The Animating Force for More of What’s Good

A new year often brings about the rise of hope. The hope of more freedom, more prosperity, more stock market gains… and a better world for humanity.

Of course, very often we don’t get all of what we hope for. Yet it’s our eternal optimism and desire to strive for more of what’s good and what’s truly meaningful in life that animates the free world.

That striving for more also is largely the force that animates investor sentiment. It also is one of the key animating forces in my Intelligence Report, Successful Investing and Fast Money Alert advisory services.

In fact, in the Fast Money Alert service, one that I am honored to co-write with my colleague Dr. Mark Skousen, we expect 2018 to be a year replete with some very large individual stock winners.

These bullish expectations are why, in less than 24 hours from now, Mark and I are holding a live online event titled the “2018 Trade of the Year Emergency Summit.”

This event is free, but you do have to register today to make sure you reserve your spot.

I’m really looking forward to this event, as it gives us the chance to let readers in on how we select stocks and options in the Fast Money Alert service. It also gives us a chance to show you just how well we’ve done over the past year.

More importantly, the summit allows us to tell you about several companies we think are primed to profit in a very big way in 2018. So, if you can join us on Thursday, January 11, at 2 p.m. EST, we’d love to have you.

In some sense, the timing of this event couldn’t be much better. Just think about how we are entering 2018.

We have the tailwind of tax reform at our backs, a tailwind that the markets have pined for since Donald Trump won the presidency.

We also have solid economic growth in both the United States and throughout much of the world. It is the global economic growth story (including the growth here at home) that is providing the fundamental backbone of higher equity prices.

Then we have the earnings picture, which is expected to continue driving equity prices into new, record-high territory.

According to CFRA Research, the consensus estimate for Q4 is for a 10.6% increase in S&P 500 profits. That would represent the third quarter in the past four quarters with earnings per share (EPS) gains of more than 10%.

Yet CFRA doesn’t stop there. The research firm also estimates that in Q1 through Q3, S&P 500 profit growth also will top 10%. That’s another very strong springboard by which stocks can keep heading higher.

Add to the equation a relatively benign geopolitical environment (despite the bellicose North Korean bluster), and you have a good setup for stocks.

In fact, just last week we got one of the most bullish calls on 2018 from securities firm UBS. Analysts at the bank raised their S&P 500 EPS forecast for the year to $157, which represents a robust 18% year-over-year gain.

Moreover, UBS predicted that kind of earnings growth could lead to the S&P 500 at 3,150 by year’s end. That’s about 15% higher from current levels. And while the UBS call is one of the most bullish on Wall Street, it’s certainly well within the realm of possibility given current conditions, and given the relative lack of major headwinds on the horizon.

Another reason for the presence of hope and optimism here is the Dow, which lithely breached the 25,000-mark last week.

Though this is just another psychological milestone that serves as a good headline for the financial media, there is real significance in the fact that the move shows people want to buy stocks, and want to participate in what is undeniably one of the greatest wealth-building tools ever devised by humankind.

In 2018, we’ll also be eager participants in this wealth-building device, and we’ll do so via the best stocks, exchange-traded funds (ETFs), mutual funds and options the market has to offer.

And of course, we’ll do so via the animating force for more of what’s good.

***********************************************************

ETF Talk: Exploring a Bond Fund with Minimal Exposure to Rate Hikes

As its name implies, the Vanguard Short-Term Bond ETF (BSV) tracks shorter-term U.S. government, investment-grade corporate and investment-grade international dollar-denominated bonds.

Informed investors are probably aware that bond yields remain at or near historically low levels. Additionally, there is worry that subsequent rate hikes by the Federal Reserve could create an inverse yield curve detrimental to many investments at some point in the near future. Under these conditions, investing in short-term bond exchange-traded funds (ETFs) is preferable to being in ETFs focused on long-term bonds, as there is less potential that fallout from the Fed’s interest rate hikes will affect the securities. All of the bonds in BSV’s portfolio have maturities ranging anywhere from one to five years.

With over $50 billion of total assets under its belt and $118 million in daily trading volume, BSV is a substantial fund with a lot of liquidity. The fund is passively managed using index sampling and is also held by many large investment banks as a way to diversify portfolios and hedge against risk.

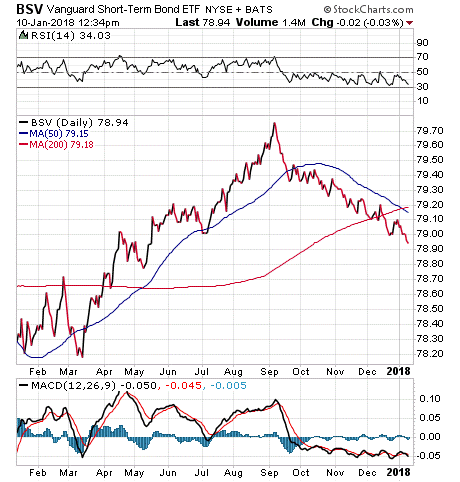

BSV has been receiving some mixed press lately. In late December, Nasdaq.com reported that the Relative Strength Index (RSI) reading for BSV had dropped below 30 to 27.5, indicating that the fund was potentially oversold. However, Nasdaq.com also noted on Jan. 2 that a 0.9%, or $221.4 million, inflow into the fund had occurred after several weeks of a declining share price.

Over the last year, BSV has traded in a tight pattern of less than 2%. The fund hit its 52-week high of $80.25 on Sep. 7 and has since fallen back to trade around $79, as you can see below. However, the slide seems to have stabilized as the fund has traded in a tight spread of less than 20 cents since Christmas. BSV pays a small dividend of 1.76% and has a low expense ratio of just 0.07%, a hallmark of many Vanguard funds.

BSV’s top five holdings in the portfolio are the U.S. Treasury 1.375% Note, 1.87%; U.S. Treasury 1.25% Note, 1.68%; U.S. Treasury 1.5% Note, 1.66%; U.S. Treasury 2.0% Note, 1.65%; and U.S. Treasury 1.125% Note, 1.32%. Other substantial sector holdings of BSV other than the U.S. Treasury include Industrials, 14.7%, and Financial Institutions, 10.9%.

If you are seeking to invest in the bond market with minimal exposure to the dangers of Fed rate hikes, then I encourage you to look into the Vanguard Short-Term Bond ETF (BSV) as a potential purchase.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*********************************************************************

Smoking an Unstoppable Freedom Wave in 2018

It is a new year, and that means a new crop of federal, state and local laws go into effect. Some of those laws are the restrictive sort that prohibit specific behaviors or that levy fines for a given offense. Others are laws of permission, i.e., the removal of previous restrictions on human actions now deemed permissible by the legal system.

In my home state of California, one of the most prominent new state laws of permission is the legalization of what’s known as “adult marijuana use.”

On New Year’s Day, I woke up to news reports in the greater Los Angeles area featuring excited citizens eager to exercise their newfound freedom to legally purchase up to an ounce of marijuana and/or related cannabis products.

Now, as you might expect, there were huge lines outside the now-legal dispensaries that were literally wrapped around the buildings.

As you likely know, legal recreational use of marijuana has been gaining a foothold throughout the country. Moreover, medical use of marijuana and cannabis-related products also has become legally permissible throughout much of the country.

California’s legalization of adult marijuana use makes it the eighth state to do so. Later this year, both Massachusetts and Maine are expected to make the legal leap into adult usage. Currently, there are 29 states, plus the District of Columbia, that have laws that at a minimum legalize cannabis for medical purposes.

I view this legalization trend as an extremely positive development, and you don’t have to be a marijuana smoker or a cannabis user to think so.

I am not a cannabis user but, in my view, the legalization of a product that people have used for thousands of years, both as a medicinal aid and a tool to alter mental states, is part of a trend I call the “unstoppable freedom wave.”

This is a trend that animates the American spirit, and that no matter how oppressed and/or self-modulated, it cannot be suppressed for too long.

This freedom always breaks into the clear, sometimes despite itself. It is a freedom for individuals to think about what they want, say what they want, wear what they want, live how they want, marry who they want… and ingest the substances they want, without the heavy hand of government interference.

This unstoppable freedom wave broke out after the disaster of prohibition (where teetotalers persuaded the government to restrict Americans from choosing to drink alcohol). The marijuana issue is no different, save for marijuana actually being a far less destructive drug than alcohol, both physically and socially.

According to recent surveys conducted by Gallup, more Americans favor legalizing marijuana than at any other point since Gallup began asking Americans about their views in 1969. Back then, only 12% of Americans favored legalizing cannabis. Today, 64% of the country is in favor of it. This is proof that most Americans want the freedom to put marijuana in the public market.

Now, from an investment standpoint, we can leverage this unstoppable freedom wave by investing in the best companies in the medical and legal marijuana industry. There are many ways to do this, and I am in the process of researching many of these companies for potential allocation in my Successful Investing and Intelligence Report investment newsletters.

In fact, just this week in my Fast Money Alert service, my partner, Dr. Mark Skousen, and I recommended a stock benefitting from the boom in medical and legal marijuana use.

Given the freedom wave that’s embraced legal cannabis use, there’s a whole lot of growth to go in the future. But just how big is the cannabis industry?

According to a report from ArcView Market Research, the total economic output from legal cannabis will grow 150% from $16 billion in 2017 to $40 billion by 2021. Moreover, ArcView thinks that U.S. consumer spending on legal cannabis in 2021 of $20.8 billion will generate $39.6 billion in overall economic impact, 414,000 jobs and more than $4 billion in tax receipts.

That’s a lot of cannabis cash, and a lot of profits for investors who embrace this unstoppable freedom wave.

Stay tuned.

P.S. Want the latest exchange-traded fund (ETF) and stock recommendations backed up by a 40-plus-year plan that’s helped investors maximize gains and protect against pernicious downturns in the market? Then I invite you to check out Successful Investing today!

*********************************************************************

Namath on Confidence

“When you have confidence, you can have a lot of fun. And when you have fun, you can do amazing things.”

— Joe Namath

I am a big fan of confidence and the role it plays in a person’s success (or lack thereof). That’s why one of my favorite athletes of all time was pro football Hall of Fame quarterback Joe Namath. The man was so confident he literally guaranteed a victory in Super Bowl III, and then went on to deliver what was perhaps the greatest upset in Super Bowl history. Yes, Namath had the skills to back up his confidence. Yet plenty of players had more skill than “Broadway Joe,” but few had his confidence, style and swagger.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.