Ask Me Anything, Bridge and Bitcoin Edition

Since the terrible maritime accident that caused the near-instant collapse of the Francis Scott Key bridge in Baltimore early Tuesday morning, I’ve fielded multiple questions about this from readers concerned about the potential economic aftereffects of this tragedy.

Because of these questions, as well as a slew of recent questions on Bitcoin, this week, I decided to do another edition of “Ask Me Anything.” First, let’s start with the Baltimore bridge collapse.

Here is the essence of the inquiries posed to me by multiple readers on this subject: “Jim, do you think the Baltimore bridge collapse and subsequent shipping disruptions it will cause will have a big impact on supply chains, and could this lead to a bounce back in inflation?”

As we wrote this morning in my Eagle Eye Opener regarding this situation, there is unlikely to be a big impact on global supply chains that leads to inflation, and that’s due to two main reasons.

First, as of 2021, Baltimore was the 17th-largest port in the U.S. based on total tonnage, according to Bureau of Transportation Statistics. However, the port does rank near the top in terms of volume of automobiles and light trucks it handles and for vessels that carry wheeled cargo, including farm and construction machinery. Because the port is somewhat specialized, it’s not large enough to cause a material supply chain disruption that leads to broader inflation. Additionally, many of the port’s major imports are specialized automobiles, and that disruption will be partially absorbed by ports in Charleston, Savannah and New York/New Jersey.

Second, there aren’t major energy imports into the port that could lead to an inflationary spike in energy prices. Coal is a major export from the port and that will cause short-term disruptions, and that’s why we saw the coal names down sharply Tuesday, such as CONSOL Energy Inc. (CEIX) and rail operator CSX Corporation (CSX), which slid 6.8% and 1.9%, respectively. Yet, in early Wednesday trading, CEIX was up nearly 3% while CSX was up some 1%, so each have recaptured about half of yesterday’s declines.

But while it will take a long time to rebuild the bridge, this isn’t a material negative for either company. However, if we do see declines in these and related stocks, that will likely be a long-term buying opportunity.

So, while the bridge collapse is both a human tragedy and a short-term negative for specific companies (Northeastern coal and rails, autos due to delayed imports) it’s unlikely to alter the outlook for inflation or growth and it’s not enough to disrupt the bullish mantra I’ve written about in detail in my newsletters of 1) Stable growth, 2) Falling inflation, 3) Looming Fed rate cuts and 4) AI enthusiasm.

Michael C. writes: “Jim, can you explain what’s going on with Bitcoin, and specifically the Bitcoin halving?”

Subscribers to my Successful Investing and Intelligence Report newsletters were treated to a full explanation of the reason for Bitcoin’s latest move, and it has a lot to do with the upcoming “halving.” So, Michael, if you were a subscriber, you would already know the answer. But since you are a reader of The Deep Woods that values my advice on these matters, I will gladly give you the essential answer right now.

One reason for the big move higher in Bitcoin is that the recent approval of the spot Bitcoin ETFs has helped the cryptocurrency vault firmly in the minds of even casual observers of markets. The other big reason is “the halving.”

You see, Bitcoin’s “anonymous” creator, Satoshi Nakamoto, wanted Bitcoin to stand out from all paper currencies (i.e., dollar, euro, franc, etc.). Satoshi wanted Bitcoin to hold its value (or gain in value) over time, so he built an “anti-inflationary mechanism” into its code.

Per its code, the “block subsidy is cut in half every 210,000 blocks, which will occur every four years.” Therefore, every four years, there’s a 50% reduction in the number of new Bitcoins that come to market. This continuous four-year cycle — built into Bitcoin’s code — is fixed and can’t be altered. This is what’s known as “the halving.”

The 2024 halving will reduce the number of new Bitcoins mined (the “block reward”) from 6.25 to 3.125 per block — or from 900 Bitcoins produced each day to 450 Bitcoins produced daily. Eventually, the number of Bitcoins will hit its maximum supply of 21 million coins — expected to be by the year 2140. There are roughly 19.6 million Bitcoins in existence today.

Now, Bitcoin has gone through three of these cycles so far. The first was in November 2012. The second was in July 2016. The third was in May 2020. And every time, Bitcoin’s price has rallied substantially.

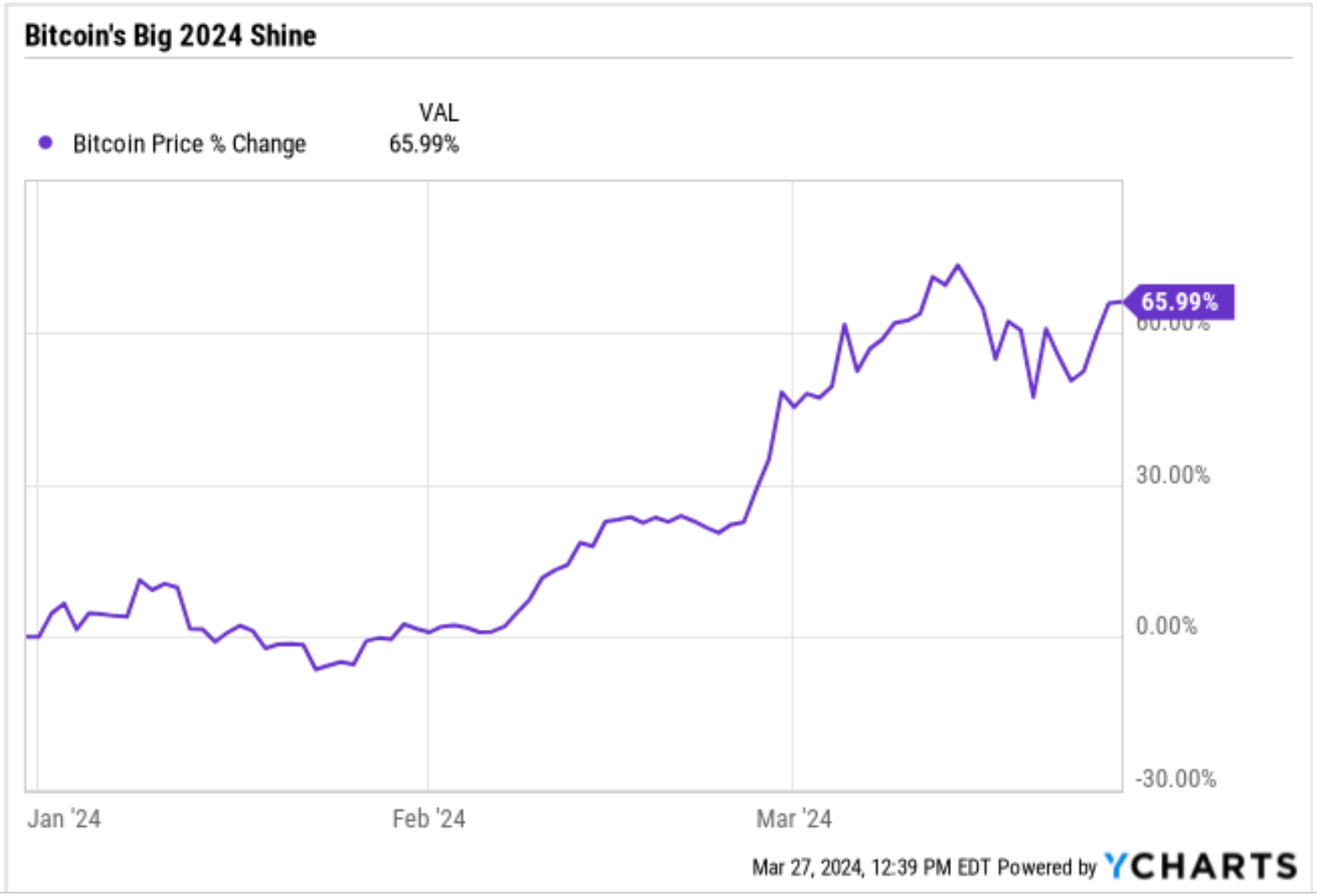

Although nowhere near the gains after the halving occurs, there’s also typically a considerable bump in price leading up to the halving like we’ve seen this year, with Bitcoin breaking $73,000 and surging nearly 66% since the year began.

So, why does this predictable event result in these outsized gains? It’s pretty much Economics 101: As supply decreases and demand remains constant (or increases), the only thing left to move is price.

The next halving is projected to take place around April 19-20, 2024. So, if past is prologue, some of these gains have been driven by halving anticipation, but I suspect there is more to come.

Would you like to find out my thoughts on topics such as the economy, markets, investing, social issues, pop culture issues, literature, music, fitness or anything else I’m into?

If so, just email me. I welcome all inquiries, but I ask that you keep it all respectful, and in the name of the very best within you.

***************************************************************

ETF Talk: Spotlight on Spot ARK 21Shares Bitcoin ETF

A new trend has swept the market lately: spot bitcoin exchange-traded funds (ETFs)!

On January 10, 2024, the Securities and Exchange Commission (SEC) approved 11 new spot bitcoin ETFs, offering investors a more convenient avenue to invest in the original cryptocurrency. Unlike regular ETFs, spot bitcoin ETFs track Bitcoin’s current price, often referred to as the spot price.

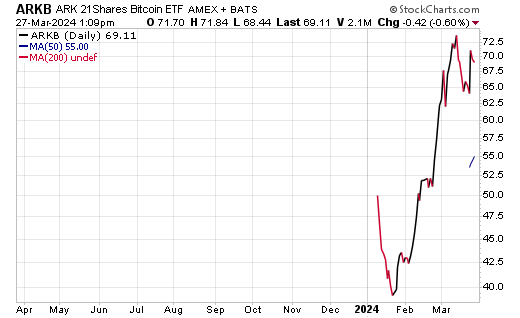

Among these newly approved ETFs is the ARK 21Shares Bitcoin ETF (ARKB), which was established on January 10, 2024. Spot bitcoin ETFs present a straightforward method for portfolio diversification by incorporating Bitcoin into investment strategies. Notably, the flexibility of spot bitcoin ETFs allows for the creation or redemption of shares based on market demand.

The approval of spot bitcoin ETFs signifies a notable shift in regulatory treatment towards cryptocurrencies. These ETFs offer investors a regulated means for long-term exposure to bitcoin, with holdings securely stored in cold storage. As discussed in my ETF Talk on March 13, 2024, this vehicle provides regulated exposure to an asset with significant potential.

Furthermore, spot bitcoin ETFs provide investors with the potential to broaden portfolio diversification by incorporating an asset that displays minimal correlation with conventional investments. Notably, ARKB distinguishes itself through its simplicity, providing exposure to Bitcoin without unnecessary intricacies. Investors may find value in this uncomplicated method of accessing the cryptocurrency market.

ARKB tracks the performance of Bitcoin measured by the performance of CME CF Bitcoin Reference Rate, a New York Variant/Index that is adjusted to the Trust’s liabilities and expenses.

ARKB now has an expense ratio of 0.21% and $2,105 million in assets under management (AUM), as of February 29, 2024. Since its inception, the fund’s net asset value (NAV) has increased by 31.64%, with all its assets placed in Bitcoin (BTC).

Source: StockCharts.com

Before diving into spot Bitcoin ETFs, consider both the pros and cons.

On the bright side, their approval enhances Bitcoin’s legitimacy as an asset class, offering investors access across various accounts, potentially boosting liquidity and stability and featuring lower trading fees compared to some crypto exchanges.

But investors need to be wary, as investing in spot bitcoin ETFs introduces more regulation and reliance on third-party custodians, with potential consequences for both the ETF price and underlying Bitcoin, alongside annual fees and exposure to Bitcoin’s inherent volatility, posing risks for investors unprepared for its fluctuations.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to email me. You may see your question answered in a future ETF Talk.

*****************************************************************

In case you missed it…

A Throne with No Game

As a power user of information, I have a highly developed sense of “NewsQ” (i.e., what news is relevant, and what isn’t, when it comes to moving markets). In fact, the term “NewsQ” is one that I invented to describe this skill. And as a power user of information, unfortunately, I cannot escape gossip. That’s especially true of the gossip from across the pond regarding the British royal family.

As valiantly as I try, I have failed to evade the latest barrage of news about Princess Kate and her “troubled marriage” with Prince William, her recent health issues, the breach of her medical records and the latest gossip dustup, the digital alteration and enhancement of royal family photographs. Then, of course, there’s the health of King Charles III, who has been diagnosed with an undisclosed form of cancer, and that’s about all that’s been released regarding his condition.

One of the publications I read regularly for international NewsQ is The Guardian. A recent piece by the excellent columnist Zoe Williams titled, “The one thing we’ve learned from the Kate photo scandal? There’s no such thing as a fairytale life,” gives us the following insight on this issue of the royals and their current place in the collective psyche:

“A small but growing number of us wish they would simply desist, become normal, stop costing so much. A sizeable middle doesn’t care one way or the other, and those who do watch these lives with fascinated admiration need them to be perfect. We can talk loftily about William and Kate’s missteps — how could they have been so stupid as to Photoshop an image, and so amateurishly? Don’t they know the first rule of lying, in public life, which is: stop doing it and tell the truth? But they haven’t been stupid at all, they’ve behaved exactly as humans do, trapped in a deal they can’t uphold. They cannot lead the perfect, trouble-free lives that they have to lead in order to make sense.”

Williams points out here the folly of trying to lead “perfect, trouble-free lives,” as there’s no such thing, and no one can hold up that end of a deal — or that ideal.

Source: Shutterstock

Now, after reading the Williams piece, I was reminded of the wider issue of the royals and what the concept itself actually represents. And far from being an ideal, it’s actually extremely caustic and destructive.

In September 2022, I addressed this subject in detail in my article, “Reject This Game of Thrones.” Today, I want you to read that piece again, and do so in light of the latest royal gossip. It will give you a deeper sense of the real issues at hand here, and why they matter to the world.

As you’ll learn, it’s still time to reject this game of thrones, and the latest disfunction just shows how this throne has no game.

Reject This Game of Thrones

If you’ve tuned in to TV news anytime over the past six days, you’ve been inundated with coverage of the death of Queen Elizabeth II. Indeed, the mostly fawning treatment of the Queen’s passing, her role in history, her record long reign, her succession, the celebrity and death of her firstborn son’s former wife, her other son’s sexual scandals, her grandsons and their personal drama and the sycophantic weeping of her “subjects” in the media has been something of a personal irritant to me.

Yes, I certainly understand the media’s desire to cover every moment of this situation. After all, the media is all about ratings, because ratings equal revenue, and news is a business, and the royals make for big ratings. And as a radical for capitalism, I endorse that.

However, as a man who abhors the notion of monarchy and its roots in such despicable ideas as the “divine right of kings,” I find the pageantry rather loathsome. In fact, I am someone who has a visceral sense of nuisance whenever I see a picture of the royals, and the reason why is because I’m opposed to concepts such as one human having political province over others simply by accident of birth.

Now, I know I am viewing this issue through a decidedly American lens, but I was taught from my earliest reading of government that “all men are created equal.” Yet in monarchies of any kind, even the timid version such as that of Britain, the sovereigns are thought to be created better than their subjects, and therefore they have the right to tell other humans what to do, how to live and who to serve.

Stated in starker terms, in most historical “absolute” monarchies, subjects don’t own their lives, the king or queen does — and that makes people slaves of the state.

Of course, Britain is not an absolute monarchy any longer. The country has long been a “constitutional monarchy,” which is a system of government in which a monarch shares power with a constitutionally organized government — and this is indeed progress.

Yet in the case of Britain, King Charles III now is not only the titular and ceremonial head of state, but he’s also head of the Church of England and the head of the armed forces. Talk about being born with a silver spoon in your mouth.

Now, some writers/intellectuals that I admire, in particular Andrew Sullivan, have written eloquently about Queen Elizabeth II and the virtues she embodied. Here he writes, “With her death, it’s hard not to fear that so much she exemplified — restraint, duty, grace, reticence, persistence — are disappearing from the world.” Fair enough, as I am all for virtues such as grace, reticence and persistence.

But then a few paragraphs later, Sullivan goes on to defend the Crown by enlisting the help of writer C.S. Lewis, who once said: “Where men are forbidden to honor a king, they honor millionaires, athletes or film stars instead; even famous prostitutes or gangsters. For spiritual nature, like bodily nature, will be served; deny it food and it will gobble poison.”

Think about this for a moment. In Lewis’s view, we should honor a king, who ascended to his lot simply by virtue of birth, but we shouldn’t honor millionaires, athletes or film stars — people who have actually put the hard work into it and have done what is required to achieve their status in life?

This is my biggest issue with the notions of royalty of any sort. To be honored and endowed with position, privilege, wealth, admiration, power and respect by accident of your birth, and not because of the hard work it took you to become a millionaire or a standout athlete or a film star, is a perversion of reality that needs to be called out now — especially while the world is mired in an orgy of royal worship.

Yes, as Lewis says, spiritual nature, like bodily nature, needs to be served. But I say that bestowing virtues on a person because of their birth, and not because of their actions, is gobbling up the worst kind of servile poison — poison that inevitably leads to subjugation of the ugliest sort. And if you don’t believe me, read up on the violent atrocities of empires throughout history.

At the root, you’ll find the structural servility of men under the authority of monarchs — and to toward that poison, I say reject this game of thrones.

*****************************************************************

The Boys Are Back

That jukebox in the corner blasting out my favorite song

The nights are getting warmer, it won’t be long

Won’t be long till summer comes

Now that the boys are here again

–Thin Lizzy, “The Boys Are Back in Town”

As any child of the 1970s is likely to recall, the rock anthem “The Boys Are Back in Town” by the great Irish band Thin Lizzy was an instant classic blaring through all of our big speakers and wearing out our scratchy vinyl records. And though we have just entered spring, the lyrics here about it not being long until summer comes takes me back to a more carefree time when I rode my bike all day, practiced piano, hit home runs in little league and watched sitcoms with my parents at night.

Of course, the boy that I was is no longer, but those feelings of liberation at a life unbound remain — and I am reminded of those feelings by the sense memory of great songs such as “The Boys Are Back in Town.” If you long for a little unbound memory, go back and listen to some of the music you loved in your teen years. I can guarantee it will conjure up smile-inducing recollections.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods