The Beautiful Banality of Sublime Moments

- The Beautiful Banality of Sublime Moments

- ETF Talk: Smart Beta, Smart Bet?

- The Cat and the Horror (2023)

- On Fixing Things

***********************************************************

The Beautiful Banality of Sublime Moments

Sublime moments. They may seem infrequent and evanescent, and many of the moments we categorize as “peak experiences” are, by their very nature, uncommon.

Yet it is my opinion that these sublime experiences don’t have to be as infrequent and uncommon as most people perceive them to be. I say that because all too often, we overlook, take for granted, or otherwise fail to really notice the beautiful banality of sublime moments happening all around us.

You see, the world of daily peak experiences, wonderment and awe of the sort that many of us experience only on rare occasions is open to us, if we know how to pay attention to each moment.

For example, last year I flew home to Southern California after a business trip to Washington, D.C. During my flight, I looked out the window and essentially witnessed the curve of the earth.

The curve of the earth as viewed from my window seat.

Now, I suspect you have been on a commercial airliner and looked out the window. But when you did, did you really pause and notice that sublime curve?

Did you drink in the wider notion that you were thousands of feet in the air, hurtling through the atmosphere at hundreds of miles per hour? I noticed this that day, and I did so with a glass of wine in my hand, and while also ironically listening to the song “Curve of the Earth” by the great Matt Nathanson.

Check out the chorus here from the song, and I suspect you’ll understand why it made such an impression on me at that moment:

Tell me does the world revolve the same?

Tell me do the people all take care of you?

Did you doubt the curve of the earth?

And every word, every word…

The serendipity of this confluence of circumstances was not lost to me. In fact, I had to pause and make sure I really noticed everything about this moment. The feeling of wonderment at the technological achievements of the human mind that allowed me to fly across the country in about five hours while listening to music recorded, digitally reproduced and then pumped into my aural canal from little white pods wirelessly broadcasting the sound directly into my brain.

Yes, these things happen to millions of people every day, but most people don’t really notice how truly sublime an achievement it is.

Instead, many people lament the fact that things aren’t even better, or more convenient, or less expensive than they are.

Hey, I understand this. We all get used to modern life and the convenience of our wondrous world, and we all often take for granted that the luxuries produced by capitalism are here, on demand, for us to enjoy. And when things don’t go as planned, or when there is a glitch in our desire fulfillment chain, people take the opposite tack of noticing peak experience and focus on the distressed experience.

But in my opinion, this a huge mistake.

Now, I am not saying we should accept things that are broken, damaged or that don’t work. And if there is a problem to be solved, a need to be fulfilled or a fix that needs implementing, we should do it.

Yet in a world surrounded by brilliant achievement, wondrous technology and tremendous bounty — I think each day demands a bit more sublime notice.

So, right now, pause and notice the sublime nature of the wondrous things in your life.

Look around the room, look at the computer, tablet or phone you are reading this on, and let that sense of awe at the achievement wash over you as if you were seeing the curve of the earth for the first time.

Then, I want you to reach for the tissue to blot your eyes, because when you stop to truly notice the beautiful banality of sublime moments, the swelling of your spirit might just evoke a few teardrops of wonderment.

***************************************************************

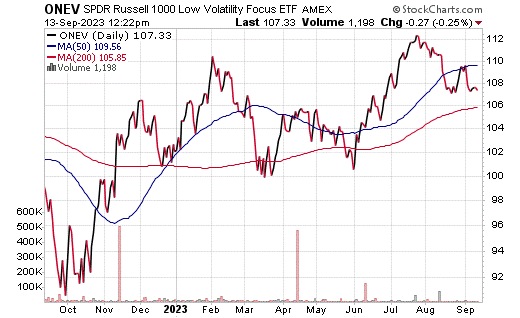

ETF Talk: Smart Beta, Smart Bet?

Smart beta funds have been increasing in popularity over the past 10 years.

Using mostly passive investment methods, smart beta funds apply a factor investing approach. These smart beta funds track an index but aim to beat the returns by using a variety of factors to shift the metrics used to select stocks.

Strategies range from equally weighted, fundamentally weighted, factor-based or low volatility. These portfolios offer transparent, low-cost investment strategies.

And multi-factor strategies, unlike single-factor methods, provide exposure to any combination of factors to track an index. The investor benefits through greater diversification, a broader foundation for returns and the potential for lower tracking errors.

The cherry on top is that the expense ratio is typically lower than an actively managed fund. One multi-factor smart beta fund worth examining is the SPDR Russell 1000 Low Volatility Focus ETF (NYSE: ONEV).

The SPDR Russell 1000 Low Volatility Focus ETF is a multi-factor smart beta exchange-traded fund (ETF) that provides broad exposure to large capitalization U.S. indices. The fund uses a multi-factor sampling strategy to maintain a portfolio of stable, low volatility stocks with a combination of growth and value equities and a small-size factor tilt. The portfolio aims to offer below average risk alongside an average return, seeking to reflect the performance of the Russell 1000 Low Volatility Focused Factor Index, the fund’s benchmark.

To create a basket of stocks, this fund, unlike other low volatility funds, scales the factor scores of the Russell 1000 index members based on these four out of five common factors: value, quality, small size and low volatility. These factors allow for a range of the Russell 1000 midcaps to be included in the weighting strategy that may not be considered using a single-factor approach.

This alternative weighting diversifies the portfolio by focusing on different segments of the market. This keeps the portfolio more balanced than traditional market-cap weightings, with the goal of maximizing risk-adjusted returns. Top asset classes currently contributing to this fund are Industrials, Consumer Cyclical, Technology and Healthcare.

For long-term investors who want to explore multi-factor smart beta investing, the SPDR Russell 1000 Low Volatility Focus ETF provides low-cost entrée into the large capitalization area of the market and promises a high return. The fund is sponsored by State Street Global Advisors.

Top holdings in the portfolio include Cencora Inc (NYSE: COR), Cognizant Technology Solutions Corp Class A (NASDAQ: CTSH), Archer-Daniels Midland Co (NYSE: ADM), Centene Corp (NYSE: CNC) and McKesson Corp (NYSE: MCK).

Since its December 2015 inception, the fund has trended higher. ONEV is part of a trio of ETFs that aim to achieve high quality and value alongside low volatility.

The fund is down 2.68% over the past month, up 3.33% over the past three months and up 5.45% year to date. The fund has a net asset value of $547.28 million and a modest expense ratio of 0.2%.

While multi-factor smart beta portfolios may be appropriate for some investors, there is a wide range of available strategies. Investors should always do their due diligence before adding any stock, fund, or ETF to their portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

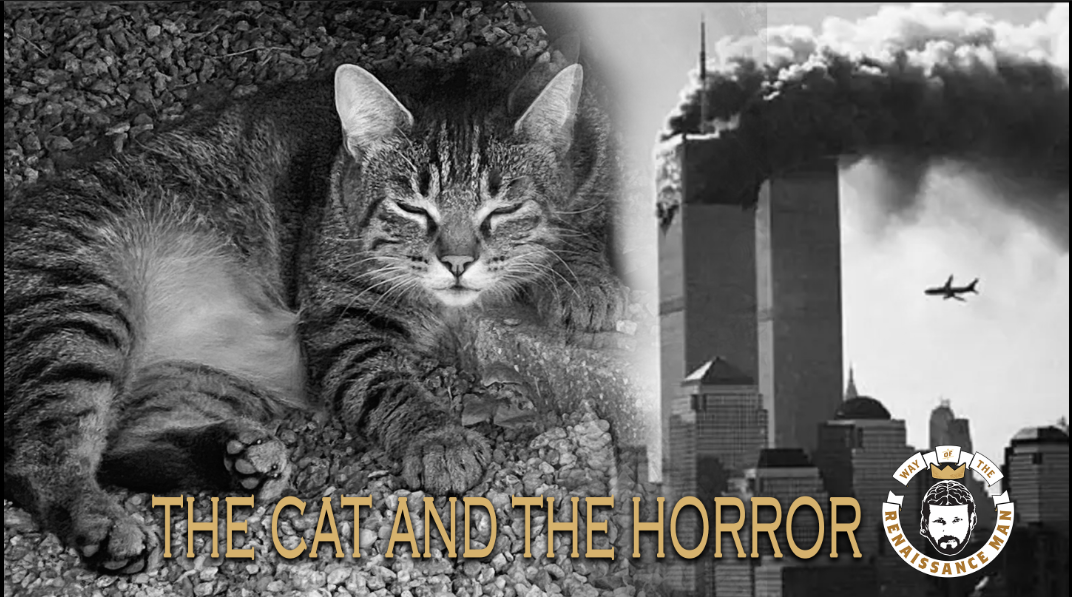

The Cat and the Horror (2023)

There was a cat sleeping on my porch

She didn’t know what I had witnessed

The lacerated skyline of metropolis

A bleeding out of her twin sons

Flying lancets piercing steel hulls

Black smoke seasoning the azure sky

As the falling man descends to the concrete

Incendiary ideas born in Bronze

To please a prophet on a white horse

Hatred of the good for being the good

Crumbles a once-proud icon

Falling ash blankets District streets

A macabre concoction of concrete, bone, blood

Fury rises in the giant’s heart

Rage and revenge burn white

Country targeted, let there be fight

Two decades later, let there be flight

There is a cat sleeping on my porch

While the world remembers

— Jim Woods, September 6, 2023

***

On Monday, we marked the 22nd anniversary of the attacks on September 11, 2001.

For me, the passing of more than two decades hasn’t been enough to fade the scars.

For me, those scars will never be allowed to fade.

Etched on my personal black box recorder are the memories I had circa 1999, when I checked in at the World Trade Center lobby to report to work for my first day at Morgan Stanley. The firm’s training program for new advisers/traders took place in those Twin Towers, and in the weeks that followed, I spent many an afternoon high atop the Manhattan skyline, learning the business inside the iconic monument erected to celebrate capitalism, Western achievement and the wealth of nations.

Their boldness, their glaring simplicity, their twin-brother like stance and their defiance of the rest of the New York City skyline was all part of the reason the World Trade Center was targeted for destruction by forces whose primary directive is death to the infidel.

On that day, when the blue skies were pierced by the stiletto insertion of commercial jets into the towers, I watched the events unravel from some 2,500 miles west. A condo nestled at the foot of the Hollywood Hills hardly seemed congruent to the billowing smoke oozing out of the structural siblings.

The only connection in my mind was… my mind.

A mind having been there just a couple of years earlier, wondering what it would be like to actually be there in that moment.

Wondering if I would have been incinerated along with the roughly 2,600 other souls that were extinguished that day.

Wondering if I would have acted heroically, the way so many did.

Wondering if I would have succumbed to the cowardice that so often accompanies paralytic fear.

I would like to think I could have been a hero. I need to think I would have been a hero.

Fortunately, I didn’t have to find out.

Instead, from afar, from the safety of Hollywood, I watched. All day, all night, I watched. Compelled by the horror; compelled by the enormity. Thinking to myself, “Will this be the world from here on?”

Would the world be plunged into war? At that moment, I wanted war. I wanted vengeance. I wanted to pound those responsible, and the philosophy that animated these acts into a pulp.

I still want to.

I want to stoke the burn of that day. I want to remember the collapse of icons.

I want to keep calling out the life-hating, celebratory death cult of ideas that is radical Islam, and I want to rejoice in its defeat.

The scars of history must never be allowed to heal, and no salve of time should be permitted to mask the day America would be altered forever.

Note: For the full immersion experience, I invite you to listen to a special audio essay of “The Cat and the Horror.”

*****************************************************************

On Fixing Things

“If you want to fix the world, start by fixing yourself.”

–Heather Wagenhals

The celebrated author, speaker, entrepreneur and “Renaissance Woman,” Heather Wagenhals, gave a speech recently to a group of aspiring millionaires. In that speech, she delivered a line that I thought was quite profound, not only in its wisdom but in its cutting truth. You see, many of us want to change the world and make it a better place, and that’s certainly a worthy goal. But the best way to do that is to start by making yourself a better person. Accomplish that goal first, which is no easy task, and then you can train your sights on the world at large.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods