Embracing the Giving Season

- Embracing the Giving Season

- ETF Talk: Profiting From the Rise of Online Retail

- Sadness Amidst the Benevolent Universe

- Charlie Brown Wisdom

***********************************************************

Embracing the Giving Season

The holidays are the giving season, and it is called the giving season for good reason. You see, it’s estimated that about 30% of annual donations occur between Thanksgiving and the start of the new year, with the majority of those gifts being sent in the final three days of the year.

This year, I’m proud to say that I have donated more to charity than any other year in my life, and part of the reason why I have been able to do so is due to the success of my newsletter advisory services. You see, the more money you make for your subscribers, the more subscriptions you sell and the more renewals you get.

So, by helping you out by providing great investing information, you reward me with more subscription revenue and more personal income. And the more personal income I have, the more I am able to donate to the charities of my choice.

Now, in addition to the increased amount of money I am able to donate to the charities of my choice, more personal income and more investment success also mean more “units of choice.”

I’ve written about the concepts of “units of choice” before in this publication, because it’s a great way to look at the role of money in our lives. You see, the more capital we have, the more things we can do with that capital. More importantly, we can do more with the limited time that we all have.

This year, I spent a lot of my “units of choice” doing things that matter to me and donating to the charities that matter to me. For example, this year, I donated one of my older automobiles to a charity that provides assistance to disabled military veterans.

I also spent some time at charity events for my favorite veteran’s organization, Friends of Freedom.

This group was started by my friend and fellow Renaissance Man David Haddad, who was a guest on my podcast last year. Under David’s expert stewardship, Friends of Freedom has delivered over 750,000 cigars for troops to enjoy in war zones in Iraq and Afghanistan.

Your editor playing in the annual Friends of Freedom charity poker event.

Friends of Freedom also helps veterans by assisting them with rent, utilities, car repairs, the transition to civilian life and more.

If you’ve looking for a charity to support with veterans in mind, then choose Friends of Freedom.

Another, more recent, charity event that I attended just this past weekend was sponsored by the iconic heavy metal band “Metallica.” I was there for the band’s epic 40th anniversary takeover of its home city of San Francisco, where the performers played two incredible sold-out shows at the 18,000-seat Chase Center.

Your editor, alongside Eagle Financial Publisher Roger Michalski, rocking out and doing a charity beach clean up in San Francisco.

I also had the privilege of doing an early morning beach clean-up alongside hundreds of other Metallica fans, including my Eagle Financial Publishing colleague Roger Michalski, who is arguably one of the band’s biggest fans.

This event was sponsored by Metallica’s charity, All Within My Hands, which helps raise money for a cross-section of national and local charities. Importantly, every penny of the donations received by All Within My Hands goes directly to the organization’s charity partners.

I must say that it felt great to be out in the very chilly San Francisco morning air, doing good and helping clean up the city’s beautiful beach. No, I didn’t get anything out of this other than a sense of accomplishment, and the warm and fuzzy feelings one gets knowing one is doing something good for his fellow humans (oh, there was that cool t-shirt they gave us, too, but I digress).

So, this year, if you’ve found yourself doing well, making good investment decisions and/or feeling otherwise healthy and wealthy, why not take some of your units of choice and aim that at the charity of your choice? And whether you choose to donate a little time, a little money or like me, a little time and a little money, I guarantee it will make you feel good.

Finally, remember that we only get so many trips around the Sun before our time here expires. So, within those beautiful trips, why would you want to be anything but kind to your fellow travelers?

Happy holidays, and may we always live our lives in the name of the very best within us!

***************************************************************

ETF Talk: Profiting From the Rise of Online Retail

Are brick-and-mortar stores on the way out?

After all, with the rise of Amazon.com Inc. (NASDAQ:AMZN) and the shift to online retail companies as a result of the COVID-19 pandemic, it seems like the old American pastime of going to the mall in order to buy the goods that we want or need may be ending. The data seem to support this conclusion, and an article by Coresight Research claims that “25% of America’s roughly 1,000 malls will close over the next three to five years.”

One exchange-traded fund (ETF) that will likely be unaffected by the rise of so-called “dead malls” is IBUY Amplify Online Retail ETF (NYSEARCA: IBUY). This ETF tracks an index of global stocks issued by companies that earn a majority (at least 70%) of their revenue from online retail stores. While companies can be of any market capitalization, American firms receive a minimum 75% weight. Foreign companies receive the rest. Such a procedure keeps the whole portfolio from being dominated by Amazon.

Currently, the fund’s top holdings include Amazon.com Inc. (NASDAQ:AMZN), Expedia Group, Inc. (NASDAQ: EXPE), Liquidity Services, Inc. (NASDAQ: LQDT), Groupon, Inc. (NASDAQ: GRPN), Etsy, Inc. (NASDAQ: ETSY), Copart, Inc. (NASDAQ: CPRT), Airbnb, Inc. Class A (NASDAQ: ABNB) and Booking Holdings (NASDAQ: BKNG).

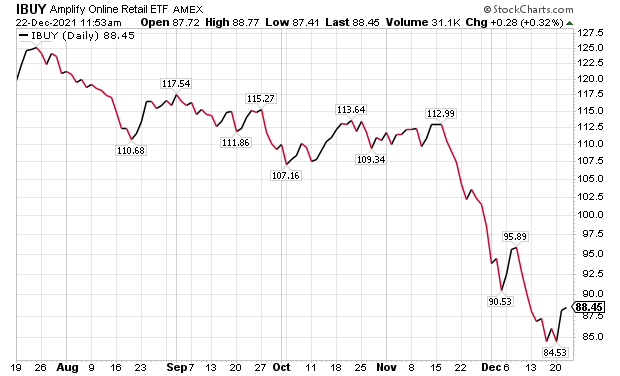

This fund’s performance has been problematic, especially when including the damage done by the COVID-19 pandemic. As of Dec. 21, IBUY has been down 17.94 over the past month and down 21.53% for the past three months. It is currently down 22.87% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $633.57 million in assets under management and has an expense ratio of 0.65%.

In short, while IBUY does provide an investor with a way to profit from online retail stocks, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

In case you missed it…

Sadness Amidst the Benevolent Universe

The year is nearly over, and compared to 2020, 2021 has been a relative return to normalcy.

I mean, despite this year’s political, social and pandemic tumult and flare-ups, compared to the previous year, we actually got to navigate some pretty tame waters.

Yet, in reflecting back on the events in my life that happened nearly one year ago to the day, I was overcome by a memory of personal sadness. You see, it was just one year ago that I learned of the death of one of the investment world’s outstanding pioneers, and also the creator of the original iteration of the Successful Investing newsletter, Dick Fabian.

Dick was an independent man of action, and someone who created opportunity out of adversity. After suffering big losses in the bear market and recession of the early 1970s, Dick decided that there had to be a better way to invest and a better way to help investors protect their money from the kind of market that hit so many so hard.

So, he sat down at his dining room table and began the process of thinking up a plan to track the wider trends in the market. It was there that he discovered that if you had owned shares in the market during periods when the domestic benchmark was trending above its 39-week moving average and, more importantly, if you were out of the market during the periods when that benchmark was trending below its 39-week average, you would have largely optimized your gains and minimized your losses.

It is this simple, yet brilliant, insight that allowed Dick Fabian to build one of the most successful, and longest-lasting, newsletters in the industry. And it is that same insight that his son, my friend and fellow investment guru Doug Fabian, continued to put into action in the service to help investors for decades when he took over the reins as editor.

Today, I am both humbly honored and proud to continue applying Dick’s brilliant insight and Doug’s expert stewardship to a new generation of investors through my leadership of Successful Investing. And whatever the new developments in the market may be, the heart of this service will always feel the distant beat of the man who sat down at the dining room table and subsequently created something from nothing via the power of his rational mind.

This kind of man is both rare and truly deserving of celebration.

I had the honor of celebrating his life just about a year ago at his memorial service in Southern California along with Doug and numerous members of the Fabian family, as well as Dick’s many friends and colleagues.

The famous clergyman Robert South once said, “If there be any truer measure of a man than by what he does, it must be by what he gives.”

Well, Dick Fabian’s gift to the world was his brilliant insight, and for that, we all must bow our heads in gratitude.

Finally, the end of 2021 is just a little more than two weeks away. And while this year had its challenges, it was nothing like 2020, a year which we’d all probably choose to lose from our collective memory, if we could. Yet, what the two previous years have reinforced for us is that society has once again prevailed, mostly intact, throughout another bout of pestilence and political polarization.

And do you know why we prevailed?

It is because humans are the most resilient and most successful species on the planet, and the reason for our success is our reason, i.e., our only tool of survival, our rationality. Remember this, and revere this, and know that you are part of an exclusive club that conquers the adversity of existence with the power of thought.

Also, remember that while the past two years’ sadness and tribulations have tested our individual and collective mettle, the concept of what novelist/philosopher Ayn Rand called the “benevolent universe premise” remains intact.

What this means is that the universe and reality are “benevolent,” not in the sense that they are designed for humans in mind. They are not. In fact, I think the universe is entirely indifferent to humans.

What the benevolent universe premise means is that if we choose to think for ourselves, if we choose to adapt to the ever-changing nature of reality and if we act rationally — we can give ourselves the best possible chance to achieve our values.

So, despite the sorrow, hardship, pandemic, loss, suffering and sadness — the benevolent universe remains — and now it is up to us all to choose our own happiness.

*****************************************************************

Charlie Brown Wisdom

“I never thought it was such a bad little tree. It’s not bad at all, really. Maybe it just needs a little love.”

–Linus Van Pelt, “A Charlie Brown Christmas”

If you’ve seen “A Charlie Brown Christmas,” then you know all about the little tree that wasn’t very attractive, but which Charlie thought needed him. In our own lives, it’s easy to fall into periods where we may not feel very attractive, or very valuable or even very good about ourselves.

Yet, it is during these times that we need to allow ourselves to love the most important person in our lives — ourselves. So, no matter how bad you’re feeling, probably all you need is a little love — so go ahead and give it to yourself. You, and the world, will be much better off because of it.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods