Give the Gift of Ideas

There are only a dozen or so shopping days left until Christmas, and while I hope you are close to completing your holiday list, I suspect that you still may have a few names you haven’t crossed off just yet.

Hey, I know gift giving can be difficult, as it is often hard to find the right present for someone. Fortunately, I had some help on this front from a wise mentor of mine, who told me some years ago that he had two rules when giving gifts.

The first applies more to a man courting a woman, and it goes like this: “The key to a woman’s heart is an unexpected gift at an unexpected time.”

From experience, I can confirm that this maxim works exceedingly well.

As for maxim two, it is as follows: “It doesn’t have to be expensive, but it does have to be special.” This rule doesn’t just apply to lovers, but to all of us during the holidays.

Now, I am of the opinion that the most special gift you can give or receive, and the gift that matters most, is the gift of ideas.

That’s why today, I am going to tell you about some of my favorite holiday gifts, gifts brimming with great ideas.

The easiest, most cost-effective and arguably the best way to give ideas is through books. Whether it is a great work of literature, an insightful self-help manual or a great “how to” book on a subject close to the recipient’s heart, a really good book has got to be my all-time favorite special gift to give (and one that also happens to be inexpensive).

For those who love literature, fiction, action, adventure, mystery and philosophy, then give the gift that asks, “Who Is John Galt?” Here, I am recommending the greatest novel ever written (in my not-so-humble opinion), “Atlas Shrugged” by Ayn Rand.

If you’ve read the novel, you know how brilliant it is. But if you haven’t read it in some time, give yourself a gift and read it again. And, if you have any young minds on your holiday shopping list, then giving them “Atlas Shrugged” will make them remember you forever — and it may indeed alter the course of their lives the way it altered mine.

For those who prefer self-help style works, I recommend one of the original works on how to be human, “Meditations,” by Marcus Aurelius.

This work is more than 2,000 years old, but the wisdom in it applies to what you are doing right now — and what a human being should do every day to maximize their time on earth. The insights, wisdom and practical guidance delivered on every page of this work are amazing, and the subjects vary from how best to deal with life’s inevitable adversity to how best to interact with others. I also highly recommend the Gregory Hays translation, as I think it is the smoothest and most poetic out there.

As for the “how to” category, well, I’ve always felt that a collection of wisdom from the best brains in that industry has been most special to me. And on this front, there is no better “how to” anthology than the one by my friend, fellow Fast Money Alert co-editor and brilliant economist, Dr. Mark Skousen.

The work I am specifically referring to here is “The Maxims of Wall Street.” This is a collection of some of the greatest wisdom ever to flow from the biggest and brightest names on Wall Street. Great investors such as Jesse Livermore, Baron Rothschild, J.P. Morgan, Benjamin Graham, Warren Buffett, Peter Lynch and John Templeton are just a sneak peek at some of the names you’ll discover in this fantastic collection.

Then, there is profundity from the likes of Ben Franklin, John D. Rockefeller, Joe Kennedy, Bernard Baruch, John Maynard Keynes, Steve Forbes and numerous other luminaries too copious to mention.

Your editor with his signed copy of “The Maxims.”

As Mark puts it, “For years, I’ve been compiling these financial adages, ancient proverbs and immortal poems found in new and rare financial books and quoted regularly by investors, money managers, brokers and old timers.”

So, whether this gift of ideas is to yourself or to someone special, you should definitely do everyone a favor and give “The Maxims of Wall Street” to those you value.

Now, for those who are into health and fitness, there’s one must-read book full of brilliant ideas on the subject that I recommend with all my being, and that book is “Body by Science” by Dr. Doug McGuff and John Little.

This work presents a scientifically proven formula for maximizing muscle development in the briefest time possible (although don’t confuse brevity with being easy, because these workouts are killers!). Yet, the best part of the “Body by Science” protocol is that you can do it in about 12-20 minutes a week.

And while that may seem like an incredible claim, it is one backed by rigorous research. Moreover, I can tell you from personal experience that this training works, as the concepts contained in this work have been the basis of my workout protocol for the past three decades.

So, there you have it, a few practical ideas on how to give the best gift anyone can ever give or receive — the gift of ideas.

***************************************************************

As we wind down 2023, let’s look at those exchange-traded funds (ETFs) that haven’t quite hit the high notes.

In this analysis, we’ll dive into the realm of dividend ETFs that could potentially rebound as flight-to-safety plays, if there is a recession next year. If you’re up for braving a bit of risk in the coming year, consider taking the leap and investing.

Despite their underwhelming performance, dividend growth funds have become the go-to strategy for long-term investors seeking a steady income flow. These ETFs will not only infuse a portfolio with cash, but also offer a chance for investors to diversify.

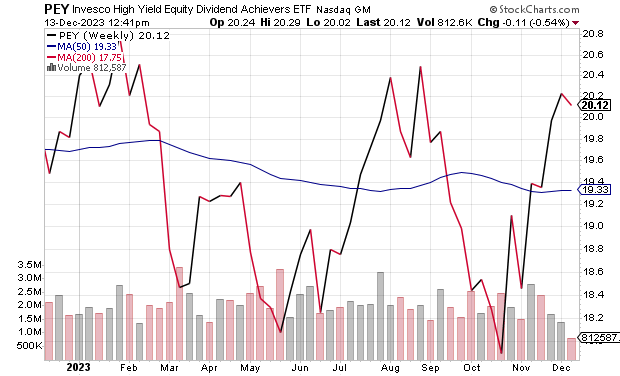

One ETF that caught my eye is the Invesco High Yield Equity Dividend Achievers ETF (PEY). This smart-beta index fund selects 50 of the highest-yielding dividend stocks from the NASDAQ U.S. Broad Dividend Achievers Index. With a decade-plus track record of raising dividends, this ETF is worth considering. Even if it may lag during strong markets, it performs extraordinarily well during periods of low and negative equity returns.

What makes dividend funds like PEY even more attractive to investors is the fact that it pays dividends monthly and has continually increased its income contributions in the past 10 years. Having invested at least 90% of its total assets in stocks with dividend increases ensures consistent growth.

Not all dividend stocks qualify for PEY. To earn a spot in this ETF, companies must have a solid track record — boosting their annual regular cash dividend payments for the last 10 consecutive calendar or fiscal years. Additionally, companies must meet a minimum market capitalization mark of $1 billion to be eligible for inclusion. The index is reconstituted annually and rebalanced quarterly on a rigorous schedule.

PEY boasts a diverse portfolio, allocating to various sectors, including financials, utilities, consumer staples, materials, communications services, consumer discretionary, industrials, energy, information technology, real estate and health care. There is something for everyone in this diverse mix, so why not consider investing?

Geographically speaking, this ETF seems to provide an interesting opportunity for investors, with a total of 97.87% of holdings based in the United States and the remaining holdings based in Switzerland (2.13%).

However, it is important to stay vigilant of the risks involved with investing in dividend ETFs like PEY. One risk is the possibility of a negative return.

Top holdings in the portfolio include Verizon Communications (NYSE: VZ), Altria Group Inc. (NYSE: MO), Universal Corp (NYSE: UVV), KeyCorp (NYSE: KEY), The Scotts Miracle Gro Co. Class A (NYSE: SMG), Northwest Bancshares Inc. (NASDAQ: NWBI), Truist Financial Corp. (NYSE: TFC), Lincoln National Corp. (NYSE: LNC), Walgreens Boots Alliance Inc. (NASDAQ: WBA) and Sandy Spring Bancorp Inc. (NASDAQ: SASR). These constitute 28.49% of total assets according to Yahoo Finance. Overall, there is a total of 50 holdings in the PEY portfolio.

As of December 12, 2023, this fund is up by 5.91% over the past month, 0.87% for the past three months and 1.13% year to date.

The fund has $1.3 billion in net assets under management, and an expense ratio of 0.52%. The year-to-date daily return of the fund is 2.19% and the current dividend yield is 5.12%, as of Dec. 11. Meanwhile, the price-per-earnings (PE) ratio recently stood at 10.71.

Source: StockCharts.com

Overall, dividend ETFs hold promise for long-term investors seeking high-yield returns. Dividend ETFs such as PEY show their potential resilience amid market uncertainty. While PEY boasts a track record of dividend growth and a diverse portfolio, investors must navigate eligibility criteria and associated risks.

With its predominantly U.S.-based holdings, coupled with a sprinkle of Swiss assets, recent gains and manageable expenses, PEY may seem alluring. Yet, investors should be familiar with the associated risks.

I am always happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

The Skinny on Weight-Loss Drugs

America loves weight-loss drugs.

Here, I’m talking about the newest class of weight-loss drugs, the “GLP-1 drugs.” Indeed, the long-term impact of GLP-1 drugs has been a significant story in markets throughout 2023, but lately its had a bigger macro impact as expectations for this drug have resulted in substantial gains for specific large-cap pharmaceutical stocks and recent significant weakness in previously “safe” food stocks that’s contributed to the underperformance of the consumer staples sector in 2023.

The reason these GLP-1 drugs have had such a varied and broad impact on different parts of the market can be summed up by this statement: There are expectations that these GLP-1 drugs could result in substantially less food consumption across the country in the coming years. They literally could reduce the demand for food!

In a recent issue of our daily morning briefing Eagle Eye Opener, my “secret market insider” and I presented an analysis of the potential impact of these weight-loss drugs on different parts of the market, as they are becoming an increasingly popular topic amongst investors. Here, we explained 1) What GLP-1 drugs are (and what they do), 2) Why they’ve impacted markets and 3) How to gain exposure to them (and, for contrarians, what food and staples ETFs have underperformed because of GLP-1 drug concerns).

Let’s take a look at that analysis now, as it could turn skinny investor pockets fat!

What are GLP-1 drugs? The brand names of two of the most popular GLP-1 drugs are Ozempic and Wegovy (both produced by Novo Nordisk (NVO)). GLP-1 drugs were initially designed as a diabetes drug, as GLP-1 drugs stimulate the body to produce more insulin after someone has eaten. The extra insulin helps to reduce sugar levels and has proven very effective in controlling Type-2 diabetes. But along the way, users of the drugs noticed a side effect: They weren’t as hungry and lost weight. Studies have found that using GLP-1 drugs can lead to 10-15 pounds of weight loss. Given that, these now are being marketed as weight loss drugs and their popularity has exploded.

Why has this impacted markets? In short, because a lot of people are starting to use them. In the second quarter, sales of Ozempic rose more than 50% from a year ago (from $2.1 billion in 2022 to $3.2 billion), while Wegovy sales rose 30% from 2022 (to $1.1 billion). That’s having a direct impact on two of the biggest pharma stocks that have “first mover advantage” in this space.

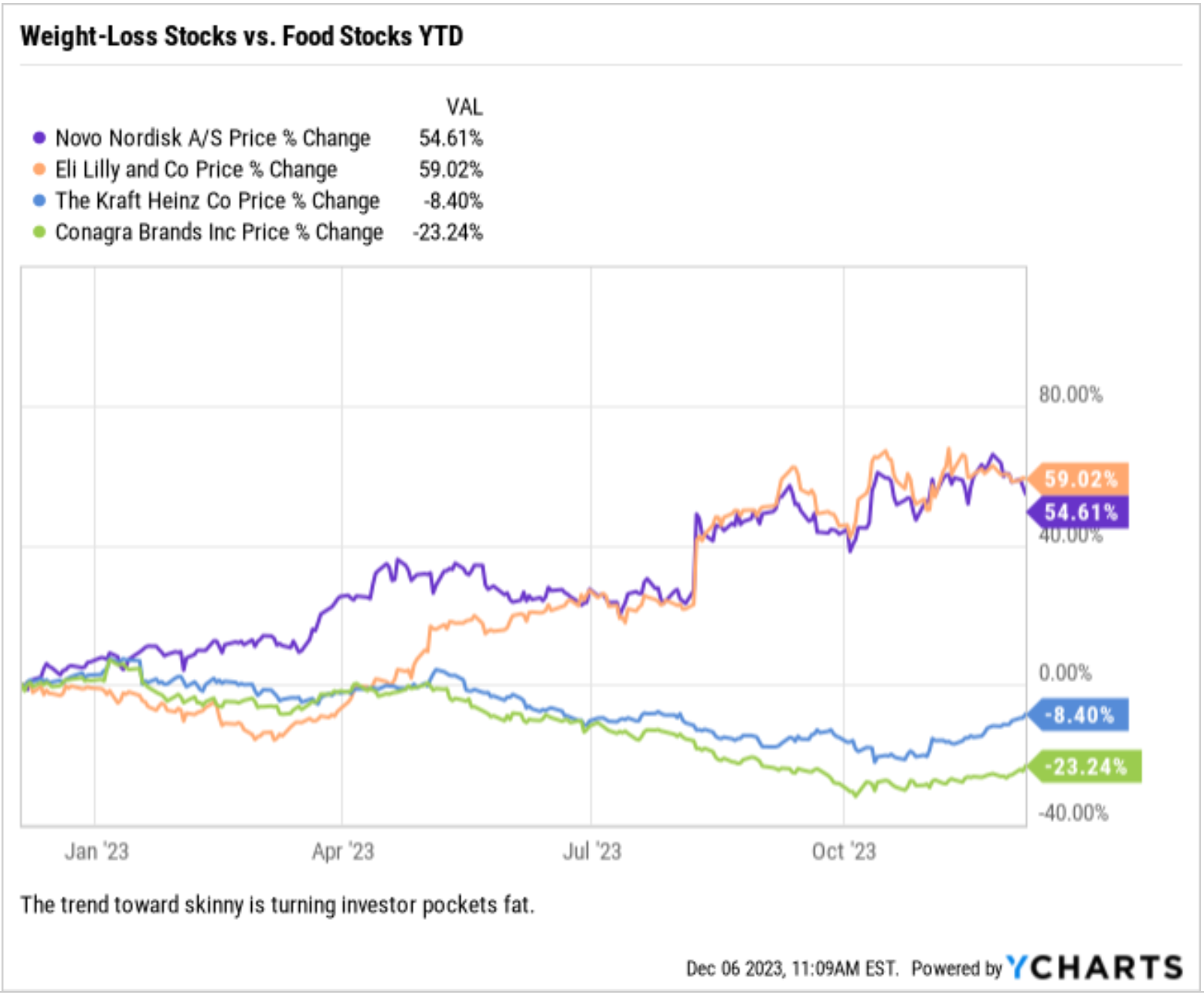

Novo Nordisk, who has two GLP-1 drugs (Ozempic and Wegovy), has risen 54.5% year to date (YTD). Eli Lilly (LLY), who manufactures Mounjaro, is up nearly 59% YTD (full disclosure, I am long both NVO and LLY in my newsletter advisory services). Conversely, pharma names that are not in this space have seen less-stellar returns. Merck (MRK) is down 5% YTD, while Pfizer (PFE) has collapsed 42%, in part due to collapsing Covid vaccine demand.

While certain pharma names have benefitted, a lot of processed food companies have seen their stocks fall sharply on concerns that, over the long term, widespread adoption of these GLP-1 drugs could structurally reduce demand for processed foods. Companies such as Kraft (KHC), Conagra (CAG) and Mondelez (MDLZ) have lagged the S&P 500, and in the cases of Kraft and Conagra, posted substantially negative returns (down 8.5% and 23% YTD, respectively). The reasoning here is clear: Estimates for GLP-1 drug usage forecast 25-50 million users by 2030.

If GLP-1 drugs reduce appetites by 10-20%, then the impact of aggregate food consumption will be in the low-single-digit-percent range (according to Bank of America). For the food companies, that’s evaporation of real and substantial demand. Being, it’s anecdotal and still early, but the risk here to food companies is real.

Finally, because food companies are a large part of consumer staples ETFs, their poor performance has negatively impacted the returns of the Consumer Staples Select Sector SPDR (XLP) and other consumer staples funds. XLP has declined 7.9% YTD, and while part of that has been the lack of a growth slowdown and higher yields that makes high dividend stocks less attractive, another part of this underperformance has been concerns about food demand. Food products account for 17% of XLP, while the impact of potentially reduced caloric demand can impact the grocers and the food-inclusive retailers.

The point being, food processors and large retailers with food exposure aren’t as big a weight on the market as tech, but they’re not unsubstantial, either. Meanwhile, those types of industries are heavily weighted in consumer staples ETFs and some dividend-focused ETFs. Bottom line, the evolution of these GLP-1 drugs and how they impact food demand is something all investors need to watch going forward.

So, what is the best way to get exposure to GLP-1 stocks, and what food stocks could be a contrarian opportunity?

For targeted GLP-1 exposure, obviously buying Novo Nordisk (NVO) and Eli Lilly (LLY) gets the job done as these two names are leaders in the space.

From an ETF standpoint, there are many pharmaceutical ETFs in the market today. The largest pharma ETF, the iShares U.S. Pharmaceuticals ETF (IHE), doesn’t have exposure to Novo Nordisk, which is a problem if the goal is GLP-1 exposure. Instead, the VanEck Pharmaceutical ETF (PPH) (here again, we are long PPH in my newsletter advisory services) is a better choice as Eli Lilly (LLY) is the largest holding (8.3%) while Novo Nordisk (NVO) is second at 6.5%.

Additionally (and presumably), most major pharma companies will invest in these GLP-1 drugs (PFE has a once-daily weight loss GLP-1 drug in development, as do most other major pharma companies) so we can expect other pharma names to release their versions in the coming year. Bottom line, PPH provides broad pharma exposure but also provides relatively large allocations to the two market leaders in the GLP-1 space.

Switching to the losers of the GLP-1 drug story (and for the contrarians out there), the case can easily be made that a lot of these longer-term forecasts about food demand destruction are overblown, and as such, there’s opportunity in the food names.

The Invesco Food and Beverage ETF (PBJ) has lagged the broader markets this year (down 5.7%), in part because of GLP-1 demand concerns. Some of the largest holdings in PBJ are the negative-exposed GLP-1 names, including Kraft Heinz (KHC) and Mondelez (MDLZ). PBJ trades at just 13.9X forward earnings and sports a yield of 2.41%. The point being, the underperformance has created value for those value-oriented types.

The anticipation of the impact of GLP-1 drugs has influenced specific stocks and sectors both positively and negatively, and that’s not likely to change. Given this potential and the topic in the popular lexicon, we think that understanding what GLP-1 drugs are and how they are impacting markets is important, especially for those interested in either side of this trade.

Did you like what you just read? Do you want this kind of analysis every morning before the market opens? If so, then you need to subscribe to the Eagle Eye Opener, today.

For just a skinny price, you can read about all kinds of ways to make your pockets fat!

*****************************************************************

The Way the Winds Blows

We can only grow the way the wind blows

We can only bow to the here and now

Or be broken down blow by blow

— RUSH, “The Way the Wind Blows”

Growth and living in the moment. These are two notions that are critical to a happy life, but that so often get lost in the chaotic mix of pressing existence. If we want to avoid being broken, we must strive to grow the way the wind blows.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods