I Got Those Low Down, April 15 Blues

So, did it sting this year more than ever before? Did you get hit with an unexpectedly bigger tax bill? I know I had to pay just a little bit more to help fund the federal leviathan this year, and I’m not alone.

According to the Internal Revenue Service statistics, the average tax refund is down 8.7 percent from this time last year. That readjustment has come after the biggest tax law changes in decades. While the IRS doesn’t offer figures about what people owe, I think it’s safe to assume that many Americans have been hit with an unexpectedly higher tax bill than they’ve seen in many years.

So, since all of our tax payments are due in less than a week, I thought I’d offer up a few thoughts and suggestions (both serious and musical) on the subject.

Now, you might argue that taxes are just the price we pay for society. But as my friend, economist extraordinaire and Fast Money Alert co-editor Dr. Mark Skousen writes, “Taxation is the price we pay for failing to build a civilized society. The higher the tax level, the greater the failure. A centrally planned totalitarian state represents a complete defeat for the civilized world, while a totally voluntary society represents its ultimate success.”

The profundity here should be obvious to anyone who has even a passing acquaintance with the principles of liberty. And while the idea of a “voluntary society” may seem foreign to those of us who’ve lived most of our lives in post-New Deal America, all one needs to do is dig a bit deeper under a surface that says, “Well, that’s just the way it is.”

Another beautiful advocate for freedom is philosopher and novelist Ayn Rand. While Rand is most famous for her two masterful works of fiction, “The Fountainhead” and “Atlas Shrugged,” she also wrote brilliant non-fiction, particularly in the realm of principled politics and the way a free society should be funded.

Here’s an excerpt from Rand on the subject of voluntary society from her essay, “Government Financing In A Free Society”:

“In a fully free society, taxation — or, to be exact, payment for governmental services — would be voluntary. Since the proper services of a government — the police, the armed forces, the law courts — are demonstrably needed by individual citizens and affect their interests directly, the citizens would (and should) be willing to pay for such services, as they pay for insurance.”

Rand was of the opinion that the principle of voluntary government financing, while not an easy task to implement, is the only consistent and moral way to structure a free society’s funding. Of course, the key here is establishing a “free society,” i.e. a society where government plays only a minor role in the lives of its citizens.

We’re far from that today, sadly, and we all realize that every April 15. Yet the necessary, although not sufficient, condition for getting that change started is to first realize that the principle of confiscatory taxation backed up by the government’s monopoly of physical force is inconsistent with, and anathema to, freedom.

Okay, so much for the political philosophy portion of our program. Now let’s have a little April 15 musical cheer to lighten things up.

As you likely know, there are a lot of good “tax songs” in music history. Perhaps the most famous is “Taxman” by The Beatles. Here’s my favorite lyric from the classic:

If you drive a car, I’ll tax the street

If you try to sit, I’ll tax your seat

If you get too cold, I’ll tax the heat

If you take a walk, I’ll tax your feet…

Other great tax songs include “Success Story” by The Who. Here are my favorite lyrics:

Away for the weekend

I’ve gotta play some one-night stands

Six for the tax man, and one for the band…

And then there are these great lyrics from country icon Johnny Paycheck and his tune, “Me and the IRS.”

Well how can I keep my arm around my woman

With Uncle Sam’s hand in my pants

If I can’t pay the fiddler, how the hell am I gonna dance?

Now if that lyric didn’t give you a little smile this tax season, I don’t know what will.

**********************************************

Join Me at the MoneyShow in Las Vegas, May 13-15

I invite you to join me for the MoneyShow in Las Vegas, May 13-15, when I will be a featured speaker to share my latest views about the market and the best investments to make now. The event will be based at the Bally’s/Paris Resorts and feature more than 200 presentations. Other featured speakers include Steve Forbes, Dr. Mark Skousen and Hilary Kramer. Click here to register free as my guest or call 1-800-970-4355 and be sure to use my priority code of 047465.

**************************************************************

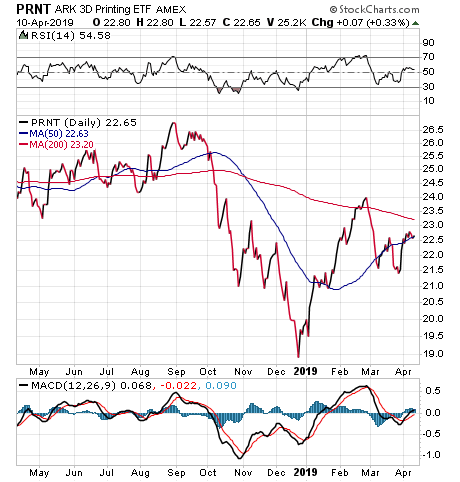

ETF Talk: Offering Exposure to Cutting-Edge Technology

One of the most interesting and potentially disruptive technological innovations of the digital age has been the rise of 3D printing.

Indeed, the advent of this new technology has raised questions about intellectual property rights, aerospace regulation and gun legislation that have yet to be answered satisfactorily. At the same time, this invention also has triggered new opportunities for investors.

For instance, the Ark 3D Printing ETF (BATS:PRNT) is the first such fund on the market that can provide investors with exposure to companies that are involved in 3D printing and 3D printing businesses. Currently, PRNT limits its geographic reach to companies that are based in the United States, non-U.S. developed markets and Taiwan.

PRNT’s underlying index is made up of five components related to 3D printing. Those components are 3D printing hardware, CAD and 3D printing software, 3D printing centers, scanners and measurement and 3D printing materials. While each of these components is weighted differently (50%, 30%, 13%, 5% and 2%, respectively), selected securities within each category receive the same weight.

Some of this fund’s top holdings include ExOne Co. (NASDAQ: XONE), Stratasys Ltd. (NASDAQ: SSYS), MGI Digital Graphic Technology (OTCMKTS: FRIIF), Prodways Group SA (EPA: PWG), Reinshaw plc (OTCMKTS: RNSHF), 3D Systems Corporation (NYSE: DDD), HP Inc. (NYSE: HPQ) and Organovo Holdings Inc. (NASDAQ: ONVO).

While these companies are mainly in the computers, phones & household electronics sector (25.95%), this ETF also has holdings in companies that produce software and IT services (24.32%), machinery, equipment and components (16.83%), professional & commercial services (8.25%), biotechnology and medical research (5.09%) and health care equipment (5.09%).

The fund currently has $38.45 million in assets under management and an average spread of 0.97%. It also has an expense ratio of 0.66%, meaning that it is more expensive to hold in comparison to other exchange-traded funds.

In terms of PRNT’s MSCI ESG Fund Quality Score, PRNT’s score of 5.75 ranks in the 51st percentile within its peer group and in the 58th percentile within the global universe of all funds in the MSCI ESG Fund Metrics coverage.

This fund’s performance has been quite solid in the long term. While it only has climbed 0.01% in the past month, it rose 12.04% during the past three months and jumped 14.81% year to date.

Chart courtesy of StockCharts.com

In short, while PRNT does have several advantages over some of its peer funds and provides an investor with the ability to profit from some truly cutting-edge technology, this ETF’s risks and costs are not zero.

Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their portfolios.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

***************************************************************

We All Scream for Ice Cream: A Joe Biden Update

Things don’t look too good for Joe Biden at the moment. The former vice president and longtime U.S. senator from Delaware hasn’t even officially launched his 2020 presidential bid. Yet “Uncle Joe” is already facing a slew of allegations that his “tactile politics,” as the New York Times described it, could short circuit his candidacy before it ever begins.

Now, in fairness to Mr. Biden, he hasn’t been accused of any crime or sexual harassment by any of the women speaking out on how his personal style made them feel “weird and uncomfortable.” Yet in a Democratic primary race which looks to be a sprint toward the most ludicrous “woke” policies on economics, race, gender and social justice issues, the former vice president’s “old school” approach of pressing the flesh isn’t likely to win him the nomination.

That’s just fine by me, because a Biden presidency wouldn’t be good for the country. I base that opinion not only on my disagreements with him on policy, but also on my personal interaction with the man.

In August 2008, I wrote a humor-laced reflection on the nearly five hours I spent sitting next to then-Sen. Biden on a flight from Washington, D.C. to Los Angeles. And given the recent headlines regarding Mr. Biden, I thought I would republish that piece for you today in The Deep Woods.

So, please enjoy my reflections on the former vice president in the following article titled, “We All Scream for Ice Scream: A Joe Biden Tale.”

********************

You can tell a lot about a man by the way he eats.

Some men like to sit down to a meal, take their time and savor each and every morsel of food and drink. People like this tend to be thoughtful, meticulous, confident and in many cases, hedonistic. How do I know this? Well, I’ve been known to spend more time than most getting through a multi-course, wine-paired meal.

Still, other men like to dig right into their prize, attacking the meal with fervor and a literal hunger for life that reveals their carpe-diem approach to the world. This type of person tends to be decisive, purposeful, driven and a born leader. My favorite example of this type of eater is my good friend and fellow investment guru Doug Fabian.

But what do you say about a man who eats his meal in reverse order?

That thought has plagued me ever since I sat next to Sen. Joe Biden on a flight from Washington, D.C. to my hometown of Los Angeles, California. Sen. Biden was on his way to L.A. for an appearance on HBO’s “Real Time with Bill Maher,” while I was returning home from my annual pilgrimage to the nation’s capital for a meeting with friends, publishers and people from some of my favorite think tanks.

After exchanging pleasantries with the senior senator from Delaware, Biden wasted no time in digging right into his criticisms of the war in Iraq, and what he perceived to be the folly of the Bush administration. I expected nothing less from the senator, as he’s known for his outspoken critiques and his shoot-from-the-hip commentary.

What I didn’t expect was a lesson in how to eat a meal backwards.

Now, since I had the benefit of first-class seating accommodations during this journey, the flight attendants were very conscientious when it came to serving what was a surprisingly tasty meal. The first course was a salad with Italian dressing, which was followed by a main course of a plump, well-seasoned chicken breast and a side of rice. The best part of the meal for me was the dessert, which was a generous scoop of gourmet chocolate ice cream.

I ate my meal with my usual casualness, and in the aforementioned order. Sen. Biden, however, took a different path. Biden accepted the salad, but he put it aside and saved it for later. When the main course came, he politely rejected it. But when the ice cream came, Biden’s fervent personality really came out. He emphatically asked for a serving, although he had not yet eaten any food.

Biden ate his ice cream while we discussed Kevin Phillips’ book “American Theocracy,” the then-latest critique of the Bush administration’s religious overtones. After eating the ice cream, Biden pulled out a hefty ham sandwich from his briefcase and consumed it in a deliberate and determined fashion. Once the sandwich disappeared, the senator turned to the only remaining bit of food left on his tray table, the salad.

As I watched this reverse-order meal consumption, a thought occurred to me: Is this why the federal government is so screwed up? Is Sen. Biden’s backwards approach to a meal indicative of what’s wrong with Washington? Does this backwards eating pattern explain why the government does everything less efficiently and less effectively than the private sector?

Given my theories on discerning knowledge of a person based on how they eat, what was I to make of Sen. Biden’s meal habits? The only logical conclusion is that Biden looks at the world — shall we say — differently from the rest of us. And while there is nothing wrong with a little different perspective on things, I don’t think I want someone a heartbeat away from the presidency who eats his ice cream first.

The next thing you know is that person will advocate raising taxes to stimulate the economy, negotiating with our ideological enemies as a means of portraying strength and railing against judges who think that interpreting the Constitution is the only proper function of the courts.

Wait a second… that’s what Biden wants?

I knew there was a reason why he ate the ice cream first.

*********************************************************************

A Soul in Bloom

“If you’ve never been thrilled to the very edges of your soul by a flower in spring bloom, maybe your soul has never been in bloom.”

— Audra Foveo

I receive a lot of quotes from readers for use in The Deep Woods, and most of them are fantastic. Today, I wanted to single out a quote I received from reader Angela N., as it’s one of the most beautiful sentiments I’ve ever read.

The way I see it, this thought speaks to the power of marveling in what is seemingly ordinary but is actually extraordinary when you get down to the science behind it. Another way to put it is that when you look at anything in this beautiful world, always try to look at it through the prism of principles. And, always try to peel the onion skin of meaning down another layer. Doing so will make things just that much more beautiful, and it also will help your thinking evolve into a thing of beauty.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods