Birthday Bull Market Musings

German philosopher Friedrich Nietzsche famously wrote, “That which does not kill us, makes us stronger.” I’ve always lived by those words, and I think it’s important for us to always be pushing our boundaries. This is true physically, mentally and even emotionally.

I think this is especially true during times when personal reflection just comes more naturally than at other times, as in important anniversary dates… and especially birthdays.

Just yesterday, I turned the page on another year on this beautiful planet. So, I got to thinking deeply about ways I could push the limits a bit more in a variety of ways.

For you, the Weekly ETF Report reader, that means I plan to push the boundaries by adding even more personal, even more in-depth and even more interesting content to this publication.

Hey, it’s my view that no matter how good things currently are, I always can try to make them better. And, that’s my promise to you going forward. I not only value your time, I value your trust. Anything that can help foster that trust and make our bond stronger, that’s what I will do.

This week, I have a special content feature for you from my friend and uber-smart market analyst Tom Essaye of the Sevens Report.

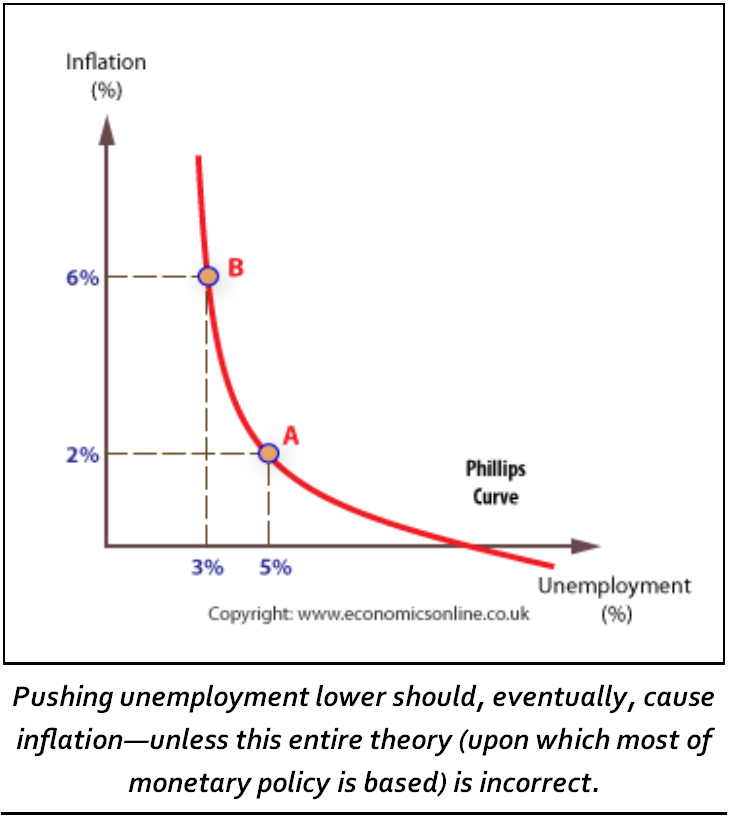

This feature is all about something you may have heard of late, or that you likely will hear about soon. It is called the Phillips curve. It specifically is a thesis that factors in Federal Reserve policy decisions heavily.

Unfortunately, the Phillips curve thesis may be breaking down.

Here is how Tom explains it:

The Phillips curve is a term you’re likely seeing and hearing more recently than at any time previously in your career (regardless of how long it is). The reason the Phillips curve is being discussed so much is simple: There is a growing school of thought that thinks the Phillips curve is broken. If that’s the case, then the Fed and other central banks may be largely powerless to spur inflation (which is a potential negative for the broad markets).

Before we get into this debate, first let’s get a bit of background on the Phillips curve. Basically, the Phillips curve is just a graph of this simple idea — Low unemployment creates higher inflation.

From a common-sense standpoint, it is logical. Less available workers and robust business activity (so low supply and high demand for workers) will cause salaries (the “price” of a worker) to rise, and that in turn will flow through to the entire economy.

So, the Phillips curve says low unemployment will spur inflation. And, this idea has been the cornerstone of Fed policy for decades.

But, there’s a small problem: It doesn’t appear to be working in today’s economy, as historically low unemployment is failing to spur inflation.

Now, this may seem like a theoretical, academic conversation, but it has real, near-term market consequences. For instance, the entire mid-July rally in stocks came because the Fed began to note low inflation more than low unemployment. That caused the decline in Treasury yields and exacerbated the drop in the dollar.

However, that may have changed with Friday’s jobs report. The unemployment rate hit 4.3%, a fresh low for this expansion and a multi-year low. So, while there is a debate about the Phillips curve still being accurate, the bottom line is that the Fed still follows it. At some point, if unemployment continues to drop, the Fed will have to continue with its rate increases.

So, the 4.3% unemployment rate was the reason the jobs report didn’t spur a rally in stocks. And, going forward, whether unemployment continues to decline will have an important impact on returns, regardless of inflation.

If unemployment grinds towards 4% or below, the Fed will have to get hawkish or either 1) Abandon decades of monetary policy that has largely worked, or 2) Risk a significant rise in inflation down the road (according to the Phillips curve) that would require a sharp, painful increase in interest rates — a move that almost certainly would put the U.S. economy into recession.

The next data point in this saga comes Friday via CPI. At some point, low unemployment will cause inflation, and if inflation shows more signs of stabilizing (like it did in the jobs report), expect bank stocks to potentially break out.

Thank you, Tom, for that outstanding analysis. I know I will be watching the Phillips curve much closer from here on.

*************************************************************

ETF Talk: Introducing a Large-Cap Growth Fund

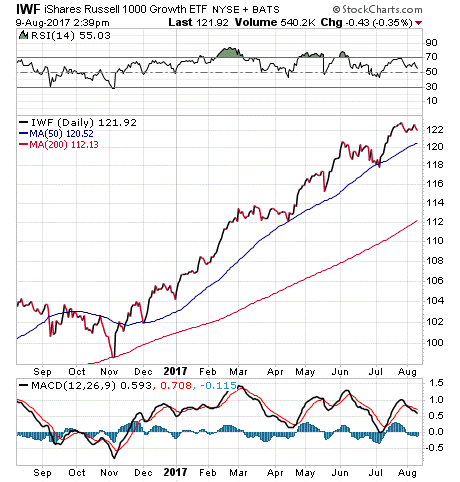

The iShares Russell 1000 Growth ETF (IWF) selects mostly large-cap stocks from the Russell 1000 Index that show high-growth characteristics.

With $36.15 billion in total assets under management and average daily trading volume of $184.77 million, IWF is a massive fund with supreme liquidity.

In contrast to its sister fund, the iShares Russell 1000 Value ETF (IWD), which was featured in the previous ETF Talk, IWF is focused on stocks that have high potential for above-average growth relative to the market. But in the short term, they may not necessarily offer a “good value” or even be underpriced.

Growth stocks also may appeal to those who seek capital appreciation rather than dividend income. Indeed, companies focused on growth typically reinvest their earnings and pay either a small or no dividend.

IWF selects stocks based on rankings of three fundamental factors: price-to-book ratio, forecasts for medium-term growth and five-year historical sales growth. The rankings then are standardized and built into a final composite score with a growth variable factored in.

Growth stocks have been in favor so far this year on the back of a proposed pro-growth political agenda and an earnings season that is turning up strongly. Year to date, IWF has generated a 13.87% return, compared to the S&P 500’s 10.86%. IWF has a distribution yield of 1.23% and an expense ratio of 0.20%.

As a result of its growth-oriented strategy, IWF has a bias towards technology firms. Roughly one-third of its holdings are in the information technology industry, which is an industry typically associated with high volatility and strong potential for growth. Plus, 18% of IWF is in consumer discretionary stocks and 13.5% is in health care.

IWF is somewhat diversified, with 557 total holdings. Its top five holdings are Apple Inc. (AAPL), 7.07%; Microsoft Corp. (MSFT) 4.63%; Facebook (FB), 3.43%; Amazon.com Inc. (AMZN), 3.36%; and Alphabet Inc. Class A (GOOGL), 2.40%.

For those who are looking for future growth, the iShares Russell 1000 Growth ETF (IWF) may be worth adding to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

************************************************************

Will Politics Kill This Bull Market?

Live by the sword, die by the sword.

It’s the common rendering of the Biblical verse Matthew 26:52, which in the King James version reads, “Then said Jesus unto him, Put up again thy sword into his place: for all they that take the sword shall perish with the sword.”

This bull market reminds me of that poetic verse. Since Election Day, stocks have surged to more than 32 all-time record highs on the Dow Jones Industrial Average.

One cursory glance at the SPDR Dow Jones Industrial Average ETF (DIA) shows the near-parabolic surge in markets from Nov. 9 until today.

Remarkably, there have only been two breaches of the 50-day moving average since Election Day. That is what resilient bull markets are all about!

Still, I firmly believe that this bull market has lived by the sword of political hopes.

Those hopes are, of course, rooted in President Trump’s pro-growth economic agenda. That agenda included regulatory reform; Obamacare repeal/replace, an infrastructure spending plan, and, most importantly, tax reform that includes a substantive cut in the corporate tax rate.

Well, so far, we’ve had some good regulatory reform via executive order, but that’s largely been on the margins. It is a good start, but nothing that would justify this sustained bull.

As for Obamacare, well, that must be looked upon as an epic fail by not only President Trump, but also by Republicans in Congress. Despite having majorities in both chambers, the GOP failed to deliver on one of its key platform positions of the past seven years.

Yet interestingly, the failure to repeal/replace Obamacare still didn’t stop this bull market. Nor has the lack of any progress on an infrastructure spending plan. In fact, infrastructure has rarely been mentioned by the White House despite all the campaign rhetoric about building a “big, beautiful” border wall, and rebuilding the nation’s roads, bridges, dams, etc.

So, it seems like the only sword of hope that has yet to be dulled is tax reform.

On that front, the president and his economic team, along with Congressional leadership, have been painting broad brush strokes on a plan. In a joint statement from administration officials, congressional GOP leaders and the chairmen of the tax-writing committees presented the broad goals for tax legislation. However, the statement lacked the nuts-and-bolts details of the plan, which have yet to be finalized.

I think the president and GOP Congressional leaders had better get their collective act together on tax reform. If they fail to wield this sword properly, i.e., if they fail to get legislation signed into law that brings taxes down corporate bottom lines enough to justify the market’s very high multiples… then this bull market will die by that dull sword.

In my Successful ETF Investing service, we currently are riding this bull market to big gains — both for income investors and growth investors. If you’d like to discover how we’ve done it, and also how we have a rock-solid, four-decade-tested plan to avoid big market meltdowns, I invite you to check out Successful ETF Investing today.

***************************************************************

Nixon Memories

“Only if you have been in the deepest valley can you ever know how magnificent it is to be on the highest mountain.”

— President Richard Nixon, Aug. 9, 1974

Forty-three years ago today, President Nixon said these words in his farewell resignation address. The words are indeed profound, and they probably were among the most profound the disgraced chief executive ever uttered in public. If you remember that day, as I do (though I was just a child), you remember a time when the world was in flux, and stocks were rocky. Today, the world also is in flux, yet stocks are riding high. Yet it behooves us to always remember that circumstances can change in an instant, both at the highest levels of political office and the highest levels of the equity markets.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.