For the Love of Conversation

IMPORTANT ANNOUNCEMENT: We are having our Eagle Virtual Trading Event on Thursday, Jan. 19. If you haven’t signed up for this yet, there’s still time. Just click here now to sign up for free. Believe me, you won’t want to miss this online event — as we bring together all of Eagle’s investment experts at the same time to reveal our Top 6 Picks for 2023. Reserve your seat now by clicking here.

***************************************************************

Okay, I’ll admit it: I am in love.

No, I am not speaking here of romantic love, as that’s a topic for another forum. Today, the love I want to talk about is the love I have for conversation, my love of exchanging ideas and my love of persuading someone that what I think to be correct is a point of view that they might also want to consider.

First off, notice how I said that I am love with conversation, and not with argument. Yes, from a formal education perspective, I’ve been trained to analyze complex arguments. I spent my undergraduate years at UCLA honing this skill while earning my B.A. in Philosophy. But argument in the adversarial, confrontational sense is not what I love.

What I love is a conversation where both parties can exchange even diametrically opposed views and still come out of the experience with a richer understanding of the opposing side, and perhaps a greater understanding of the strengths and flaws of their own side. And while this can be difficult at times, it also can be a profoundly rewarding experience.

Yet as my father often told me, when you engage in any difficult pursuit in life, you want to “make sure the juice is worth the squeeze.” That was his way of saying that if you engage in any pursuit or any exchange, you should first consider whether it’s worth your time and effort.

Unfortunately, in our ultra-polarized political and social milieu, it has become increasingly difficult to come to the conclusion that the juice is worth the squeeze. That’s not only true of opposing sides in an issue, but often from people who are mostly of similar opinion on many topics.

I’ll relate two personal experiences here to give you an idea of when the juice is not worth the squeeze, and when it is worth it.

I attended a gathering of libertarian/free-market types last year. This event had two very prominent speakers who conducted an excellent Q&A session after interesting presentations. One of the questions, was, however, incredibly disturbing.

A woman had asked a question about the pandemic and the lockdowns, a question which contained in it a very negative assessment of Dr. Anthony Fauci, and how he has handled the public communication on COVID-19. Then she ended her question by asking the speakers the following: “So, who is worse, Dr. Fauci or Dr. Mengele?”

The room sort of gasped, and rightly so. And to their credit, the speakers pivoted, basically brushing the comment aside as that of a disturbed person who equated one of the world’s leading experts on immunology and infectious diseases with one of the most despicable characters in human history, a Nazi doctor who performed heinous medical experiments at the Auschwitz death camps.

Later that evening, I was engaged in a great conversation with several people, and this same woman rudely interrupted our conversation to start talking about her agenda. I couldn’t help but address her with my assessment of her sickening question, asking her if she really believed that Dr. Fauci and Dr. Mengele were in any way equivalent. Her answer (prepare to be stunned): “Dr. Fauci is worse, at least Dr. Mengele didn’t kill anyone.”

I immediately knew that conversing with this woman was an example of the juice not being worth the squeeze, because what do you say to someone who is this ignorant and this confused? Does she not know that Dr. Mengele was called the “Angel of Death?” A person such as this is not subject to rational discourse, and she proved it with basically every word she uttered. My advice is to not waste your time with these sorts. The juice ain’t worth the squeeze.

On the opposite, and much more hopeful, end of the spectrum was an interaction I recently had with a neighbor of mine. This man was a self-proclaimed political progressive who is proudly in the Bernie Sanders wing of the Democratic Party.

He and I were talking politics during a weekend barbecue at a nearby ranch, and I told him that while I disagreed with Sen. Sanders on policy, I understood why his views had such strong appeal. In fact, I even referred my neighbor to my Feb. 20, 2020, article on the subject.

I explained that the reason why I thought Sanders is so appealing to so many is because he doesn’t just talk about policy, he talks about policy in moral terms. Policy isn’t just about what works or what maximizes the social welfare. Policy, according to Sanders, is about what’s morally right and wrong.

This Sanders supporter admitted that he never thought of it that way, and that he agreed with me upon reflection. From there, I was able to talk about this issue in moral terms, explaining to him that I thought it was immoral for government to punish the highest achievers in our society and to redistribute their achievement to others by force (i.e., taxation).

My moral assessment of that premise is that it is theft, and prohibition against theft is a moral principle that every society in history has abided by. I further explained that what I would like to see is a politician arguing in favor of capitalism — not just on utilitarian grounds, but also on moral grounds.

Those grounds are that capitalism is the only economic system that supports individual rights, property rights and freedom from force and coercion, either by other individuals or by a collection of individuals known as government.

The result of this exchange was that my neighbor learned more about his own position, and why he held it. Moreover, he learned much more about my position, and why I held it. And not just in some tribal, red state vs. blue state paradigm. Rather, I was talking to this man about moral principles, and how they operate in politics.

We both came away from our discussion gratified, and in this case, the juice was definitely worth the squeeze.

So, whenever you’re interacting with others, or whenever you choose to take on a difficult task (or really whatever you choose to do in life), I recommend determining whether the juice is worth the squeeze.

If it’s not, then find a squeeze that is worthy of your life. And most importantly, surround yourself with those who also have a love of conversation, and who can engage in the rational quest for enlightenment.

***************************************************************

ETF Talk: Invest in Media and Entertainment with This Fund

Buy when there’s blood in the streets.

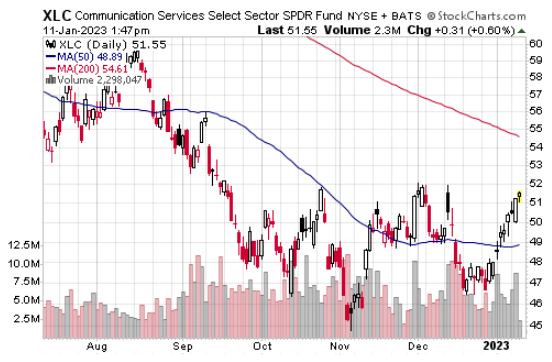

It’s one of the oldest pearls of wisdom on Wall Street, and for good reason. You see, often the sectors that have been bloodied the most one year are the ones that come back the strongest the next year. So, with this bloody notion in mind, I present to you the Communication Services Select Sector SPDR (NYSEARCA: XLC).

XLC tracks a market-cap-weighted index of US telecommunication and media & entertainment components of the S&P 500 index. The Communication Services Select Sector SPDR Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Communication Services Select Sector Index.

It seeks to provide an effective representation of the communication services sector of the S&P 500 Index and to provide precise exposure to companies from telecommunication services, media, entertainment and interactive media and services. It also allows investors to take strategic or tactical positions at a more targeted level than traditional style-based investing.

The fund generally invests its assets in the securities making up the index. The index includes stocks that have been identified as Communication Services companies by the GICS (Global Industry Classification Standard), including securities of companies from the following industries: diversified telecommunication services; wireless telecommunication services; media; entertainment; and interactive media & services. The fund is non-diversified.

Source: www.stockcharts.com

As of this writing, the fund trades around $51.44 a share, giving it a 1.10% distribution yield. Its expense ratio is 0.10%, meaning it is relatively inexpensive to hold compared to other exchange-traded funds.

However, as with any opportunity, potential investors should conduct their own due diligence in deciding whether this fund fits one’s own individual investing needs and portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Warning, Your Answer May Sanction Tyranny

I have one key question for you to answer, because based on your answer, you should be in agreement with me about my conclusions. So, here’s the question:

Do you own your own life?

If the answer is “no,” and you think that another individual or collective of individuals (e.g., the government, a king or a dictator) owns your life, then whatever the collective wants to do with you, or any group of individuals that gather together to achieve a common purpose, is at the whim of the masses or any demagogue with a gun.

If, however, you are like me, and you think the answer to the question is “yes,” you do own your own life, you are therefore free to think and act for yourself, associate with who you want and make decisions about how you run your affairs and your business.

And, as long as you are not violating the rights of others who also own their own lives, then you should be free to act according to what you think is in your best interest, even if it turns out those decisions are not in your best interest.

This principle of self-ownership is at the crux of the current debate over social media companies in the wake of the torrent of dysfunction coming from this space. Although already prevalent, this issue really ramped up about a year ago with the banning and de-platforming of then-President Trump and other conservative voices. Twitter began the wave of bans when it initially suspended and then banned the former president’s personal feed.

Now, you may have been outraged by the banning of Mr. Trump from Twitter. You also may think that this sets a bad precedent, and that companies such as Twitter, Meta Platforms (META) and its social media site Facebook, are psychotic in terms of their bias against conservatives, Trump, other non-mainstream groups and really any individuals or groups that they deem violate their rules, standards and practices. And you may indeed be correct.

And, because it is my opinion that you own your own life, you are certainly free to disagree with these companies’ decisions, and you are free to complain about it to them, or to close your account or to otherwise voice your concern about any of the issues surrounding what the proper function of these companies should be.

What you are not free to do, at least if you are being logically consistent, is to question the individuals that created and manage these companies’ right to own their own lives, and that means their right to decide who to permanently ban and who to de-platform, or how they should be able to run their enterprises.

If you agree that you own your own life, then don’t Elon Musk and Mark Zuckerberg also own their own lives?

Don’t these individuals also have the freedom to make decisions for the companies they created and/or now own, even if those decisions turn out to be bad business moves? If these ideas are unduly biased, the decisions will come back to harm their respective bottom lines, causing them to suffer the consequences.

Indeed, over the past year, both Musk and Zuckerberg have seen their respective net worths plummet, and shareholders in their respective companies also have suffered the consequences. Zuckerberg reportedly lost an estimated $78 billion in net worth last year, as META stock plunged some 63%.

Musk saw his net worth plunge more than anyone in history, with an estimated decline in personal fortune of some $115 billion. Tesla (TSLA) shareholders were largely victims of the backlash against Musk’s move to purchase Twitter and his subsequent self-destructive and bizarre trolling behavior on the platform, behavior that’s caused a backlash among Tesla owners and shareholders. TSLA shares have cratered some 72% over the past year, as Musk’s devalued personal brand has helped take down one of Wall Street’s and corporate America’s greatest success stories.

The wider point here is that both Musk and Zuckerberg are suffering the consequences of their actions. In a free society where individuals own their own lives, that’s how it should be.

Now, if you think that you do not own your own life, and you think that Musk and Zuckerberg also do not own their own lives, that means you are probably in favor of Big Government telling them — and by extension, you — what to do, what to think, what to feel and what you can and cannot say.

And if you don’t think you own your own life, then you also are likely an advocate of “breaking up Big Tech,” as you think that these entities should, in effect, be socialized and deemed a “public utility.”

You also likely believe that the government should tell these individuals how they should run their companies, whom they should allow on their platforms, how much money they should charge for advertising, who they should hire and how much money their employees should make.

In short, if you don’t think you own your own life, then you are an advocate for telling these people — and by extension all people — what to do, what to think and what to feel.

So, it comes down to the main question: Do you own your own life?

If the answer is yes, then you must also agree that Musk and Zuckerberg and any other person or group of persons also have the same ownership and rights to do with their creations as they choose.

If the answer is no, then like so many people in human history, you will have philosophically sanctioned tyranny.

*****************************************************************

Reflective Learning

“We do not learn from experience, we learn from reflecting on experience.”

— John Dewey

I am all for experiencing everything one can in life, because life is both finite and fleeting. Yet if we fail to reflect on our experience in a serious way, we will never truly learn from that experience, regardless of how profound it may be.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.