On the Intangible Essence of Friendship

- On the Intangible Essence of Friendship

- ETF Talk: An Investment Trip to India

- A Message from the Fed Whisperer

- The Best and Highest Use

***********************************************************

On the Intangible Essence of Friendship

Friendship. It’s an essential component of any life well-lived. However, it’s also somewhat of a mysterious proposition, because what draws one person to another is often difficult to define. Yet, we all know what a friend is, and who our friends are, and what we like about our friends.

Interestingly, most of us have friends of different varieties. Some are business friends, some are neighborhood friends, some are hobby-related friends, or friends that like the same type of music, or football team or automobile brand. I have a variety of friends like this, as I suspect you do as well.

But then there are friends that you connect with on a slightly different level. Indeed, a deeper, more profound level. Not necessarily on a deep philosophical level (although, for me, this is usually the connection I make), but on a “spiritual” level. Now, when I say spiritual, I am speaking here of the human spirit, or the “sense of life” that a person embodies.

Yet what, precisely, do I mean by a sense of life?

Well, the term comes from the great novelist/philosopher Ayn Rand, who defines sense of life as “a pre-conceptual equivalent of metaphysics, an emotional, subconsciously integrated appraisal of man and of existence. It sets the nature of a man’s emotional responses and the essence of his character.”

This technical definition of sense of life isn’t the easiest thing to grasp. Rather, it’s one of those intangible aspects of another person that just resonates with you. It’s sort of like finding the flame of a kindred spirit among the many faces one encounters during a lifetime, and then recognizing yourself in that fire.

I am fortunate to say that I have found more than a handful of these sense-of-life brothers in arms throughout my 50-plus trips around the sun, and I am grateful for each and every one of you (and because I know my close-knit clan of sense-of-life compatriots are regular readers of this column, I know you are smiling right now, which also makes me smile).

This week, I had the great fortune to be visited by one of my sense-of-life brothers in arms, my friend James “Mr. C.” Here we are outside the ranch with a bottle of “Heaven’s Door” bourbon, musical genius Bob Dylan’s brand of premium whiskey, which I highly recommend.

James is one of the most accomplished guys I know.

He’s an extremely successful businessman who spent more than three decades as an auto industry executive. He’s also a successful entrepreneur, investor, husband, father, grandfather, former Marine Corps officer and all-around excellent man. Yet, all of those accomplishments are in addition to Mr. C’s radiant sense of life, a component of his personality that I was drawn to from our very first meeting a few years ago.

I really enjoyed hanging out with James, as it’s the kind of experience that lets you know you there are others who see the world through a similar lens, and who take on existence the way I think it should be taken on — with love, aggression, wit, smarts, principles and a real sense of fun.

So, my recommendation for you is the following: Take a quick mental inventory of your true friends. The ones whose sense of life you most resonate with. Then, pick up your phone, text, call or write them an email telling them how much you appreciate them in your life.

Or, if you are fortunate to have a platform of the sort that I do here in “The Deep Woods,” you can tell them all, for the whole world to hear, how much you appreciate them being a part of your life.

Doing so will make you feel honored to be alive, and I suspect that doing so will make your sense-of-life brothers in arms feel the same way, too.

P.S. Come join me and many of my Eagle colleagues on an incredible cruise. If you book before Sept. 29, you’ll receive a spend-as-you-wish $250 shipboard credit! In addition, this is all-inclusive — meals, drinks and even the excursions are included in your one-time price! We set sail on Dec. 4 for 16 days embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.

***************************************************************

ETF Talk: An Investment Trip to India

Over the past few years, there has been a lot of talk about emerging markets in the Asia-Pacific region. One of those, India, with its robust gross domestic product (GDP) growth and desire to become increasingly industrialized, has captured the attention of many investors, who observe the progress that developing nations, such as India, are making to better the well-being of their populations.

After contracting following the COVID-19 pandemic, the economy of India has made a comeback with its projected GDP growth of 6.1% in 2023, according to the International Monetary Fund. Following the UN projection news that the growing Indian population is expected to reach over 1.4 billion people, surpassing the population of mainland China, there has been a renewed interest in investing in this emerging economy, including from tech companies such as U.S.-based Apple (NASDAQ: AAPL).

Other factors make India an emerging market, with the potential to grow in the next few decades. Consider the progress made by the country on the front of increasing literacy rates from 40.8% in 1981 to 77% by 2023, alongside an increasing business education with six of 2023’s Financial Times Global Top business schools being located there. Furthermore, factors such as the youth of the Indian population, the second largest digital literacy rate and the role of the English language give India a strategic edge in the increasingly interconnected world.

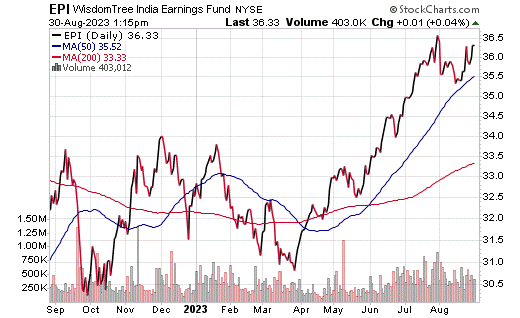

Indian ETFs allow investors to geographically diversify their global portfolio by owning companies trading on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India Ltd. (NSE). Currently, there are 14 Indian ETFs trading on the U.S. stock market with WisdomTree India Earnings ETF (NYSEARCA: EPI) being the second largest after iShares MSCI India (BATS: INDA).

With EPI reaching the AUM milestone of $1.1 billion, this might present investors interested in Indian equities with a great opportunity to enter the market. EPI’s focus on “old industries” means the fund remains fairly diversified, with its largest sectors being materials, energy and financials. By investing in the fund, investors can gain exposure to broad, all-cap equity Indian companies, as well as use this access to Indian markets with a valuation-centric approach.

The WisdomTree India Earnings Fund seeks investment returns by tracking the price and yield performance of the WisdomTree India Earnings Index, which measures the performance of Indian incorporated and traded equities eligible for purchase by foreign investors.

Top holdings in the portfolio include Tata Steel Limited (NSE: TATASTEEL), Reliance Industries Limited (NSE: RELIANCE), ICICI Bank Limited (NYSE: IBN), Oil & Natural Gas Corp. Ltd. (NSE: ONGC), Infosys Limited (NYSE: INFY), Axis Bank Limited (NSE: AXISBANK), Tata Consultancy Services Limited (NSE: TCS), NTPC Limited (NTPC.NS), Power Grid Corporation of India Limited (NSE: POWERGRID) and Indian Oil Corp. Ltd. (POWERGRID.NS).

Chart courtesy of StockCharts.com

As of June 2023, this fund is up by 0.39% over the past month, up 8.97% over the past three months and up 11.45% year to date. The fund has $1.1 billion in total assets under management, and it has an expense ratio of 0.85%.

EPI provides a great opportunity for global investors to expand their portfolio while investing in an emerging market with a surging GDP. However, investors in this ETF should be aware of the potential currency fluctuation as well as political and economic uncertainty that might impact their investment. Such investments in frontier markets like India have a tendency to be less liquid and efficient than those made in developed markets. Investors should always do their due diligence before adding any investment to his or her portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

A Message from the Fed Whisperer

Treasury yields are on the march higher. Indeed, the move to multi-decade highs in the 10-year Treasury Note yield has been the primary (but not only) reason stocks have declined over the past several weeks. Now, one of the reasons yields have risen is because investors have been “pushing out” the date of expected rate cuts, as investors begin to accept the Fed may keep rates “higher for longer.” That idea was furthered last weekend in an article by “Fed Whisperer” Nick Timiraos of the Wall Street Journal, and that article was responsible for the rise in yields last Monday.

In last Tuesday’s issue of my daily market briefing, Eagle Eye Opener (which you simply must subscribe to, if you want to know what real professionals are watching each trading day), we explained that there’s usually always one Fed Whisperer at the Wall Street Journal, and currently it’s Timiraos. Prior to Timiraos, the Fed Whisperer was Jon Hilsenrath.

The fact that these Fed reporters have deep insight into what the Fed may do is not a coincidence, because the Fed does not like to surprise markets anymore, so the more it can telegraph its decisions and communications, theoretically, the smoother the digestion of that news by stock and bond markets. Point being, whether official or unofficial, the Fed tends to “tip off” the current WSJ Fed reporter to any policy shifts or changes so that it can be disseminated in the markets and not surprise investors.

It’s for that reason that an article from Timiraos last weekend caught the market’s collective attention. The focus of the article was on an economic statistic called “r-star” or sometimes “r*”, but if we read between the lines of the econ speak, the message was clear: The chances the Fed hikes again and/or keeps rates higher for longer may be higher than the market currently appreciates, and if that’s true, it’ll add another headwind for stocks because it’ll damage one of the three pillars of the rally (i.e., the assumption the Fed is done or almost done).

What did Timiraos say? Essentially, Timiraos said that there’s a growing feeling among Fed members that the neutral real interest rate is higher than currently thought. The neutral real interest rate, which is r*, is the level of real interest rates (so nominal fed funds minus expectations for inflation over the next year) that is neither a tailwind nor a headwind on economic growth (so it’s neutral).

Why does this matter? In eras of high inflation, such as now, the Fed wants to get real interest rates into “restrictive” territory, so that economic growth and inflation both slow. But what is “restrictive?” Well, restrictive depends on where Fed officials think the neutral real rate is. Consider that for the last several years, Fed consensus has been that the neutral real rate was 0.5% (so, fed funds 0.5% above one-year inflation expectations). With longer-run annual inflation expectations still around 2-3% and fed funds at 5.375%, right now, real rates are clearly above neutral (2.5-3.5%, depending on how you calculate forward inflation). If the neutral real rate is still 0.5%, then that means real rates are 2-3% above neutral and are putting a serious headwind on growth.

But what if the neutral rate isn’t 0.5% anymore? What if it’s 1.5% or 2.0%?

If that’s the case, then real interest rates aren’t as restrictive as we thought they were, and as a result, rate hikes won’t slow the economy nor blunt inflation as much as the Fed would expect. The net result isn’t so much that the Fed will keep raising rates, but instead that the Fed will keep rates higher for longer, because they aren’t as much of a headwind on growth as was previously expected. That’s why the neutral rate matters and why yields rose after the Timiraos article.

What Comes Next? This debate about the level of r* (or the neutral real interest rate) has been ongoing for months, and there are camps in the Fed that think it’s higher than 0.5% and camps in the Fed that think it is still 0.5%. The reason this article caught everyone’s attention is because Timiraos wrote it a few days before Federal Reserve Chairman Jerome Powell spoke at the Jackson Hole Summit last Friday, and there was some concern that this article could be softening up the market for Powell to deliver a hawkish message that drives home the higher-for-longer message to markets. If that’s the case, expect more volatility in stocks and bonds.

Bottom line, higher for longer is a risk to this rally, because it’s not the height of rates that matters as much as how long they stay high, so we’ll continue to monitor the debate over r* in the coming weeks. But in the more immediate term, if we had seen Powell hint at higher for longer last Friday, we would have needed to brace for more equity market volatility, with defensive sectors (utilities, healthcare, staples) likely to continue relatively outperforming (as they have since this pullback started).

*****************************************************************

The Best and Highest Use

“Gambling is entertainment… Financial markets, what one often refers to as speculation, is really the force by which we move capital to the best and highest use.”

–Kenneth C. Griffin

The billionaire hedge fund manager and Citadel Advisors chief gets it spot-on here with his contrast of an entertainment pursuit versus how investing really works. And while speculation of the sort we do in my newsletter advisory services can certainly be entertaining (especially when we realize huge gains), it shouldn’t be confused with Vegas-style casino gaming (although I’ve been known to realize a few huge gains there, too).

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods