What Can Go Wrong in 2022

- What Can Go Wrong in 2022

- ETF Talk: An ETF that Bets on a Recovery in China

- Battle Buddies, Gold and Exposing Fraudsters

- If Things go Right in 2022

- Unlearning the Untrue

***********************************************************

What Can Go Wrong in 2022

You’ve undoubtedly already seen more 2022 predictions than you care to digest, so I won’t assault you with some arbitrary thoughts about what’s going to happen over the next 12 months. That said, in last week’s “The Deep Woods,” we did speculate on some of the things that could go right in the market in 2022.

That issue was extremely well received by readers, and in a testament to the intelligence and intellectual curiosity of our tribe, the logical follow-up inquiry was — what can go wrong in 2022?

Like I wrote last week, I am an optimist at heart, but I’m also a realist. That means I know there that are always plenty of things that can go wrong, especially when it comes to the markets and the economy. So, what can go wrong in 2022?

As I did last week, this week I am going to provide an excerpt from the Dec. 29 issue of my daily market briefing, “Eagle Eye Opener.” This publication is a joint venture between me and my “market insider,” a macro analyst who provides institutional research to many of the top pros on Wall Street, but who also allows me to share some of his insights each trading day in the “Eagle Eye Opener.”

So, here is what can go wrong in 2022.

There are essentially two major risks to the market as we start 2022. First, the market multiple drops from 20X to something lower. Second, corporate earnings drop.

However, both of these risks would be the effects of actual events, and they can only happen if something causes them to happen. So, let’s identify those events or causes that would lead to either of those outcomes. If we can recognize the events, we can potentially get defensive ahead of any pullback.

What Could Go Wrong 1: COVID-19 Doesn’t Go Away. Key Indicator to Watch: Case Counts. Markets are fully pricing in that COVID-19 will essentially “go away” in the next several months, either in an actual sense or in a practical sense where people just ignore it, and it doesn’t change daily life. But that is not the reality right now. While Omicron isn’t as dangerous as other variants, it’s still screwing up the economy. Growth will decline in Q4 because of Omicron, due primarily to worker shortages and cancellations of trips and other gatherings.

Additionally, Omicron will only extend the supply chain issues that are one of the main causes of inflation. Here’s why that matters: Unlike before during the pandemic, it’s unlikely the Fed will relax tapering or planned rate hikes due to COVID-19 spikes, unless COVID-19 is a major economic threat. Right now, it’s an economic nuisance, not a threat.

To put it differently, the threat to the economy from COVID-19 now has to far outweigh the potential inflationary impact. Unless that happens (and it’s not happening now), the Fed will keep tapering quantitative easing (QE) and hiking rates even if Omicron is a headwind on growth. That could lead to stagflation, which would be a major headwind on stocks.

What Could Go Wrong 2: Inflation Doesn’t Subside. Next Key Event: Consumer Price Index (CPI) on Jan. 14. Even if Omicron subsides as expected, inflation will have to come down to remove the possibility of the Fed getting too aggressive and tightening too quickly. And while COVID-19-related supply chain problems are part of high inflation, there are other, non-COVID-19 factors pushing inflation higher.

Additionally, if inflation stays high enough for long enough, companies will see margin compression. If inflation is going to come down, then we must see COVID-19 go away to ease supply chain issues.

But even if that happens, it’s still not a guarantee that inflation will suddenly fall back close to pre-COVID-19 levels. Stubbornly high inflation could lead to 1) The Fed tightening too quickly and 2) Earnings dropping, which would obviously be negatives for stocks.

What Could Go Wrong 3: Fed Commits a Policy Mistake. Key Indicator to Watch: 10s-2s Yield Spread. The sudden hawkish turn in the Fed over the past two months has been nothing short of historic. In December, Federal Reserve Chairman Jerome Powell abandoned the use of the term “transitory” for inflation, and instead doubled the pace of tapering. Meanwhile, the Fed consensus went from one rate hike in 2022 to three!

While not likely, the Fed’s sudden hawkish turn could lead to a policy mistake whereby the Fed hikes too quickly to end inflation, yet those rate hikes snuff out the economic rebound.

The 10s-2s yield spread will be the best indicator of this, as we’d see it invert much sooner than we’d normally expect (which is likely going to be in the first half of 2022).

What Could Go Wrong 4: The U.S. Economy Loses Momentum. Key Indicator to Watch. Is there an economic hangover looming in 2022? There’s no question that the U.S. economic recovery is strong, but it’s not clear how much of that growth has been driven by government stimulus.

Moreover, the decline in fiscal support for the economy in 2022 is substantial and we don’t know how much damage that will do to consumer demand. Additionally, it’s reasonable to assume a lot of the wage increases that are going to happen, have happened, given the improvement in the labor market.

But if inflation remains this high, we could easily see demand destruction if wages level out and there are no more stimulus checks coming from Washington. If that’s the case, the Fed will be hiking into an economic hangover/natural economic slowdown, and we’re looking at stagflation.

As we have consistently said, a 20X multiple is usually a “best case” multiple for the market, and clearly if any of these events happen, the market multiple will drop to something lower and more normal.

In an environment of slowing economic growth or stagflation, the market multiple can drop all the way to 15X, but we think that’s too extreme for these scenarios. So, we think a reasonable multiple if we have any of these negative events is 18X.

The current 2022 S&P 500 earnings per share (EPS) expectation is $226. That gives us a target of 226*18 or 4,068, about 15% lower from here. Now, if we also see expected S&P 500 earnings drop, using a 5% earnings decline, then we are looking at $215*18 = 3,870, or about 19% lower from here.

Now, these are clearly pretty negative scenarios, as it implies a material decline in the macroeconomic outlook. But the bottom line is that real risks are present as we start the coming year, and while the negative outcomes for this market aren’t the most likely ones, at the same time, we need to be watching carefully for them. If we see a scenario where the market multiple starts to decline or expected earnings drop, we will need to get defensive and fast. You will hear that from us loudly and clearly.

For more on how you can be forewarned about the “what could go wrong in 2022” scenario, then I recommend subscribing to my “Eagle Eye Opener” daily market briefing today.

Think of it as a market-based, intelligence insurance policy to help you navigate the coming year, and well beyond.

***************************************************************

ETF Talk: An ETF that Bets on a Recovery in China

China has been an exciting investment theme for many years now.

Chinese tech companies have been an even hotter investment theme, as its emerging market continues to mature and the comforts of the developed world become more accessible to the country’s growing middle class. China’s economy, as most traders know, has been expanding at an impressive rate for decades, and consumption and government spending have risen aggressively.

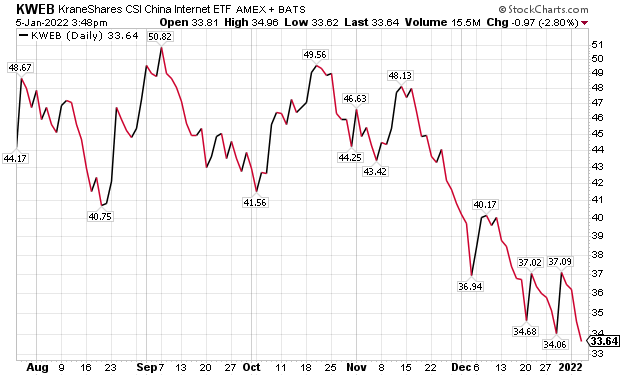

One way to invest in this theme is through KraneShares CSI China Internet ETF (KWEB). This exchange-traded fund (ETF) invests in China-based companies that are primarily engaged in the internet business or related technology.

Many prominent Chinese internet companies essentially mimic established domestic giants, such as Alphabet Inc. (NASDAQ: GOOGL), formerly Google, and Amazon.com Inc. (NASDAQ: AMZN). But this does not mean the market is smaller.

In fact, Chinese online retail sales were more than double the same figure for the United States in 2020. It is worth noting that the developing nature of the economy means that a lesser percentage of the population has yet to use the internet at all. As a result, there is inherent room for growth.

KWEB currently holds net assets of over $6 billion. Its expense ratio is somewhat high at 0.70%, possibly due, in part, to the fund’s exposure to foreign securities trading on the Hong Kong market.

KWEB’s performance for the past year is actually quite poor, registering at -56%. Part of this loss may be due to recent regulations. This may mean that the fund can be purchased at an attractive entry point at this time, as even recovering those losses would double an investor’s money. But whether such a rebound will happen anytime soon is far from certain.

Chart courtesy of stockcharts.com

Top holdings of this fund include Tencent Holdings Ltd., 10.66%; Meituan, 8.00%; Alibaba Group (BABA), 6.68%; Baidu Inc. (BIDU), 6.19%; and Kanzhun Ltd. (BZ), 4.84%. There are 55 positions in total, though this includes duplicates of a few companies for which the fund holds both American Depositary Receipts (ADRs) and Chinese shares.

For investors who believe the Chinese internet industry is likely to turn around this year, KraneShares CSI China Internet ETF (KWEB) could offer a potential way to take advantage of such a lucrative event.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

******************************************************************

Battle Buddies, Gold and Exposing Fraudsters

One of the best things about having the Way of the Renaissance Man podcast is that I get to have great conversations with the some of the smartest people in the world.

And on the latest episode, I do just that, as I welcome my friend, fellow U.S. Army veteran, West Point graduate and the premier expert in the field of precious metals investing, Rich Checkan.

Rich is the President and COO of Asset Strategies International (ASI), which is the only dealer of physical gold, silver, and other precious metals that I recommend.

In this episode, we discuss the importance of being a critical thinker, and the importance of talking about ideas and exposing oneself to all opinions. It is through the process of filtering out the good from the bad ideas, and knowing when you can, and cannot, compromise, that you become a better decision maker.

Other topics in this wide-ranging discussion include the Jan. 6 insurrection, the importance of rational arguments, the virtue of rational persuasion, the role of passion in the world and the critical need to do something meaningful in life.

Plus, no discussion with Rich Checkan would be complete without his expert view on gold and precious metals.

I always enjoy my conversations with my “battle buddy” Rich Checkan, and I know you will too.

******************************************************************

In case you missed it…

If Things Go Right in 2022

During this time of the year, most financial media consumers are treated to a rash of predictions for 2022. While many of these predictions are thought-provoking, many others are dire and heavily skewed to scare readers into buying this or that product or service.

Well, I am an optimist at heart, although I’m also a realist. Sure, things can go wrong in the markets in 2022. In fact, I suspect we will see more challenges in the year to come due to changing Federal Reserve policy, rising inflation and the lack of huge fiscal stimulus of the sort markets have become used to over the past year.

Yet, what if things go right in 2022? What if the naysayers are wrong, as they so often are? What will that mean for stocks in the year to come?

To answer this question, I am going to provide an excerpt from the Dec. 28 issue of my daily market briefing, the “Eagle Eye Opener.” This publication is a joint venture between me and my “market insider,” a Wall Street pro who provides institutional research to many of the top pros on Wall Street, but who also allows me to share some of his insights each trading day in the “Eagle Eye Opener.”

So, here is what could happen if things go right in 2002.

We’ve identified five catalysts that, if they all break the right way, could push stocks meaningfully higher — meaning by more than 20%. Below, we’ve identified those catalysts, along with key events or indicators to watch.

What Could Go Right 1: Inflation Peaks. Next Key Event: Consumer Price Index (CPI) on Jan. 14. We expect inflation to be a major influence on markets in 2022, primarily because of the politics of inflation: It is now listed high among concerns for consumers and voters, and as such the focus on inflation from Washington (including the White House, Capitol Hill and the Fed) is as intense as we’ve seen it in decades. That is one of the major factors behind the Fed’s more aggressive tapering of quantitative easing (QE), and if inflation peaks, starting with the CPI in three weeks, that will take some of the pressure off the Fed. It will also reduce the chances that the Fed tightens too quickly.

What Could Go Right 2: Central Banks Don’t Tighten Too Much. Key Indicator to Watch: 10s-2s Yield Spread. This obviously goes hand in hand with inflation. If various measures of inflation begin to back off (CPI, Core PCE Price Index, Inflation Expectations) then the chances the Fed overtightens will decline significantly, and that could be an unanticipated tailwind for stocks in Q1 2022. The 10s-2s spread is the key metric to watch here, and if it continues down towards 0%, that’s a clear sign that the markets are worried about over-tightening. If it can rally comfortably above 100 basis points, that’s a sign that the market feels good about the pace of tightening (and that will again be a positive for stocks).

What Could Go Right 3: 2023 Earnings Remain Very Strong. Next Key Event: Week of Jan. 10-Feb. 4, Q4 Earnings Season. That 2023 is not a typo. Sooner than later, (by early to mid Q2), the markets will begin to focus on 2023 earnings, which currently are estimated to be $250/share for the S&P 500. If corporate earnings commentary in the coming weeks again downplays inflation pressures and margin compression, and we see earnings estimates for both 2022 and 2023 rise, then that will allow the S&P 500 to trade decidedly higher from here and still be in the bounds of “reasonable” valuations.

What Could Go Right 4: COVID-19 Ends. Key Indicator: Case Counts. Each successive wave of COVID-19 has seen less and less of a market reaction, including with regard to Omicron. If, as the market currently expects, Omicron essentially “burns out” and we are left with the vast majority of the global population with some protection against future disease (either natural antibodies or vaccines), then markets will increasingly view COVID-19 as “over.” That will provide a general tailwind for stocks.

What Could Go Right 5: Republicans Win Either the House or Senate. Key Indicator to Watch: Polls as We Move Towards November. Markets prefer gridlock over one party being in total power, as this usually guarantees that there will be no major changes to tax policy or other important regulations or laws. And while a divided government will set up a potential repeat of the debt ceiling and shutdown dramas of the ’12-’16 periods in 2023, the markets will embrace a divided government in 2022.

As you can see, there are a lot of things that could go right for markets, and if these do happen, we could see stocks have another very strong year. Now, for all of these elements to go right seems as though it would be the macroeconomic equivalent of pulling an “inside straight” for the poker players out there. Yet, pulling that inside straight is possible, and as always, you will have the best seat at the table if you’re watching the action unfold alongside us as a reader of the “Eagle Eye Opener.”

For more on how you can subscribe today, simply click here.

*****************************************************************

Unlearning the Untrue

“The most useful piece of learning for the uses of life is to unlearn what is untrue.”

–Antisthenes

The ancient Greek philosopher is understandably overshadowed by the giants that are Plato and Aristotle, but his work contributed much to the lexicon of Hellenic ideas. In this quote, Antisthenes reminds us that it’s important to shed beliefs, assumptions and erroneous thinking that turns out to be untrue. In 2022, I want you to do the same thing. Challenge your ideas of what is true, and if you find you have no good evidence for holding a belief, let it go. It might just be the most useful piece of learning you can have.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods