The Best ETF Ideas for 2016: Growth

Although we have about another six weeks left in 2015, it’s never too early to start thinking about what is on the horizon for next year.

Today, I want to present to you the best exchange-traded fund (ETF) ideas for 2016 if your primary goal is growth investing. Next week, we’ll cover the best ETF ideas for income investors. For today, let’s stick to the growth side of things.

First, let me say that I think 2016 will be a relatively tough equity market, with U.S. stocks likely to move modestly higher in the low-to-mid single-digit-percentage gains. We do have the fact that this is an election year in our favor, as election years do tend to be good for the equity markets historically.

One of the factors we need to watch closely next year that will determine how markets perform is the price action in commodities such as oil and copper. Another key will be the performance of emerging markets and China. If these areas stabilize, that will do a lot to prop up markets worldwide. Then there’s the Fed and the fate of interest rates, which going into 2016 likely will continue to occupy all of our minds.

Given the conditions as we approach 2016, I think next year will be all about looking for the best sector ideas going forward — both for growth investing and for income investing.

Here’s my personal list of five growth ETF ideas for 2016. Some of these we currently own in the Successful ETF Investing newsletter, and some are just on our radar. All, I suspect, will offer investors good opportunities to profit in the year to come.

1) Health Care Select Sector SPDR Fund (XLV). Healthcare is an industry that continues to benefit from demographics, innovation, mergers and acquisitions (M&A) deals and insurance mandates. XLV is the ETF that holds the biggest and best health care stocks around.

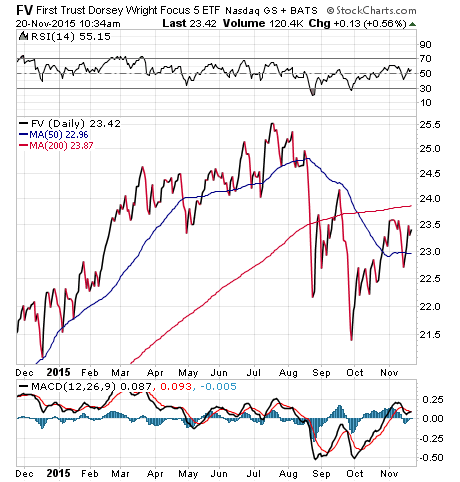

2) First Trust Dorsey Wright Focus 5 ETF (FV). This is a “fund of funds” that simultaneously holds other funds that have allocations to top-performing sectors. Biotech, Internet, consumer staples, consumer discretionary and healthcare all are part of this fund.

3) PureFunds ISE Cyber Security ETF (HACK). This is a cybersecurity stock ETF that we’ve written about extensively in this publication and in the Successful ETF Investing newsletter. We also recently conducted a FREE webinar on HACK, which I encourage you to check out before you start making investment decisions in 2016.

4) iShares India 50 ETF (INDY). India is a country that has a pro-capitalist political climate, a huge amount of human capital and citizens hungry for economic growth and an enhanced living standard. INDY is a way to get exposure to the companies benefitting most from these trends.

5) WisdomTree Japan Hedged Equity Fund (DXJ). Japan continues to put the pedal to the metal on “Abenomics,” which means more quantitative easing from the Bank of Japan and likely more upside for Japanese stocks. And, with DXJ’s hedge component, you get that performance without the negative influence of any currency disparities.

When it comes to growth in 2016, these are the funds I think represent great ideas going forward. If you want more ideas, including which funds we’re buying right now, then I invite you to check out my Successful ETF Investing newsletter today!

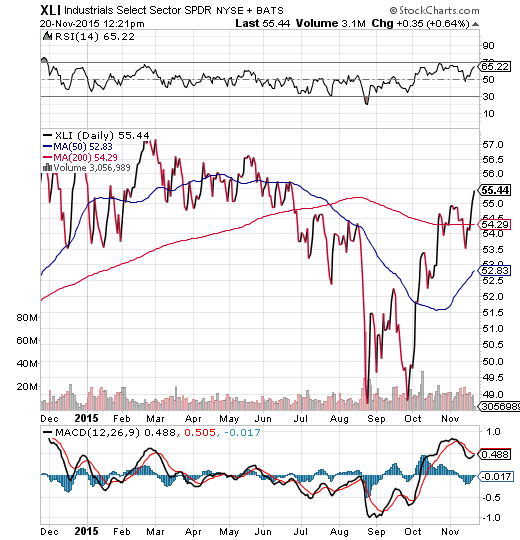

ETF Talk: Consider Putting Industrials Sector Fund to Work for You

The industrials sector contains some of the great workhorses of the U.S. economy. Containing about 10% of components on the S&P 500, the corresponding exchange-traded fund (ETF), Industrial Select Sector SPDR ETF (XLI), invests in large-cap companies in the Industrial Select Sector Index. This index covers areas such as aerospace and defense, machinery, airlines, construction and engineering.

Unlike the consumer discretionary sector featured last week, industrials do not fluctuate much with the rise and fall of consumer sentiment; rather, they are more closely attuned to trends both domestically and abroad.

View the current price, volume, performance and top 10 holdings of XLI at ETFU.com.

With a string of positive U.S. sessions in October and news of a strengthening global economy, XLI’s stock has risen more than 12% in a little over a month from its low in late September. The fund still is down about 3.5% year to date, but it could be in a good position if the global market continues to be solid. The dividend yield is a little over 2% and has increased in each quarter of 2015 so far. XLI also has more than $6.5 billion in assets managed, with an expense ratio of 0.15%.

Due to the sector’s diversity, XLI’s top holdings represent several different fields. Combined, the top 10 holdings account for nearly 50% of the fund’s assets. The biggest holding by far is General Electric (GE), with 11.38% of total assets, more than double the weighting of other top companies. 3M (MMM), the adhesives company, has 5.3% of assets, followed by aerospace giant Boeing (BA) with 5.13%. Honeywell International (HON) and United Technologies (UTX) each hold 4.4%.

If an industrial fund featuring these classic American companies seems appealing to you, you may want to take a look at Industrial Select Sector SPDR ETF (XLI). In my next ETF Talk column, I plan to write about another sector for your consideration.

View the current price, volume, performance and top 10 holdings of XLI at ETFU.com.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

Six Questions to Ask Before You Buy Any ETF

I often am asked by readers, radio show listeners and clients about exchange-traded funds (ETFs). Why I like them so much, why they are better than mutual funds, why I prefer them to individual stocks, etc.

Today, I am going to provide a few questions for you, questions you should ask yourself before you buy any ETF.

Here is my list of the six key questions you must ask before you commit your investment capital to an exchange-traded fund.

1) Why am I buying? Do you need to generate growth from your assets, or is income more what you are looking for? Are you buying this ETF for a long-term hold, or do you plan on trading the fund? The first question of why you are buying is all about you and your goals, so the more defined your objectives are, the better your outcome is likely to be.

2) What asset class am I buying? Is this ETF an equity (stock) fund, or is it a bond fund? Is it pegged to a specific market sector, or is it an inverse fund? Knowing what you are buying is critical, so make sure you are fully aware of what’s in that ETF.

3) What index is my ETF following? Is your ETF exposed to the S&P 500? Is it pegged to the Dow? Or, is it pegged to the NASDAQ 100? All three funds of this sort are broad-based equity funds, but they are not created equal in terms of composition and diversification. Knowing how diversified you are in a fund is important, and you know that by knowing what index the ETF follows.

4) What’s the cost? How much is that ETF going to cost you? What is its “expense ratio?” If you don’t know how much you’re paying for something, you can’t make a good decision about value.

5) What’s the asset size and volume of this ETF? Are you buying an ETF with a lot of liquidity and a lot of trading volume? Or, are you looking at an ETF with little assets under management and one that trades low volume. The answer here can make a difference when it comes to efficient trade execution and fund pricing, so be aware of the size of the ETFs you want to buy.

6) What’s my exit point? Do you know when you’re going to sell this ETF? How much downside can you handle? When will you take your winnings off the table? Only you can answer these questions based on your personal investing situation, but answer them you must if you want to be an efficient, and successful, ETF investor.

Finally, recently subscribers to my Successful ETF Investing newsletter received the first new domestic equity buy signal in some time. If you want to find out what we’re buying, then I invite you to check out the newsletter today.

And remember, next week it’s the best ideas for income investors, so be sure to tune in!

‘Churchillian’ Failure

“Success consists of going from failure to failure without loss of enthusiasm.”

— Winston Churchill

He was arguably the greatest statesman of the 20th century, and observing the geopolitical events of the 21st century, it would be nice if we had a presence like Winston Churchill leading the charge against global threats. Unfortunately, Churchillian leadership skills are sorely lacking in today’s political landscape.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about several ETFs that can be used as signposts for the broader market. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian