My Five Favorite Quotes to Live By

- My Five Favorite Quotes to Live By

- ETF Talk: Seeking Solace in a Covered-Call ETF

- Four Questions This Market MUST Answer

- The Joy of Understanding

***********************************************************

My Five Favorite Quotes to Live By

When it comes to the wisdom required to get us through life and to help us navigate its inevitable turbulent swings, sometimes all we need is the power of a great quote.

As a self-described “Renaissance Man,” I’m a big fan of finding wisdom about life from all sorts of disparate sources. That wisdom could come from literature, or from song lyrics, or from sports figures. Yet wherever it comes from, the wisdom we can gather from others can help keep us high during the best of times… and help us keep our heads high during the worst of times.

Here are five of my favorite quotes that apply to both life — and investing.

“Every man’s life ends the same way. It is only the details of how he lived and how he died that distinguish one man from another.”

— Ernest Hemingway

One of my favorite writers, Ernest Hemingway, knew how to live life on the intense edge. Here, the pugnacious novelist reminds us that all that really matters in life is how you spend your days.

When it comes to investing, like Hemingway, you need to be aggressive and intense, as really good results come to those who embrace the action.

“Hemingway” also is the name of my trusty canine.

“I was blessed with talent, but I worked like I had none.”

— Kobe Bryant

The Los Angeles Laker great always worked harder than just about any of his competitors. Could Kobe have coasted on his innate talent and still done well? Probably. However, it was his attitude and work ethic that set him apart from the rest, and that made him one of the greatest players of all time.

Whatever you do in life, if you adopt the work ethic and attitude of Kobe Bryant, you are likely going to do very well.

If I took the time to bleed from

All the tiny little arrows shot my way,

I wouldn’t be here!

— Rollins Band, “Shine”

In-your-face punk rocker Henry Rollins is a personal hero of mine, as his focused lyrics and penetrating ideas on cultivating strength of will are indeed inspirational.

Here, Rollins reminds us that you are always going to be criticized by others for what you do. And so what?

Do what you think is best and ignore the haters, as they’ll always want to shoot arrows your way.

From first to last

The peak is never passed

Something always fires the light

That gets in your eyes

— RUSH, “Marathon”

The quintessential progressive rock trio has the best lyrics in all of rock music. In this song, RUSH tells us that no matter how much you achieve, you can always challenge yourself and achieve more.

This is a great lesson for anyone because no matter how well you do, you can always be a little smarter, a little savvier and a little more fulfilled.

“The quickest descent into unhappiness is to constantly compare yourself to others.”

— Jim Woods

This final one is my own, and it’s helped keep my restless mind in check on countless occasions.

While it’s natural to gauge your success in life by the success or lack thereof in others, you will drive yourself crazy if you obsess over what others have, or how others are living or what others have achieved.

To be truly happy, you need to be happy with your own striving for success, and for your own victories. In fact, the only person you should compare yourself with is you.

So, strive to be better than you were the previous day. If you can achieve that, you’ll be on the path toward happiness.

***********************************************************

ETF Talk: Seeking Solace in a Covered-Call ETF

As global uncertainty continues to thrive during the COVID-19 pandemic and the war in Ukraine, and inflation increasingly makes its economic effects known, investors have once again been impelled to find a source of refuge from the bulls that are bringing large sectors of this market down. One such sanctuary is to utilize a covered-call investment strategy.

For those who are less seasoned investors, a covered-call strategy is when an investor writes calls against a stock that he or she owns and then collects the premium when the option expires. This strategy can continue ad infinitum until the trader decides to sell the stock.

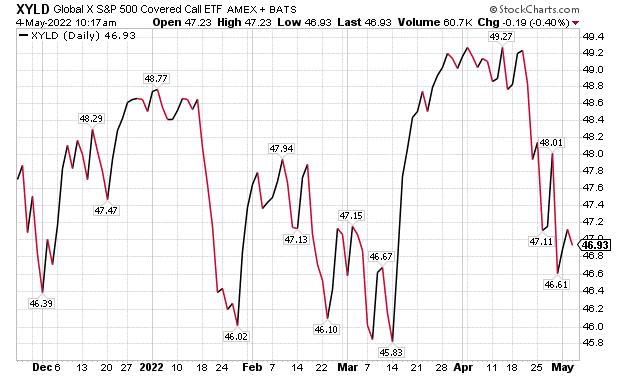

While this can be done on a stock-to-stock basis, it can also be done more efficiently under the umbrella of an exchange-traded fund (ETF). An example of such a fund is the Global X S&P 500 Covered Call ETF (NYSEARCA: XYLD). Specifically, XYLD writes one-month, at-the-money call options on the index of S&P 500 stocks that it holds.

Currently, the fund’s top holdings include Apple Inc. (NASDAQ: AAPL), Microsoft Corp. (NASDAQ: MSFT), Amazon.com, Inc. (NASDAQ: AMZN), Tesla Inc. (NASDAQ: TSLA), Alphabet Inc. Class A (NASDAQ: GOOGL), Alphabet Inc. Class C (NASDAQ: GOOG), Berkshire Hathaway Class B (NYSE: BRK.B) and UnitedHealth Group Inc. (NYSE: UNH).

As of May 3, XYLD has been down 4.15% over the past month and 0.50% for the past three months. It is currently down 2.87% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $1.57 billion in assets under management and has an expense ratio of 0.60%.

In short, while XYLD does provide an investor with a way to use covered calls, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

Four Questions This Market MUST Answer

The market has come under severe selling pressure, and nothing has told us that more than the price action since last Thursday, when stocks began to plummet on a combination of hawkish “Fed speak” and global growth concerns.

In early trading on Wednesday, April 27, markets rebounded a bit, but that isn’t much consolation for the bulls, as stocks in the Nasdaq Composite officially entered in bear market territory (i.e., more than 20% below their most recent highs).

So, what is it going to take for stocks to begin a marked improvement from here?

To answer that question, the market needs to answer four key questions. And fortunately, my “secret market insider” and I took on these four key questions in today’s issue of the Eagle Eye Opener.

In fact, subscribers to this daily market briefing already knew about these four questions before the market opened today, so they had a head start on what the pros are focusing on.

Today, as a courtesy, and as a self-admitted attempt to bring you on board as a subscriber to Eagle Eye Opener, I am putting in an excerpt from that critical issue. So, here we go…

Four Questions for the Selloff: Why Have Stocks Dropped to the March Lows? What’s Holding Up Best? What Makes This Stop? How Bad Can It Get?

On April 26, the Nasdaq closed at fresh year-to-date (YTD) lows and the S&P 500 closed essentially on YTD lows, as the selling over the last several trading days has been intense. Given this steep decline and the fact that the S&P 500 is teetering on important support, I wanted to step back and clearly explain: 1) Why have stocks dropped so sharply in less than a week? 2) What’s holding up best through this rout? 3) What makes this stop? 4) How bad could it get?

Why Have Stocks Dropped to YTD Lows? The S&P 500 has declined 7% in just five trading days. If there is a singular reason “why,” it is rising worries about a global recession. Notably, it’s not coming from the United States or the Fed. The outlook for Fed policy hasn’t changed nearly as much as the drop in stocks would imply.

Instead, it’s coming from overseas. China is doubling down on its hopeless “Zero COVID-19” policy, whereby it shuts down huge cities and essentially causes economic “brownouts” to stop the spread of COVID-19. And since that’s a futile strategy that won’t work, markets are concerned this will go on in perpetuity. Meanwhile, these temporary economic shutdowns are more than offsetting the stimulus from Reserve Ratio cuts (and all other stimulus). Bottom line, if the Chinese economy plunges into recession, it’s bad for every major economy, including the United States.

Meanwhile, as we stated when Russia first invaded Ukraine, the longer this dragged on, the worse it would be for economic growth — especially in Europe, because it would turbo charge commodity prices and other inflation. Well, we are two months into the war, and there are no signs it’s ending anytime soon, and more signs it could spread beyond Ukraine into Moldova. The growth headwinds from this war are raising the chances of a recession in Europe and the United Kingdom. If that happens, it’ll be bad for every major economy (including the United States).

Bottom line, what’s changed since Thursday, April 21, is that worries about a global recession have surged given 1) Concerns about China’s growth and 2) the Russia/Ukraine war isn’t ending anytime soon and may actually spread. That’s the main reason the S&P 500 is down so sharply.

What’s Been Working? Since last Wednesday (when the breakdown occurred), all 11 sector SPDRs are lower, but the defensive sectors have relatively outperformed. Consumer Staples (XLP) and Utilities (XLU) are down 2% and 4%, respectively, while Real Estate (XLRE) and Healthcare (XLV) are down 5% each. More broadly, minimum-volatility exchange-traded funds (ETFs) such as SPLV and VTV also are relatively outperforming, down 4.5% each, and this mirrors what’s outperformed the entire YTD. Since growth worries are at the core of this pullback (and at the core of YTD volatility) we continue to expect these ETFs to relatively outperform and view them as a safe place to “hide” amidst increased volatility.

What Makes It Stop? The core concern is a looming global slowdown, so we have to get news that reduces that concern. Specifically, that means 1) China reversing its “Zero COVID-19” policy or COVID-19 subsiding so there are no more lockdown threats. 2) Russia and Ukraine declaring a ceasefire or truce. 3) The Fed backing off its hawkish rhetoric.

Unfortunately, none of those events are likely in the near term, and until some of them at least partially occur, it’ll be tough for stocks to mount a real rally. Regarding earnings, yes, they can help if they are great, but the cause of this current air pocket is macro-growth concerns, and good earnings won’t erase those.

How Bad Could It Get? In the April Market Multiple Table, we put a “Gets Worse If” target of 3,763, based on a 17X-18X multiple of current year earnings. Interestingly, that’s also around the level where most analysts think the “Fed Put” would reappear.

We continue to think that’s an appropriate level to look for material support. That’s another 10.3% from current levels, which would put the S&P 500 close to -20% YTD.

Should We Raise Cash? There’s no doubt that the prospects for a global slowdown are being driven higher by China’s COVID-19 policies and the ongoing Russia/Ukraine war. And in that respect, downside risks are rising.

That said, the macroeconomic environment hasn’t deteriorated 7% in four trading days, so we view this drop as overdone given actual fundamentals. Selling when markets overreact to fundamentals isn’t a historically good strategy, so we will hold on here and take the pain. At these levels, the S&P 500 is trading at 18.5X this year’s earnings and around 17X 2023 earnings. And given corporate commentary and earnings that are pretty solid, those valuations are generally fair.

Now, I wouldn’t say we’re bullish, but we don’t think this recent drop is representative of current fundamentals, and if our goal is to raise cash, we’d prefer to do it more in the middle of the 4,170-4,600-trading range, and not here.

***

If you want to get access to this kind of unique market analysis every trading day, directly to your inbox at 8 a.m. Eastern, then I invite you to check out my Eagle Eye Opener right now. There’s no time like the present to gain more market insight.

*****************************************************************

The Joy of Understanding

“The noblest pleasure is the joy of understanding.”

–Leonardo da Vinci

The quintessential Renaissance Man knew that the ultimate gratification in life is to truly know something. If you know reality, and you know yourself, you are unstoppable.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods