Can You Still Find Stocks That are ‘Always Up’ (Even Now)?

“This market is crazy!”

That’s how one highly respected colleague described the volatility in markets over the past week or so, and I must say that I wholeheartedly agree. In fact, the price action in markets since early October has been wild and dangerous, as well as fraught with massive up days and even bigger down days.

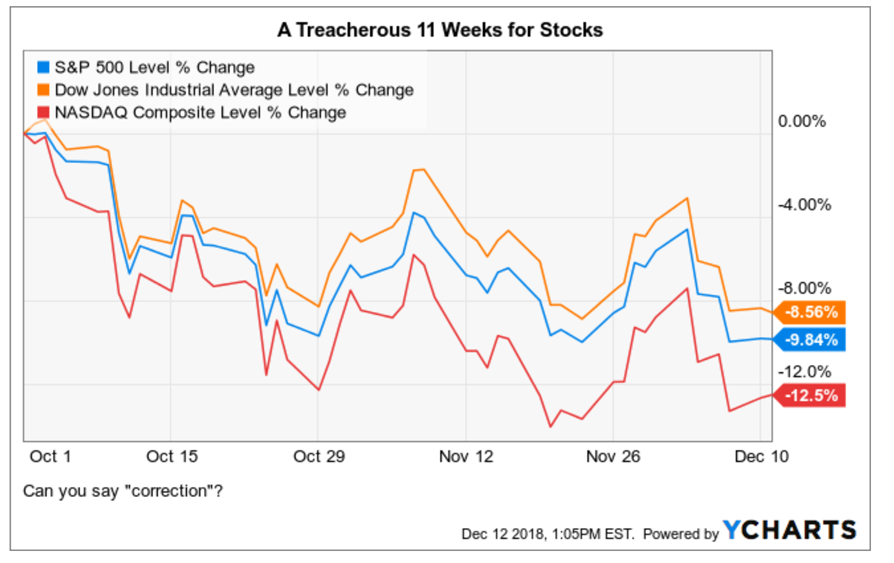

To get a sense of just how volatile and downright treacherous this market has been since October, take a look at the chart here of the Dow, S&P 500 and NASDAQ Composite from Oct. 1 through the close on Tuesday, Dec. 11.

As you can see, for most of October the bears were firmly in control. The bulls did manage to push their way onto the scene in early November, but that didn’t last very long. Since then, we’ve seen a big fight for control over the market among both camps, yet that fight still has left the NASDAQ in a full-blown correction (10% off the most-recent highs). The Dow and S&P 500 aren’t far behind either.

Yet here’s a life principle to keep in mind as it applies to many things, including stocks. As George Orwell wrote in perhaps the greatest political satire of all time, Animal Farm, “All animals are equal, but some animals are more equal than others.”

The same is true for stocks.

While as a whole, stocks that make up the Dow, S&P 500 and NASDAQ are dancing to the correction tune, there are many outstanding stocks that have gone up — way up — over the past 11 weeks. Not only that, but these stocks also have seen big gains over the past six months, 12 months and, in many cases, three, five and even 10 years.

I recently came up with a name for these: I call them “Always Up” stocks, because if you look at their charts over a period of more than just a few weeks, these stocks seem to be always up.

Of course, I am not saying that on any given day, or in any defined period of days, weeks or even months that these “Always Up” stocks might not have traded lower. Yet over the past year, and in many cases, multiple years, the trend in these stocks is definitively higher, and the gains you would have made as an investor are substantial.

Ok, so, you might be saying to yourself right now, “Alright Jim, but anyone can find stocks that have gone up after they’ve already gone up.”

To that I would say, yes, I completely agree. Yet the stocks I am referring to here aren’t just stocks I dug up after the fact. Rather, these are the stocks that have been in my “bullseye” for a while, and many are stocks that I have recommended to subscribers of my various newsletter advisory services.

Moreover, in addition to banking gains in many of these “Always Up” stocks, my subscribers also have banked very big gains (in some cases Triple-digit-percentage gains), trading specific call options on these same stocks.

And what does it take for a stock to end up in my “bullseye?” Well, it takes a combination of strong fundamental metrics (e.g. revenue and earnings growth) and outstanding relative share-price performance. These stocks also have to have a lot of positive news fueling their gains, and a strong “story” of sorts that puts them in the forefront of investors’ buy lists.

Once I find these great candidates, I go to the charts for a little technical analysis to determine when to actually buy, when to sell, and what options plays are most likely to work out profitably.

Now, over the next week or so, I will be making public more information about how these “Always Up” stocks fit into my bullseye strategy, but today that’s all my publisher will allow me to tell you (believe me, I tried to get him to budge, but the guy is nothing if not obstinate).

So, if you’ve been looking for a way to identify great stocks in this crazy market environment, and in not-so-frenetic environments, then keep your eyes on your email box for more regarding this exciting upcoming announcement.

**************************************************************

ETF Talk: This Fund is All About ‘Pure’ Value

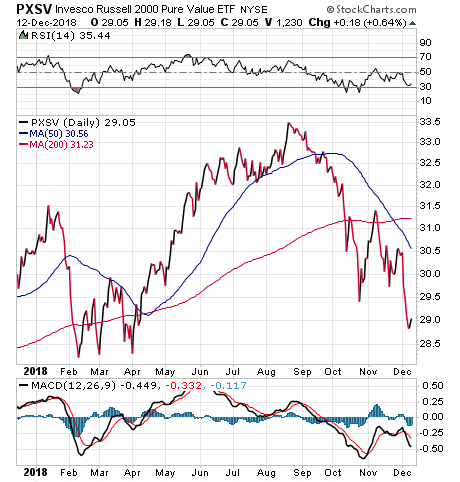

The Invesco Russell 2000 Pure Value ETF (PXSV) tracks an index of U.S. value stocks that are ranked by size from 1,001 to 3,000 of market capitalization.

The fund, based on the Russell 2000 Pure Value Index, has stock holdings that are selected and weighted by price to book, historical sales growth and growth forecast. PXSV will invest at least 90% of its total assets in the component securities that comprise the index.

The fund changed indexes in May 2015, but it remains one of the few “pure” value funds in the small-cap space. Its fee, which is among the highest in its fund segment, also has not changed. However, the revamped PXSV emphasizes exposure to stocks with stronger value characteristics than the traditional Russell value indexes. The fund’s previous index did this, too, but used a Research Affiliates Fundamental Index (RAFI), which is a fundamentals-based methodology.

Before the change to the new index, the fund only held about $70 million in assets. Low assets led to a low trading volume that raised transaction costs at the retail level. Still, the fund offers a valid alternative to vanilla value fund competitors that may help to attract investors.

The top PXSV sectors include financial services, real estate, industrials, consumer cyclicals, technology and energy. The fund’s top 10 holdings, consisting of 9.61% of the total, are Iridium Communications Inc. (IRDM), Esterline Technologies Corporation (ESL), Natural Grocers by Vitamin Cottage Inc. (NGVC), Genworth Financial Inc. (GNW), Mallinckrodt PLC (MNK), Cooper Tire & Rubber Co. (CTB), PDL BioPharma Inc. (PDLI), DHT Holdings Inc. (DHT), ATN International Inc. (ATNI) and Independence Realty Trust Inc. (IRT).

PXSV currently has $76.78 million in net assets and an average 0.40% spread, which is the difference between the bid and asking prices of a security. It has a 2.21% yield and a year-to-date return of 9%. The fund also has an expense ratio of 0.35%, so it is relatively cheap to hold in comparison to other exchange-traded funds.

Credit goes to Stockcharts.com

To sum up, this ETF presents a viable option for investors seeking to add a small-cap fund to their holdings. PXSV has a high fee but focuses on stocks with strong value characteristics and remains one of the few options for investors interested in small-cap, “pure” value funds. Investors should, as always, exercise their own due diligence to decide whether or not PXSV is a worthwhile investment.

I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

**************************************************************

Decisions, Motorcycle Adventures and the Way of the Bushido

Some men exude robust confidence. Others radiate intelligence and intellectual prowess. Still others project a quiet physical strength that tells the world, “I got this.”

But all of these qualities are rarely found in one man. Keith Fitz-Gerald is just such a man.

On this episode of the Way the Renaissance Man podcast, I sit down with investment expert, husband, father, Samurai and, most importantly, my good friend, to discuss a wide variety of fascinating topics.

From our debate at the FreedomFest conference about the future of Tesla and Elon Musk, to the qualities that make an ideal Renaissance Man, to the Japanese concept “kaizen” and why it’s important to live by, I think you’ll find my discussion with Keith quite compelling.

You’ll also find out the lessons Keith gleaned from his great-grandfather, a World War I fighter pilot, and how his grandmother inspired his passion for life and influenced his career choice.

Plus, find out about Keith’s amazing immersion in martial arts, including his knowledge of Samurai and Japanese culture and how he integrates those concepts into everything he does. And, we also talk about motorcycle adventures, decision making, the way of the Bushido and much more.

Finally, I tell you a story about how Keith introduced me to the most incredible sound you never want to hear.

Remember, if you like the Way of the Renaissance Man podcast, I encourage you to subscribe to the show on iTunes.

Doing so is free, and it will ensure you never miss the latest episodes.

*********************************************************************

Orwell on Nationalism

“Nationalism is power hunger tempered by self-deception.”

–George Orwell

There’s been a lot of talk of late about “nationalists” and “globalists.” Judging by the way these terms are used by politicians, pundits and many in the public, there is definitely a lot of confusion as to what people really mean when they use either term. These words also have “hidden” connotations and are often used by various fringe groups as code words of sorts to export specific ideas.

Yet when I hear the term “nationalism” thrown about, I think of how Orwell defined it in the above quote. Indeed, history has shown what a toxic cocktail power and self-deception can be when married with tribalism. That was particularly true in the post-WWII milieu of 1945 when Orwell wrote poignantly on the subject, and it remains true today. For those interested in digging deeper on this subject, I recommend the author’s very thoughtful essay, “Notes on Nationalism.”

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods