How a Philosopher Taught Me to Trade Options

Alright, I know what you’re thinking. How the heck did a philosopher teach me how to trade options?

Well, if you’ve been a reader of The Deep Woods for even just a short time, you likely know that I am a huge advocate of cultivating and integrating all kinds of knowledge about the world — and not just knowledge that’s directly related to stocks, bonds, exchange-traded funds (ETFs) and options.

The way I see things, it’s important to cultivate and integrate knowledge from wherever you find it, including from sources such as pop culture, literature, science, religion, music, history, art, biology, psychology — and especially philosophy.

Doing so makes you a better, well-rounded human, and I think it also makes you a better investor. The reason why is because the more you know about why you’re doing things, the better you get at doing them.

Still, what do I mean when I say a philosopher taught me how to trade options? Well, to understand this, we must go back about 2,500 years ago to pre-Socratic Greece and learn about the man named Thales of Miletus.

Thales was a brilliant philosopher and one of the first real Western thinkers and scientists (although “scientist” wasn’t a term that was used at the time). He is best known for his thesis that “all things are water,” which we know now to be erroneous, but was a groundbreaking thought, given the scientific infancy of 6th century B.C. Greece.

Moreover, Thales was among the first thinkers to make hypotheses that were testable and falsifiable, both bedrock principles of scientific inquiry today, but absent among his fellow thinkers at the time.

According to the Internet Encyclopedia of Philosophy, none other than the great Aristotle identified Thales as the first person to investigate basic principles, the first to question the origins of substances and matter and, therefore, the founder of the school of natural philosophy.

Among his accomplishments was the successful prediction of an eclipse of the sun that occurred on May 28, 585 B.C. Although it’s not known exactly how Thales was able to predict this event, the most likely explanation is that he studied the solar and lunar cycles.

Yet still, what did I learn about trading options from Thales?

To answer that, we must realize that Thales was a philosopher and a man not particularly concerned with the accumulation of monetary wealth. And because of his lack of finances, he often was criticized by the elites of Athenian society. To prove the elites wrong, and to demonstrate the power of reason and natural philosophy, Thales did something that should put him in the investing history books.

Based on his study, assessment and knowledge of the Greek climate, Thales reasoned that there would be a particularly good harvest for olives one year. But rather than sit on this information, Thales had taken the next step and put deposits down on all the olive presses in Miletus over the preceding winter.

Thales basically cornered the market on olive presses for a small investment. Stated in modern trading terms, Thales bought call options on olive presses and paid a small amount for the right to control those presses (i.e., he paid a small premium for the options).

When his prediction of a bountiful olive harvest did indeed come to pass, Thales’ bet paid off handsomely. The boom harvest created heavy demand for the olive presses, and because Thales held a virtual monopoly on these presses, he was able to rent them out at a huge profit.

In my opinion, this was perhaps one of the most important events not only in market history, but in the whole of human history.

The reason why is because Thales demonstrated that “science” and the accumulation of wealth really are connected. And, as the old saying goes, knowledge is power. He also demonstrated that if you know what your competition doesn’t, you will have a tremendous advantage over them.

It is for this life lesson, as well as the accompanying investing lesson of Thales and the olive presses, that we should be thankful for the man from Miletus.

I know I am thankful for him, as his foresight and virtual creation of the concept of options trading has allowed me to help investors make some serious profits. And that’s precisely what we have done already in my new High Velocity Options advisory service.

In fact, in the first three weeks we have banked realized gains of 59.47% in Peloton Interactive (PTON) put options, 81.56% in the Invesco S&P 500 Equal Weight (RSP) call options and 88.75% in Western Alliance Bancorp (WAL) call options — all in about three weeks!

Hey, it’s no wonder why we decided to call it “High Velocity Options.”

To find out more about my new trading service, and how you can start making big options profits fast, then I invite you to check out my “High Velocity Options” advisory service right now.

Finally, the next time someone asks who taught you about investing, instead of naming someone conventional such as Warren Buffett, Ray Dalio or John Templeton, tell them about Thales of Miletus.

***************************************************************

ETF Talk: Gold Miners ETF Has Potential to Shine

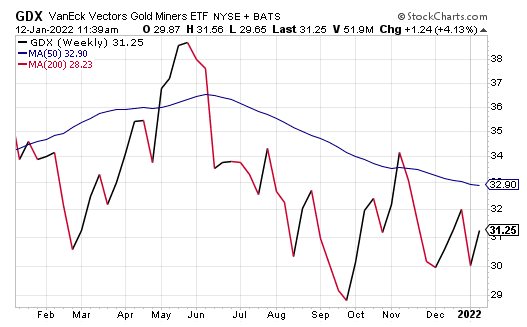

The VanEck Gold Miners ETF (GDX) tracks a market-cap-weighted index of global gold-mining firms.

GDX is one of the most popular funds in the global gold-mining segment. The exchange-traded fund (ETF) is a trading powerhouse with deep primary, secondary and derivatives markets.

Following a 2013 overhaul of the fund’s index, GDX is no longer limited to U.S.-listed firms, nor does it filter out stocks that have hedged their gold exposure with derivatives. In addition, GDX includes companies that mine precious metals other than gold, so it’s not entirely pure-play gold miners.

GDX includes all the major names, but the fund’s broader take on the gold-mining space means that the big mining companies get less weight than in a neutral benchmark. As an industry benchmark, GDX falls a bit short, but it’s still hugely popular with investors.

The exchange-traded fund has amassed $12.7 billion in net assets with a 0.03% average spread and 58 holdings. It has a 0.52% expense ratio, meaning it is in the low-medium range of cost to hold in relation to other ETFs.

Source: StockCharts.com

The Gold Miners ETF seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry. This could be a great opportunity for investors looking to get into the gold-mining industry.

VanEck Gold Miners ETF has an MSCI ESG Fund Rating of AAA, based on a score of 8.71 out of 10. The MSCI ESG Fund Rating measures the resiliency of portfolios to long-term risks and opportunities arising from environmental, social and governance (ESG) factors. ESG Fund Ratings range from best (AAA) to worst (CCC). Highly rated funds consist of companies that tend to show strong and/or improving management of financially relevant environmental, social and governance issues. These companies may be more resilient to disruptions arising from ESG events.

However, as with any opportunity, I urge all potential investors to exercise their own due diligence in deciding whether or not this fund fits their own individual portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

Reeducating America, Conceptually

You often hear that education is the key to success. And while I agree with that statement in principle, it’s important to understand that it is the kind of education one gets that really matters.

In the new episode of the Way of the Renaissance Man podcast, I speak with Ed Thompson, a man whose mission is to help reeducate America, conceptually.

Ed is the founder of the Conceptual Education Project, a group spearheading an effort to reform the education system by guiding it away from the current “progressive” philosophy first created by John Dewey, and into a more “conceptual” philosophy.

Jim Woods and Ed Thompson talk “conceptual” education.

The basis of the organization’s program is to help train intellectuals who can articulate and advocate a rational approach to primary and secondary education, with a view to radically influencing how teachers’ colleges teach.

If you are concerned with the current state of the anti-conceptual approach to education that pervades America’s K-12 system, and you want to find out how you can help make things more philosophical, and more conceptual, then this episode is a great place to start.

******************************************************************

In case you missed it…

What Can Go Wrong in 2022

You’ve undoubtedly already seen more 2022 predictions than you care to digest, so I won’t assault you with some arbitrary thoughts about what’s going to happen over the next 12 months. That said, in last week’s “The Deep Woods,” we did speculate on some of the things that could go right in the market in 2022.

That issue was extremely well received by readers and, in a testament to the intelligence and intellectual curiosity of our tribe, the logical follow-up inquiry was: what can go wrong in 2022?

Like I wrote recently, I am an optimist at heart, but I’m also a realist. That means I know there that are always plenty of things that can go wrong, especially when it comes to the markets and the economy. So, what can go wrong in 2022?

This week I am going to provide an excerpt from the Dec. 29 issue of my daily market briefing, “Eagle Eye Opener.” This publication is a joint venture between me and my “market insider,” a macro analyst who provides institutional research to many of the top pros on Wall Street, but who also allows me to share some of his insights each trading day in the “Eagle Eye Opener.”

So, here is what can go wrong in 2022.

There are essentially two major risks to the market as we start 2022. First, the market multiple drops from 20X to something lower. Second, corporate earnings drop.

However, both risks would be the effects of actual events, and they can only happen if something causes them to happen. So, let’s identify those events or causes that would lead to either of those outcomes. If we can recognize the events, we can potentially get defensive ahead of any pullback.

What Could Go Wrong 1: COVID-19 Doesn’t Go Away. Key Indicator to Watch: Case Counts. Markets are fully pricing in that COVID-19 will essentially “go away” in the next several months, either in an actual sense or in a practical sense where people just ignore it, and it doesn’t change daily life. But that is not the reality right now. While Omicron isn’t as dangerous as other variants, it’s still screwing up the economy. Growth will decline in Q4 because of Omicron, due primarily to worker shortages and cancellations of trips and other gatherings.

Additionally, Omicron will only extend the supply chain issues that are one of the main causes of inflation. Here’s why that matters: Unlike before during the pandemic, it’s unlikely the Fed will relax tapering or planned rate hikes due to COVID-19 spikes, unless COVID-19 is a major economic threat. Right now, it’s an economic nuisance, not a threat.

To put it differently, the threat to the economy from COVID-19 now has to far outweigh the potential inflationary impact. Unless that happens (and it’s not happening now), the Fed will keep tapering quantitative easing (QE) and hiking rates even if Omicron is a headwind on growth. That could lead to stagflation, which would be a major headwind on stocks.

What Could Go Wrong 2: Inflation Doesn’t Subside. Next Key Event: Consumer Price Index (CPI) on Jan. 14. Even if Omicron subsides as expected, inflation will have to come down to remove the possibility of the Fed getting too aggressive and tightening too quickly. And while COVID-19-related supply chain problems are part of high inflation, there are other, non-COVID-19 factors pushing inflation higher.

Additionally, if inflation stays high enough for long enough, companies will see margin compression. If inflation is going to come down, then we must see COVID-19 go away to ease supply chain issues.

But even if that happens, it’s still not a guarantee that inflation will suddenly fall back close to pre-COVID-19 levels. Stubbornly, high inflation could lead to 1) The Fed tightening too quickly and 2) Earnings dropping, which would obviously be negatives for stocks.

What Could Go Wrong 3: Fed Commits a Policy Mistake. Key Indicator to Watch: 10s-2s Yield Spread. The sudden hawkish turn in the Fed over the past two months has been nothing short of historic. In December, Federal Reserve Chairman Jerome Powell abandoned the use of the term “transitory” for inflation, and instead doubled the pace of tapering. Meanwhile, the Fed consensus went from one rate hike in 2022 to three!

While not likely, the Fed’s sudden hawkish turn could lead to a policy mistake whereby the Fed hikes too quickly to end inflation, yet those rate hikes snuff out the economic rebound.

The 10s-2s yield spread will be the best indicator of this, as we’d see it invert much sooner than we’d normally expect (which is likely going to be in the first half of 2022).

What Could Go Wrong 4: The U.S. Economy Loses Momentum. Key Indicator to Watch. Is there an economic hangover looming in 2022? There’s no question that the U.S. economic recovery is strong, but it’s not clear how much of that growth has been driven by government stimulus.

Moreover, the decline in fiscal support for the economy in 2022 is substantial and we don’t know how much damage that will do to consumer demand. Additionally, it’s reasonable to assume a lot of the wage increases that are going to happen, have happened, given the improvement in the labor market.

But if inflation remains this high, we could easily see demand destruction if wages level out and there are no more stimulus checks coming from Washington. If that’s the case, the Fed will be hiking into an economic hangover/natural economic slowdown, and we’re looking at stagflation.

As we have consistently said, a 20X multiple is usually a “best case” multiple for the market, and clearly if any of these events happen, the market multiple will drop to something lower and more normal.

In an environment of slowing economic growth or stagflation, the market multiple can drop all the way to 15X, but we think that’s too extreme for these scenarios. So, we think a reasonable multiple if we have any of these negative events is 18X.

The current 2022 S&P 500 earnings per share (EPS) expectation is $226. That gives us a target of 226*18 or 4,068, about 15% lower from here. Now, if we also see expected S&P 500 earnings drop, using a 5% earnings decline, then we are looking at $215*18 = 3,870, or about 19% lower from here.

Now, these are clearly pretty negative scenarios, as it implies a material decline in the macroeconomic outlook. But the bottom line is that real risks are present as we start the coming year, and while the negative outcomes for this market aren’t the most likely ones, at the same time, we need to be watching carefully for them. If we see a scenario where the market multiple starts to decline or expected earnings drop, we will need to get defensive and fast. You will hear that from us loudly and clearly.

For more on how you can be forewarned about the “what could go wrong in 2022” scenario, then I recommend subscribing to my “Eagle Eye Opener” daily market briefing today.

Think of it as a market-based, intelligence insurance policy to help you navigate the coming year, and well beyond.

*****************************************************************

Free the Potential

“Free the child’s potential, and you will transform him into the world.”

— Maria Montessori

The education pioneer built the teaching method that bears her name on five distinct principles: 1) Children are shown respect, 2) Kids have absorbent minds, 3) Sensitive periods are critical for learning, 4) Kids learn best in a prepared environment and 5) Kids can teach themselves through auto-education.

These principles are what make the Montessori teaching method so effective, and they are what allow students to free their own potential and think for themselves. If you have young children or grandchildren and you are looking to educate them wisely, start off by checking out a Montessori school.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.