A Less-Than-Bonding Experience

The bond market is trying to tell us something.

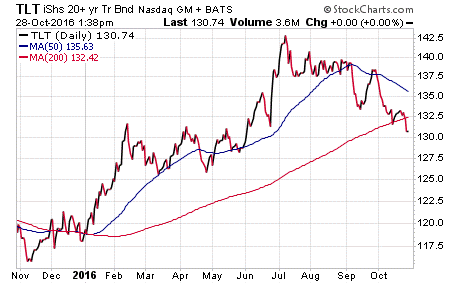

If you look at the price of the iShares 20+ Year Treasury Bond ETF (TLT), you can see that bond prices are falling (i.e. bond yields are rising).

In fact, the decline in bond prices of late has brought TLT, which is a benchmark fund for long-term Treasury bond prices, down below key support at the 200-day moving average.

This is a big signal for markets, as it means that the smart money is lightening up on bond exposure after a protracted move higher since about this time last year.

That trend is telling, as it means that investors basically are pricing in a Fed rate hike in December. The last statistic I saw showed that traders now peg the chances of a Fed hike at the December Federal Open Market Committee (FOMC) meeting at 73%. That tells me rates are going up by the end of the year.

Another reason bond prices are falling — and bond yields are rising — is because the world knows that central banks haven’t been as aggressive on the monetary easing front as most thought they would be after the late-June U.K. Brexit vote.

That vote caused a spike in bond prices in late June. But since then, the market has slowly brought bond prices back down below pre-Brexit levels.

If you own long-term Treasury bonds here, now wouldn’t be a bad time to start to contemplate lightening up your position, as it seems like the glory days for this income asset are probably in the rear-view mirror.

In today’s issue of Successful ETF Investing, my subscribers will be receiving specific instructions on what bond funds to sell and what bond funds to hold.

If you’d like to find out more about this list, then I invite you to subscribe to Successful ETF Investing today!

***Publisher’s Note***

I am happy to announce that Mike Turner has joined the Eagle Financial Publications family. Mike and I sat down for a short discussion about investing that you can listen to by clicking here now.

In this interview, you will get to know Mike better and learn a few other things, such as:

- Why most people buy and sell stocks at the wrong time

- Mike’s 10 Rules for Investing that everyone should know

- Why Bloomberg put Mike’s investing “Tools” product on more than 330,000 of its computer terminals

- And lots more!

Listen to Mike’s insights on the markets by clicking here now.

ETF Talk: Volatile Fund Paints a Picture of the Asian Market

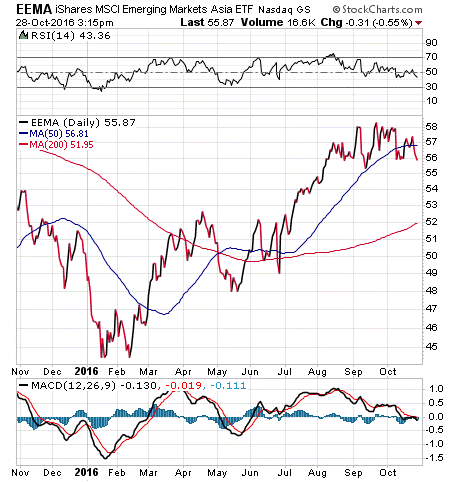

A U.S. incorporated exchange-traded fund (ETF), the iShares MSCI Emerging Markets Asia ETF (EEMA), holds a market-cap-weighted index of Asian emerging markets companies.

Since the fund’s inception in February 2012, it has provided good coverage of the Asian market, with significant allocation of funds in Asia’s major economies such as China, South Korea and Taiwan. The fund also gives exposure to the region’s biggest current sectors: technology and financials.

EEMA favors large-cap rather than small-cap companies, with more than 69% of the fund’s portfolio invested in companies with a market capitalization of $5 billion or more. The fund has an expense ratio of 0.49% and a dividend yield of 1.92%.

EEMA currently has $195.03 million assets under management and is growing, which is a positive sign, especially for the long term. However, as depicted in the graph below, the return for the fund has fluctuated wildly. Year to date, it has notched a return of 14.45%, beating out the S&P 500’s return of 4.98%. One example of the fund’s volatility is its irregular dividend payouts over the years, with an income distribution of $1.38 in 2013, $0.78 in 2014 and $1.23 in 2015.

Financial research firm Morningstar has given EEMA an “Average” rating and mentions that it is an “opportunity buy” for adventurous investors. Currently, Wharton Business Group owns 20% of the fund’s total shares, and the firm continues to purchase further shares as a sign of belief in the fund’s strength.

View the current price, volume, performance and top 10 holdings of EEMA at ETFU.com.

EEMA’s top five holdings are Tencent Holdings Ltd., 5.33%; Taiwan Semiconductor Manufacturing, 5.13%; Samsung Electronics Ltd., 4.81%; Alibaba Group Holding, 3.99%; and China Mobile Ltd., 2.45%. These five holdings combined make up more than 20% of the fund’s investments.

EEMA provides investors with targeted access to a specific subset of emerging market stocks, mostly large-cap companies, and it can be used to tailor an investor’s portfolio by expressing a regional view of the emerging markets. If you feel confident about Asia’s continuous growth in the long run, I encourage you to look to iShares MSCI Emerging Markets Asia ETF (EEMA) as a possibility for your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

The Best and Worst Single-Country ETFs

Single-country ETFs have had an interesting year.

Emerging markets make the list of best performers, and the list of worst performers. That usually doesn’t happen, but this year isn’t your typical market year.

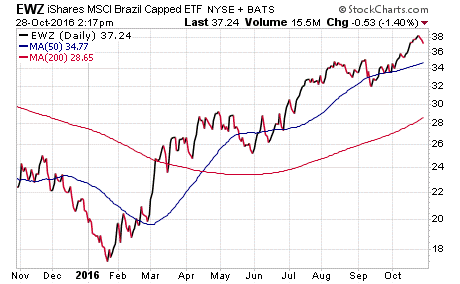

At the top is Brazil, and the performance of ETFs pegged to this South American emerging market stalwart.

The iShares MSCI Brazil Index (EWZ) has had a stellar year-to-date showing, with a gain of 82.2%.

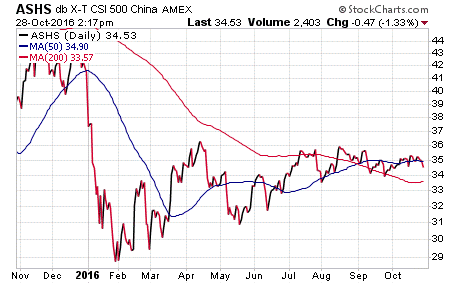

Near the bottom of the list is the Deutsche X-trackers Harvest CSI500 (ASHS), a proxy for China’s A-shares market. This fund is down some 16.4% so far in 2016.

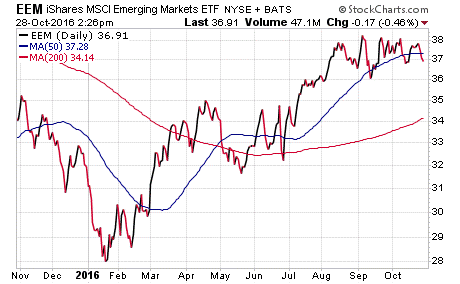

In the aggregate, emerging markets have performed extremely well in 2016, with the iShares MSCI Emerging Markets (EEM) up 14.7%.

At the beginning of the year, I told readers that I thought conditions were right for some nice upside in emerging markets and, for the most part, that prediction has proved prescient.

Yet the disparity in individual countries shows that not all emerging markets are created equal.

In 2017, I think there is a good chance that emerging markets will continue their broad upside trend. However, the key to success here is knowing which countries to embrace and which to avoid.

The Heart’s Memory

“The heart’s memory eliminates the bad and magnifies the good.”

— Gabriel Garcia Marquez

The great writer’s insight here also applies to investing. Too often, we remember the great wins and what led us to them, and we forget about the lessons we learned when we lost money or made a bad decision. So, my advice to you is to try not to let the heart’s memory get in the way of your objective analysis.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about why there is still so much uncertainty in the market.