Lessons Learned at 168 MPH

- Lessons Learned at 168 MPH

- ETF Talk: Analyzing a ‘Foreign’ ETF

- The ‘Red Pill’ of Real Estate featuring Dutch Mendenhall

- Podcasters of the World Unite

- Tolkien on Kindness

***********************************************************

Lessons Learned at 168 MPH

Some people play golf. Some people play tennis.

And while I certainly understand the appeal of these great activities, I prefer to engage in recreational activities that are, shall we say, a little more extreme.

Another way to describe my proclivities is the way many of my friends and family do, and that is to just say that “Well, Jim’s just a little bit crazy.”

Now, I know what my friends and family mean when they say I’m a little crazy. And I know that they don’t mean that in the clinical sense. What they do mean is that the recreational activities I engage in are usually relatively high-risk, and often come with an intensity factor that’s a little bit high on the extreme scale.

Tactical marksmanship, Brazilian jujitsu and high-intensity training to build muscular size and strength are some of these activities. Yet there are even more extreme arrows in my recreational quiver.

I bring this up, because some of the greatest insights I’ve gleaned about myself, including insights on risk taking, risk management — even the meaning of life itself — have come to me while engaged in extreme pursuits.

Moreover, these insights have helped me become a more skillful writer, entrepreneur, investor… and just a more well-rounded Renaissance Man.

Perhaps most importantly, I suspect some of these insights can help you do the same.

For many years, I was really into motorcycles, and not just riding motorcycles around on the weekends exploring the country. My motorcycle pursuits involved sport bikes and, in particular, road racing bikes. These are the bikes that go really, really fast, and the bikes that require you to lean off of them and drag your knee on the ground to go really fast around turns.

In other words, they are the kind of motorcycles that can get you into a lot of trouble, if you don’t know what you’re doing.

So, when I decided to buy my first road racing bike in the mid-2000s, I didn’t just go to the dealership, jump on the prettiest model and ride off the lot with abandon. Instead, I did my research on what was the best model of road race bike for riders just getting into the sport.

Then, I researched which training facilities were considered the most effective, and the ones that stressed safety first. I also made sure I researched the right safety equipment, including which brands offered the best protection in the event of the inevitable crash.

It was only after doing this due diligence on what the sport requires to be able to excel, stay relatively safe and really enjoy the experience that I actually embarked on the motorcycle road race journey.

It is this kind of thorough due diligence that I bring to the rest of my personal life, and to my professional life as an investment newsletter writer.

Yet, aside from the lesson of proper due diligence, I think the real lessons one learns in life are those garnered under heavy stress. You see, it’s the presence of stress — literally life-threatening stress — that teaches us a lot about ourselves, our resolve and our ability to focus our minds on a singular task.

That’s the lesson I learned after participating in several motorcycle road racing “track days.” This is where you go out with a group of riders of similar experience and try to do your best lap times around a professional racetrack.

The track where I really learned a lot was the Auto Club Speedway in Southern California. This track has one of the longest straightaways in road racing, and experienced riders regularly reach speeds north of 170 mph.

Your editor tackling the turns at the racetrack.

After several “timid” laps around the track reaching top speeds of 130, then 140 and then 150 mph, I finally felt comfortable enough to open up my machine to see what she could really do. Yet this decision came toward the end of the day, and my brakes weren’t working as well as they had been early in the session.

I found this out quickly, as I spun up the engine on the Honda CBR 1000, hitting an exhilarating 168 mph on the front straight before applying the front brake — only to find that I was getting little response.

Moreover, as I looked ahead, there was a pack of riders in front of me who were slowing down for the next turn, a task I should have already done seconds before. I decided there were only a couple of things I could do. I could apply both the front and rear brakes as hard as I could, hoping the bike would slow enough for me to pull off the racing line, or I could dump the bike while going about 160 mph and risk severe injury (but still manage to avoid my fellow riders).

My decision had to be split second, and as you can imagine, it was under extreme duress. I opted to trust my equipment, and my training, by pumping the lever that controls the front brake, downshifting into a lower gear to slow the bike down and gently but steadily applying the rear brake to help slow the bike and steady the chassis. The maneuver worked, and I was able to guide the bike — and myself — back into pit lane safely.

That day, I learned to A) Trust my equipment, B) Trust my training and C) Trust my judgement under stress.

If I had panicked and opted to get off the bike, the consequences could have been disastrous.

So, the next time you’re faced with a situation where a potential calamity quickly approaches, trust your due diligence, trust your training (i.e. your accumulated knowledge) and, above all, trust your judgment and wisdom.

It is the knowledge of self and confidence in your own decisions that will carry you through times of acute stress.

Whether that stress is manufactured by your “crazy” choice to ride a motorcycle really, really fast, or whether that stress is created by an investment you’ve made in the equity markets, in a business, or anywhere in your personal life, what will get you through is a clear mind, good preparation… and trust in your good judgment.

***************************************************************

ETF Talk: Analyzing a ‘Foreign’ ETF

Sometimes, it is best to stay at home and remain faithful to the tried-and-true experiences that you’ve known all your life. Such a decision provides one with a safe harbor during tumultuous times. At other times, it is wiser to cast off, explore new horizons and experience new sensations.

This dilemma also applies to the stock market. At certain periods in the market cycle, it is wise to remain faithful to the well-known and stable companies and funds that are stalwarts in any balanced portfolio. Such a decision often produces a reliable, if not spectacular, return. At other times, investing in foreign or less-well-known companies may be the wiser decision to maximize returns, at, of course, the risk of incurring heavier losses.

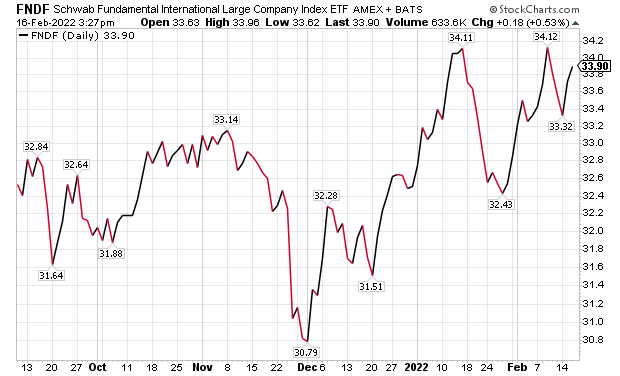

One exchange-traded fund (ETF) that is heavily involved in foreign companies is the Schwab Fundamental International Large Company Index ETF (NYSEARCA: FNDF). This ETF tracks an index of large firms from developed markets that are not in the United States. To select the stocks in its portfolio, it consults three different metrics: sales, cash flow and dividends. The fund’s managers then measure large-cap companies from FNDF’s parent index, the FTSE Global Total Cap Index, by these metrics. The top 87.5% of the companies by score are included in the portfolio.

Interestingly, while the index weights are determined annually, they are implemented across the year instead of all at once. That is, the fund’s managers divide the portfolio into four equal segments, and each segment is rebalanced on a quarterly basis. Not only does this methodology reduce the risk of buying shares of the fund at a bad time, but it also increases investment capacity.

Currently, the fund’s top holdings include Shell PLC (NYSE: SHEL), BP plc (NYSE: BP), Toyota Motor Corp. (NYSE: TM), Samsung Electronics Co., Ltd. (KRX: 005930), TotalEnergies SE (NYSE: TTE), HSBC Holdings Plc (NYSE: HSBC), Nestle SA (OTCMKTS: NSRGY) and Glencore plc (OTCMKTS: GLNCY).

This fund’s performance has been problematic, especially when including the damage done by the COVID-19 pandemic. As of Feb. 15, FNDF has been down 1.14% over the past month and up 2.64% over the past three months. It is currently up 3.72% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $7.70 billion in assets under management and has an expense ratio of 0.25%.

While FNDF does provide an investor with a way to profit from foreign companies, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors should always conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

The ‘Red Pill’ of Real Estate featuring Dutch Mendenhall

What happens when you put two entrepreneurial Renaissance Men together in a recording studio?

You get a wide-ranging podcast that includes topics such as real estate investing, healthy eating habits, Chinese politics, technology, sensory deprivation tanks, capitalizing on history, gun rights, the psychology of foreclosures and a peek inside the unique RAD Diversified REIT.

Jim Woods and Dutch Mendenhall discuss real estate investing, capitalizing on history and sensory deprivation tanks.

In this episode, I discuss all of these topics and much more with the very interesting Dutch Mendenhall, president of RAD Diversified.

You can read all about RAD Diversified and the company that Dutch built, and the investment opportunities in their unique real estate investment trust (REIT), in my new special report, “The Ultimate ‘Fixer Upper’ for Your Portfolio.”

If you want to get to know more about the man behind the RAD Diversified REIT, then this podcast is for you.

*****************************************************************

In case you missed it…

Podcasters of the World Unite

When a star player in your profession comes under attack, it behooves you to take a look at the reasons why, and to see if there is any “there,” there. I say that because if the biggest name in a given industry has come under fire for supposed wrongdoing, then you can bet that anyone in that industry will be subject to that same kind of scrutiny.

Such is the case with podcaster Joe Rogan, and his amazingly successful, entertaining, and educational podcast, “The Joe Rogan Experience.” Now, in the interest of full disclosure, I am a fan of Joe Rogan. I think he is a brilliant stand-up comedian, an excellent analyst and commentator for the Ultimate Fighting Championship, and he is hands-down the most accomplished podcaster in the world today. I also consider him a “Renaissance Man” in the true sense, as he has mastered a variety of different skills in multiple fields.

In fact, it’s undeniable that Joe Rogan is a huge reason why podcasts have become so popular in recent years. And admittedly, listening to Rogan’s casual, long-form conversations replete with interesting guests on all sorts of fascinating topics is in part what inspired me to create my own podcast, “Way of the Renaissance Man.”

So, what is the deal with Rogan and the controversy he’s currently mired in?

The recent hullabaloo began after a group of medical experts complained about Rogan “broadcasting misinformation, particularly regarding the COVID-19 pandemic.” The group of 270 experts penned an open letter addressed to the audio streaming service Spotify Technology S.A. (NYSE: SPOT), the streaming service that broadcasts “The Joe Rogan Experience,” condemning Rogan’s “platforming” of what they considered misinformation about the pandemic, the efficacy of the COVID-19 vaccines and the controversial scientists who don’t share the mainstream scientific opinion on these issues.

The controversy was exacerbated by rock legend Neil Young, as he offered up his own protest of Spotify and Rogan by threatening to pull his music off the site. “They can have Neil Young or Rogan. Not both,” said Young. Once again, in the interest of full disclosure, I am a huge Neil Young fan, and one of the best concerts I have ever attended was Young’s solo-acoustic show at the Dolby Theatre in Hollywood a few years ago.

Moreover, I can totally understand Young’s stance on this issue. He is exercising his freedom of choice in the service of his ideas, and though you may not agree with those ideas, Neil Young has every right to do with his music what he chooses, including pull it from Spotify in protest.

Now, once again, I am going to admit something here to you, and say that I was actually bothered by Rogan’s focus on alternative scientific opinions when it comes to COVID-19, the vaccines and the platforming of dissenting voices. It’s not that I don’t think those voices should be heard, far from it. Instead, I think that with an issue of such crucial, life-and-death importance, such as how best to wage war on a global viral pandemic, one should make every effort to present all sides of an issue — including the mainstream side — so that individuals can make up their own minds.

Much to his credit, Rogan agreed with this sentiment, as he issued an apology to the public regarding the issue, saying, “I’m not trying to promote misinformation. I’m not trying to be controversial.” Rogan added, “I think if there’s anything that I’ve done, that I could do better is have more experts with differing opinions right after I have the controversial ones. I would most certainly be open to doing that.”

To me, that should have ended the controversy, as Rogan basically did what any rational, moral person should do in this instance, and that is recognize a possible mistake was made and pledge to correct that mistake. Or in special ops terms, Rogan took “extreme ownership” of the situation, and acted like a noble, honorable man.

Yet Rogan’s ownership of this situation wasn’t good enough for some. Instead, the smear merchants came out of their moral hovels and launched a hit campaign against the podcaster using the most grotesque canard one can hurl at a person, the accusation that Rogan is a racist.

Now, I don’t think this accusation deserves the dignity of me presenting the details of their lowly smear campaign, other than to say that it is obvious that Rogan’s use of the vilest racial epithet in American history was in the context of discussing how that racial epithet came to be so toxic, and how it is used in society today.

It’s also obvious that if someone, or some group, wants to decimate another person’s reputation, the easiest way to do so is to construct a racial straw man against them. Forget about the facts, or the context, or the details of one’s life. If you want to hurt a person, just paint them as a “racist.”

Yet the way I see it, if all you’ve got is to accuse someone of racism for discussing words and ideas openly, well, then that’s all you’ve got. And all you’ve got is pretty damn thin.

So, my advice to all of my fellow podcasters, podcast listeners, and readers of The Deep Woods is to rise up and unite in support of Joe Rogan. You may not like him, and you may not agree with his views or his choices. But to dismiss him based on the ugly accusation of racism is to be complicit in the crudest, most despicable, most anti-reason form of character assassination.

*****************************************************************

Tolkien on Kindness

“Some believe it is only great power that can hold evil in check, but that is not what I have found. It is the small everyday deeds of ordinary folk that keep the darkness at bay. Small acts of kindness and love.”

— J. R. R. Tolkien

The iconic novelist was known for writing about the epic struggles between the forces of good and evil in “The Lord of the Rings” series. But in this thought, he reminds us that it’s the small acts of kindness and love that really keep the darkness at bay. So, the next time you are confronted with a decision in the face of malevolence, choose kindness. It will empower you and it will defenestrate the wicked.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods