yields have gyrated wildly of late, sharply compressing that negative yield curve, the result of that prior huge inversion has been horrible for banks, and as a result, bank fundamentals are very negative.

Of course, the SVB, SBNY and SI situations all have issues specific to their situations. Those respective specific problems resulted in old-fashioned “bank runs” in the space, meaning more people went to get their money out of the bank than the bank could handle — and that’s always an extremely scary situation.

Now, the fear is “contagion,” i.e., that other banks will suffer the same fate as SVB, SBNY and SI. And seemingly right on cue, this morning, we woke to similar issues with Credit Suisse (CS), one of Europe’s most storied financial institutions.

So, what’s the bottom line here for markets? Well, this could be a silver lining in one sense, and that is we are very likely to see the Fed get much more “dovish” from here when it comes to future interest rate hikes.

We know that, because the introduction of contagion risk has significantly altered the market’s outlook on what the Fed is going to do. Prior to the failure of Silvergate, Silicon Valley Bank and Signature Bank, fed fund futures were pricing in a greater-than-50% chance of a 50-basis-point rate hike next week at the March 22 Federal Open Market Committee (FOMC) meeting and a terminal fed funds rate (level where rates finally peak) of 5.625%.

Now, in just three trading days, fed fund futures are pricing in a 25-basis-points hike next week (and the possibility of no rate hike), and a terminal fed funds rate of 4.625 — 4.875% (meaning next week’s hike could be the last of this cycle).

That change helped stocks rally big on Tuesday despite the bank failures, but of course, that Credit Suisse news overnight soured yesterday’s bullish mood.

Unfortunately, there’s likely to be more negative bank news before this whole tragicomedy is over, and that means we are likely in for more equity and bond market drama in the days and weeks to come.

So, hold on tight, as there is one thing you can bank on here, and that is this rollercoaster ride ain’t over yet.

*****************************************************************

Be A Beginner

Before the world slammed us shut

Before we knew way too much

Didn’t worry about what we didn’t understand

Swam out so far didn’t see land

Before the brain got involved

When it was heart and that’s all

Close your eyes and try to remember

When we were beginners…

–Matt Nathanson, “Beginners”

The brilliant songwriter Matt Nathanson has been quoted multiple times in this publication, and the reason why is because he so often touches something within me that I suspect will resonate with you too. In the newly released song “Beginners” off his fantastic new album, “Boston Accent,” Nathanson reminds us to not overthink the moment, and to enjoy the adventure, the feel and the taste of existence as if we were just beginning to discover it. So, whenever possible, allow yourself to be a beginner.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods