I Want To Be in This Club

- I Want To Be in This Club

- ETF Talk: Fending Off Fluctuation Via a Preferred Stock ETF

- Putting One Fake Foot in Front of the Other

- Blinded By The Light

- Rand On Taxes

***********************************************************

I Want To Be In This Club

I’m not usually the type of man who wants to be in a “club.” In fact, I generally eschew membership in social organizations, political parties and other artificial constructs that humans create to feel kinship with one another.

However, there is one club of sorts, or more specifically, a list of individuals, that I would love to count myself a member of. That club, if you will, is the group of individuals profiled in what is being described as a “bombshell” story by investigative journalism organization ProPublica.

Here’s the headline of the article lovingly capturing the attention of the mainstream media, as well as progressive and populist websites around the globe: “The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax.”

The story, which is an interesting read for a variety of reasons, is basically an analysis of the taxes paid by the richest Americans. The analysis is based on the private tax returns that ProPublica says it received from an “anonymous source.” The organization also claims that disclosing this very private information about American citizens is in the greater “public interest,” and this, they’ve concluded, outweighs privacy considerations.

So, who is in this “club” of the richest Americans, and what’s all the fuss about?

Here are some of the top names mentioned in the ProPublica article: Jeff Bezos, Elon Musk, Warren Buffett, Carl Icahn, George Soros, Michael Bloomberg, Bill Gates, Rupert Murdoch and Mark Zuckerberg. According to the report, the tax data “shows not just their income and taxes, but also their investments, stock trades, gambling winnings and even the results of audits.”

The article goes on to claim that “taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most. The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.”

Ok, let me unpack that statement, because it’s riddled with a few bad insights.

First, as my friends at Reason.com point out, “For the 2018 tax year, the last year for which we have data, the top 1 percent paid over 40 percent of federal income taxes, despite earning just under 21 percent of total adjusted gross income (AGI). The bottom 50 percent of taxpayers earned 11.6 percent of total AGI, but paid less than 3 percent of income taxes.”

So, while the elite club of richest Americans profiled in the article show that they often paid very little or no income taxes in some years, the wider point is that the oft-vilified “top 1 percent” pay far more into the federal tax system than any other group. So, in a way, the ProPublica article unwittingly got it right in the sense that this is definitely not “fair,” i.e., not fair to the top 1 percent of Americans who pay far more into the system than other groups.

The other point here from ProPublica is that the records show that the wealthiest can pay “income taxes” that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.

The problem here is that the growth of one’s fortune via such things as share price appreciation of assets, including shares in a company, or real estate or a business, is not “income” until those assets are sold. And then it’s not the same as ordinary income, but rather more like a capital gain.

Here again, I’ll let Reason.com do the explaining:

“ProPublica, however, tries to make the case that the wealthy are getting away with murder through the tax code, so they do a calculation that has never been done before, comparing growth in wealth over the course of a year to taxable income. They use this to calculate an individual’s ‘true tax rate,’ which is sort of like handing out wins in a baseball game in the middle of the early innings and calling it the ‘true outcome’ of the contest.

“It’s hard to overstate how nonsensical this comparison is (which is perhaps why it’s never been done before). Our tax system rightly does not tax growth in one’s wealth until it is realized as income. After all, the alternative is a monstrously complex and unfair system of wealth taxation that developed countries have avoided.”

Ah, but you see, here is where the progressive and the populist dream “wealth tax” comes in, one where the most successful among us are taxed on our investment prowess and our ability to accumulate appreciating assets. That tax would not just be on our incomes, but on what we own. We know this, because Senators Elizabeth Warren and Bernie Sanders have already piggybacked on the ProPublica article to buttress their argument in favor of a wealth tax.

But let’s put this into perspective that most of us can relate to. A wealth tax would, in effect, consist of tax authorities coming to you and taking an annual inventory of your stock portfolio, 401(k), home value, automobile values, collectibles, art, furniture, etc., and then determining a figure of how much you are worth. Then, they would send you a tax bill on that amount each year. It doesn’t matter that you haven’t sold these items. The tax is just based on their overall value.

In essence, the ProPublica “exposé” is, in my view, just another attempt to try and vilify the rich for doing what we all should be doing — using the money we’ve accumulated via our productive achievement, and investing that money in appreciating assets that can flourish into enormous wealth.

So, one day I hope to be in that exclusive club, the club where my tax returns reveal that I paid little or no taxes in a given year on income because all of my wealth was tied up in the best stocks, real estate and business investments that I made with the expert knowledge of the markets that I’ve accumulated over the years.

To me, the ProPublica article was a financial form of a Tony Robbins seminar, one that has motivated me to be a subject of the next ProPublica on how the super-rich legally avoid paying Uncle Sam.

If you want to come alongside me as a future member of this exclusive club, then I invite you to check out my newsletter advisory services today. Together, we can get on our way to being the subject of a ProPublica piece.

P.S. Wouldn’t it be fantastic to listen to some brilliant minds that have the opposite views of those in the ProPublica piece? How about if those views were packed into a four-day event right under the nose of Mt. Rushmore? Well, reality has delivered, and it comes to us in the form of FreedomFest 2021. This year’s theme is “Healthy, Wealthy & Wise.” The conference takes place July 21-24, in Rapid City, South Dakota. Keynote speakers include JP Sears, Ayaan Hirsi Ali, Dave Rubin, John Mackey, Dr Drew Pinsky, Jo Jorgenson, Larry Elder and many more. I will also be there as a speaker and as a podcaster, and I will be joined by friend and colleague Dr. Mark Skousen. So, if you are looking for a place to celebrate freedom and to immerse yourself in pro-human, pro-reason and pro-wealth ideas, then FreedomFest is for you! To see the full schedule, go here!

***************************************************************

ETF Talk: Fending Off Fluctuation Via a Preferred Stock ETF

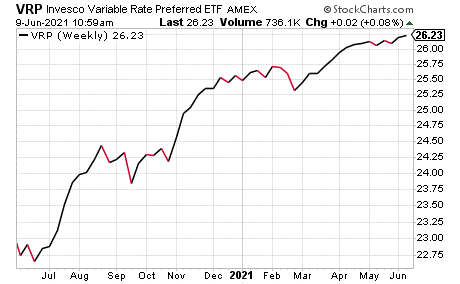

For investors looking for a fund to help position an income portfolio for rising rates, the one-of-a-kind Invesco Variable Rate Preferred ETF (VRP) may be of interest.

The exchange-traded fund (ETF) offers exposure to both U.S. and foreign-issued floating- and variable-rate preferred stocks, as well as certain types of hybrid securities that are comparable to preferred stocks. Both the stocks and hybrid securities pay a floating or variable rate dividend or coupon (an annual payment).

As a bit of background, floating-rate preferred stocks link dividends to a reference benchmark rate and a fixed spread. Variable-rate preferred stocks begin with a fixed dividend for a certain amount of time but ultimately morph into a floating-rate structure.

Preferred stocks have always been viewed as a solid alternative income generator as they offer uncorrelated price trends and hefty dividends. Since preferred stocks have the ability to diversify away from traditional bonds, the fund can help to smooth out volatility and enhance long-term returns.

Hybrid securities, on the other hand, can combine the characteristics of two groups of securities: debt and equity.

Because VRP holds hybrid securities with floating-rate components, such as senior loans, it is able to achieve a lower effective duration, which can help to mitigate against duration risk. The floating-rate components lend themselves to regular adjustments based on the dominant interest-rate environment, which, in turn, lowers the fund’s sensitivity to Treasury yield fluctuations.

Invesco.com states that VRP’s effective duration is slightly less than three-and-a-half years and has a 30-day U.S. Securities and Exchange Commission (SEC) yield of 3.78%. According to the site, the fund’s relatively low yield is credited to its strong returns and ability to hit all-time highs throughout the recovery phase of the risk-asset rally. Moreover, like a traditional bond fund, shareholders are paid monthly dividend payments.

The open-ended fund charges an annual expense ratio of 0.50% and has a 4.22% dividend yield. VRP has $1.63 billion in total assets and $1.70 billion in assets under management. Year to date, the fund’s performance has been incredibly strong. VRP had a significant dip in mid-September 2020 but saw a large spike in early November. From that point on, the fund climbed rapidly and only saw one minor dip in late February 2021. Today, the fund opened at $26.22 and is currently trading at $26.23, which is at the high end of its 52-week range of $23.35 to $26.25.

According to Invesco, VRP has 273 holdings and 75% of them are allocated to the financial sector, while the remaining 25% of its holdings are a mixture of energy, industrial and utility stocks. The fund’s top five holdings have the following weightings of each, followed by their respective annual coupon payment — the interest paid each year on a bond between its issue date and the date of maturity — include General Electric Company 3.51%, 2.41%; Wells Fargo & Company 3.90%, 1.61%; JPMorgan and Chase Company 4.60%, 1.37%; JPMorgan Chase & Co. 3.68%, 1.34% and The Charles Schwab Corporation 5.38%, 1.23%.

In sum, VRP offers exposure to both U.S.- and foreign-issued floating- and variable-rate preferred stocks and certain types of hybrid securities. It is the only fund in its segment with an emphasis on variable rate coupon securities to align itself with a rising interest-rate trend. Further, the floating-rate components of the hybrid securities allow for regular adjustments based on the dominant interest-rate environment, thus lowering the fund’s sensitivity to Treasury yield fluctuations.

So, for conservative investors, Invesco Variable Rate Preferred ETF (VRP) may be a fund worth looking into. However, interested investors are always advised to conduct their own research and decide whether a given fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

Putting One Fake Foot in Front of the Other

Some men, when faced with overwhelming, life-shattering adversity, choose to embrace the circumstance. And in doing so, they live a life of epic inspiration.

In the new episode of the Way of the Renaissance Man podcast, I speak with just such a man, former Army soldier and retired police officer, Steve Martin.

Steve is an Afghanistan war veteran whose battlefield injuries cost him both of his legs.

Yet rather than allow that to stop him, Steve chose to overcome his personal battles, conquer his inner demons, and live a life that we all can aspire to.

From overcoming pain medications and becoming one of the first double-amputee field police officers in the country, to becoming an athlete whose participation in high-profile competitions has elevated awareness for life after amputation, Steve is a man whose mindset we all can learn from.

If you want to be motivated by a real-life hero and learn about his new adventure with an organization that I am proud to sponsor and support, Friends of Freedom USA, then you will really enjoy my inspiring conversation with Steve Martin.

*****************************************************************

In case you missed it…

Blinded By The Light

He was just blinded by the light

Cut loose like a deuce another runner in the night

Blinded by the light

Mama always told me not to look into the sights of the sun

Whoa, but mama, that’s where the fun is…

— Bruce Springsteen, “Blinded By The Light”

You might find this hard to believe, but Bruce Springsteen never had a number one record. Well, sort of. You see, Bruce’s childhood memoir masterpiece, “Blinded By The Light,” did reach number one on the charts, but not in its original form (find out the real story behind the song and its unconventional lyrics straight from Bruce).

The song actually first appeared on Springsteen’s 1973 debut album, “Greetings from Asbury Park, N.J.” Yet, it was the 1976 cover version of the song by British rock band Manfred Mann’s Earth Band that reached number one on the Billboard Hot 100 in the United States in February 1977.

So, why I am bringing up rock history here this week in The Deep Woods?

Well, aside from the fact that the subject is fun to discuss, the meaning of the song, and its history on the Billboard charts, can teach us some important lessons about the markets, investing and life.

First, when Bruce wrote his story about being “blinded by the light” of the new and the unknown, and wanting to, as he puts it, “do things I hadn’t done and see things I hadn’t seen,” he didn’t envision the song being covered by a band across the pond. He also didn’t think that song would become a number one hit.

Yet, that’s the thing about life, most of the time we don’t know where our choices will lead us. Even seemingly pedestrian choices can have giant ramifications for our lives, and we never really know which of those everyday decisions will end up morphing into life-changing circumstances. So, the lesson here is to always choose wisely no matter how seemingly insignificant your decision may be, as you never know the causal significance it could have.

Second, when Bruce wrote about his desire to do things he hadn’t done, see things he hadn’t seen, and allow himself to look into the sights of the sun (because that’s where the fun is), I doubt he realized that this would be a profound lesson for investors. Let me explain.

You see, in February and March of 2020, many investors were “blinded by the light,” and not in a positive way. In fact, many were blinded by the market turmoil occurring during the beginning of the pandemic, and many pulled their money out of the market and went to cash. Now, this was a smart move for several months; however, the pernicious, COVID-19-inspired selling in markets blinded many an investor into staying on the sidelines well into the big rally and economic rebound that’s still going strong today.

So, the lesson here for investors is to not allow yourself to be blinded by the often-intense light of fear in markets.

Indeed, one of the biggest problems I encounter when talking to investors is not that they are too aggressive with their money, but that they aren’t even in the market because they want to avoid experiencing another Q1, 2020 sell-off. Some investors are even still on the sidelines as a result of fear of another 2008-2009 financial crisis.

In this case, you don’t want to be blinded by the light of fear. Instead, you want to move toward the light of future possibilities, and you want to put your money to work in the investment vehicles best suited to serve your particular circumstances and goals.

So, if you are still leery about getting in this market, I implore you to shed that fear of a tired bull. Allow yourself to look into the sights of the sun and the brightness of opportunity and embrace the potential upside — because as Bruce told us, “that’s where the fun is.”

*****************************************************************

Rand On Taxes

“Any program of voluntary government financing has to be regarded as a goal for a distant future.”

–Ayn Rand, “Government Financing in a Free Society”

The novelist/philosopher was an advocate of voluntary taxation to fund the essential needs of a very limited government, one whose proper functions are restricted to the police, the armed forces and courts of law. As Rand put it, “citizens would (and should) be willing to pay for such services, as they pay for insurance.”

Unfortunately, the massive federal leviathan is far from voluntary, and far from mere insurance to preserve our domestic safety, ensure our security against foreign enemies and to adjudicate our legal disputes. So, is it any wonder why most of us rightly take steps to minimize our tax footprint?

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods